A mechanic's lien shall have precedence over all other subsequent liens or conveyances during such time; provided, that a sworn statement of the amount due and/or approximating that to accrue for such work, labor, or materials, and a reasonably certain description of the premises, shall be filed, within the ninety-day period referred to in § 66-11-115(b), or in the case of liens acquired by contract executed on or after April 17, 1972, by virtue of § 66-11-141, within ninety (90) days after completion of the structure which is or is intended to be furnished water by virtue of drilling a well, or abandonment of work on the structure, as the case may be, with the county register, who shall note the same for registration, and put it on record in the lien book in the office of the register, for which the register shall be entitled to the sums specified in § 8-21-1001, which sums shall be paid by the party filing the same; but such fees shall be receipted for on the statement of account, and shall be part of the indebtedness or charge secured by the lien, and this registration shall be notice to all persons of the existence of such lien.

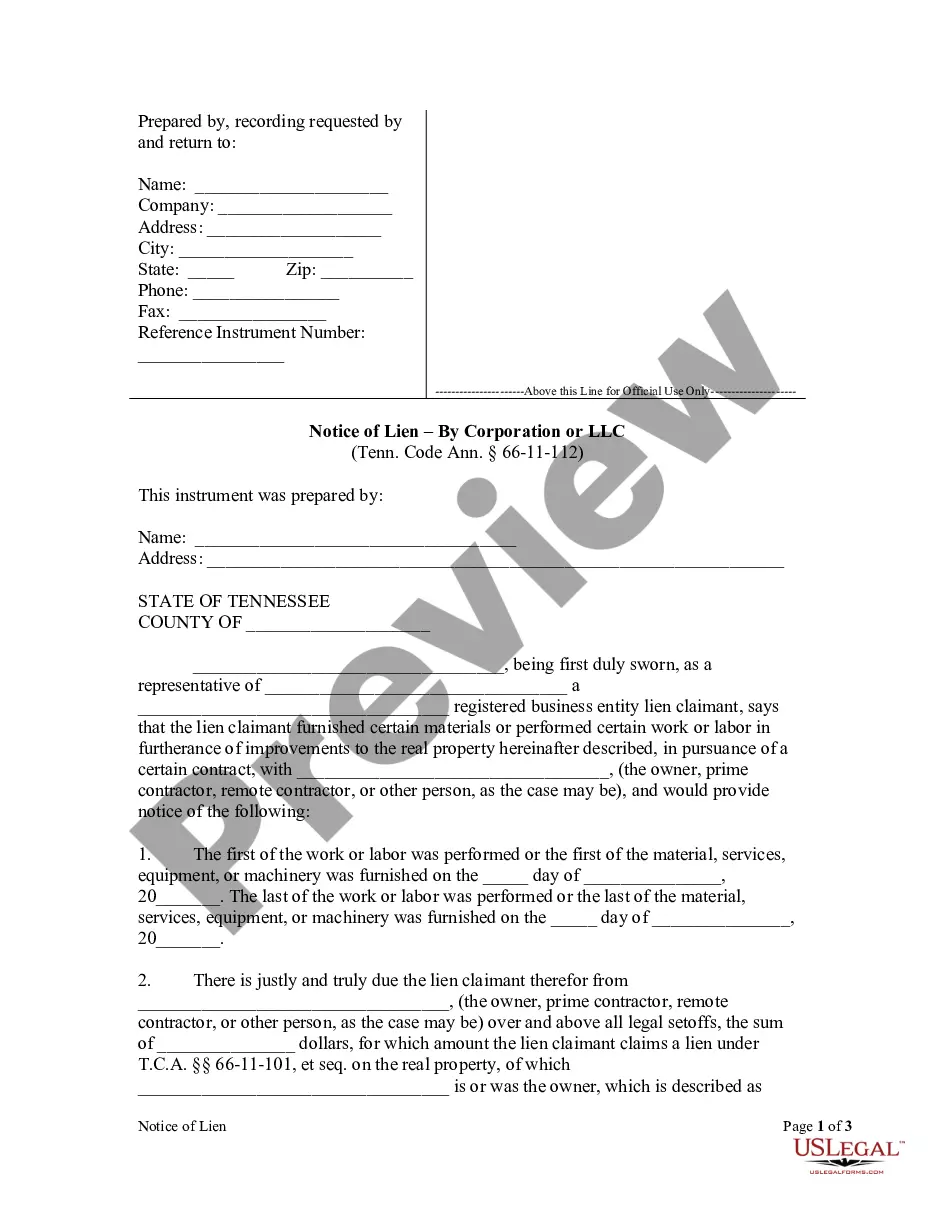

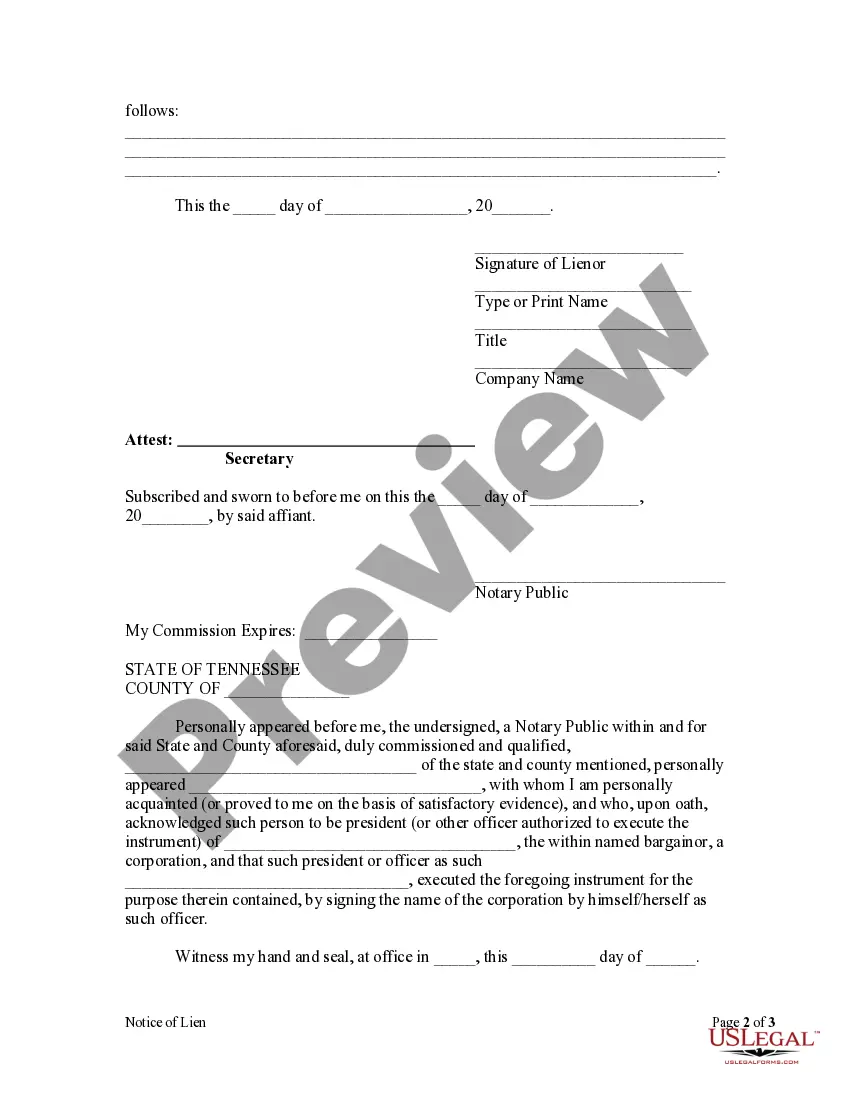

A Notice of Lien is an important legal document filed by a corporation or limited liability company (LLC) in Murfreesboro, Tennessee, to claim a legal right to a debtor's property. This document protects the creditor's interests and ensures the debt owed to them is satisfied. In Murfreesboro, there may be different types of Notices of Lien available for corporations or LCS based on the nature of the debt or the property involved. One type of Notice of Lien applicable to corporations or LCS in Murfreesboro, Tennessee, is the Mechanics' Lien. This lien is typically filed by contractors, subcontractors, or suppliers who have provided labor, services, or materials for construction or improvement of a property. The Mechanics' Lien allows these entities to secure their right to payment for the work performed or materials supplied. Another type of Notice of Lien relevant to corporations or LCS in Murfreesboro, Tennessee, is the Tax Lien. Tax liens are filed by governmental authorities, usually the IRS or state tax departments, to secure unpaid tax debts. These liens are attached to the debtor's property, creating a legal claim on it until the tax debts are settled. Furthermore, corporations or LCS may also file a UCC (Uniform Commercial Code) Lien in Murfreesboro, Tennessee. UCC liens are filed to secure debts related to personal property, such as equipment, vehicles, or inventory. These liens provide the creditor with the right to seize and sell the debtor's property to satisfy the outstanding debt. To file a Murfreesboro Notice of Lien — Corporation or LLC, certain information is typically required. This includes the debtor's name and address, a description of the property subject to the lien, the date the debt was incurred, and the amount owed. It's crucial to ensure accuracy and completeness when preparing and filing a Notice of Lien to avoid any legal complications or challenges. In conclusion, the Murfreesboro Tennessee Notice of Lien — Corporation or LLC is a vital legal document used by corporations or LCS to assert their right to a debtor's property and secure payment for outstanding debts. The various types of liens available include Mechanics' Liens, Tax Liens, and UCC Liens, depending on the nature of the debt or property involved. Properly preparing and filing a Notice of Lien is essential to protect a creditor's interests and ensure the debt owed is rightfully satisfied.A Notice of Lien is an important legal document filed by a corporation or limited liability company (LLC) in Murfreesboro, Tennessee, to claim a legal right to a debtor's property. This document protects the creditor's interests and ensures the debt owed to them is satisfied. In Murfreesboro, there may be different types of Notices of Lien available for corporations or LCS based on the nature of the debt or the property involved. One type of Notice of Lien applicable to corporations or LCS in Murfreesboro, Tennessee, is the Mechanics' Lien. This lien is typically filed by contractors, subcontractors, or suppliers who have provided labor, services, or materials for construction or improvement of a property. The Mechanics' Lien allows these entities to secure their right to payment for the work performed or materials supplied. Another type of Notice of Lien relevant to corporations or LCS in Murfreesboro, Tennessee, is the Tax Lien. Tax liens are filed by governmental authorities, usually the IRS or state tax departments, to secure unpaid tax debts. These liens are attached to the debtor's property, creating a legal claim on it until the tax debts are settled. Furthermore, corporations or LCS may also file a UCC (Uniform Commercial Code) Lien in Murfreesboro, Tennessee. UCC liens are filed to secure debts related to personal property, such as equipment, vehicles, or inventory. These liens provide the creditor with the right to seize and sell the debtor's property to satisfy the outstanding debt. To file a Murfreesboro Notice of Lien — Corporation or LLC, certain information is typically required. This includes the debtor's name and address, a description of the property subject to the lien, the date the debt was incurred, and the amount owed. It's crucial to ensure accuracy and completeness when preparing and filing a Notice of Lien to avoid any legal complications or challenges. In conclusion, the Murfreesboro Tennessee Notice of Lien — Corporation or LLC is a vital legal document used by corporations or LCS to assert their right to a debtor's property and secure payment for outstanding debts. The various types of liens available include Mechanics' Liens, Tax Liens, and UCC Liens, depending on the nature of the debt or property involved. Properly preparing and filing a Notice of Lien is essential to protect a creditor's interests and ensure the debt owed is rightfully satisfied.