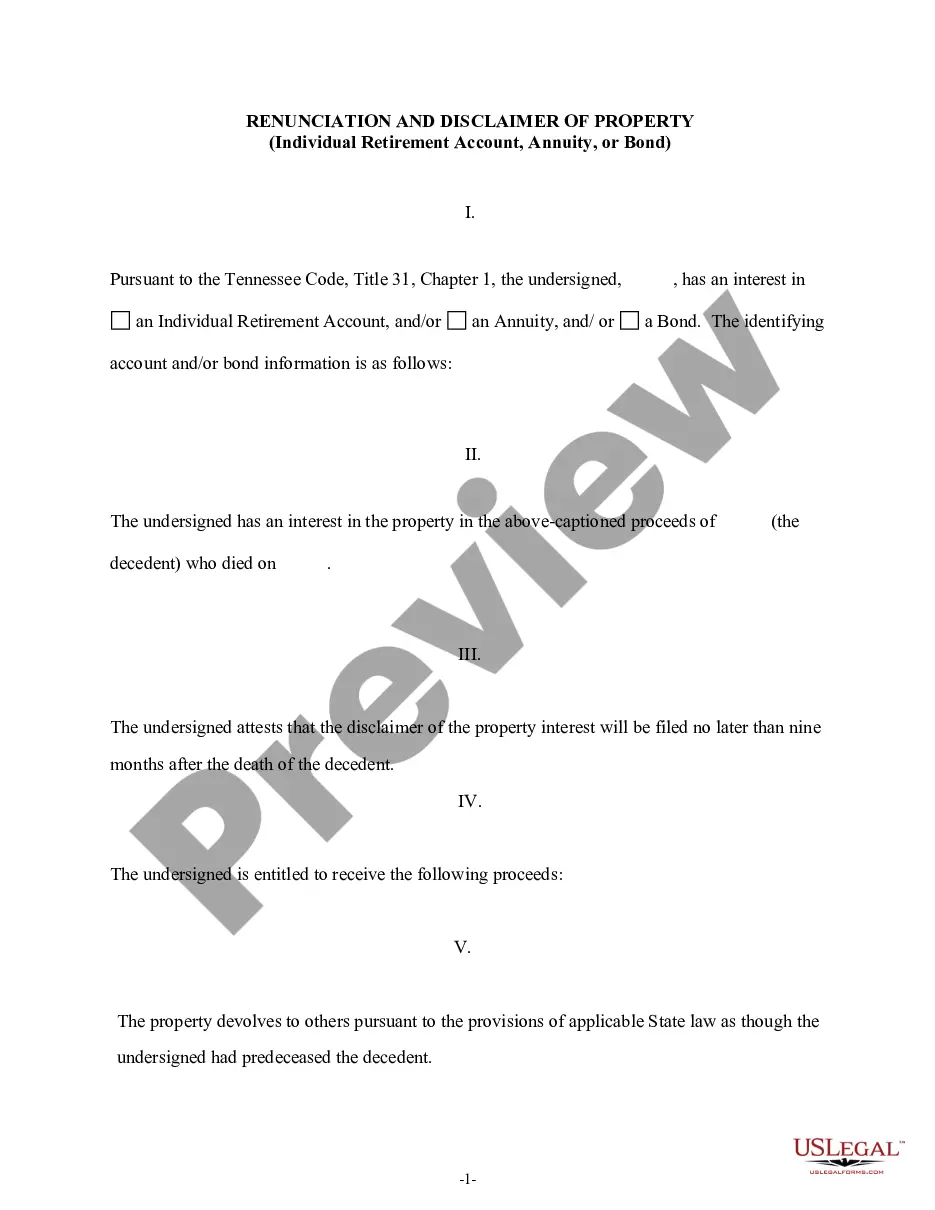

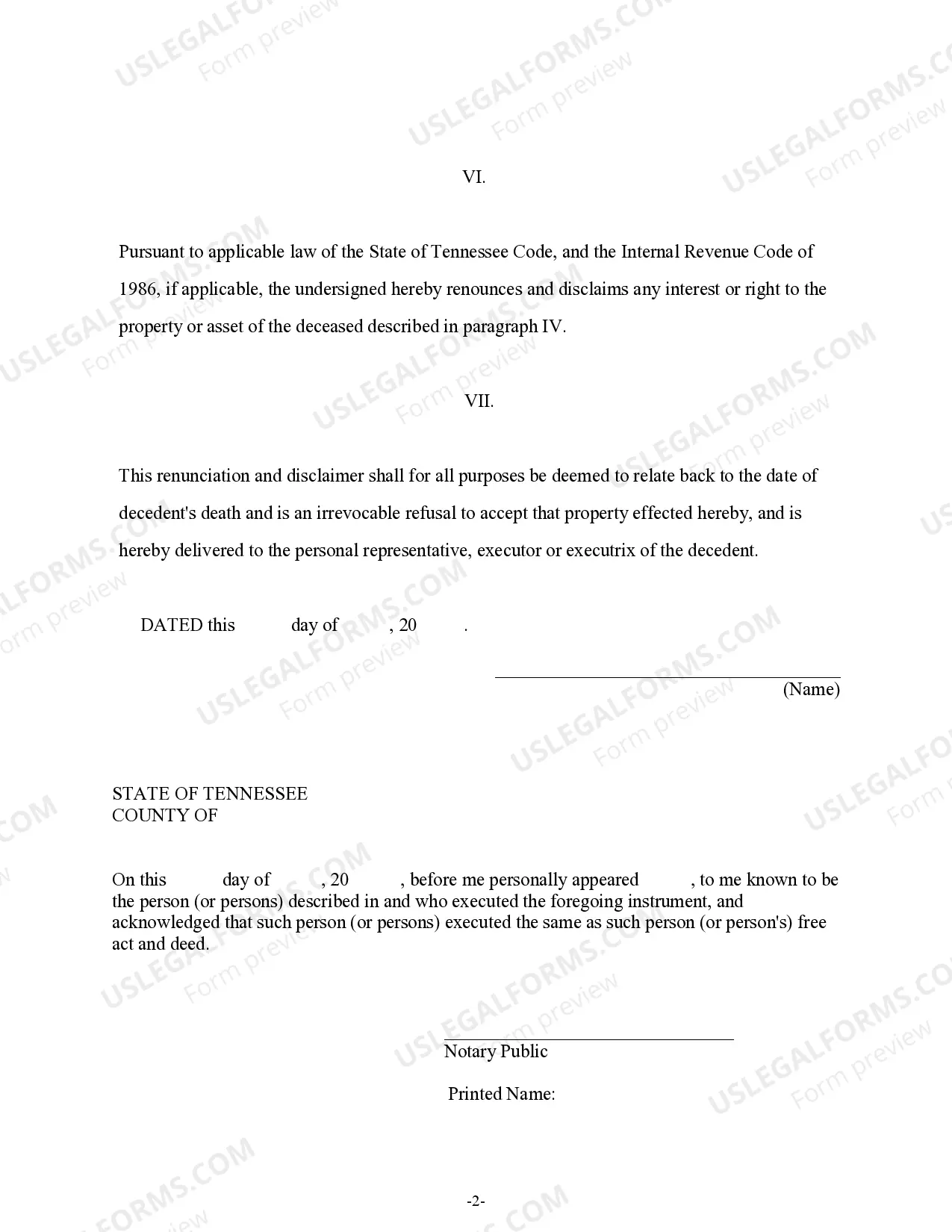

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond where the beneficiary gained an interest in the proceeds upon the death of the decedent, but, pursuant to the Tennessee Code, Title 31, Chapter 1, will renounce his/her interest in the proceeds. Therefore, the property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgement and a certificate to verify the delivery of the document.

Chattanooga, Tennessee Renunciation And Disclaimer of Property — Individual Retirement Account, Annuity, Or Bond pertains to the legal process of disclaiming or renouncing property related to individual retirement accounts (IRA), annuities, or bonds in Chattanooga, Tennessee. This legal document is crucial when an individual wishes to relinquish their rights or interests in such assets. There are various types of renunciations and disclaimers that one can make in relation to these financial instruments in Chattanooga, Tennessee. Some common types include: 1. IRA Renunciation: This involves renouncing any rights or claims to an individual retirement account. It could be due to various reasons such as not needing the funds, not wanting the associated tax obligations, or wanting to pass the assets to another party like a beneficiary. 2. Annuity Renunciation: This type of renunciation applies to annuities, which are financial products designed to provide a regular income stream during retirement. An individual might choose to renounce their rights to an annuity if they do not require the regular income, have changed their financial plans, or want to transfer the annuity to another individual. 3. Bond Renunciation: This refers to renouncing ownership or interests in bonds, which are fixed-income securities that pay periodic interest to investors. Reasons for renouncing bond ownership can include changes in investment strategies, liquidity needs, or wanting to transfer bond ownership to another party. The process of renouncing or disclaiming property usually involves legal documentation, wherein the individual explicitly states their intention to renounce their rights or interests in the specified asset(s). This document must comply with the laws and regulations of Chattanooga, Tennessee and should be properly executed and recorded. It is important to note that renouncing or disclaiming property can have legal and financial implications. Therefore, individuals considering such actions are advised to consult with an attorney or financial advisor who specializes in estate planning, retirement accounts, annuities, and bonds to ensure they fully understand the consequences and any potential tax ramifications. By utilizing the Chattanooga Tennessee Renunciation And Disclaimer of Property — Individual Retirement Account, Annuity, Or Bond, individuals in Chattanooga have a legal framework to properly handle the renunciation of their rights or interests in IRAs, annuities, or bonds, allowing for a smooth transfer or disposal of these assets as desired.Chattanooga, Tennessee Renunciation And Disclaimer of Property — Individual Retirement Account, Annuity, Or Bond pertains to the legal process of disclaiming or renouncing property related to individual retirement accounts (IRA), annuities, or bonds in Chattanooga, Tennessee. This legal document is crucial when an individual wishes to relinquish their rights or interests in such assets. There are various types of renunciations and disclaimers that one can make in relation to these financial instruments in Chattanooga, Tennessee. Some common types include: 1. IRA Renunciation: This involves renouncing any rights or claims to an individual retirement account. It could be due to various reasons such as not needing the funds, not wanting the associated tax obligations, or wanting to pass the assets to another party like a beneficiary. 2. Annuity Renunciation: This type of renunciation applies to annuities, which are financial products designed to provide a regular income stream during retirement. An individual might choose to renounce their rights to an annuity if they do not require the regular income, have changed their financial plans, or want to transfer the annuity to another individual. 3. Bond Renunciation: This refers to renouncing ownership or interests in bonds, which are fixed-income securities that pay periodic interest to investors. Reasons for renouncing bond ownership can include changes in investment strategies, liquidity needs, or wanting to transfer bond ownership to another party. The process of renouncing or disclaiming property usually involves legal documentation, wherein the individual explicitly states their intention to renounce their rights or interests in the specified asset(s). This document must comply with the laws and regulations of Chattanooga, Tennessee and should be properly executed and recorded. It is important to note that renouncing or disclaiming property can have legal and financial implications. Therefore, individuals considering such actions are advised to consult with an attorney or financial advisor who specializes in estate planning, retirement accounts, annuities, and bonds to ensure they fully understand the consequences and any potential tax ramifications. By utilizing the Chattanooga Tennessee Renunciation And Disclaimer of Property — Individual Retirement Account, Annuity, Or Bond, individuals in Chattanooga have a legal framework to properly handle the renunciation of their rights or interests in IRAs, annuities, or bonds, allowing for a smooth transfer or disposal of these assets as desired.