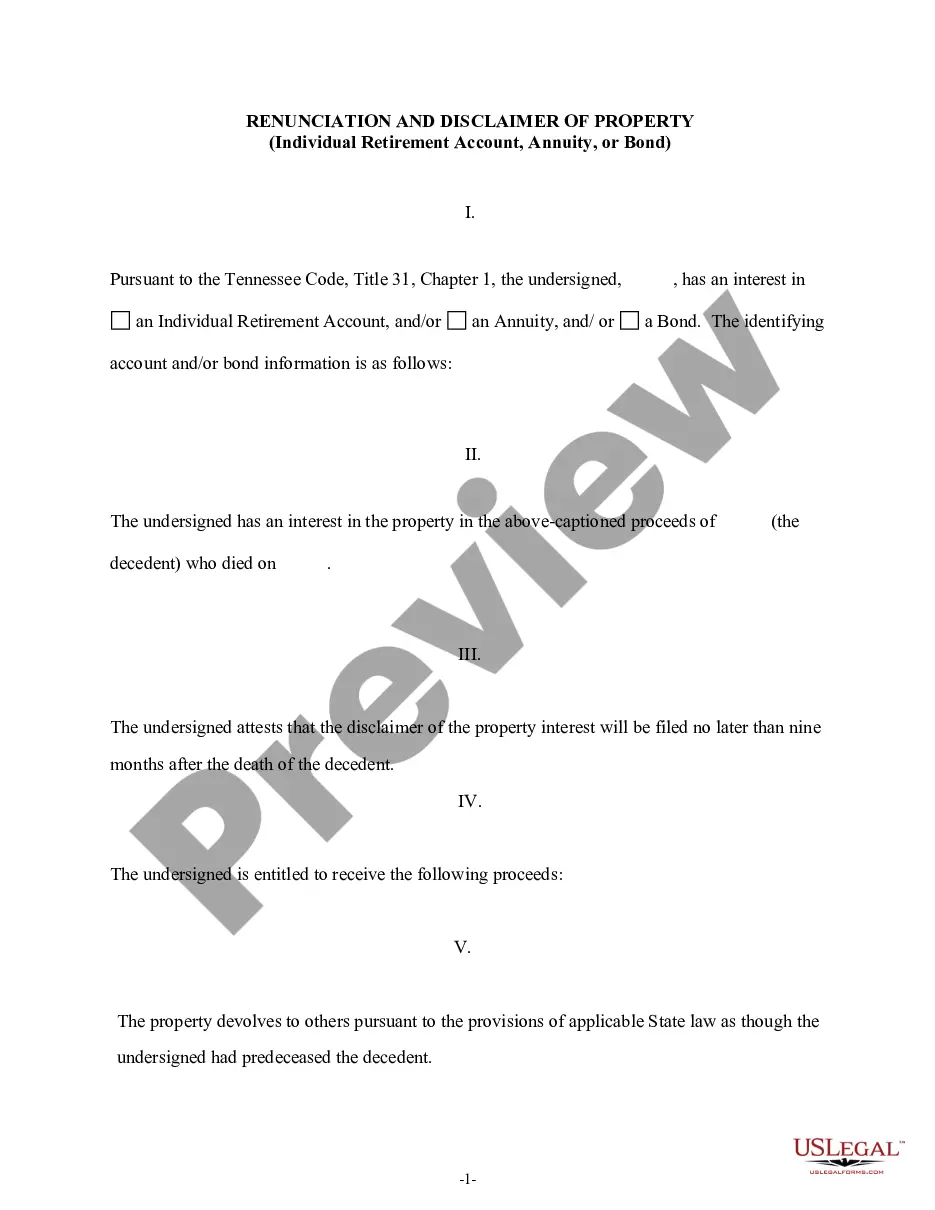

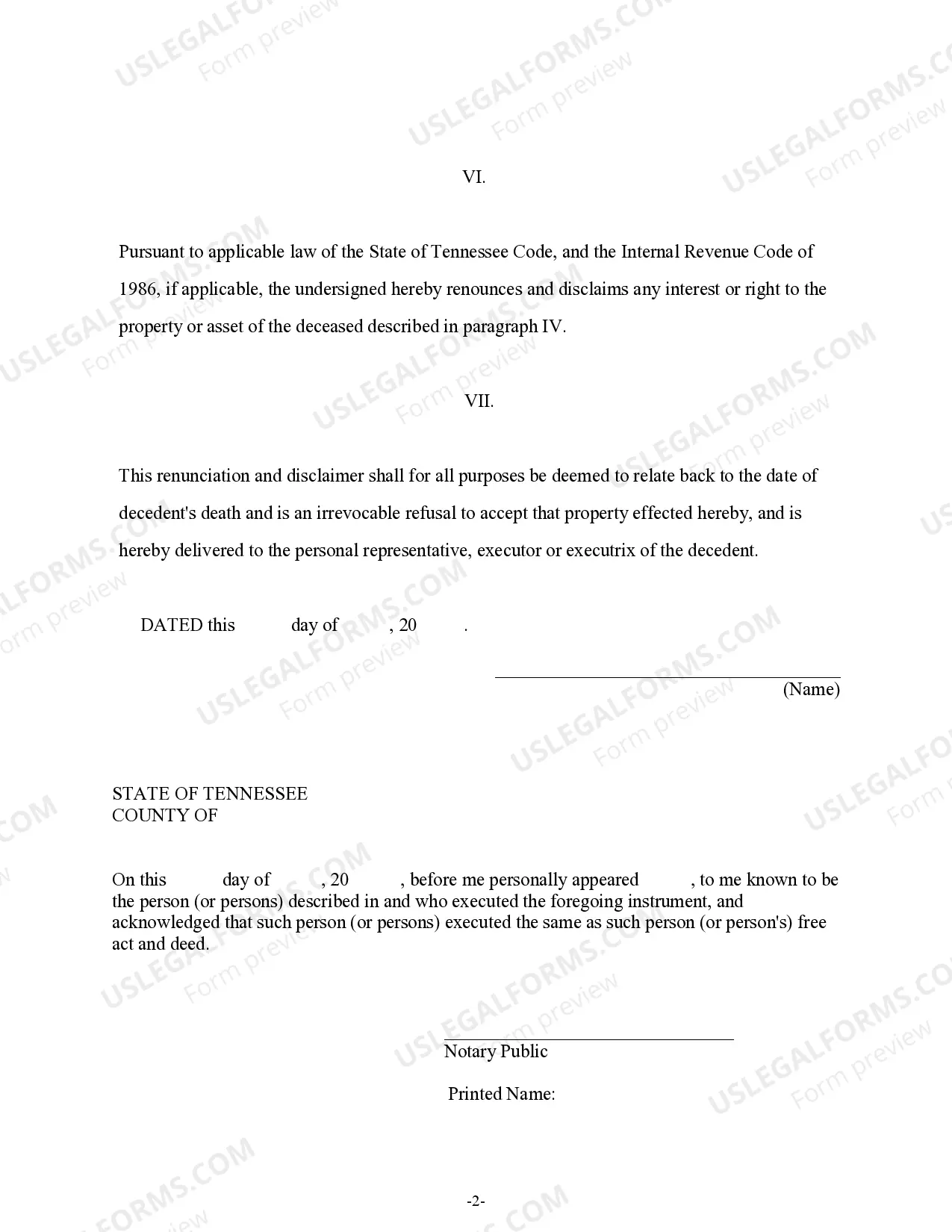

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond where the beneficiary gained an interest in the proceeds upon the death of the decedent, but, pursuant to the Tennessee Code, Title 31, Chapter 1, will renounce his/her interest in the proceeds. Therefore, the property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgement and a certificate to verify the delivery of the document.

The Clarksville Tennessee Renunciation and Disclaimer of Property — Individual Retirement Account, Annuity, or Bond is a legal mechanism that allows an individual to formally refuse their entitlement to a specific type of financial asset. This renunciation can apply to various assets such as Individual Retirement Accounts (IRAs), annuities, or bonds, among others. In Clarksville, Tennessee, individuals have the option to disclaim their claim on an inherited or designated financial asset. This renunciation can be beneficial in certain situations, whether for personal reasons or to optimize one's financial planning. By disclaiming a property, an individual essentially states that they do not want to accept ownership rights or any associated financial obligations. 1. Individual Retirement Account (IRA) Renunciation: A specific type of financial asset commonly addressed within the Clarksville Tennessee Renunciation and Disclaimer of Property is the Individual Retirement Account (IRA). IRAs are investment accounts that offer tax advantages for individuals saving for retirement. When an individual inherits an IRA, they have the option to renounce their claim on this account, allowing it to pass to the next designated beneficiary. 2. Annuity Renunciation: Another frequently encountered financial asset is an annuity contract. Upon inheriting an annuity, an individual may decide to renounce their right to future payments or ownership of the annuity. This can enable the asset to be transferred to an alternate beneficiary as indicated in the original contract. 3. Bond Renunciation: Bonds are debt securities in which an investor lends money to an entity (usually a government or corporation) for a fixed period while earning regular interest. In the context of the Clarksville Tennessee Renunciation and Disclaimer of Property, individuals may disclaim their claim to a bond, refusing its ownership rights and any associated obligations. It is important to note that renouncing or disclaiming a financial asset should be done in accordance with applicable legal requirements, ensuring compliance with estate and tax laws. A renunciation may have significant implications, and it is advisable to consult with a qualified attorney or financial advisor to understand the consequences and potential benefits of this decision fully. In summary, the Clarksville Tennessee Renunciation and Disclaimer of Property — Individual Retirement Account, Annuity, or Bond offer individuals the opportunity to formally renounce their claims on specific financial assets, including IRAs, annuities, and bonds. By renouncing an asset, individuals can bypass ownership rights and associated obligations, ensuring a smooth transfer of the asset to designated beneficiaries. Making informed decisions and seeking professional guidance is crucial when considering renunciation or disclaimer of property to ensure compliance with legal requirements and optimize financial planning for the future.The Clarksville Tennessee Renunciation and Disclaimer of Property — Individual Retirement Account, Annuity, or Bond is a legal mechanism that allows an individual to formally refuse their entitlement to a specific type of financial asset. This renunciation can apply to various assets such as Individual Retirement Accounts (IRAs), annuities, or bonds, among others. In Clarksville, Tennessee, individuals have the option to disclaim their claim on an inherited or designated financial asset. This renunciation can be beneficial in certain situations, whether for personal reasons or to optimize one's financial planning. By disclaiming a property, an individual essentially states that they do not want to accept ownership rights or any associated financial obligations. 1. Individual Retirement Account (IRA) Renunciation: A specific type of financial asset commonly addressed within the Clarksville Tennessee Renunciation and Disclaimer of Property is the Individual Retirement Account (IRA). IRAs are investment accounts that offer tax advantages for individuals saving for retirement. When an individual inherits an IRA, they have the option to renounce their claim on this account, allowing it to pass to the next designated beneficiary. 2. Annuity Renunciation: Another frequently encountered financial asset is an annuity contract. Upon inheriting an annuity, an individual may decide to renounce their right to future payments or ownership of the annuity. This can enable the asset to be transferred to an alternate beneficiary as indicated in the original contract. 3. Bond Renunciation: Bonds are debt securities in which an investor lends money to an entity (usually a government or corporation) for a fixed period while earning regular interest. In the context of the Clarksville Tennessee Renunciation and Disclaimer of Property, individuals may disclaim their claim to a bond, refusing its ownership rights and any associated obligations. It is important to note that renouncing or disclaiming a financial asset should be done in accordance with applicable legal requirements, ensuring compliance with estate and tax laws. A renunciation may have significant implications, and it is advisable to consult with a qualified attorney or financial advisor to understand the consequences and potential benefits of this decision fully. In summary, the Clarksville Tennessee Renunciation and Disclaimer of Property — Individual Retirement Account, Annuity, or Bond offer individuals the opportunity to formally renounce their claims on specific financial assets, including IRAs, annuities, and bonds. By renouncing an asset, individuals can bypass ownership rights and associated obligations, ensuring a smooth transfer of the asset to designated beneficiaries. Making informed decisions and seeking professional guidance is crucial when considering renunciation or disclaimer of property to ensure compliance with legal requirements and optimize financial planning for the future.