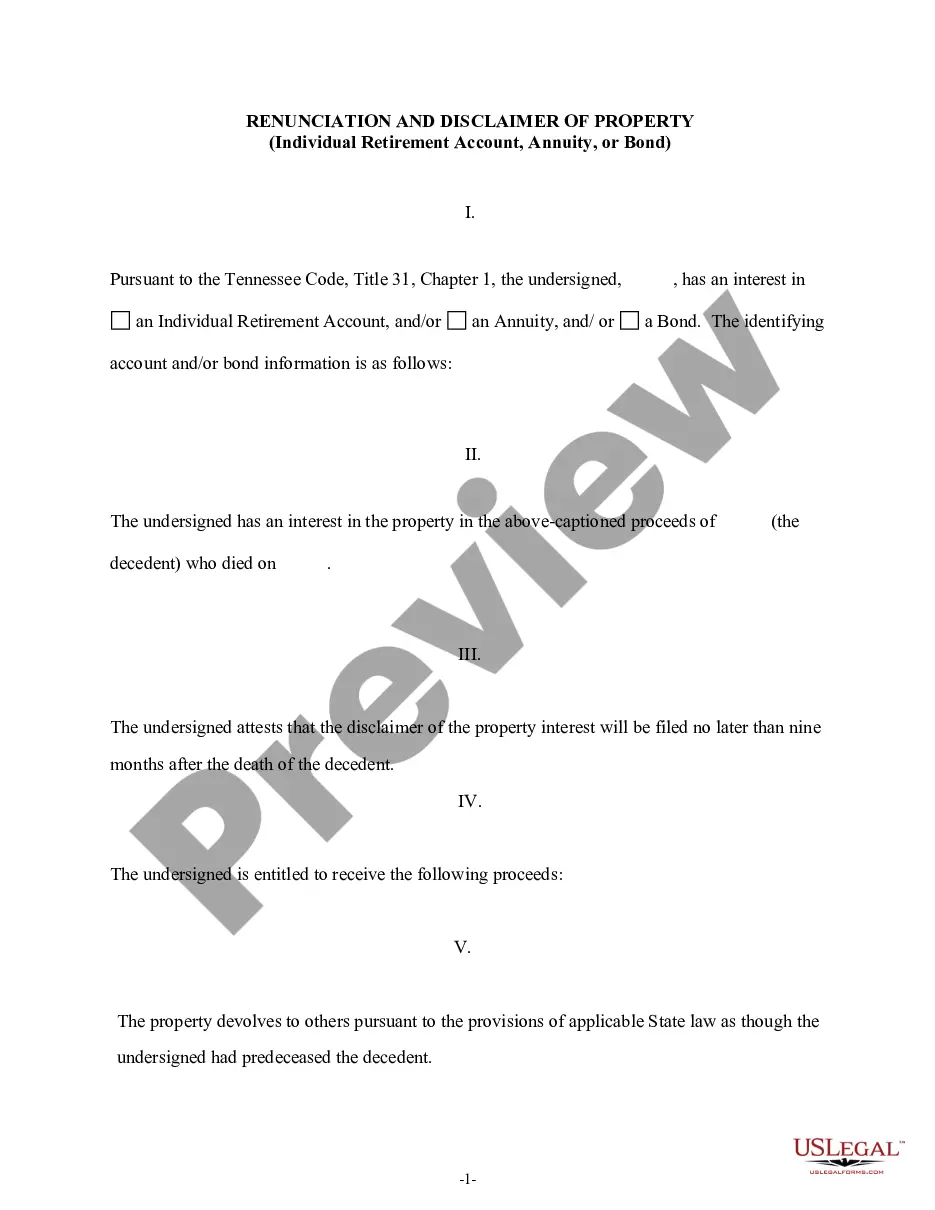

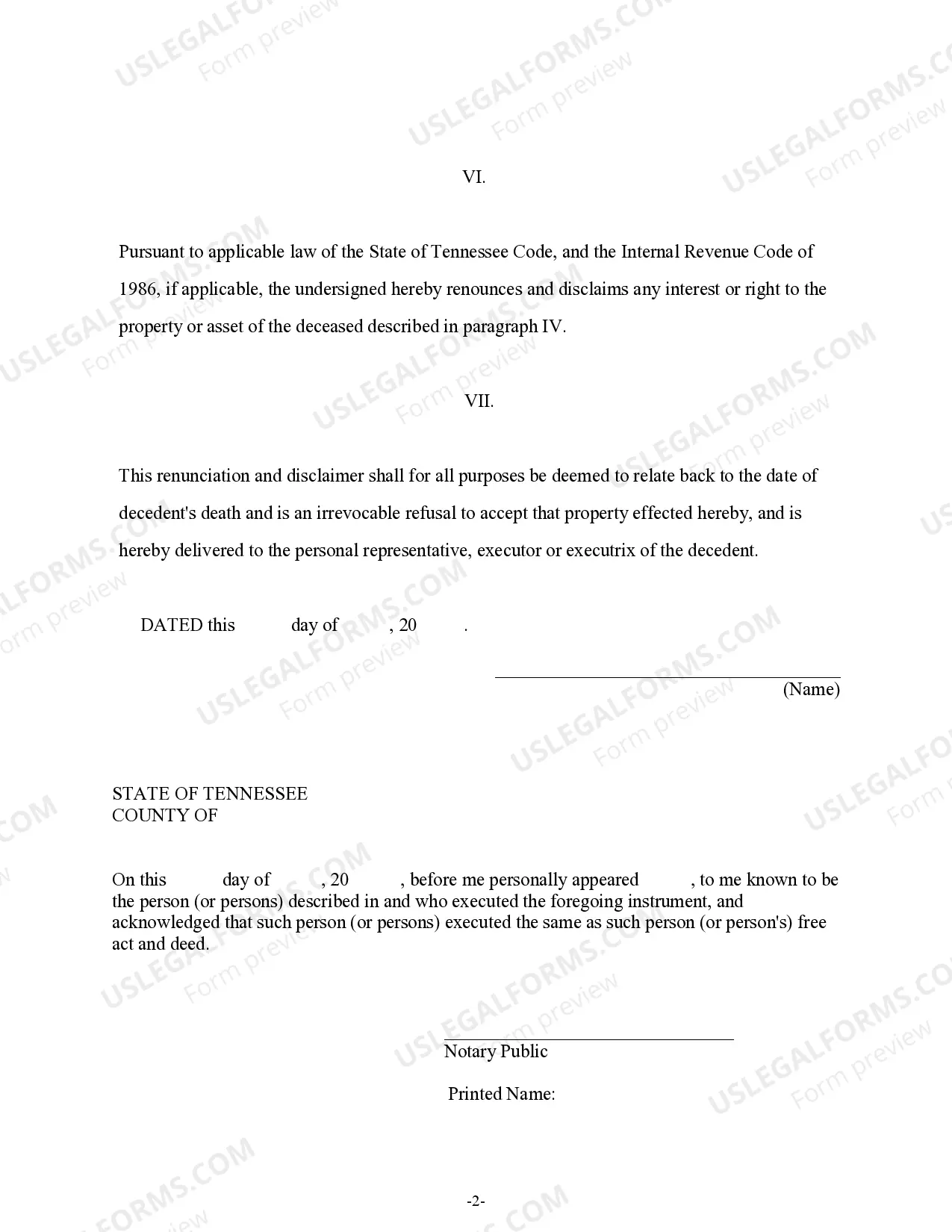

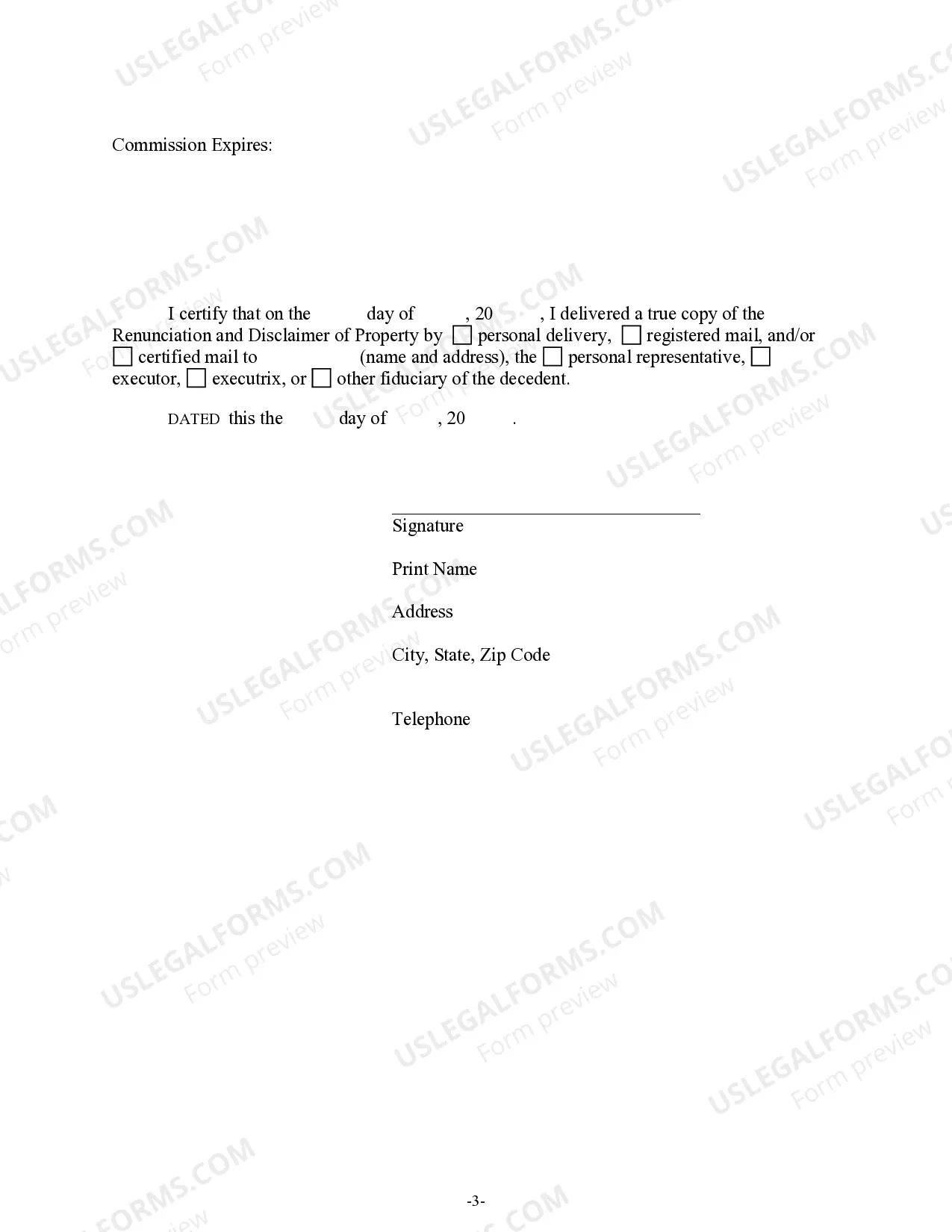

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond where the beneficiary gained an interest in the proceeds upon the death of the decedent, but, pursuant to the Tennessee Code, Title 31, Chapter 1, will renounce his/her interest in the proceeds. Therefore, the property will pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgement and a certificate to verify the delivery of the document.

Nashville Tennessee Renunciation and Disclaimer of Property — Individual Retirement Account, Annuity, or Bond is a legal document that allows an individual to formally refuse any right, claim, or interest they may have in a specific property, particularly pertaining to their Individual Retirement Account (IRA), annuity, or bonds located within the state of Tennessee. This renunciation and disclaimer process is crucial for individuals who may have been named as beneficiaries or potential recipients of such financial instruments but wish to relinquish their rights for various reasons. There are various types of Nashville Tennessee Renunciation and Disclaimer of Property — Individual Retirement Account, Annuity, or Bond that can occur, each with its own distinct nature and implications: 1. IRA Renunciation: This type of renunciation involves an individual rejecting their claim to an IRA account owned by another party. This may occur when an intended beneficiary feels that accepting the IRA would result in adverse tax consequences, financial burdens, or if they are content with their existing financial situation. 2. Annuity Renunciation: Annuity renunciations refer to individuals refusing their interest or entitlement to an annuity, which is a financial product that provides a regular income stream over a specified period or for the individual's lifetime. This decision may arise from various personal circumstances, such as financial stability, the presence of alternative income sources, or the desire to avoid any associated responsibilities. 3. Bond Renunciation: Bond renunciations involve individuals declining any rights or ownership over specific bonds within their possession or those bequeathed to them. Factors influencing such a decision could include concerns regarding the bond's performance, the desire for more liquid investments, or a lack of interest and understanding in bond investments. Whether it is an IRA, annuity, or bond, the renunciation and disclaimer process in Nashville, Tennessee, requires careful consideration and appropriate legal documentation. By renouncing their rights, individuals effectively transfer their claims to the intended secondary beneficiaries or heirs. It is crucial for individuals contemplating the renunciation and disclaimer process to consult with legal professionals to ensure compliance with Nashville, Tennessee, laws and draft appropriate documentation to formalize their renunciation. Experienced lawyers can provide guidance on the specific steps involved and help individuals navigate the legal complexities surrounding renunciation and disclaimer of property related to IRAs, annuities, or bonds in Nashville, Tennessee.