In order to preserve the virtue of the lien, as concerns subsequent purchasers or encumbrancers for a valuable consideration without notice thereof, though not as concerns the owner, such lienor, who has not so registered such lienor's contract, is required to file for record in the office of the register of deeds of the county where the premises, or any part affected lies, a sworn statement similar to that set forth in § 66-11-117, and pay the fees. The register shall file, note and record same, as provided in § 66-11-117. Such filing for record is required to be done within ninety (90) days after the building or structure or improvement is demolished, altered and/or completed, as the case may be, or is abandoned and the work not completed, or the contract of the lienor expires or is terminated or the lienor is discharged, prior to which time the lien shall be effective as against such purchasers or encumbrancers without such registration; provided, that the owner shall give thirty (30) days' notice to contractors and to all of those lienors who have filed notice in accordance with § 66-11-145 prior to the owner's transfer of any interest to a subsequent purchaser or encumbrancer for a valuable consideration.

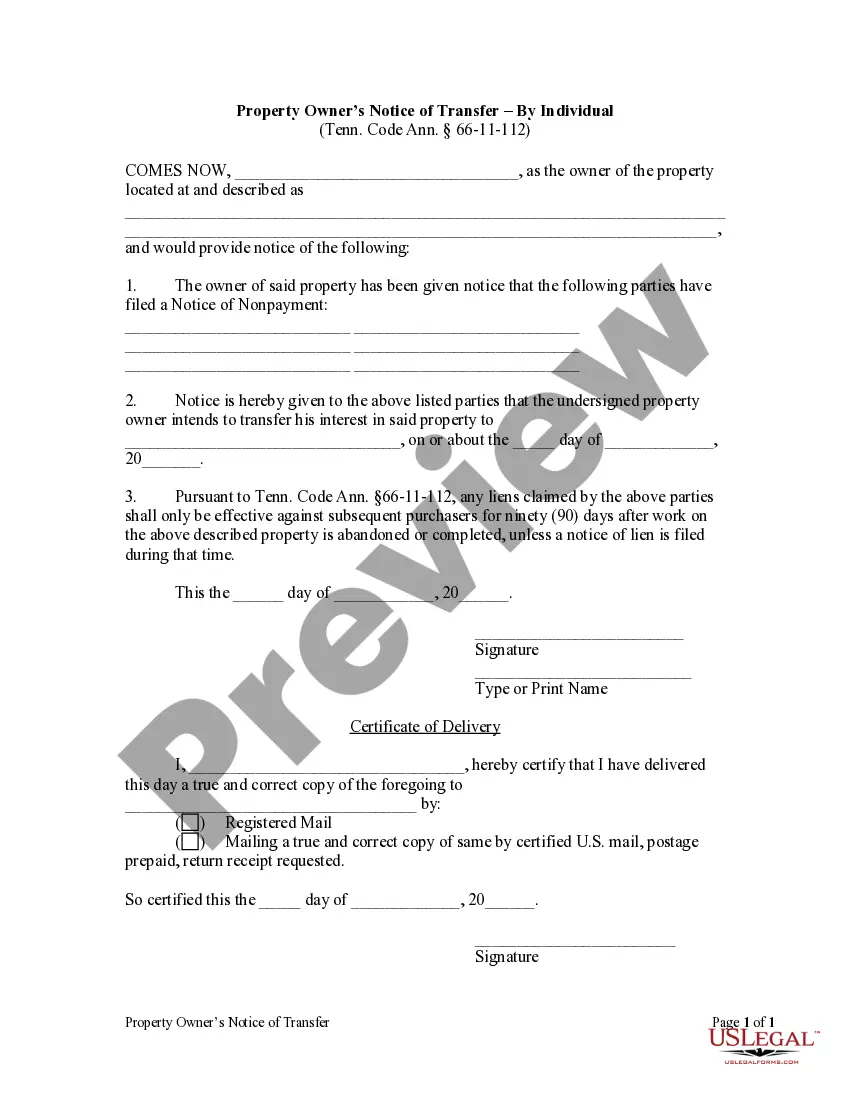

Memphis Tennessee Owner's Notice of Transfer — Individual is a legal document that serves as a declaration by a property owner in Memphis, Tennessee, to inform the relevant authorities regarding the transfer of ownership of their property. It is a critical component in the process for ensuring a smooth and properly documented property transfer. The notice of transfer is specifically designed for individuals who own real estate or other types of property in Memphis, Tennessee. It is mandatory to complete this notice and submit it to the appropriate administrative body, such as the county clerk's office or the local tax assessor's office, within a specified period of time after the transfer of ownership. The notice contains several important elements and relevant keywords that help accurately identify and document the property transfer. These include the full name and contact information of the property owner, such as their address, email, and telephone number. The property address and legal description, including the lot and block number, are also crucial details that should be included. Furthermore, the notice of transfer requires the disclosure of the new owner's information, including their full name, contact details, and any relevant identification numbers, such as a Social Security Number or Tax Identification Number. These details are essential to ensure the accurate record-keeping of property ownership and facilitate any future communications or taxation purposes. In Memphis, Tennessee, there may be different types of owner's notices of transfer — individual, depending on the specific type of property being transferred. For instance, there could be separate templates or forms for residential properties, commercial properties, vacant land, or other specialized types of properties. Each form might have slight variations in the required information, as determined by the local regulations and requirements set by the authorities. It is crucial for property owners to carefully fill out the notice of transfer form, ensuring that all the required information is accurately provided. Failure to submit this form within the designated timeframe or providing incorrect information may result in penalties, delays, or complications during the property transfer process. To obtain the correct notice of transfer form for individual property owners in Memphis, Tennessee, individuals can visit the official website of the respective administrative body, such as the county clerk's office, where downloadable forms or online submission portals may be available. Alternatively, individuals can contact the relevant office directly to inquire about the necessary documentation and obtain guidance on completing the process correctly. In conclusion, Memphis Tennessee Owner's Notice of Transfer — Individual is a crucial legal document that property owners must submit to notify the authorities about the transfer of property ownership. It helps maintain accurate records and facilitates future communication and taxation related to the property. Attention to detail and adherence to the specific requirements are vital when completing this notice to ensure a smooth and hassle-free property transfer.Memphis Tennessee Owner's Notice of Transfer — Individual is a legal document that serves as a declaration by a property owner in Memphis, Tennessee, to inform the relevant authorities regarding the transfer of ownership of their property. It is a critical component in the process for ensuring a smooth and properly documented property transfer. The notice of transfer is specifically designed for individuals who own real estate or other types of property in Memphis, Tennessee. It is mandatory to complete this notice and submit it to the appropriate administrative body, such as the county clerk's office or the local tax assessor's office, within a specified period of time after the transfer of ownership. The notice contains several important elements and relevant keywords that help accurately identify and document the property transfer. These include the full name and contact information of the property owner, such as their address, email, and telephone number. The property address and legal description, including the lot and block number, are also crucial details that should be included. Furthermore, the notice of transfer requires the disclosure of the new owner's information, including their full name, contact details, and any relevant identification numbers, such as a Social Security Number or Tax Identification Number. These details are essential to ensure the accurate record-keeping of property ownership and facilitate any future communications or taxation purposes. In Memphis, Tennessee, there may be different types of owner's notices of transfer — individual, depending on the specific type of property being transferred. For instance, there could be separate templates or forms for residential properties, commercial properties, vacant land, or other specialized types of properties. Each form might have slight variations in the required information, as determined by the local regulations and requirements set by the authorities. It is crucial for property owners to carefully fill out the notice of transfer form, ensuring that all the required information is accurately provided. Failure to submit this form within the designated timeframe or providing incorrect information may result in penalties, delays, or complications during the property transfer process. To obtain the correct notice of transfer form for individual property owners in Memphis, Tennessee, individuals can visit the official website of the respective administrative body, such as the county clerk's office, where downloadable forms or online submission portals may be available. Alternatively, individuals can contact the relevant office directly to inquire about the necessary documentation and obtain guidance on completing the process correctly. In conclusion, Memphis Tennessee Owner's Notice of Transfer — Individual is a crucial legal document that property owners must submit to notify the authorities about the transfer of property ownership. It helps maintain accurate records and facilitates future communication and taxation related to the property. Attention to detail and adherence to the specific requirements are vital when completing this notice to ensure a smooth and hassle-free property transfer.