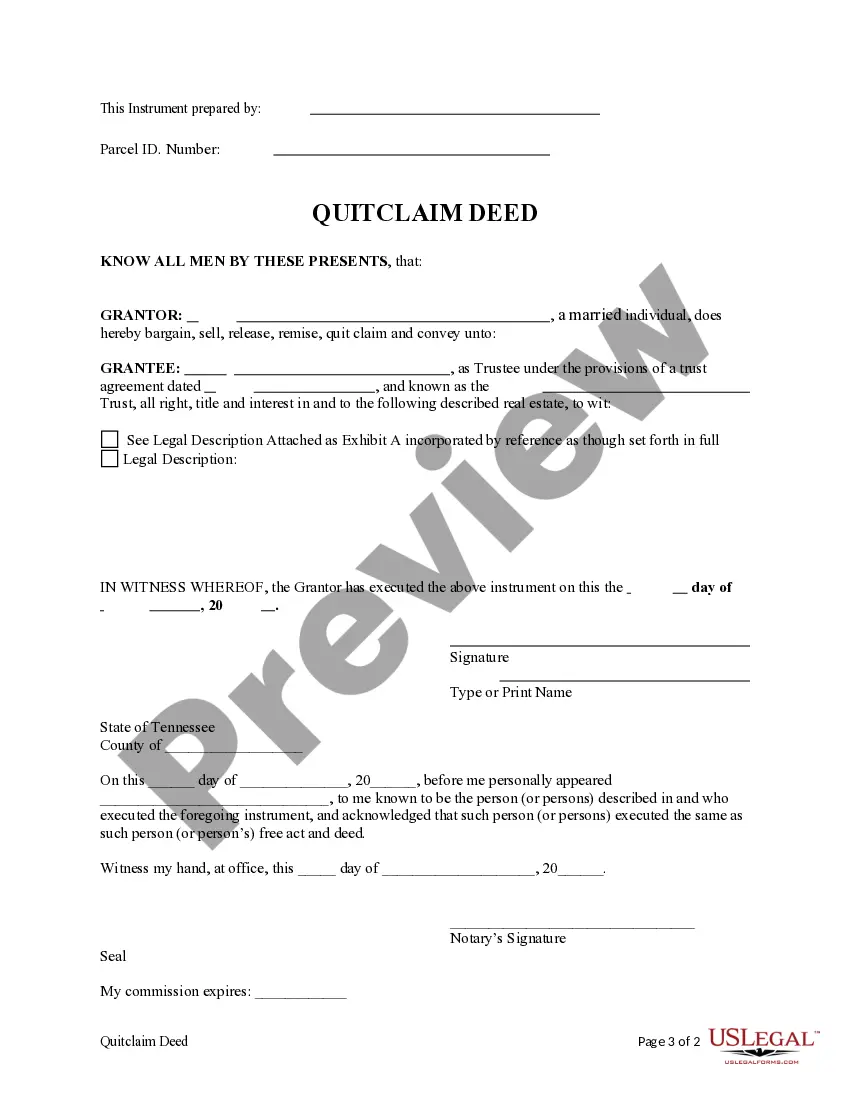

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

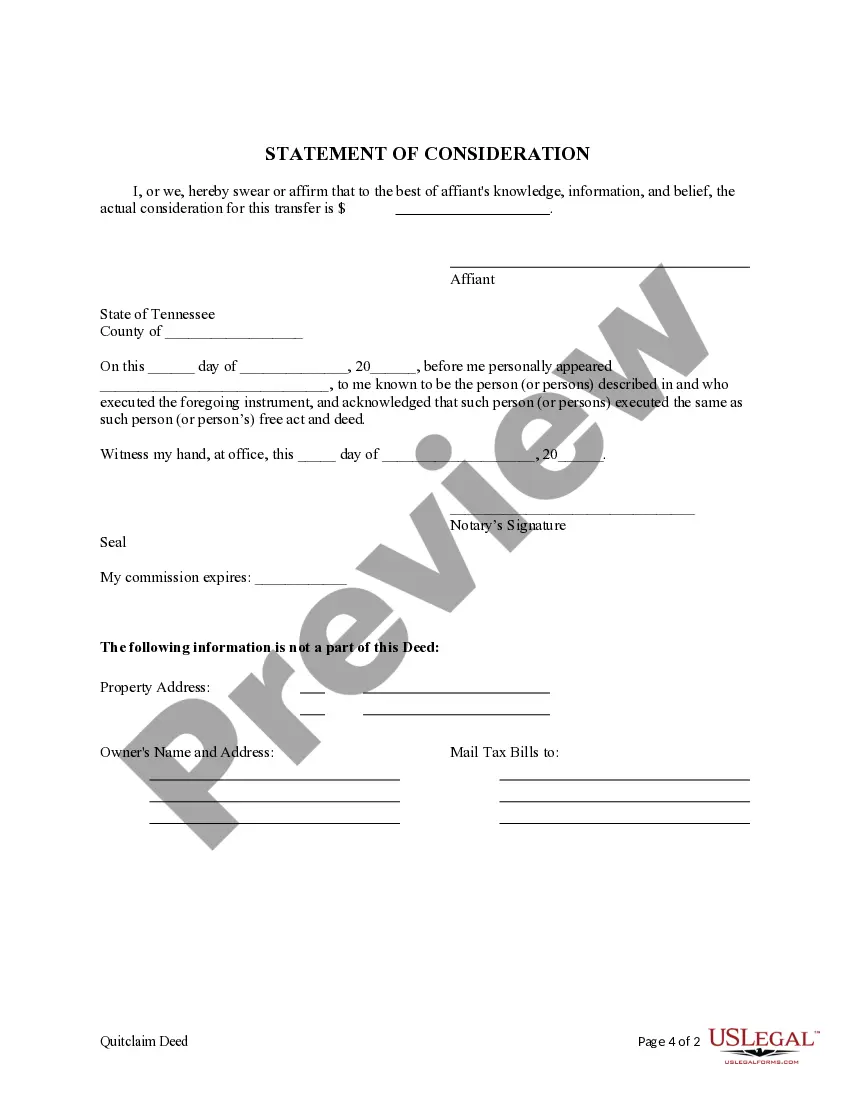

A Quitclaim Deed is a legal document used to transfer ownership of a property from one party to another, typically without any guarantees of clear title or warranty. In Knoxville, Tennessee, a Quitclaim Deed from an Individual to a Trust follows the same principles while involving the transfer of property ownership from an individual to a trust entity. A Knoxville Tennessee Quitclaim Deed from an Individual to a Trust facilitates the transfer of property ownership rights, enabling the individual to transfer the property into the ownership of a trust. This type of deed is commonly used when an individual wants to transfer their personal property to a trust for estate planning or asset protection purposes. By executing a Quitclaim Deed, the individual (granter) is essentially relinquishing any current or future interests they may have in the property and transferring those interests to the trust (grantee). This legal instrument explicitly states that the granter is conveying their interest in the property to the trust, but it does not provide any warranty or guarantee of clear title. It is important to note that there are no specific variations or different types of Knoxville Tennessee Quitclaim Deed from an Individual to a Trust based on the parties involved or the purpose of the transfer. However, individual circumstances, such as the establishment of a revocable or irrevocable trust, may result in additional specifications or clauses to be included in the deed. The essential components of a Knoxville Tennessee Quitclaim Deed from an Individual to a Trust include: 1. Names and addresses of both the granter (individual transferring ownership) and the grantee (trust entity). 2. A clear legal description of the property being transferred, including the address and any identifying information (lot number, tract number, etc.). 3. The consideration or value exchanged during the transfer. In most cases, this is a nominal amount, often referred to as "10 dollars and other valuable considerations." 4. The signature of the granter, which must be notarized to ensure its validity. 5. Recording information, such as the book and page numbers, to ensure the deed is publicly filed and becomes part of the property's official records. Executing a Knoxville Tennessee Quitclaim Deed from an Individual to a Trust involves careful consideration and is typically done in consultation with a legal professional or real estate attorney. This process ensures that all necessary legal requirements are met and that the transfer is properly documented to protect the interests of both the granter and the grantee. In conclusion, a Knoxville Tennessee Quitclaim Deed from an Individual to a Trust is a legally binding document used to transfer property ownership from an individual to a trust entity. It enables the granter to convey their interest in the property to the trust without providing any warranties or guarantees of clear title. Proper legal guidance should be sought during the creation of such a deed to ensure compliance with local laws and regulations.A Quitclaim Deed is a legal document used to transfer ownership of a property from one party to another, typically without any guarantees of clear title or warranty. In Knoxville, Tennessee, a Quitclaim Deed from an Individual to a Trust follows the same principles while involving the transfer of property ownership from an individual to a trust entity. A Knoxville Tennessee Quitclaim Deed from an Individual to a Trust facilitates the transfer of property ownership rights, enabling the individual to transfer the property into the ownership of a trust. This type of deed is commonly used when an individual wants to transfer their personal property to a trust for estate planning or asset protection purposes. By executing a Quitclaim Deed, the individual (granter) is essentially relinquishing any current or future interests they may have in the property and transferring those interests to the trust (grantee). This legal instrument explicitly states that the granter is conveying their interest in the property to the trust, but it does not provide any warranty or guarantee of clear title. It is important to note that there are no specific variations or different types of Knoxville Tennessee Quitclaim Deed from an Individual to a Trust based on the parties involved or the purpose of the transfer. However, individual circumstances, such as the establishment of a revocable or irrevocable trust, may result in additional specifications or clauses to be included in the deed. The essential components of a Knoxville Tennessee Quitclaim Deed from an Individual to a Trust include: 1. Names and addresses of both the granter (individual transferring ownership) and the grantee (trust entity). 2. A clear legal description of the property being transferred, including the address and any identifying information (lot number, tract number, etc.). 3. The consideration or value exchanged during the transfer. In most cases, this is a nominal amount, often referred to as "10 dollars and other valuable considerations." 4. The signature of the granter, which must be notarized to ensure its validity. 5. Recording information, such as the book and page numbers, to ensure the deed is publicly filed and becomes part of the property's official records. Executing a Knoxville Tennessee Quitclaim Deed from an Individual to a Trust involves careful consideration and is typically done in consultation with a legal professional or real estate attorney. This process ensures that all necessary legal requirements are met and that the transfer is properly documented to protect the interests of both the granter and the grantee. In conclusion, a Knoxville Tennessee Quitclaim Deed from an Individual to a Trust is a legally binding document used to transfer property ownership from an individual to a trust entity. It enables the granter to convey their interest in the property to the trust without providing any warranties or guarantees of clear title. Proper legal guidance should be sought during the creation of such a deed to ensure compliance with local laws and regulations.