In order to preserve the virtue of the lien, as concerns subsequent purchasers or encumbrancers for a valuable consideration without notice thereof, though not as concerns the owner, such lienor, who has not so registered such lienor's contract, is required to file for record in the office of the register of deeds of the county where the premises, or any part affected lies, a sworn statement similar to that set forth in § 66-11-117, and pay the fees. The register shall file, note and record same, as provided in § 66-11-117. Such filing for record is required to be done within ninety (90) days after the building or structure or improvement is demolished, altered and/or completed, as the case may be, or is abandoned and the work not completed, or the contract of the lienor expires or is terminated or the lienor is discharged, prior to which time the lien shall be effective as against such purchasers or encumbrancers without such registration; provided, that the owner shall give thirty (30) days' notice to contractors and to all of those lienors who have filed notice in accordance with § 66-11-145 prior to the owner's transfer of any interest to a subsequent purchaser or encumbrancer for a valuable consideration.

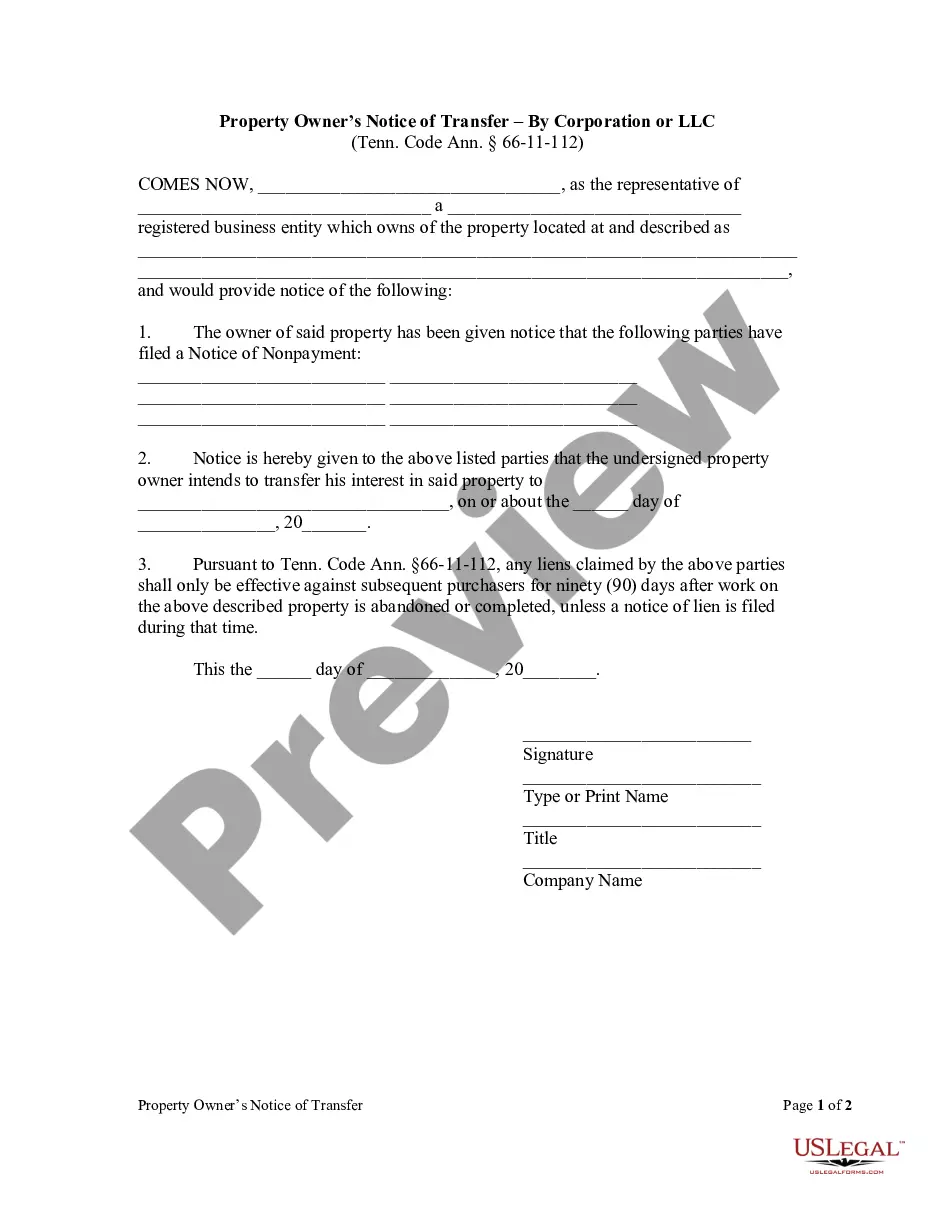

Clarksville Tennessee Owner's Notice of Transfer by Corporation or LLC is a legal document that must be filed by a corporation or limited liability company (LLC) when transferring ownership of a property located in Clarksville, Tennessee. This document formally notifies the appropriate authorities and interested parties about the change in ownership status. The Clarksville Tennessee Owner's Notice of Transfer by Corporation or LLC serves as proof of the transfer and provides important information such as the names of the transferring parties, the property address, and the effective date of transfer. The notice is usually filed with the County Clerk's Office or the Register of Deeds, depending on the specific requirements of the jurisdiction. The purpose of this notice is to ensure that all relevant parties are aware of the transfer, including government agencies, lenders, potential buyers, and other interested parties. It helps maintain transparency in real estate transactions and prevents any disputes or claims that may arise due to the change in ownership. There are various types of Clarksville Tennessee Owner's Notice of Transfer by Corporation or LLC, including: 1. Clarksville Tennessee Owner's Notice of Transfer of Real Property by Corporation: This type of notice is filed when a corporation transfers ownership of real property in Clarksville, Tennessee. 2. Clarksville Tennessee Owner's Notice of Transfer of Real Property by LLC: This type of notice is filed when an LLC transfers ownership of real property in Clarksville, Tennessee. 3. Clarksville Tennessee Owner's Notice of Transfer of Personal Property by Corporation or LLC: This notice is used when a corporation or LLC transfers ownership of personal property, such as vehicles, equipment, or inventory, in Clarksville, Tennessee. 4. Clarksville Tennessee Owner's Notice of Transfer of Business Assets by Corporation or LLC: This notice is filed when a corporation or LLC transfers ownership of its business assets, including tangible and intangible assets, in Clarksville, Tennessee. It is important to consult with a legal professional or refer to the specific regulations of Clarksville, Tennessee, to ensure the correct type of notice is used and all necessary information is included for a successful transfer of ownership.Clarksville Tennessee Owner's Notice of Transfer by Corporation or LLC is a legal document that must be filed by a corporation or limited liability company (LLC) when transferring ownership of a property located in Clarksville, Tennessee. This document formally notifies the appropriate authorities and interested parties about the change in ownership status. The Clarksville Tennessee Owner's Notice of Transfer by Corporation or LLC serves as proof of the transfer and provides important information such as the names of the transferring parties, the property address, and the effective date of transfer. The notice is usually filed with the County Clerk's Office or the Register of Deeds, depending on the specific requirements of the jurisdiction. The purpose of this notice is to ensure that all relevant parties are aware of the transfer, including government agencies, lenders, potential buyers, and other interested parties. It helps maintain transparency in real estate transactions and prevents any disputes or claims that may arise due to the change in ownership. There are various types of Clarksville Tennessee Owner's Notice of Transfer by Corporation or LLC, including: 1. Clarksville Tennessee Owner's Notice of Transfer of Real Property by Corporation: This type of notice is filed when a corporation transfers ownership of real property in Clarksville, Tennessee. 2. Clarksville Tennessee Owner's Notice of Transfer of Real Property by LLC: This type of notice is filed when an LLC transfers ownership of real property in Clarksville, Tennessee. 3. Clarksville Tennessee Owner's Notice of Transfer of Personal Property by Corporation or LLC: This notice is used when a corporation or LLC transfers ownership of personal property, such as vehicles, equipment, or inventory, in Clarksville, Tennessee. 4. Clarksville Tennessee Owner's Notice of Transfer of Business Assets by Corporation or LLC: This notice is filed when a corporation or LLC transfers ownership of its business assets, including tangible and intangible assets, in Clarksville, Tennessee. It is important to consult with a legal professional or refer to the specific regulations of Clarksville, Tennessee, to ensure the correct type of notice is used and all necessary information is included for a successful transfer of ownership.