In order to preserve the virtue of the lien, as concerns subsequent purchasers or encumbrancers for a valuable consideration without notice thereof, though not as concerns the owner, such lienor, who has not so registered such lienor's contract, is required to file for record in the office of the register of deeds of the county where the premises, or any part affected lies, a sworn statement similar to that set forth in § 66-11-117, and pay the fees. The register shall file, note and record same, as provided in § 66-11-117. Such filing for record is required to be done within ninety (90) days after the building or structure or improvement is demolished, altered and/or completed, as the case may be, or is abandoned and the work not completed, or the contract of the lienor expires or is terminated or the lienor is discharged, prior to which time the lien shall be effective as against such purchasers or encumbrancers without such registration; provided, that the owner shall give thirty (30) days' notice to contractors and to all of those lienors who have filed notice in accordance with § 66-11-145 prior to the owner's transfer of any interest to a subsequent purchaser or encumbrancer for a valuable consideration.

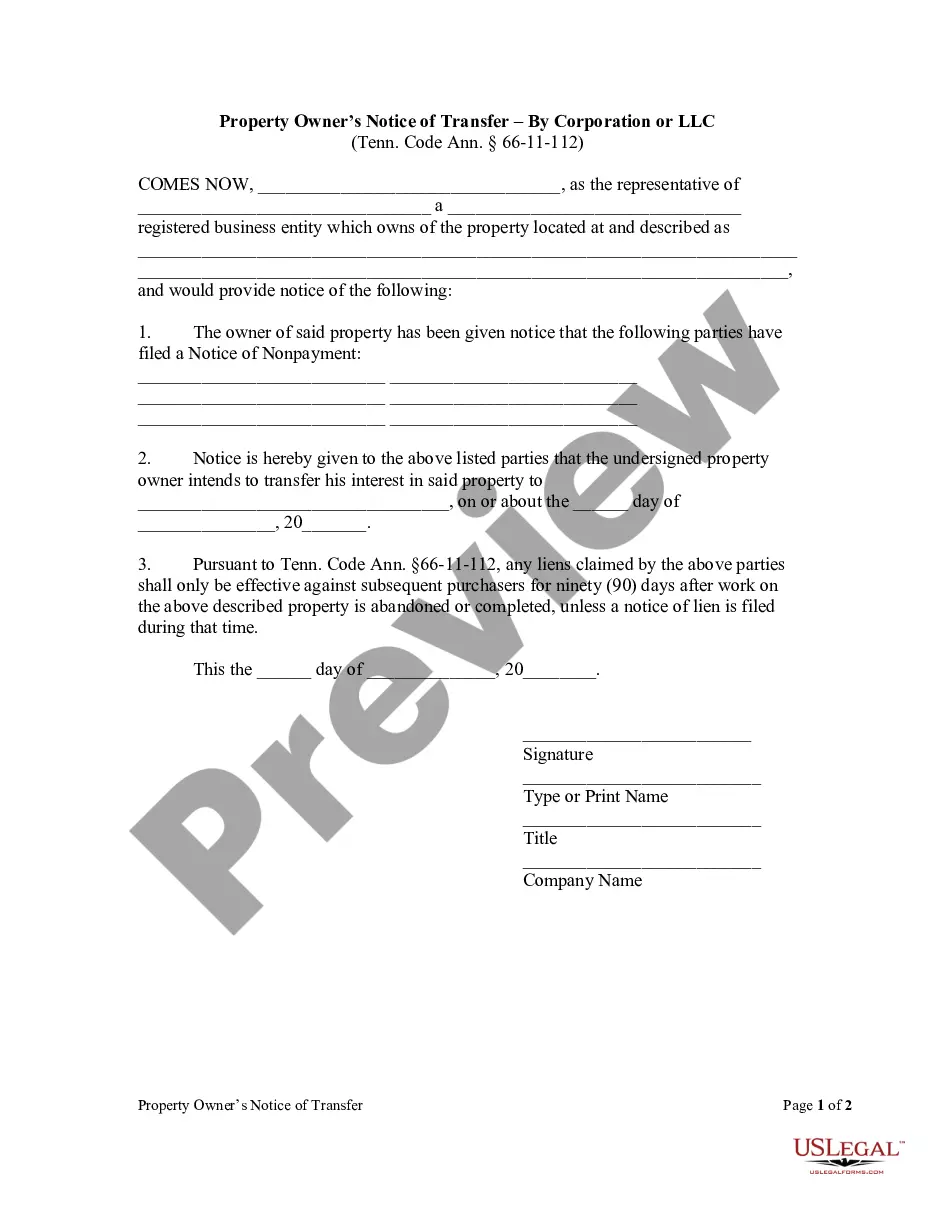

Title: Knoxville Tennessee Owner's Notice of Transfer by Corporation or LLC: Understanding the Process and Available Types Introduction: In Knoxville, Tennessee, when a property owner wishes to transfer their ownership interests through a corporation or limited liability company (LLC), they are required to file a specific document known as the Owner's Notice of Transfer. This notice serves as a notification to the relevant parties and authorities about the change in ownership. In this article, we will provide a detailed description of this notice, its importance, and explore different types of Owner's Notice of Transfer by Corporation or LLC commonly used in Knoxville, Tennessee. 1. What is the Knoxville Tennessee Owner's Notice of Transfer by Corporation or LLC? The Owner's Notice of Transfer by Corporation or LLC is a legal document submitted by a property owner, who is transferring their ownership interests, to inform the relevant parties, including the county register's office, of the upcoming change in ownership. This notice is typically required to be filed before the transfer is completed and helps maintain an accurate record of ownership for taxation and legal purposes. 2. Importance of the Owner's Notice of Transfer by Corporation or LLC in Knoxville, Tennessee: — Complies with Legal Requirements: Filing the Owner's Notice of Transfer by Corporation or LLC is often a legal requirement in Knoxville, Tennessee, ensuring compliance with state regulations related to property transfers. — Taxation Purposes: The notice helps maintain accurate records of property ownership, allowing the local government to properly assess and collect property taxes. — Avoiding Legal Issues: By officially notifying all concerned stakeholders, the notice minimizes the possibility of legal disputes arising from unclear ownership. 3. Types of Knoxville Tennessee Owner's Notice of Transfer by Corporation or LLC: a) Corporate Transfer Notice: This type of notice is used when a property owner transfers their ownership interests to a corporation. It includes information about both the transferring individual and the corporation, such as names, addresses, and relevant contact information. b) LLC Transfer Notice: Similar to the Corporate Transfer Notice, this type is utilized when a property owner transfers their ownership interests to a limited liability company (LLC). It includes details about both the transferring individual and the LLC, including their names, addresses, and contact information. c) Annual Report Notice: In some cases, an additional notice known as the Annual Report Notice may be required. This report is filed annually by a corporation or LLC to update the state on any changes to their registered agent or principal office address. Conclusion: When transferring ownership interests in Knoxville, Tennessee, through a corporation or LLC, it is crucial to follow the legal requirements by submitting the appropriate Owner's Notice of Transfer. This document ensures compliance with state regulations, facilitates accurate tax assessments, and minimizes potential legal disputes. By understanding the different types of notices, including Corporate Transfer, LLC Transfer, and Annual Report Notices, property owners can navigate the transfer process smoothly and fulfill their obligations effectively.Title: Knoxville Tennessee Owner's Notice of Transfer by Corporation or LLC: Understanding the Process and Available Types Introduction: In Knoxville, Tennessee, when a property owner wishes to transfer their ownership interests through a corporation or limited liability company (LLC), they are required to file a specific document known as the Owner's Notice of Transfer. This notice serves as a notification to the relevant parties and authorities about the change in ownership. In this article, we will provide a detailed description of this notice, its importance, and explore different types of Owner's Notice of Transfer by Corporation or LLC commonly used in Knoxville, Tennessee. 1. What is the Knoxville Tennessee Owner's Notice of Transfer by Corporation or LLC? The Owner's Notice of Transfer by Corporation or LLC is a legal document submitted by a property owner, who is transferring their ownership interests, to inform the relevant parties, including the county register's office, of the upcoming change in ownership. This notice is typically required to be filed before the transfer is completed and helps maintain an accurate record of ownership for taxation and legal purposes. 2. Importance of the Owner's Notice of Transfer by Corporation or LLC in Knoxville, Tennessee: — Complies with Legal Requirements: Filing the Owner's Notice of Transfer by Corporation or LLC is often a legal requirement in Knoxville, Tennessee, ensuring compliance with state regulations related to property transfers. — Taxation Purposes: The notice helps maintain accurate records of property ownership, allowing the local government to properly assess and collect property taxes. — Avoiding Legal Issues: By officially notifying all concerned stakeholders, the notice minimizes the possibility of legal disputes arising from unclear ownership. 3. Types of Knoxville Tennessee Owner's Notice of Transfer by Corporation or LLC: a) Corporate Transfer Notice: This type of notice is used when a property owner transfers their ownership interests to a corporation. It includes information about both the transferring individual and the corporation, such as names, addresses, and relevant contact information. b) LLC Transfer Notice: Similar to the Corporate Transfer Notice, this type is utilized when a property owner transfers their ownership interests to a limited liability company (LLC). It includes details about both the transferring individual and the LLC, including their names, addresses, and contact information. c) Annual Report Notice: In some cases, an additional notice known as the Annual Report Notice may be required. This report is filed annually by a corporation or LLC to update the state on any changes to their registered agent or principal office address. Conclusion: When transferring ownership interests in Knoxville, Tennessee, through a corporation or LLC, it is crucial to follow the legal requirements by submitting the appropriate Owner's Notice of Transfer. This document ensures compliance with state regulations, facilitates accurate tax assessments, and minimizes potential legal disputes. By understanding the different types of notices, including Corporate Transfer, LLC Transfer, and Annual Report Notices, property owners can navigate the transfer process smoothly and fulfill their obligations effectively.