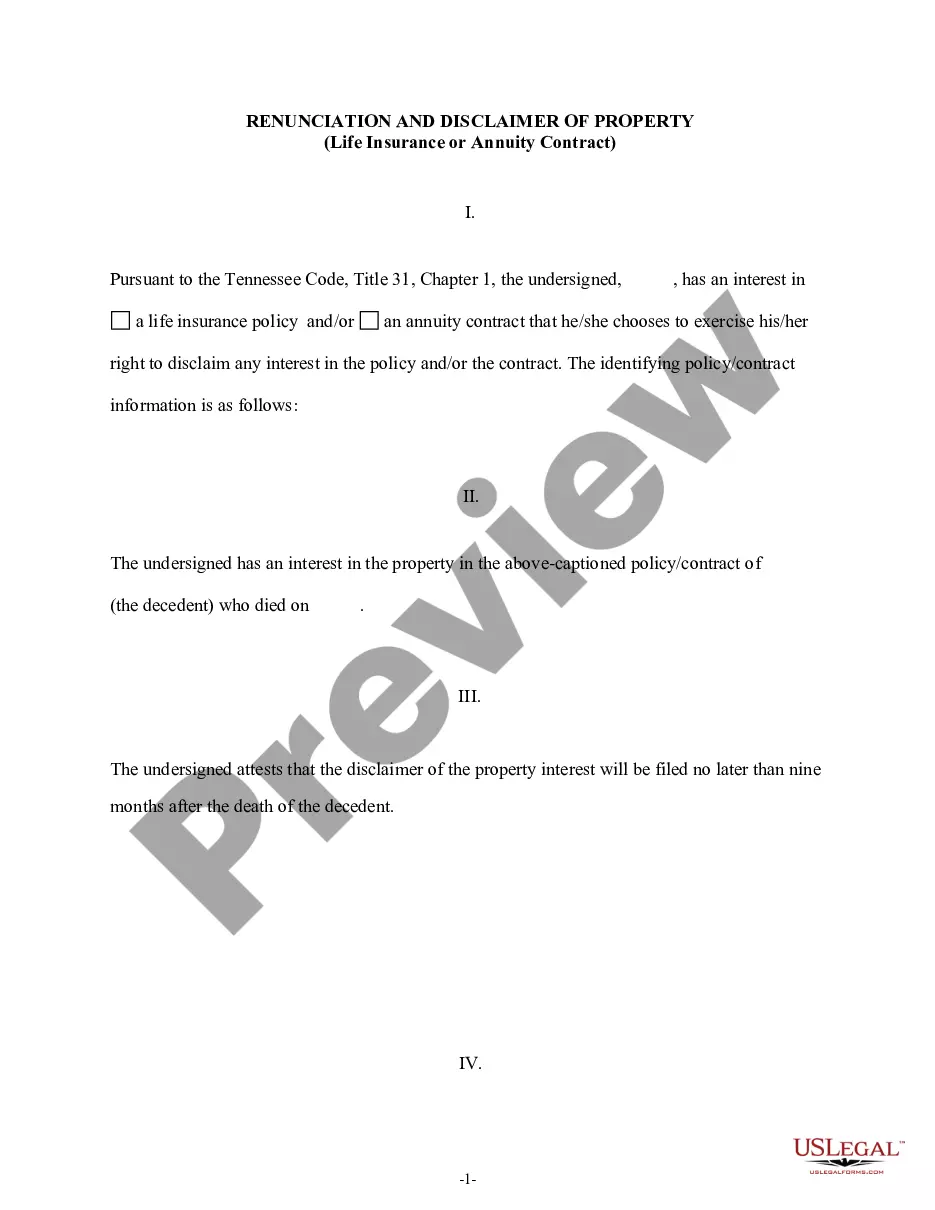

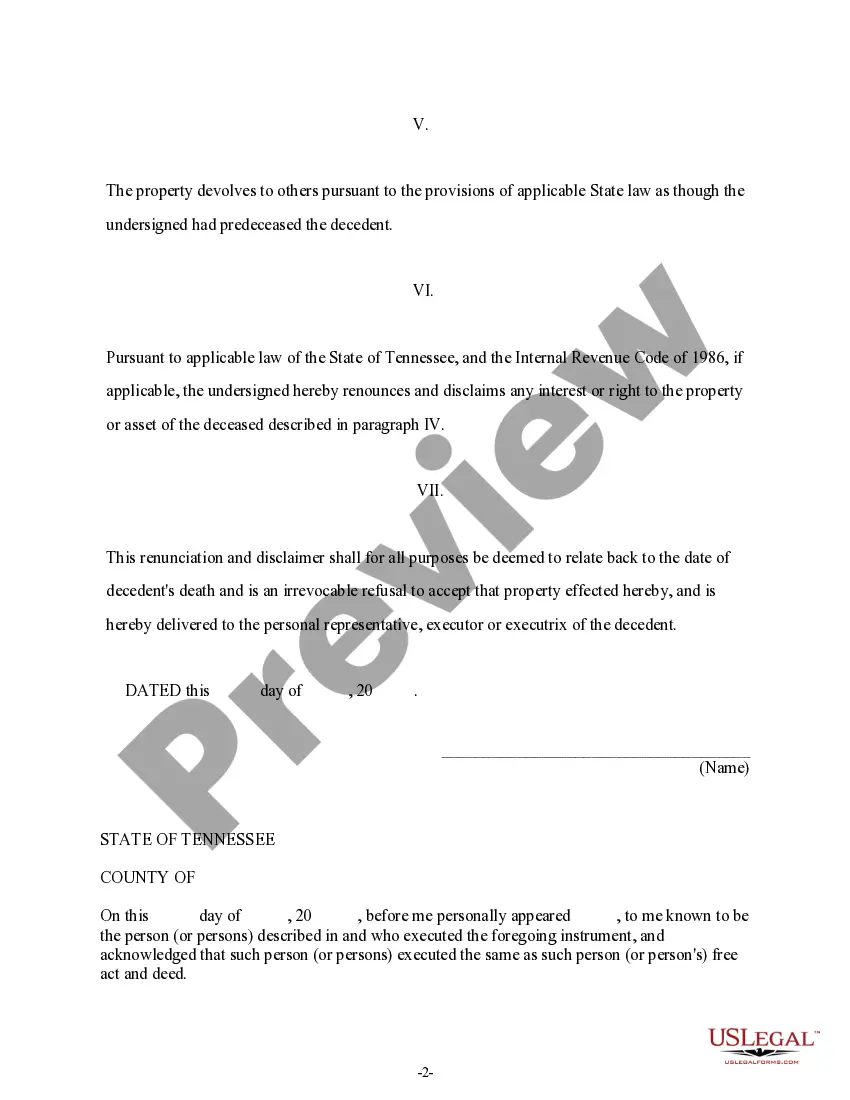

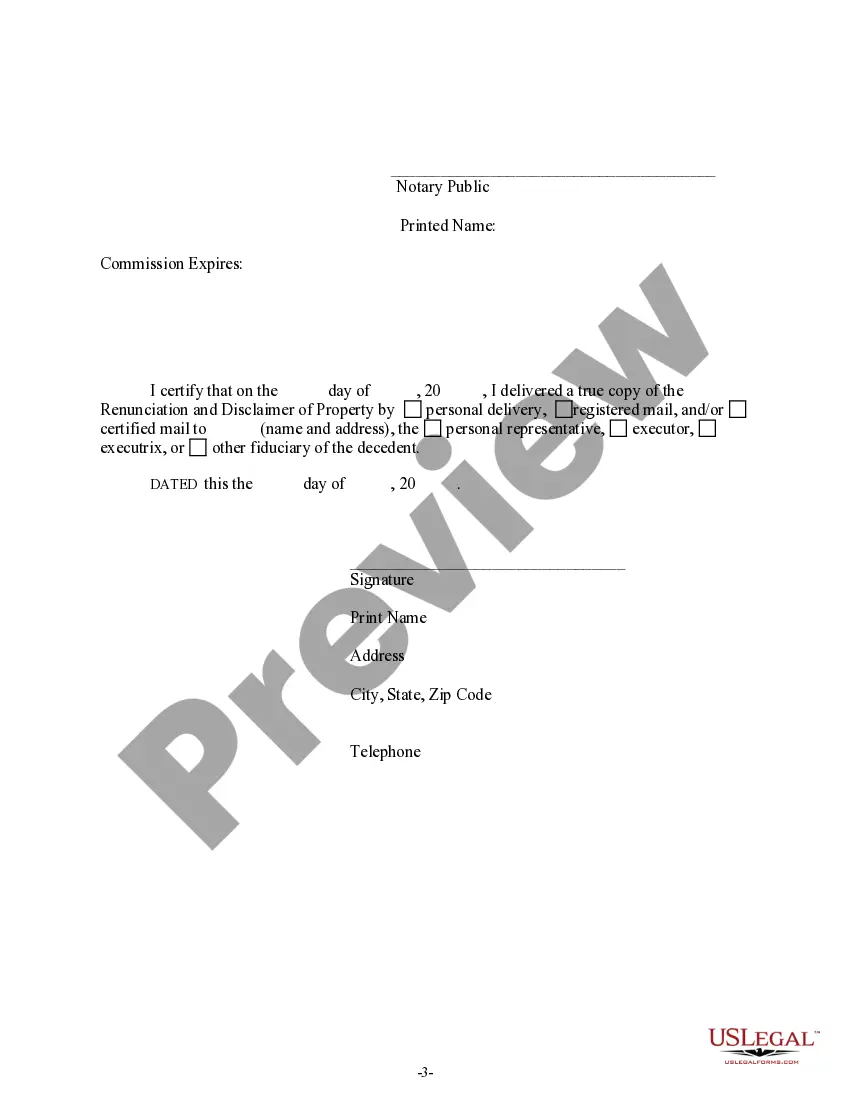

This form is a Renunciation and Disclaimer of Life Insurance or Annuity Contract proceeds, where the beneficiary gained a rightful interest in the proceeds upon the death of the decedent, but, has chosen to terminate his/her interest in the proceeds pursuant to the Tennessee Code, Title 31, Chapter 1. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also includes a state specific acknowledgement and a certificate to verify delivery.

Chattanooga, Tennessee Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract In Chattanooga, Tennessee, the process of renunciation and disclaimer of property from a life insurance or annuity contract is an important legal procedure. Individuals may choose to renounce or disclaim their interest in such contracts for various reasons, including personal preferences, financial considerations, or estate planning purposes. This detailed description will outline the key aspects of renunciation and disclaimer in Chattanooga, Tennessee. Renunciation and disclaimer of property from a life insurance or annuity contract involve the act of legally giving up one's right to receive any benefits, proceeds, or interest arising from such a contract. By renouncing or disclaiming these rights, individuals effectively disassociate themselves from the policy and its benefits, ensuring that they are not legally obligated or entitled to any future claims. It is essential to note that there are different types of Chattanooga Tennessee Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract: 1. Absolute Renunciation: This type of renunciation is a complete abandonment of all rights and interests in the life insurance or annuity contract. The renouncing party no longer has any claims or entitlements to any benefits, proceeds, or interests associated with the policy. 2. Partial Renunciation: In some instances, individuals may choose to renounce only a portion of their rights or interests in a life insurance or annuity contract. This partial renunciation allows them to retain some benefits while relinquishing others. It is important to consult with legal professionals to determine the implications and limitations of partial renunciation. 3. Disclaimer of Property: A disclaimer of property involves the legal act of refusing or disclaiming an inheritance or property interest. Individuals who are designated as beneficiaries in a life insurance or annuity contract can disclaim their right to receive any benefits from the policy. This disclaimer can be made before or after the policyholder's death, but it must comply with specific legal requirements. The process of renunciation and disclaimer in Chattanooga, Tennessee involves filing the appropriate legal documents, such as a written renunciation or disclaimer statement, with the relevant authorities or entities, such as the insurance company or the court. It is crucial to ensure that these documents are properly prepared, signed, and submitted within the prescribed time frame, according to the applicable laws in Chattanooga, Tennessee. Individuals considering renunciation or disclaimer of property from a life insurance or annuity contract should consult with experienced attorneys or legal professionals specializing in estate planning, probate law, or insurance law. These experts can provide guidance and advice tailored to the individual's specific circumstances, ensuring compliance with all legal requirements and protecting their interests. In summary, renunciation and disclaimer of property from life insurance or annuity contracts in Chattanooga, Tennessee involve legally giving up one's rights or interests in these policies. Different types of renunciation, including absolute and partial renunciation, as well as the disclaimer of property, provide individuals with options to relinquish their entitlements or claims. Seeking professional legal assistance and following the appropriate procedures are crucial to ensure a smooth and legally compliant renunciation or disclaimer process.Chattanooga, Tennessee Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract In Chattanooga, Tennessee, the process of renunciation and disclaimer of property from a life insurance or annuity contract is an important legal procedure. Individuals may choose to renounce or disclaim their interest in such contracts for various reasons, including personal preferences, financial considerations, or estate planning purposes. This detailed description will outline the key aspects of renunciation and disclaimer in Chattanooga, Tennessee. Renunciation and disclaimer of property from a life insurance or annuity contract involve the act of legally giving up one's right to receive any benefits, proceeds, or interest arising from such a contract. By renouncing or disclaiming these rights, individuals effectively disassociate themselves from the policy and its benefits, ensuring that they are not legally obligated or entitled to any future claims. It is essential to note that there are different types of Chattanooga Tennessee Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract: 1. Absolute Renunciation: This type of renunciation is a complete abandonment of all rights and interests in the life insurance or annuity contract. The renouncing party no longer has any claims or entitlements to any benefits, proceeds, or interests associated with the policy. 2. Partial Renunciation: In some instances, individuals may choose to renounce only a portion of their rights or interests in a life insurance or annuity contract. This partial renunciation allows them to retain some benefits while relinquishing others. It is important to consult with legal professionals to determine the implications and limitations of partial renunciation. 3. Disclaimer of Property: A disclaimer of property involves the legal act of refusing or disclaiming an inheritance or property interest. Individuals who are designated as beneficiaries in a life insurance or annuity contract can disclaim their right to receive any benefits from the policy. This disclaimer can be made before or after the policyholder's death, but it must comply with specific legal requirements. The process of renunciation and disclaimer in Chattanooga, Tennessee involves filing the appropriate legal documents, such as a written renunciation or disclaimer statement, with the relevant authorities or entities, such as the insurance company or the court. It is crucial to ensure that these documents are properly prepared, signed, and submitted within the prescribed time frame, according to the applicable laws in Chattanooga, Tennessee. Individuals considering renunciation or disclaimer of property from a life insurance or annuity contract should consult with experienced attorneys or legal professionals specializing in estate planning, probate law, or insurance law. These experts can provide guidance and advice tailored to the individual's specific circumstances, ensuring compliance with all legal requirements and protecting their interests. In summary, renunciation and disclaimer of property from life insurance or annuity contracts in Chattanooga, Tennessee involve legally giving up one's rights or interests in these policies. Different types of renunciation, including absolute and partial renunciation, as well as the disclaimer of property, provide individuals with options to relinquish their entitlements or claims. Seeking professional legal assistance and following the appropriate procedures are crucial to ensure a smooth and legally compliant renunciation or disclaimer process.