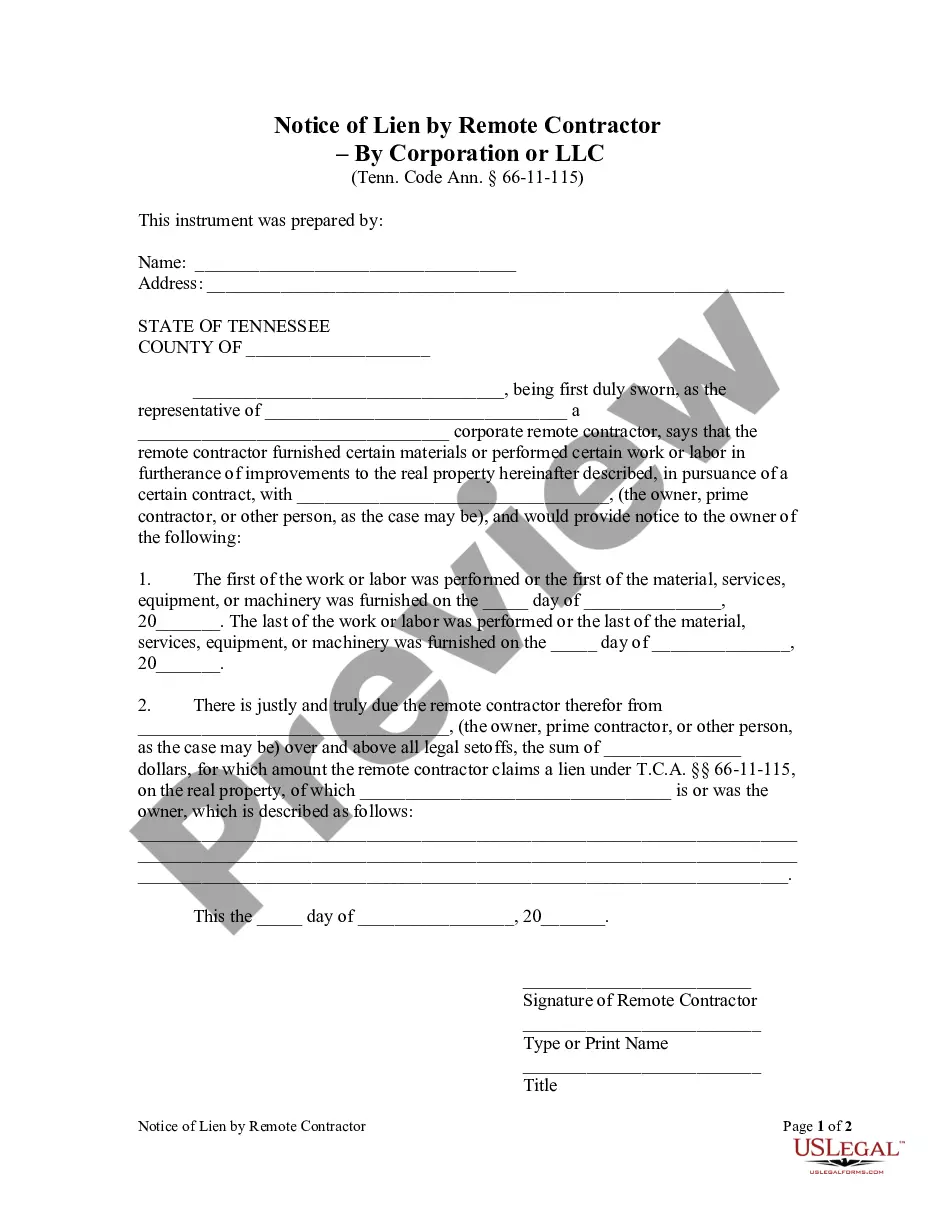

Within ninety (90) days after the demolition and/or building or improvement is completed, or the contract of such laborer, mechanic, furnisher, or other person shall expire, or such person is discharged, such person shall notify, in writing, the owner of the property on which the building is being erected or the improvement is being made, or the owner's agent or attorney, if the owner resides out of the county, that the lien is claimed.

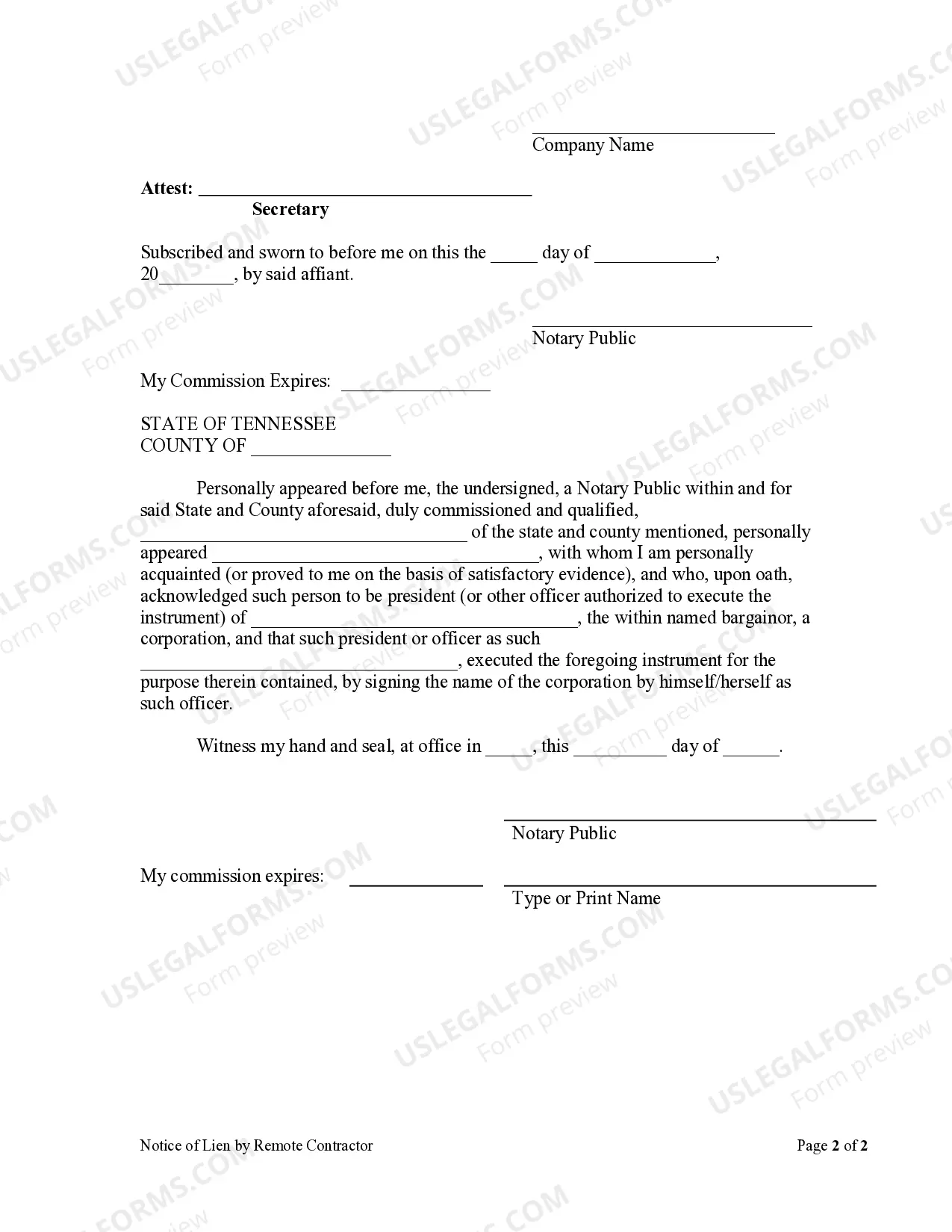

A Chattanooga Tennessee Notice of Lien by Remote Contractor — Corporation or LLC is a legal document filed by a corporation or limited liability company (LLC) to assert a lien against a property for unpaid debts or services provided by a remote contractor. This notice is issued to give notice to property owners and other interested parties about the contractor's claim for payment. The Notice of Lien by Remote Contractor is an important tool for contractors to protect their rights and ensure they receive payment for their work or services rendered. By filing this notice, the contractor establishes a legal claim against the property and may have the right to foreclose the lien if the debt remains unpaid. There can be different types of Chattanooga Tennessee Notice of Lien by Remote Contractor — Corporation or LLC, depending on the nature of the contractor's work or services. Some common types may include: 1. Construction Lien: This type of notice is typically filed by construction contractors or subcontractors for unpaid construction work or materials provided for a property. 2. Maintenance and Repair Lien: This notice is applicable when a corporation or LLC provides maintenance or repair services to a property and seeks payment for the services rendered. 3. Professional Services Lien: This type of lien is filed when a corporation or LLC provides professional services such as engineering, architectural, legal, or consulting services and seeks compensation for the services provided. 4. Equipment Rental Lien: If a corporation or LLC rents out equipment or machinery to a property owner or contractor and the payment remains outstanding, they can file this type of lien. When filing a Notice of Lien by Remote Contractor — Corporation or LLC in Chattanooga Tennessee, it is important to adhere to the legal requirements set forth by the state. Contractors should ensure the accuracy of the information provided in the notice, including the property owner's name, the amount owed, and the description of the work or services provided. Furthermore, it is crucial for contractors to adhere to specified deadlines and procedures for filing the notice. Failure to comply with these requirements can jeopardize the validity of the lien. By filing a Chattanooga Tennessee Notice of Lien by Remote Contractor — Corporation or LLC, contractors can protect their rights and increase the chances of obtaining payment for their outstanding debts. However, it is advisable to consult with a legal professional to ensure compliance with all laws and regulations governing the filing of liens in Chattanooga, Tennessee.A Chattanooga Tennessee Notice of Lien by Remote Contractor — Corporation or LLC is a legal document filed by a corporation or limited liability company (LLC) to assert a lien against a property for unpaid debts or services provided by a remote contractor. This notice is issued to give notice to property owners and other interested parties about the contractor's claim for payment. The Notice of Lien by Remote Contractor is an important tool for contractors to protect their rights and ensure they receive payment for their work or services rendered. By filing this notice, the contractor establishes a legal claim against the property and may have the right to foreclose the lien if the debt remains unpaid. There can be different types of Chattanooga Tennessee Notice of Lien by Remote Contractor — Corporation or LLC, depending on the nature of the contractor's work or services. Some common types may include: 1. Construction Lien: This type of notice is typically filed by construction contractors or subcontractors for unpaid construction work or materials provided for a property. 2. Maintenance and Repair Lien: This notice is applicable when a corporation or LLC provides maintenance or repair services to a property and seeks payment for the services rendered. 3. Professional Services Lien: This type of lien is filed when a corporation or LLC provides professional services such as engineering, architectural, legal, or consulting services and seeks compensation for the services provided. 4. Equipment Rental Lien: If a corporation or LLC rents out equipment or machinery to a property owner or contractor and the payment remains outstanding, they can file this type of lien. When filing a Notice of Lien by Remote Contractor — Corporation or LLC in Chattanooga Tennessee, it is important to adhere to the legal requirements set forth by the state. Contractors should ensure the accuracy of the information provided in the notice, including the property owner's name, the amount owed, and the description of the work or services provided. Furthermore, it is crucial for contractors to adhere to specified deadlines and procedures for filing the notice. Failure to comply with these requirements can jeopardize the validity of the lien. By filing a Chattanooga Tennessee Notice of Lien by Remote Contractor — Corporation or LLC, contractors can protect their rights and increase the chances of obtaining payment for their outstanding debts. However, it is advisable to consult with a legal professional to ensure compliance with all laws and regulations governing the filing of liens in Chattanooga, Tennessee.