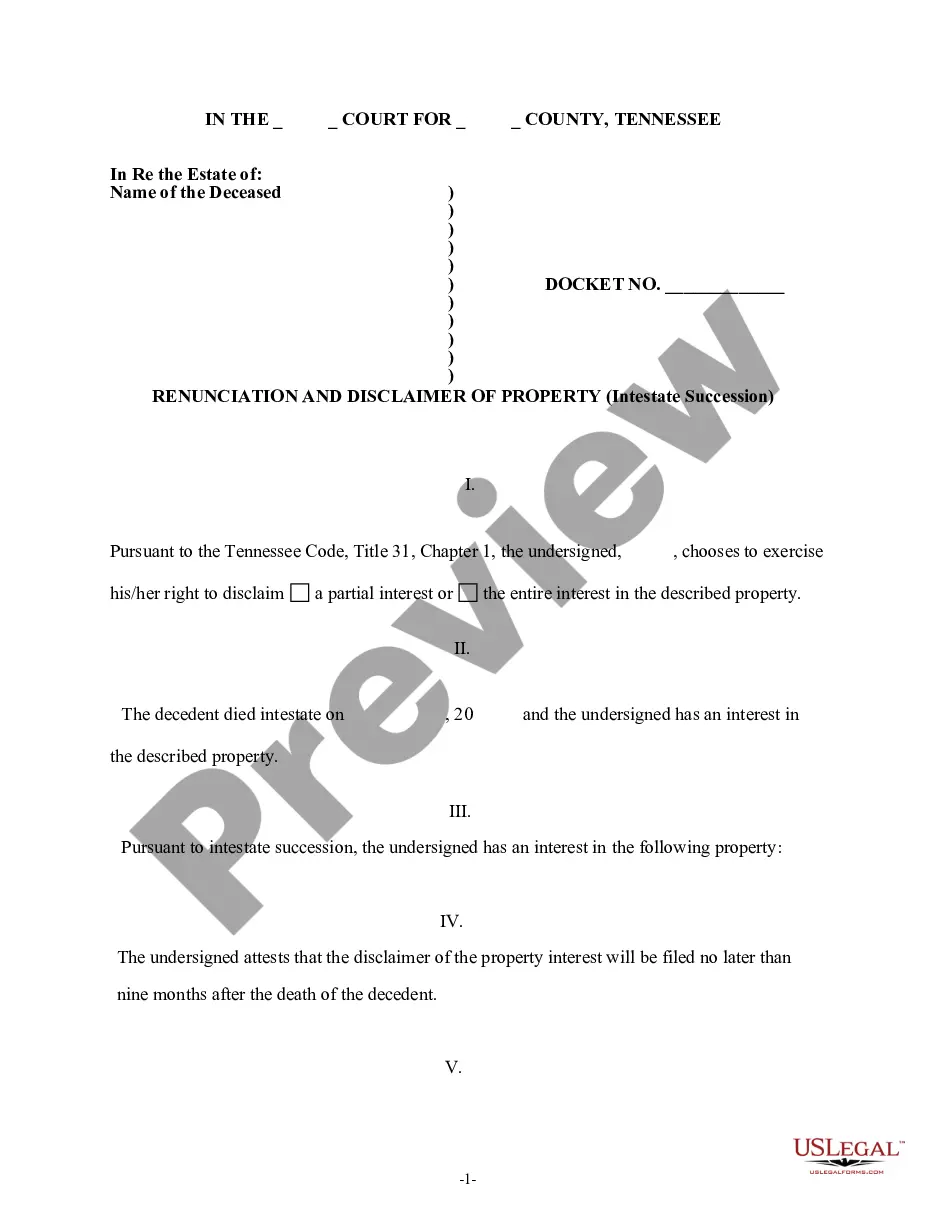

This is a Renunciation And Disclaimer of Property Received by Intestate Succession. An heir has the right to renounce any right he/he may have, in the deceased's estate. When an heir wishes to exercise that right, he/she must use this form in the State of Tennessee.

Clarksville Tennessee Renunciation And Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to formally decline their right to inherit property from a deceased person who passed away without leaving a valid will. In such cases, intestate succession laws dictate how the deceased person's estate will be distributed among their heirs. The Clarksville Tennessee Renunciation And Disclaimer of Property received by Intestate Succession is a crucial legal instrument used by individuals who may want to disclaim their inheritance rights due to various reasons. It is important to highlight that renouncing or disclaiming property received through intestate succession is a significant decision and should not be taken lightly. Seeking legal advice from an experienced attorney in Clarksville, Tennessee, is highly recommended to fully understand the implications and potential consequences involved. There are different types of Clarksville Tennessee Renunciation And Disclaimer of Property received by Intestate Succession, including: 1. Absolute Renunciation: This type of renunciation involves completely surrendering one's right to inherit any property received through intestate succession. Individuals who opt for absolute renunciation willingly give up any rights, benefits, or interests associated with the estate of the deceased. 2. Limited Renunciation: In certain situations, beneficiaries may choose to renounce their inheritance rights partially or with specific conditions. Limited renunciation allows individuals to disclaim certain portions or specific assets from the estate, while still retaining rights to other portions. 3. Conditional Renunciation: This type of renunciation is applicable when a beneficiary wants to disclaim their inheritance rights subject to specific conditions. For example, an individual may choose to renounce their share of the estate if certain debts or liabilities associated with it are not cleared or resolved. It is essential to note that the Clarksville Tennessee Renunciation And Disclaimer of Property received by Intestate Succession should be done within a specific timeframe set by state laws. Failing to meet the legal deadlines can result in the individual being considered as if they had accepted the inheritance and being bound by all the associated rights and obligations. Individuals considering renouncing their inheritance through intestate succession in Clarksville, Tennessee, should consult with a qualified attorney knowledgeable in estate planning and probate laws. By doing so, they can ensure that their rights are properly protected and that they fully understand the legal implications of renunciation.