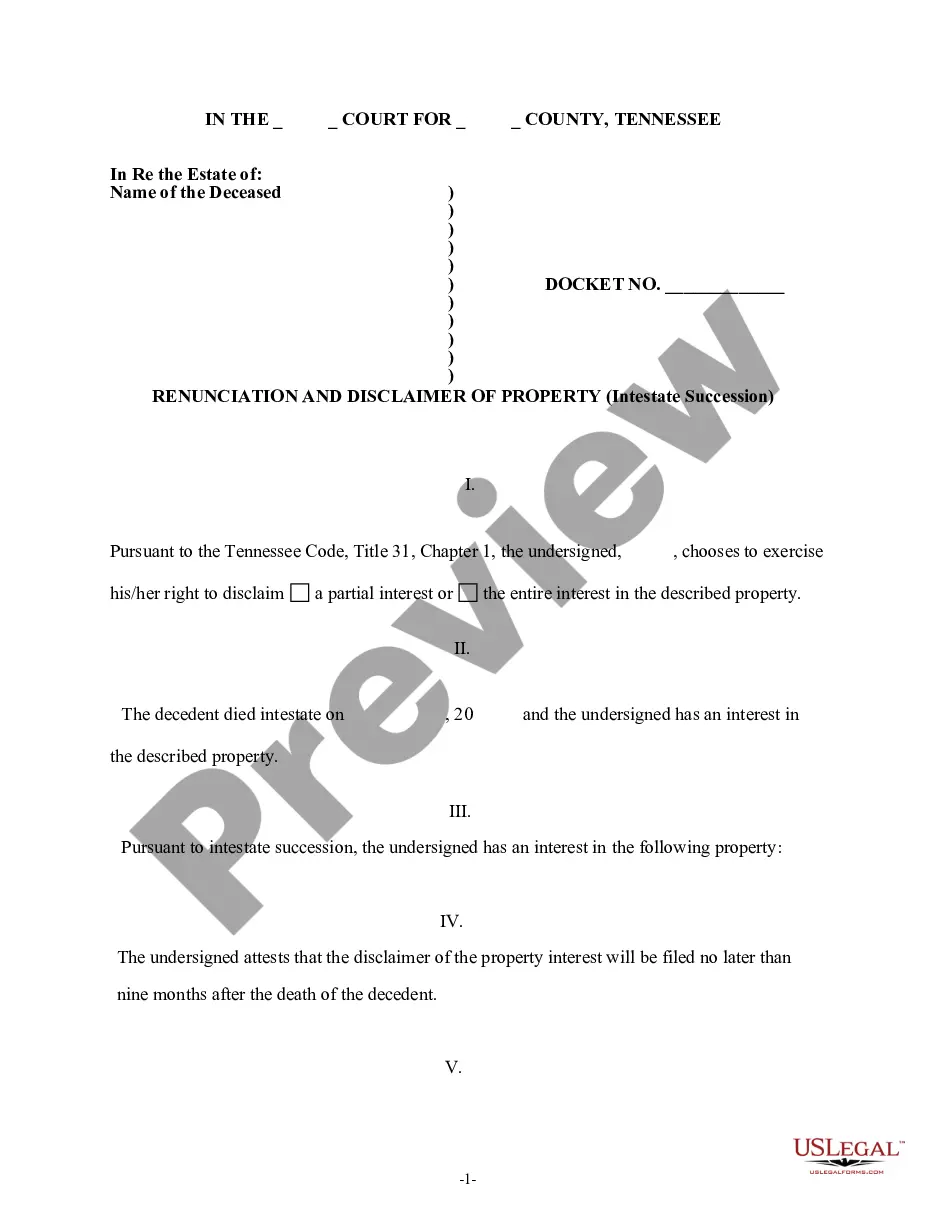

This is a Renunciation And Disclaimer of Property Received by Intestate Succession. An heir has the right to renounce any right he/he may have, in the deceased's estate. When an heir wishes to exercise that right, he/she must use this form in the State of Tennessee.

Title: Knoxville Tennessee Renunciation and Disclaimer of Property Received by Intestate Succession: Explained Introduction: In Knoxville, Tennessee, when someone passes away without leaving a valid will, their estate is distributed through a legal process called intestate succession. In some cases, beneficiaries may choose to renounce or disclaim their rights to the property they would have otherwise inherited. This article will provide a detailed description of Knoxville Tennessee Renunciation and Disclaimer of Property received by Intestate Succession, highlighting its types and significance. Key Points: 1. Understanding Renunciation and Disclaimer: — Renunciation: Renunciation refers to the act of giving up one's right to inherit property. When an individual renounces their rights, they are treated as if they were never beneficiaries. — Disclaimer: Disclaimer is similar to renunciation, but it involves refusing to accept or receive inherited property. By disclaiming, the beneficiary states that they do not wish to claim any rights or benefits associated with the property. 2. Reasons for Renunciation or Disclaimer: — Dissatisfaction with the property received: Beneficiaries may renounce or disclaim property if they are unhappy with the assets or if the property poses financial difficulties, such as tax burdens or potential liabilities. — Estate planning decisions: Some beneficiaries may have their own estate planning strategies and prefer to renounce or disclaim property to allow it to pass to secondary beneficiaries or avoid complicated tax implications. — Conflict avoidance: In situations where accepting the inherited property may lead to family disputes or disagreements, renunciation or disclaimer can help avoid conflicts. 3. Types of Renunciation and Disclaimer: — Absolute Renunciation or Disclaimer: This is the complete surrender or refusal of all rights to the property, including any future interests or benefits associated with it. — Partial Renunciation or Disclaimer: Here, the beneficiary renounces or disclaims a specific portion or certain assets within the inherited property, while still retaining other shares or interests. — Conditional Renunciation or Disclaimer: In cases where beneficiaries are unsure about the value or conditions attached to the inherited property, they may choose to conditionally renounce or disclaim until further information or verification is obtained. 4. Legal Procedures and Deadlines: — Filing Requirements: Beneficiaries who wish to renounce or disclaim their rights must submit a written renunciation or disclaimer document to the appropriate probate court. — Timelines: In Knoxville, Tennessee, the renunciation or disclaimer should be filed within a specified timeframe, typically within nine months from the decedent's passing or within nine months of attaining the age of majority for minor beneficiaries. — Legal Consequences: By renouncing or disclaiming their rights, beneficiaries become ineligible to receive any portion of the property. The renounced or disclaimed share may pass to the next eligible beneficiary as determined by the intestate succession laws. Conclusion: Knoxville Tennessee Renunciation and Disclaimer of Property received by Intestate Succession offer beneficiaries the opportunity to forego rights to inherited property under certain circumstances. Understanding the types and significance of renunciation and disclaimer is crucial for beneficiaries to make informed decisions regarding property distribution. By adhering to the appropriate legal procedures and deadlines, beneficiaries can ensure the smooth transfer of property as per the intestate succession laws in Knoxville, Tennessee.Title: Knoxville Tennessee Renunciation and Disclaimer of Property Received by Intestate Succession: Explained Introduction: In Knoxville, Tennessee, when someone passes away without leaving a valid will, their estate is distributed through a legal process called intestate succession. In some cases, beneficiaries may choose to renounce or disclaim their rights to the property they would have otherwise inherited. This article will provide a detailed description of Knoxville Tennessee Renunciation and Disclaimer of Property received by Intestate Succession, highlighting its types and significance. Key Points: 1. Understanding Renunciation and Disclaimer: — Renunciation: Renunciation refers to the act of giving up one's right to inherit property. When an individual renounces their rights, they are treated as if they were never beneficiaries. — Disclaimer: Disclaimer is similar to renunciation, but it involves refusing to accept or receive inherited property. By disclaiming, the beneficiary states that they do not wish to claim any rights or benefits associated with the property. 2. Reasons for Renunciation or Disclaimer: — Dissatisfaction with the property received: Beneficiaries may renounce or disclaim property if they are unhappy with the assets or if the property poses financial difficulties, such as tax burdens or potential liabilities. — Estate planning decisions: Some beneficiaries may have their own estate planning strategies and prefer to renounce or disclaim property to allow it to pass to secondary beneficiaries or avoid complicated tax implications. — Conflict avoidance: In situations where accepting the inherited property may lead to family disputes or disagreements, renunciation or disclaimer can help avoid conflicts. 3. Types of Renunciation and Disclaimer: — Absolute Renunciation or Disclaimer: This is the complete surrender or refusal of all rights to the property, including any future interests or benefits associated with it. — Partial Renunciation or Disclaimer: Here, the beneficiary renounces or disclaims a specific portion or certain assets within the inherited property, while still retaining other shares or interests. — Conditional Renunciation or Disclaimer: In cases where beneficiaries are unsure about the value or conditions attached to the inherited property, they may choose to conditionally renounce or disclaim until further information or verification is obtained. 4. Legal Procedures and Deadlines: — Filing Requirements: Beneficiaries who wish to renounce or disclaim their rights must submit a written renunciation or disclaimer document to the appropriate probate court. — Timelines: In Knoxville, Tennessee, the renunciation or disclaimer should be filed within a specified timeframe, typically within nine months from the decedent's passing or within nine months of attaining the age of majority for minor beneficiaries. — Legal Consequences: By renouncing or disclaiming their rights, beneficiaries become ineligible to receive any portion of the property. The renounced or disclaimed share may pass to the next eligible beneficiary as determined by the intestate succession laws. Conclusion: Knoxville Tennessee Renunciation and Disclaimer of Property received by Intestate Succession offer beneficiaries the opportunity to forego rights to inherited property under certain circumstances. Understanding the types and significance of renunciation and disclaimer is crucial for beneficiaries to make informed decisions regarding property distribution. By adhering to the appropriate legal procedures and deadlines, beneficiaries can ensure the smooth transfer of property as per the intestate succession laws in Knoxville, Tennessee.