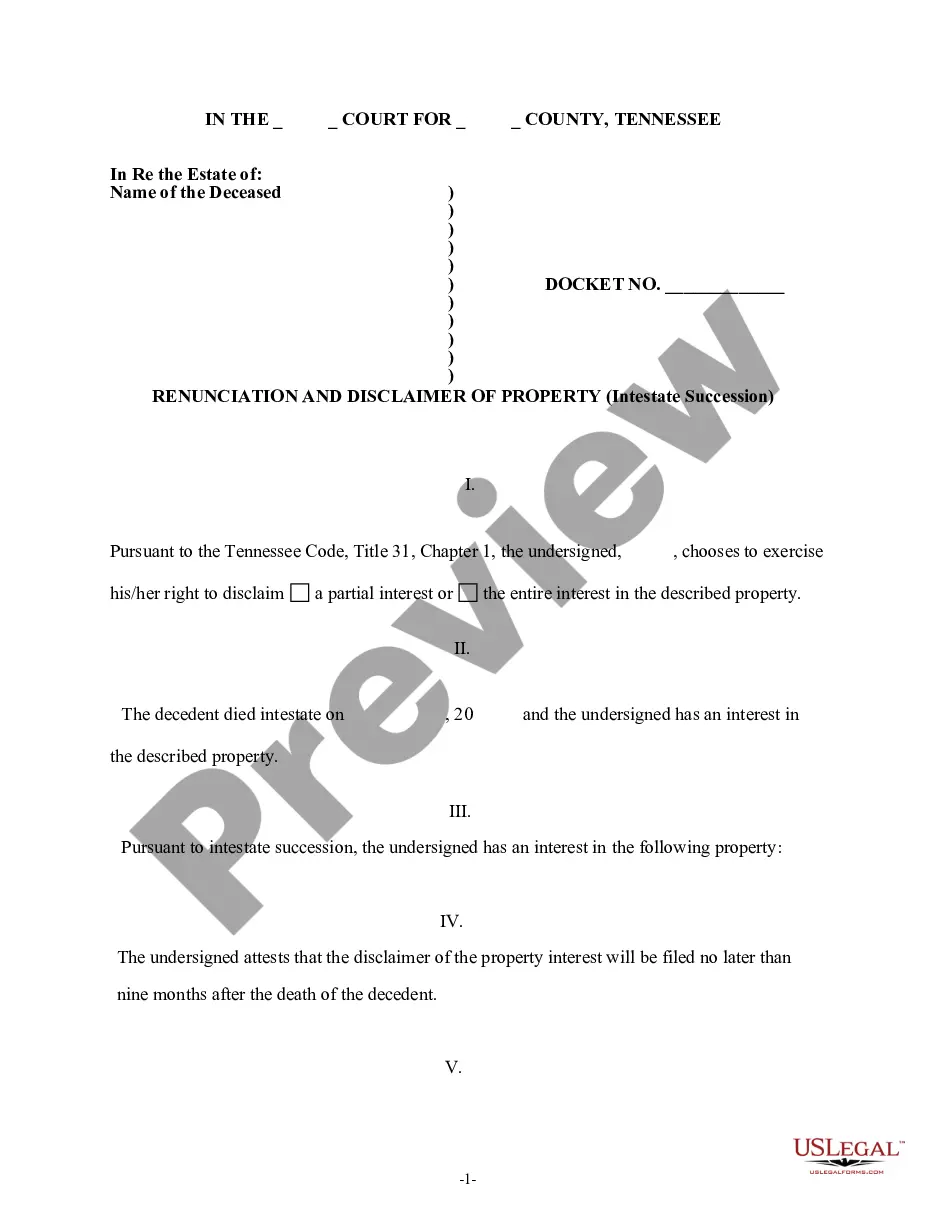

This is a Renunciation And Disclaimer of Property Received by Intestate Succession. An heir has the right to renounce any right he/he may have, in the deceased's estate. When an heir wishes to exercise that right, he/she must use this form in the State of Tennessee.

Nashville Tennessee Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Tennessee Renunciation And Disclaimer Of Property Received By Intestate Succession?

We consistently seek to reduce or evade legal complications when handling intricate legal or financial issues.

To achieve this, we enlist attorney services that are often very expensive.

However, not all legal matters are of equal intricacy.

Many of them can be managed independently.

Utilize US Legal Forms whenever you require to locate and obtain the Nashville Tennessee Renunciation And Disclaimer of Property acquired through Intestate Succession or any other form swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering a range of topics from wills and power of attorney to incorporation articles and dissolution petitions.

- Our collection empowers you to handle your issues on your own without needing a lawyer's assistance.

- We provide access to legal form samples that are not always readily available.

- Our templates are tailored to specific states and regions, making the search process significantly easier.

Form popularity

FAQ

In Tennessee for the purposes of intestacy distribution, half siblings are treated the same as whole siblings. Adopted children are entitled to the same estate share as biological children. If the decedent's spouse died before the decedent, the estate will be divided amongst the decedent's children evenly.

An affidavit of heirship is the simplest way of transferring real property after a person has passed away. When a person dies in Tennessee without a will, real estate immediately vests in the heirs of the decedent.

If the decedent is married and has children, their assets will be divided among the spouse and children equally, with the spouse getting no less than one-third. If the decedent has no spouse or descendants but has parents and siblings, the assets would be distributed equally among the parents and siblings.

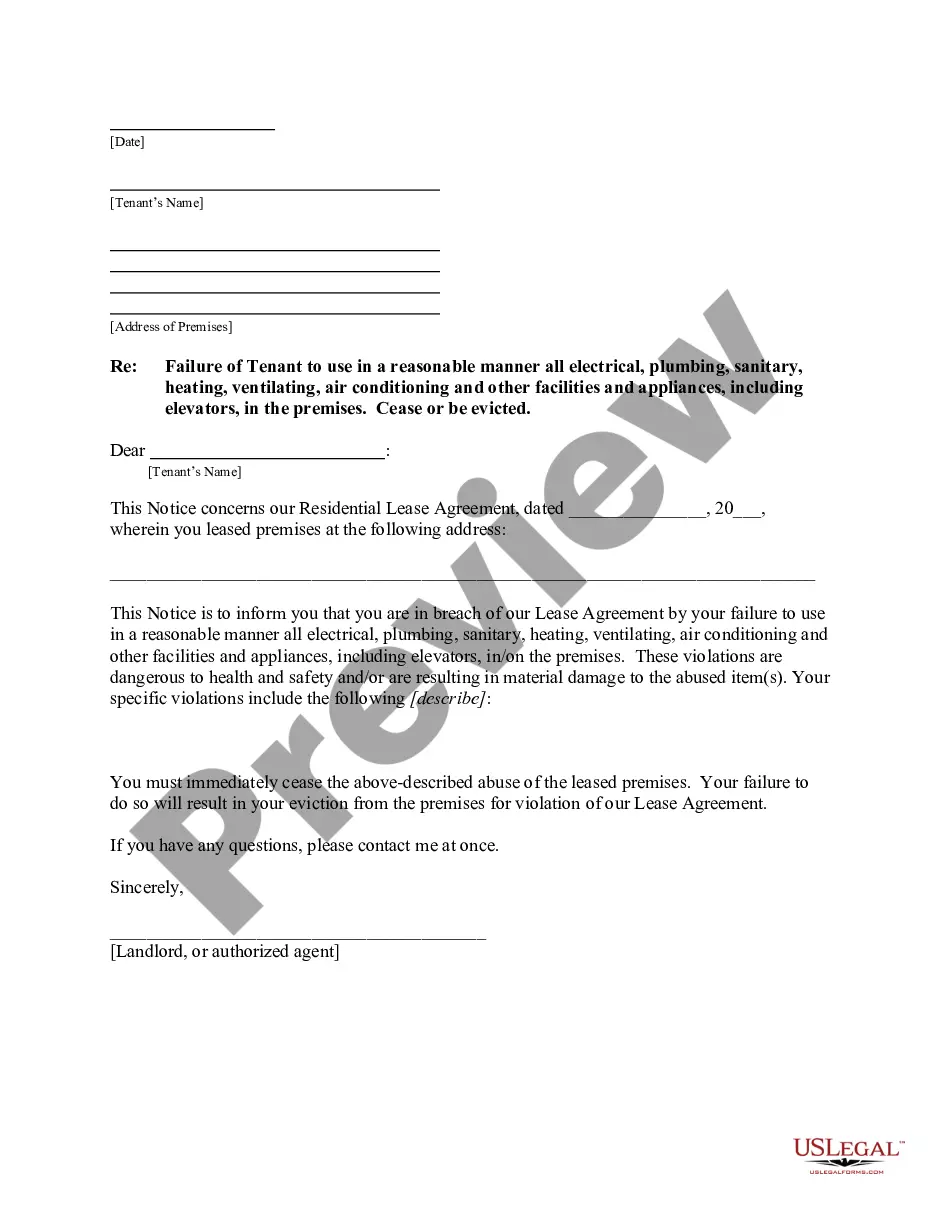

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

If a person dies intestate without any children, the spouse recovers the entire estate. If the person left a spouse and children, the surviving spouse will receive either one-third of the entire estate or a child's share of the estate, whichever is greater.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

In the context of a contract, a renunciation occurs when one party, by words or conduct, evinces an intention not to perform, or expressly declares that they will be unable to perform their obligations under the contract in some essential respect. The renunciation may occur before or at the time of performance.

Key Takeaways. Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiary?for example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.