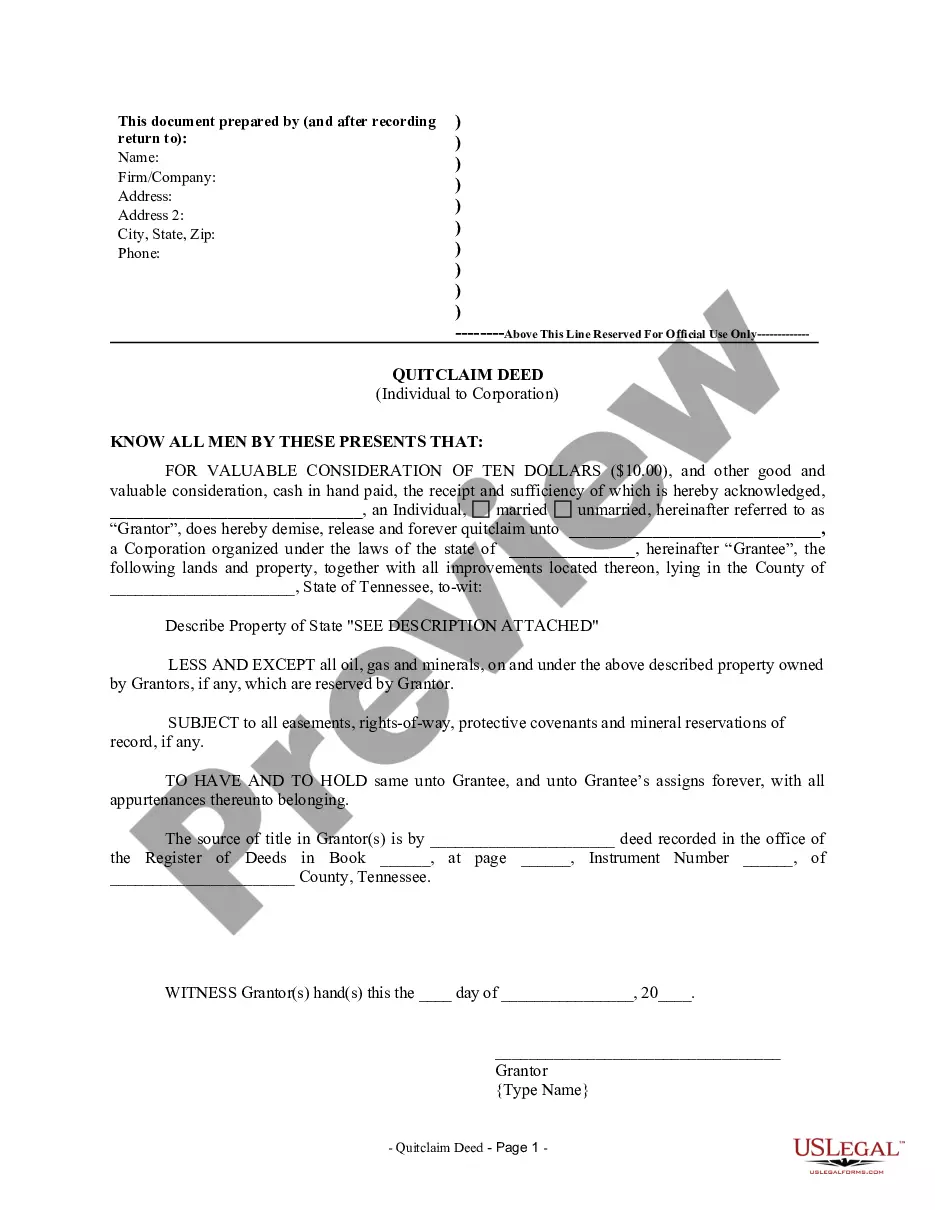

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

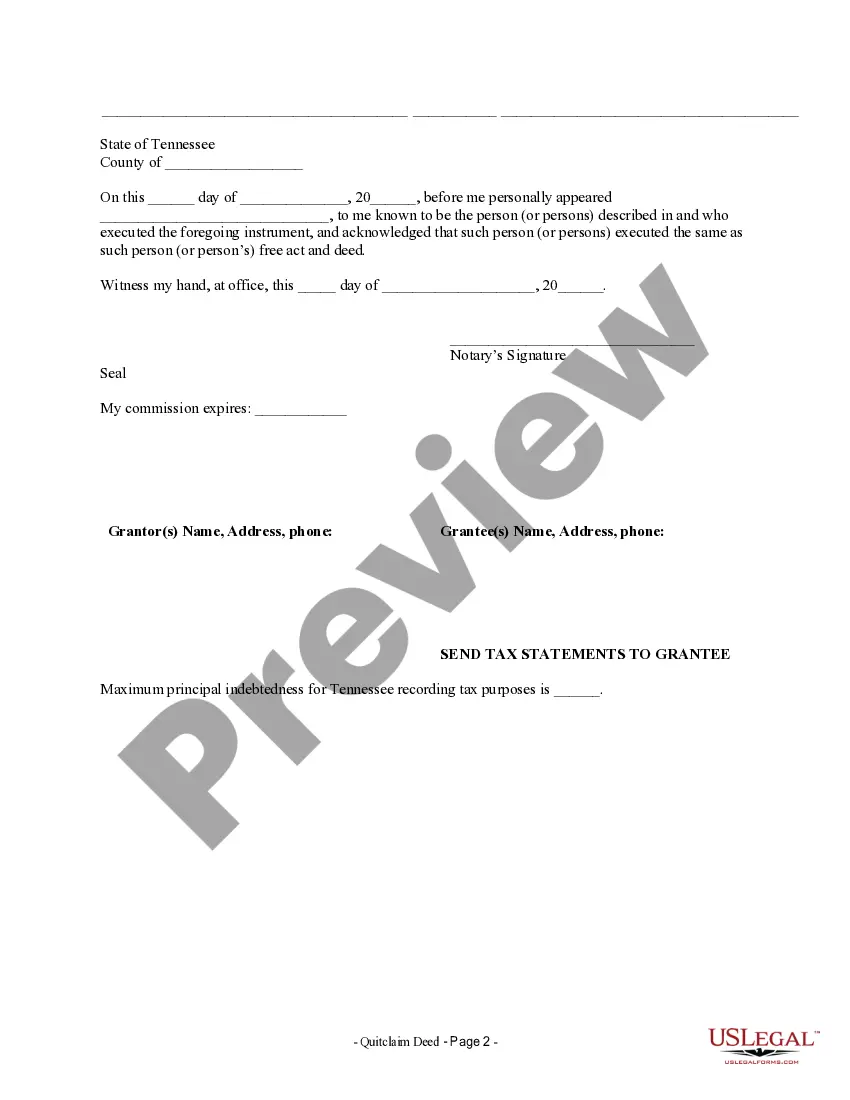

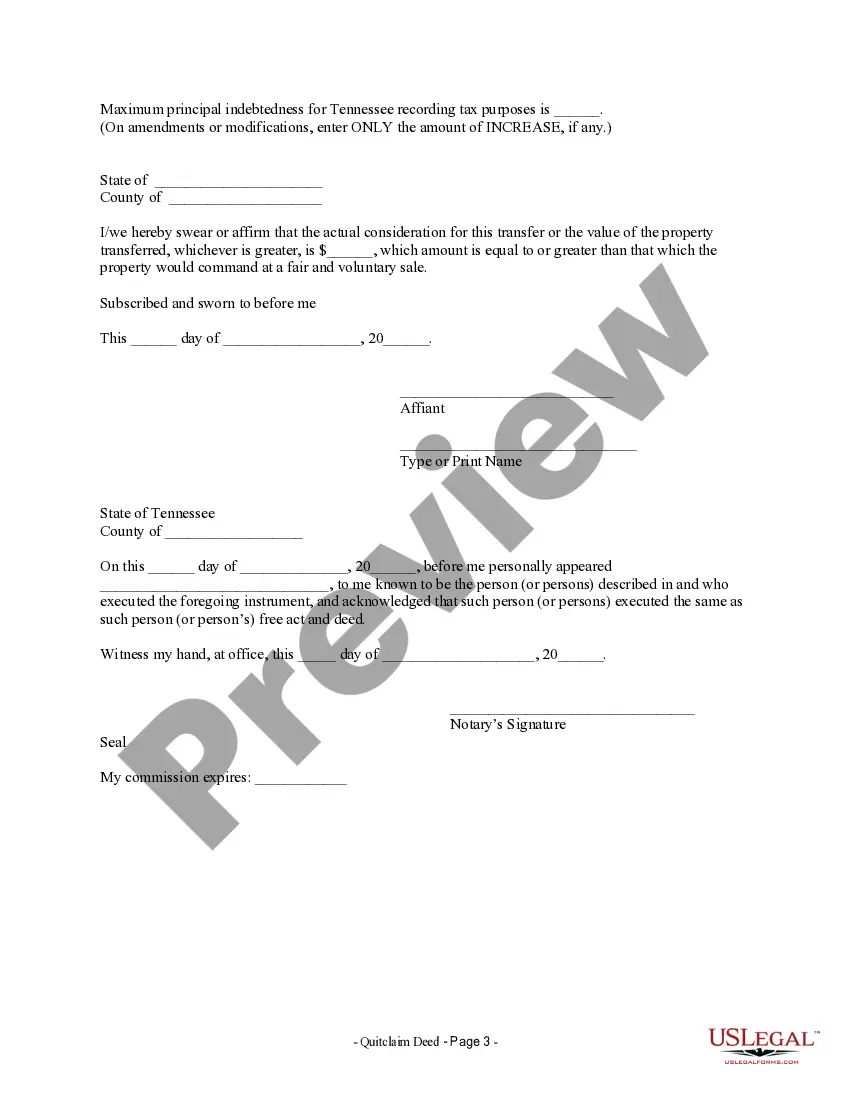

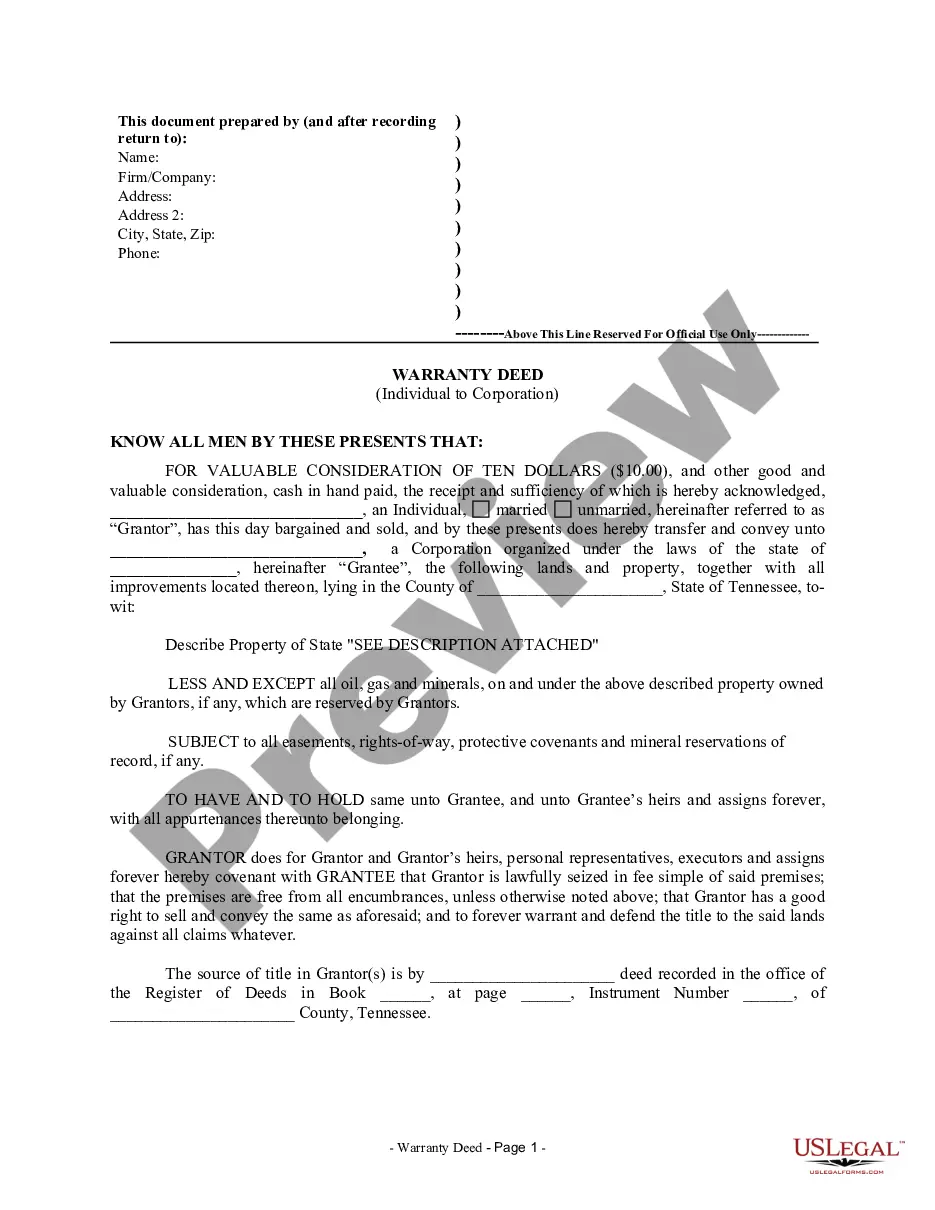

Title: Understanding Clarksville Tennessee Quitclaim Deed from Individual to Corporation: Types and Detailed Description Keywords: Clarksville Tennessee Quitclaim Deed, Individual to Corporation, Types Introduction: A Clarksville Tennessee Quitclaim Deed from Individual to Corporation is a legal document that facilitates the transfer of property ownership rights from an individual to a corporation. This type of deed is commonly used when an individual wants to transfer property to a corporation they are affiliated with or when a sole proprietorship is transitioning into a corporation. In this article, we will provide a comprehensive overview of the Clarksville Tennessee Quitclaim Deed from Individual to Corporation, including its types and a detailed description of its components. Types of Clarksville Tennessee Quitclaim Deed from Individual to Corporation: 1. General Clarksville Tennessee Quitclaim Deed: This is the most common type of quitclaim deed wherein an individual transfers their property to a corporation without any warranties or guarantees. This type of deed simply conveys the ownership rights to the corporation without imposing any responsibility on the individual for any potential existing liens, encumbrances, or undisclosed claims on the property. 2. Enhanced Clarksville Tennessee Quitclaim Deed: This specialized quitclaim deed provides an additional level of protection to the corporation by offering limited warranties against certain encumbrances or claims. The individual transferring the property provides a limited guarantee stating that they have not encumbered the property during their ownership tenure, but it does not cover any issues before their ownership. 3. Special Purpose Clarksville Tennessee Quitclaim Deed: While not a specific type of quitclaim deed, this term is used when additional conditions or restrictions are attached to the transfer of property from an individual to a corporation. These conditions may include specific usage rights, restrictions on property modifications, or any other negotiated terms agreed upon during the transfer process. Detailed Description of Clarksville Tennessee Quitclaim Deed from Individual to Corporation: A Clarksville Tennessee Quitclaim Deed from Individual to Corporation comprises several key elements: 1. Granter: The granter is the individual who currently holds the ownership rights and is transferring the property to the corporation. 2. Grantee: The grantee refers to the corporation that will become the new owner of the property. 3. Property Description: A detailed and accurate description of the property being transferred is included in the deed. This includes the legal description, physical address, and any relevant identifiers such as lot, block, or plat numbers. 4. Consideration: While not always required in a quitclaim deed, the consideration section may mention the financial or non-financial benefits exchanged for the property transfer. This could involve monetary compensation, stock shares, or other negotiated terms. 5. Warranty Clause: In a general quitclaim deed, there are usually no warranties included. However, an enhanced quitclaim deed may include a limited warranty clause providing assurances regarding the granter's actions during their ownership period. 6. Execution: The quitclaim deed must be signed and notarized by the granter in the presence of witnesses for its validity. The corporation representative should also sign as an acceptance of the transferred property. Conclusion: A Clarksville Tennessee Quitclaim Deed from Individual to Corporation is a legal instrument used for the purpose of transferring property ownership rights from an individual to a corporation. Understanding the different types of quitclaim deeds and their components is crucial when engaging in such property transfers. It is advisable to consult legal professionals to ensure compliance with state laws and to address any specific requirements or conditions applicable to the transaction.Title: Understanding Clarksville Tennessee Quitclaim Deed from Individual to Corporation: Types and Detailed Description Keywords: Clarksville Tennessee Quitclaim Deed, Individual to Corporation, Types Introduction: A Clarksville Tennessee Quitclaim Deed from Individual to Corporation is a legal document that facilitates the transfer of property ownership rights from an individual to a corporation. This type of deed is commonly used when an individual wants to transfer property to a corporation they are affiliated with or when a sole proprietorship is transitioning into a corporation. In this article, we will provide a comprehensive overview of the Clarksville Tennessee Quitclaim Deed from Individual to Corporation, including its types and a detailed description of its components. Types of Clarksville Tennessee Quitclaim Deed from Individual to Corporation: 1. General Clarksville Tennessee Quitclaim Deed: This is the most common type of quitclaim deed wherein an individual transfers their property to a corporation without any warranties or guarantees. This type of deed simply conveys the ownership rights to the corporation without imposing any responsibility on the individual for any potential existing liens, encumbrances, or undisclosed claims on the property. 2. Enhanced Clarksville Tennessee Quitclaim Deed: This specialized quitclaim deed provides an additional level of protection to the corporation by offering limited warranties against certain encumbrances or claims. The individual transferring the property provides a limited guarantee stating that they have not encumbered the property during their ownership tenure, but it does not cover any issues before their ownership. 3. Special Purpose Clarksville Tennessee Quitclaim Deed: While not a specific type of quitclaim deed, this term is used when additional conditions or restrictions are attached to the transfer of property from an individual to a corporation. These conditions may include specific usage rights, restrictions on property modifications, or any other negotiated terms agreed upon during the transfer process. Detailed Description of Clarksville Tennessee Quitclaim Deed from Individual to Corporation: A Clarksville Tennessee Quitclaim Deed from Individual to Corporation comprises several key elements: 1. Granter: The granter is the individual who currently holds the ownership rights and is transferring the property to the corporation. 2. Grantee: The grantee refers to the corporation that will become the new owner of the property. 3. Property Description: A detailed and accurate description of the property being transferred is included in the deed. This includes the legal description, physical address, and any relevant identifiers such as lot, block, or plat numbers. 4. Consideration: While not always required in a quitclaim deed, the consideration section may mention the financial or non-financial benefits exchanged for the property transfer. This could involve monetary compensation, stock shares, or other negotiated terms. 5. Warranty Clause: In a general quitclaim deed, there are usually no warranties included. However, an enhanced quitclaim deed may include a limited warranty clause providing assurances regarding the granter's actions during their ownership period. 6. Execution: The quitclaim deed must be signed and notarized by the granter in the presence of witnesses for its validity. The corporation representative should also sign as an acceptance of the transferred property. Conclusion: A Clarksville Tennessee Quitclaim Deed from Individual to Corporation is a legal instrument used for the purpose of transferring property ownership rights from an individual to a corporation. Understanding the different types of quitclaim deeds and their components is crucial when engaging in such property transfers. It is advisable to consult legal professionals to ensure compliance with state laws and to address any specific requirements or conditions applicable to the transaction.