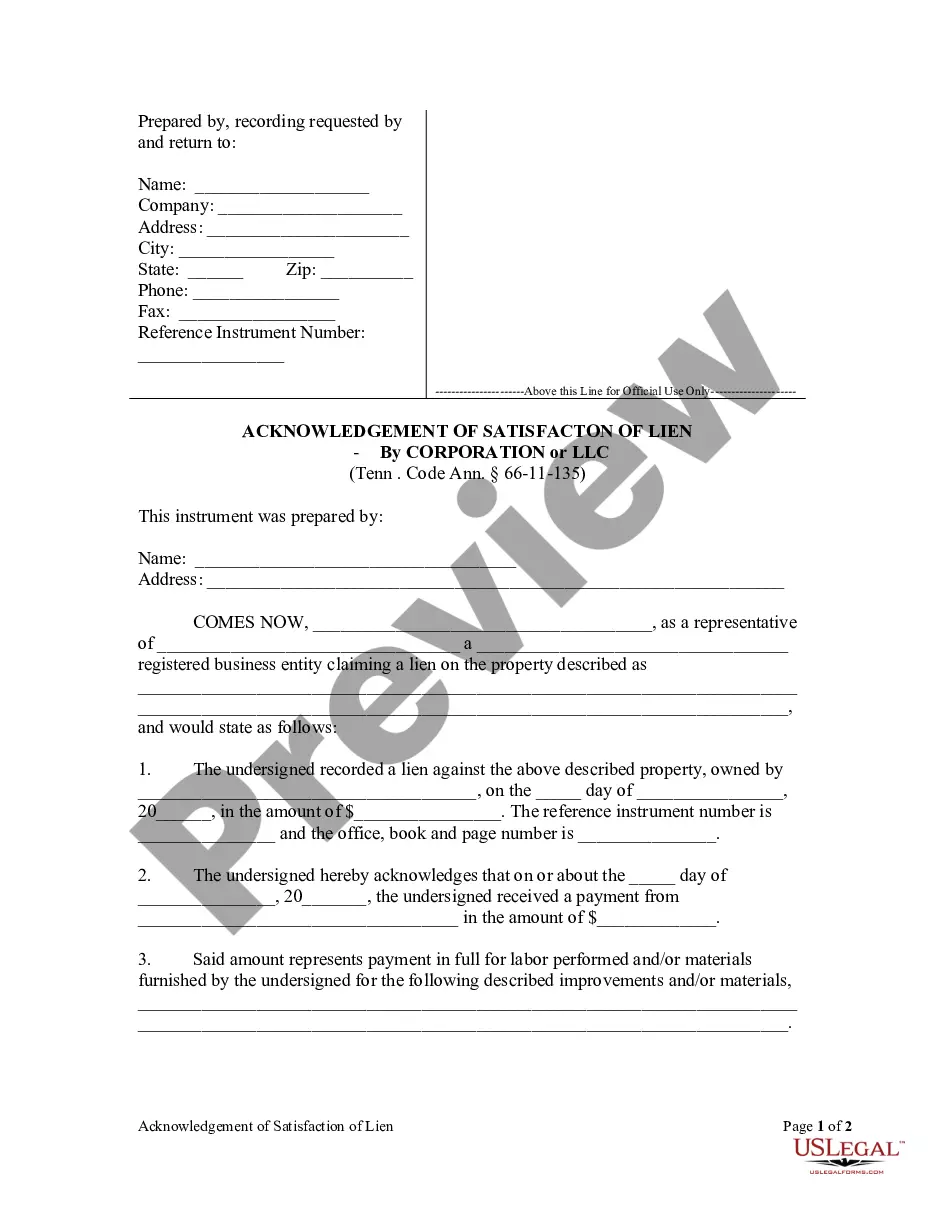

When a registered lien is satisfied, by payment or otherwise, the claimant shall acknowledge satisfaction by entry on the lien book; and if the claimant neglects or fails to do so for twenty (20) days after written demand, the claimant shall forfeit and pay to the owner or contractor the sum of fifty dollars ($50.00), and be liable to any person injured to the extent of the injury, which in no event shall be less than one hundred dollars ($100).

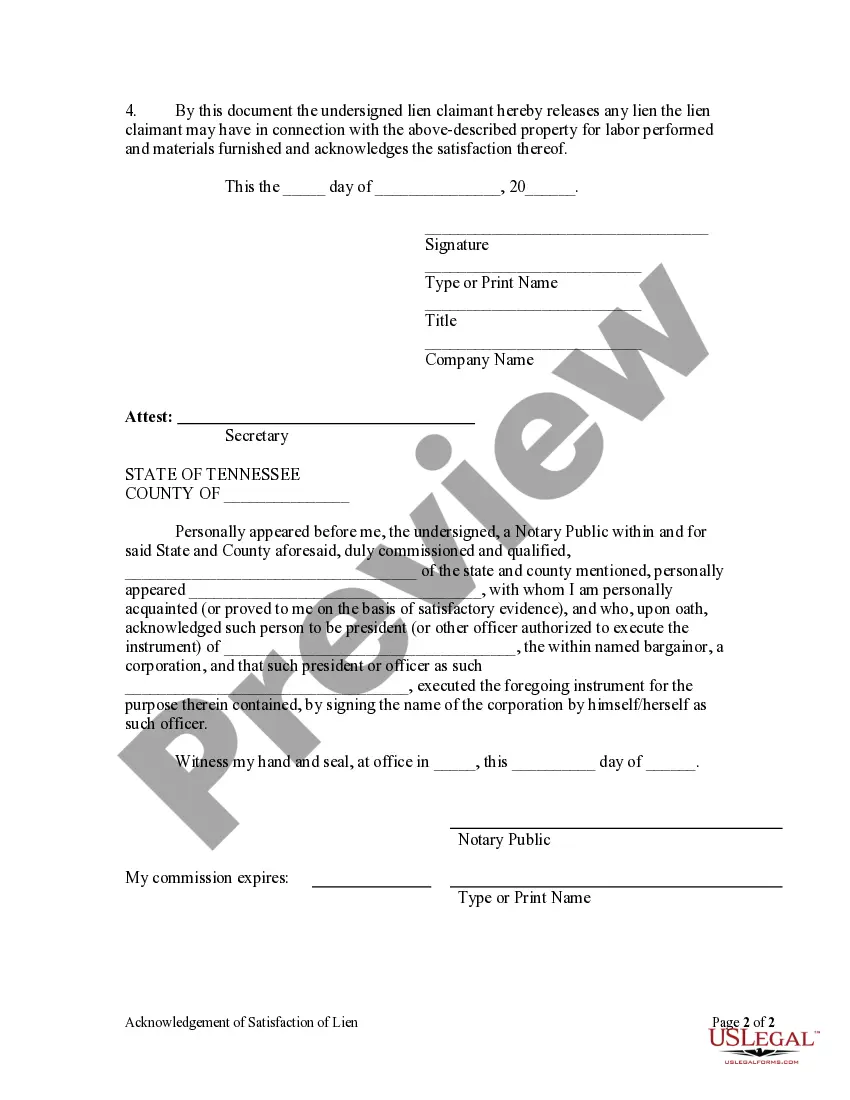

Title: Understanding Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC Keywords: Knoxville Tennessee, Acknowledgment of Satisfaction, Corporation, LLC, legal document, requirements, types, procedure, importance Introduction: In Knoxville, Tennessee, an Acknowledgment of Satisfaction for a Corporation or Limited Liability Company (LLC) is a legal document used to declare the fulfillment of a debt or obligation by a business entity. In this article, we will explore the details of this acknowledgment, its requirements, types, and why it is significant for corporations and LCS. 1. Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: The Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC is an official document that confirms the fulfillment of a financial obligation owed by a corporation or an LLC to another party. It ensures the legal release of any liens, encumbrances, or claims connected to the debt. 2. Types of Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: a. Full Satisfaction: This type of acknowledgment is used when the corporation or LLC has fully satisfied all its financial obligations, leaving no outstanding debts or claims against it. b. Partial Satisfaction: If the corporation or LLC has partially fulfilled its financial obligations, this acknowledgment is used to document the payment made and the remaining balance. 3. Requirements for Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: To ensure the validity and legality of the acknowledgment, certain requirements must be fulfilled: a. Proper Identification: The person executing the acknowledgment must provide valid identification to establish their authority to act on behalf of the corporation or LLC. b. Accurate Information: The document should contain accurate details, such as the name of the corporation or LLC, the debt amount, the creditor's name, and any other relevant information related to the satisfaction. c. Notarization: The acknowledgment must be notarized by a qualified notary public to validate the signatures and affirm the authenticity of the document. 4. Procedure for Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: To complete the acknowledgment of satisfaction, follow these general steps: a. Draft the Document: Prepare the acknowledgment using the appropriate legal language, including all relevant details and information. b. Obtain Execution: Ensure the authorized representative of the corporation or LLC signs the acknowledgment in the presence of a notary public. c. Notarization: Schedule an appointment with a notary public to notarize the document. The notary will verify the signer's identity and witness the signature. d. Filing and Distribution: Make copies of the notarized acknowledgment and distribute them to the appropriate parties, ensuring the original is filed with the pertinent recording authority. 5. Importance of the Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: a. Legal Protection: The acknowledgment acts as conclusive evidence that the corporation or LLC has fulfilled its financial obligations, providing protection against future claims or potential disputes. b. Public Record: By filing the acknowledgment, it becomes a part of the public record, ensuring transparency and enabling interested parties to verify the satisfaction of debts. c. Proof for Creditors: The acknowledgment serves as proof to creditors that the corporation or LLC has satisfied the debt, allowing them to update their records and remove any liens or encumbrances. Conclusion: The Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC is a crucial legal document that declares the fulfillment of a debt or obligation by a business entity. Understanding its types, requirements, and importance ensures smooth financial transactions, legal protection, and accurate record-keeping.Title: Understanding Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC Keywords: Knoxville Tennessee, Acknowledgment of Satisfaction, Corporation, LLC, legal document, requirements, types, procedure, importance Introduction: In Knoxville, Tennessee, an Acknowledgment of Satisfaction for a Corporation or Limited Liability Company (LLC) is a legal document used to declare the fulfillment of a debt or obligation by a business entity. In this article, we will explore the details of this acknowledgment, its requirements, types, and why it is significant for corporations and LCS. 1. Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: The Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC is an official document that confirms the fulfillment of a financial obligation owed by a corporation or an LLC to another party. It ensures the legal release of any liens, encumbrances, or claims connected to the debt. 2. Types of Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: a. Full Satisfaction: This type of acknowledgment is used when the corporation or LLC has fully satisfied all its financial obligations, leaving no outstanding debts or claims against it. b. Partial Satisfaction: If the corporation or LLC has partially fulfilled its financial obligations, this acknowledgment is used to document the payment made and the remaining balance. 3. Requirements for Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: To ensure the validity and legality of the acknowledgment, certain requirements must be fulfilled: a. Proper Identification: The person executing the acknowledgment must provide valid identification to establish their authority to act on behalf of the corporation or LLC. b. Accurate Information: The document should contain accurate details, such as the name of the corporation or LLC, the debt amount, the creditor's name, and any other relevant information related to the satisfaction. c. Notarization: The acknowledgment must be notarized by a qualified notary public to validate the signatures and affirm the authenticity of the document. 4. Procedure for Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: To complete the acknowledgment of satisfaction, follow these general steps: a. Draft the Document: Prepare the acknowledgment using the appropriate legal language, including all relevant details and information. b. Obtain Execution: Ensure the authorized representative of the corporation or LLC signs the acknowledgment in the presence of a notary public. c. Notarization: Schedule an appointment with a notary public to notarize the document. The notary will verify the signer's identity and witness the signature. d. Filing and Distribution: Make copies of the notarized acknowledgment and distribute them to the appropriate parties, ensuring the original is filed with the pertinent recording authority. 5. Importance of the Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC: a. Legal Protection: The acknowledgment acts as conclusive evidence that the corporation or LLC has fulfilled its financial obligations, providing protection against future claims or potential disputes. b. Public Record: By filing the acknowledgment, it becomes a part of the public record, ensuring transparency and enabling interested parties to verify the satisfaction of debts. c. Proof for Creditors: The acknowledgment serves as proof to creditors that the corporation or LLC has satisfied the debt, allowing them to update their records and remove any liens or encumbrances. Conclusion: The Knoxville Tennessee Acknowledgment of Satisfaction for Corporation or LLC is a crucial legal document that declares the fulfillment of a debt or obligation by a business entity. Understanding its types, requirements, and importance ensures smooth financial transactions, legal protection, and accurate record-keeping.