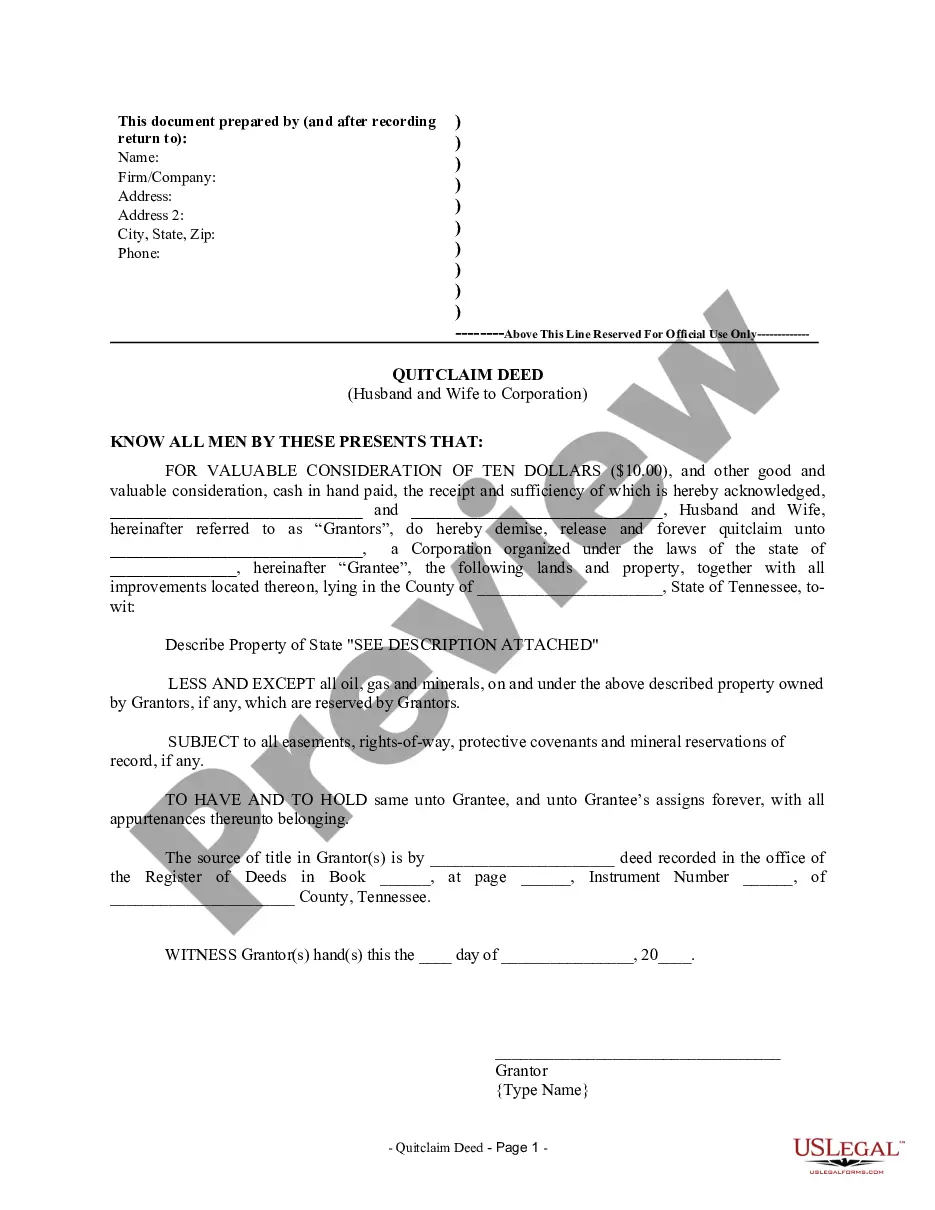

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Knoxville Tennessee Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of a property from a husband and wife to a corporation. This type of deed is commonly used when a married couple wants to convey property rights to a corporation, such as for business purposes, tax advantages, or liability protection. The quitclaim deed is a legal instrument that transfers the interest or rights a party has in a property, without providing a guarantee or warranty of the property's title. It means that the husband and wife are transferring their ownership rights, but they are not making any promises or assurances about the property's title or any liens that may exist. Knoxville, Tennessee is known for its vibrant business community, with many husband and wife partnerships operating successful ventures. In such cases, these entrepreneurs may decide to transfer the ownership of their property to a corporation they have formed or plan to establish. This deed allows the couple to transfer both of their interests in the property, protecting their personal assets and facilitating the corporate structure. Different types of Knoxville Tennessee Quitclaim Deed from Husband and Wife to Corporation may include variations based on the specific purpose or conditions of the transfer. Here are a few examples: 1. "Standard Knoxville Tennessee Quitclaim Deed from Husband and Wife to Corporation": This type of deed is used for a straightforward transfer of ownership from the couple to a corporation, with no additional contingencies or specific conditions. 2. "Quitclaim Deed with Tax Advantages for Knoxville Tennessee Husband and Wife to Corporation": In this case, the deed may be tailored to highlight the tax advantages of the transfer, such as minimizing capital gains taxes or estate taxes. 3. "Knoxville Tennessee Quitclaim Deed for Liability Protection from Husband and Wife to Corporation": This type of deed emphasizes the importance of transferring ownership to limit personal liability. It may include language that specifically states the purpose as asset protection or shield against potential lawsuits. 4. "Quitclaim Deed for Knoxville Tennessee Real Estate Business from Husband and Wife to Corporation": This specific type of transfer caters to couples who own real estate properties for investment or rental purposes. The deed may include provisions regarding rental income allocation or management responsibilities to ensure a smooth transition. It is important to consult with an attorney or a real estate professional to determine the most appropriate type of quitclaim deed for the specific circumstances and objectives involved in the transfer of property from a husband and wife to a corporation in Knoxville, Tennessee.A Knoxville Tennessee Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of a property from a husband and wife to a corporation. This type of deed is commonly used when a married couple wants to convey property rights to a corporation, such as for business purposes, tax advantages, or liability protection. The quitclaim deed is a legal instrument that transfers the interest or rights a party has in a property, without providing a guarantee or warranty of the property's title. It means that the husband and wife are transferring their ownership rights, but they are not making any promises or assurances about the property's title or any liens that may exist. Knoxville, Tennessee is known for its vibrant business community, with many husband and wife partnerships operating successful ventures. In such cases, these entrepreneurs may decide to transfer the ownership of their property to a corporation they have formed or plan to establish. This deed allows the couple to transfer both of their interests in the property, protecting their personal assets and facilitating the corporate structure. Different types of Knoxville Tennessee Quitclaim Deed from Husband and Wife to Corporation may include variations based on the specific purpose or conditions of the transfer. Here are a few examples: 1. "Standard Knoxville Tennessee Quitclaim Deed from Husband and Wife to Corporation": This type of deed is used for a straightforward transfer of ownership from the couple to a corporation, with no additional contingencies or specific conditions. 2. "Quitclaim Deed with Tax Advantages for Knoxville Tennessee Husband and Wife to Corporation": In this case, the deed may be tailored to highlight the tax advantages of the transfer, such as minimizing capital gains taxes or estate taxes. 3. "Knoxville Tennessee Quitclaim Deed for Liability Protection from Husband and Wife to Corporation": This type of deed emphasizes the importance of transferring ownership to limit personal liability. It may include language that specifically states the purpose as asset protection or shield against potential lawsuits. 4. "Quitclaim Deed for Knoxville Tennessee Real Estate Business from Husband and Wife to Corporation": This specific type of transfer caters to couples who own real estate properties for investment or rental purposes. The deed may include provisions regarding rental income allocation or management responsibilities to ensure a smooth transition. It is important to consult with an attorney or a real estate professional to determine the most appropriate type of quitclaim deed for the specific circumstances and objectives involved in the transfer of property from a husband and wife to a corporation in Knoxville, Tennessee.