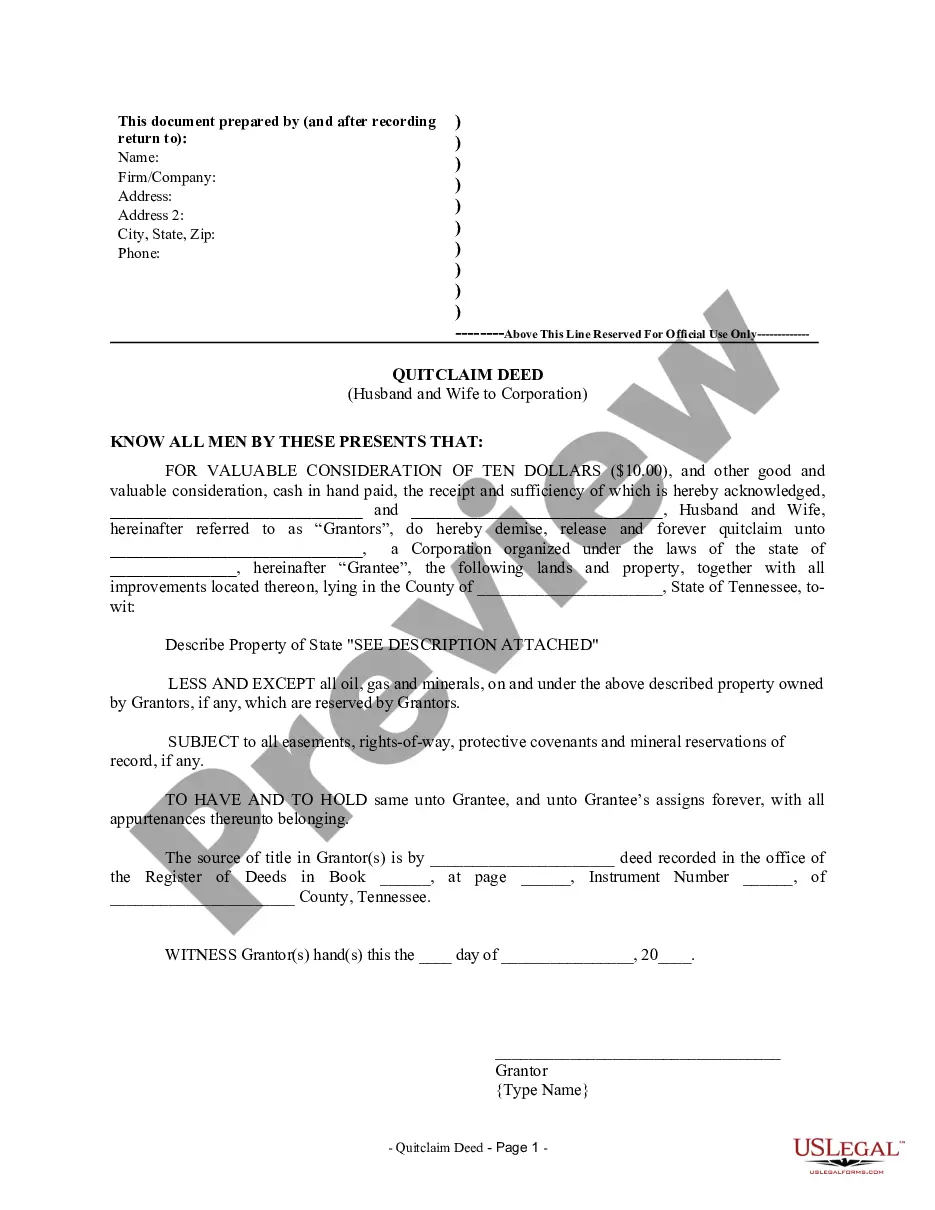

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Memphis Tennessee Quitclaim Deed from Husband and Wife to Corporation refers to a legal document that transfers the ownership of a property from a married couple to a corporation using a quitclaim deed. A quitclaim deed is a type of deed that enables the transfer of a property's ownership without guaranteeing that the property is free of any liens or encumbrances. It essentially transfers the interest, if any, that the granter (in this case, the husband and wife) has in the property to the grantee (the corporation). There are no specific variations of Memphis Tennessee Quitclaim Deed from Husband and Wife to Corporation, but the deed may be customized to reflect the specific details of the transaction, such as the property address, the names of the husband and wife, the name of the corporation, and the legal description of the property being conveyed. Keywords relevant to this topic include quitclaim deed, Memphis Tennessee, husband and wife, corporation, property ownership transfer, legal documentation, ownership interest, liens, encumbrances, property address, property description. Overall, a Memphis Tennessee Quitclaim Deed from Husband and Wife to Corporation refers to a legal instrument used to transfer ownership of a property from a married couple to a corporation using a quitclaim deed, providing a means for the transfer of interest, if any, without any guarantee of the property's status or freedom from encumbrances or liens.A Memphis Tennessee Quitclaim Deed from Husband and Wife to Corporation refers to a legal document that transfers the ownership of a property from a married couple to a corporation using a quitclaim deed. A quitclaim deed is a type of deed that enables the transfer of a property's ownership without guaranteeing that the property is free of any liens or encumbrances. It essentially transfers the interest, if any, that the granter (in this case, the husband and wife) has in the property to the grantee (the corporation). There are no specific variations of Memphis Tennessee Quitclaim Deed from Husband and Wife to Corporation, but the deed may be customized to reflect the specific details of the transaction, such as the property address, the names of the husband and wife, the name of the corporation, and the legal description of the property being conveyed. Keywords relevant to this topic include quitclaim deed, Memphis Tennessee, husband and wife, corporation, property ownership transfer, legal documentation, ownership interest, liens, encumbrances, property address, property description. Overall, a Memphis Tennessee Quitclaim Deed from Husband and Wife to Corporation refers to a legal instrument used to transfer ownership of a property from a married couple to a corporation using a quitclaim deed, providing a means for the transfer of interest, if any, without any guarantee of the property's status or freedom from encumbrances or liens.