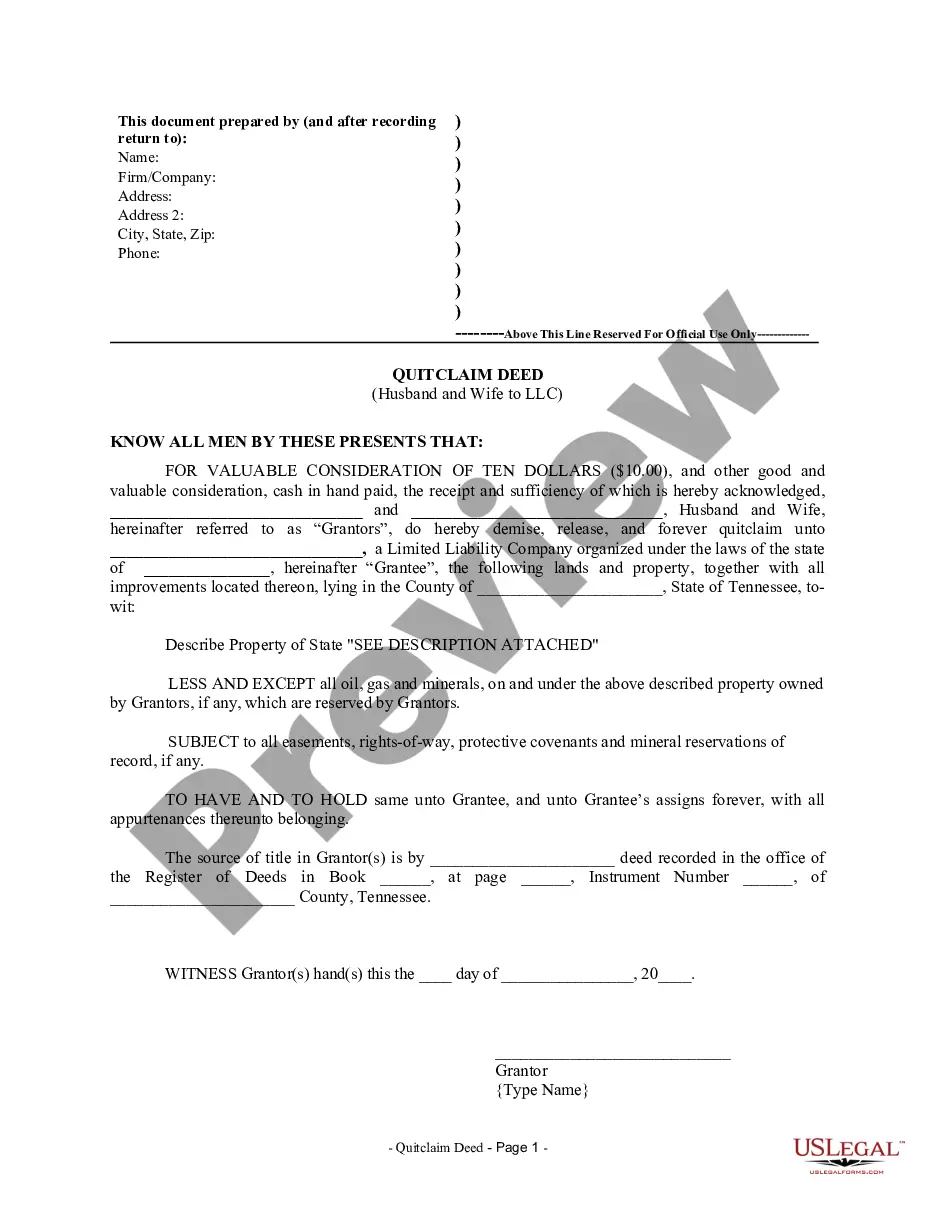

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Chattanooga Tennessee Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of real property from a married couple, referred to as the granters, to a limited liability company (LLC). This type of deed is frequently used when spouses who jointly own property want to transfer their interest to an LLC they own or are creating, in order to protect their personal assets or for business purposes. The Quitclaim Deed is a common form of transferring property ownership in Chattanooga, Tennessee, and it conveys the granters' rights, interests, and claims to the property to the LLC, without making any guarantees about the title's integrity. It should be noted that the LLC does not gain any additional protections or guarantees on the title by using a quitclaim deed. There are a few variations and specific situations that may require different types of Chattanooga Tennessee Quitclaim Deeds from Husband and Wife to LLC, such as: 1. Individual Transfer to Existing LLC: In this scenario, a husband and wife who jointly own a property transfer their interests to an LLC that they already have established. The deed will reflect the transfer of the specific percentages or shares of ownership to align with the LLC's requirements. 2. Individual Transfer to Newly Created LLC: Here, a husband and wife who own property jointly form a new LLC to hold and manage the property. The quitclaim deed will confirm the transfer of their ownership interest to the newly formed LLC, outlining each spouse's percentage or share of ownership. 3. Transfer to LLC for Asset Protection: In situations where the married couple intends to protect their personal assets from potential liabilities associated with the property, they may create or utilize an existing LLC solely for property ownership. The quitclaim deed will ensure the transfer of ownership to the LLC, establishing a separation between their personal assets and the property. Regardless of the specific type of Chattanooga Tennessee Quitclaim Deed from Husband and Wife to LLC, it is crucial to consult with a qualified attorney or real estate professional to ensure compliance with local laws and regulations. Working with professionals will help avoid any potential issues or complications during or after the transfer process. Keywords: Chattanooga Tennessee, Quitclaim Deed, Husband and Wife, LLC, property ownership, transfer of ownership, real property, legal document, limited liability company, joint ownership, personal assets, business purposes, title's integrity, transferred interests, percentages of ownership, existing LLC, newly created LLC, asset protection, liabilities, local laws and regulations, professionals, transfer process.A Chattanooga Tennessee Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of real property from a married couple, referred to as the granters, to a limited liability company (LLC). This type of deed is frequently used when spouses who jointly own property want to transfer their interest to an LLC they own or are creating, in order to protect their personal assets or for business purposes. The Quitclaim Deed is a common form of transferring property ownership in Chattanooga, Tennessee, and it conveys the granters' rights, interests, and claims to the property to the LLC, without making any guarantees about the title's integrity. It should be noted that the LLC does not gain any additional protections or guarantees on the title by using a quitclaim deed. There are a few variations and specific situations that may require different types of Chattanooga Tennessee Quitclaim Deeds from Husband and Wife to LLC, such as: 1. Individual Transfer to Existing LLC: In this scenario, a husband and wife who jointly own a property transfer their interests to an LLC that they already have established. The deed will reflect the transfer of the specific percentages or shares of ownership to align with the LLC's requirements. 2. Individual Transfer to Newly Created LLC: Here, a husband and wife who own property jointly form a new LLC to hold and manage the property. The quitclaim deed will confirm the transfer of their ownership interest to the newly formed LLC, outlining each spouse's percentage or share of ownership. 3. Transfer to LLC for Asset Protection: In situations where the married couple intends to protect their personal assets from potential liabilities associated with the property, they may create or utilize an existing LLC solely for property ownership. The quitclaim deed will ensure the transfer of ownership to the LLC, establishing a separation between their personal assets and the property. Regardless of the specific type of Chattanooga Tennessee Quitclaim Deed from Husband and Wife to LLC, it is crucial to consult with a qualified attorney or real estate professional to ensure compliance with local laws and regulations. Working with professionals will help avoid any potential issues or complications during or after the transfer process. Keywords: Chattanooga Tennessee, Quitclaim Deed, Husband and Wife, LLC, property ownership, transfer of ownership, real property, legal document, limited liability company, joint ownership, personal assets, business purposes, title's integrity, transferred interests, percentages of ownership, existing LLC, newly created LLC, asset protection, liabilities, local laws and regulations, professionals, transfer process.