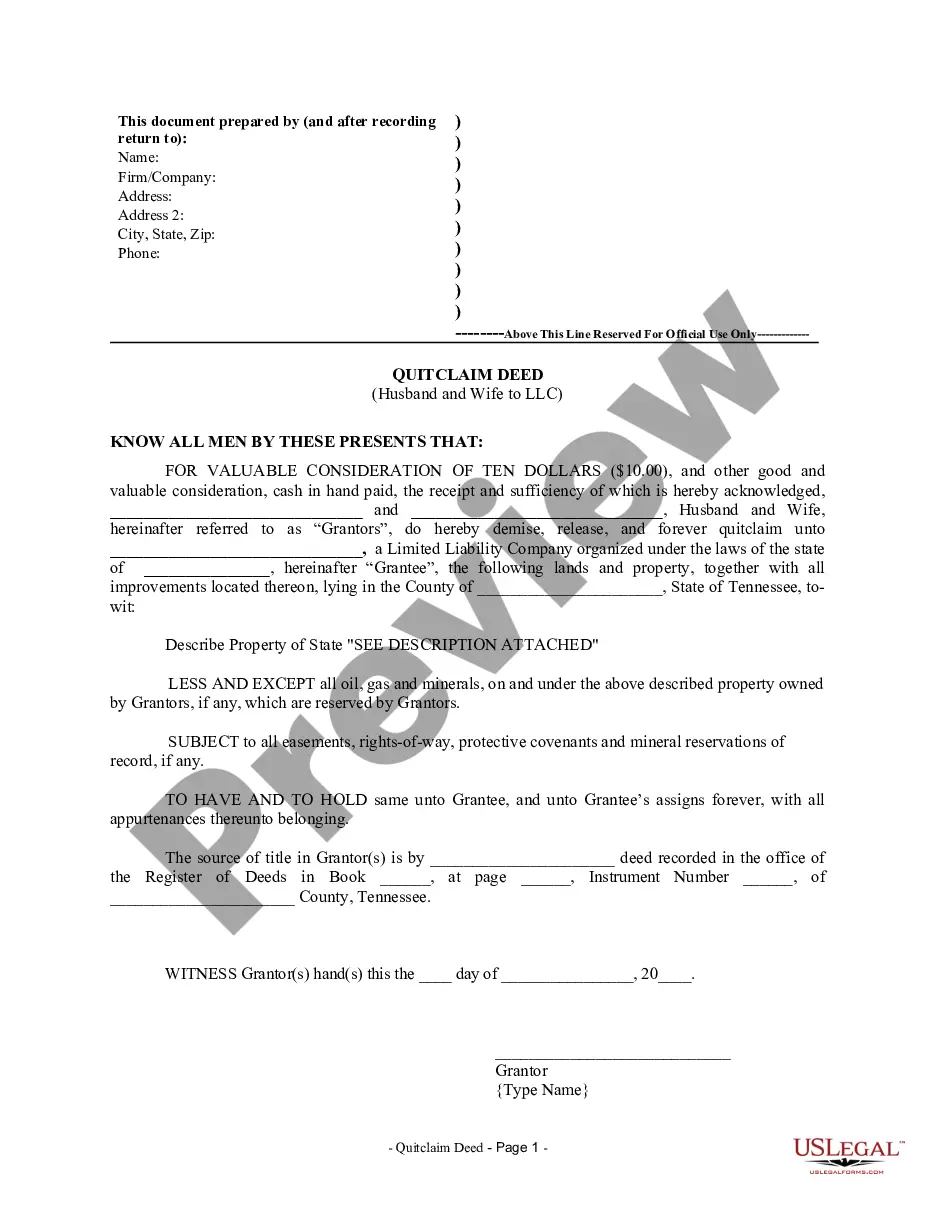

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Clarksville Tennessee Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of ownership rights of a property from a married couple to a limited liability company (LLC). This type of deed is commonly used when individuals wish to transfer property owned jointly by them as spouses into an LLC, which can provide various benefits such as liability protection and easier management. The Clarksville Tennessee Quitclaim Deed from Husband and Wife to LLC is an essential document that ensures a smooth and lawful transfer of property rights. This deed outlines the transfer of ownership rights from the husband and wife, known as the granters, to the LLC, the grantee. It typically includes details such as the names and addresses of the granters and the LLC, the legal description of the property being transferred, and any pertinent terms and conditions. There are a few variations of Clarksville Tennessee Quitclaim Deed from Husband and Wife to LLC that may be relevant to different circumstances: 1. Single Parcel Transfer: This is the most common type of quitclaim deed, which involves the transfer of ownership of a single property from the husband and wife to the LLC. It can be used when the entire property is being transferred. 2. Partial Parcel Transfer: This type of quitclaim deed is utilized when only a portion of the property owned by the husband and wife needs to be transferred to the LLC. It allows for a specific section, such as a designated plot or area, to be transferred while retaining other portions under personal ownership. 3. Multiple Parcel Transfer: In cases where the husband and wife jointly own multiple properties and wish to transfer all of them to the LLC, a quitclaim deed can be used to facilitate the transfer of all properties at once. This helps consolidate ownership and management under the LLC. 4. Conditional Transfer: Sometimes, a quitclaim deed may be subject to certain conditions or limitations. For instance, it may stipulate that the transfer of ownership to the LLC is only valid if specific criteria are met, such as obtaining permission from a governing authority or paying off outstanding debts. This type of deed can add clauses to ensure the transfer occurs only under certain circumstances. 5. Contingent Transfer: A contingent quitclaim deed is used when the transfer of ownership to the LLC depends on a future event. This allows for flexibility in situations where ownership rights may need to be transferred at a later date. For example, the deed may state that ownership will transfer to the LLC upon the death of one of the spouse granters. In conclusion, a Clarksville Tennessee Quitclaim Deed from Husband and Wife to LLC is a legal instrument that enables the transfer of property rights from a married couple to an LLC. Understanding the various types of quitclaim deeds available can help individuals choose the most suitable option based on their specific circumstances and objectives. It is important to consult with a qualified legal professional to ensure the proper preparation and execution of the deed.A Clarksville Tennessee Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of ownership rights of a property from a married couple to a limited liability company (LLC). This type of deed is commonly used when individuals wish to transfer property owned jointly by them as spouses into an LLC, which can provide various benefits such as liability protection and easier management. The Clarksville Tennessee Quitclaim Deed from Husband and Wife to LLC is an essential document that ensures a smooth and lawful transfer of property rights. This deed outlines the transfer of ownership rights from the husband and wife, known as the granters, to the LLC, the grantee. It typically includes details such as the names and addresses of the granters and the LLC, the legal description of the property being transferred, and any pertinent terms and conditions. There are a few variations of Clarksville Tennessee Quitclaim Deed from Husband and Wife to LLC that may be relevant to different circumstances: 1. Single Parcel Transfer: This is the most common type of quitclaim deed, which involves the transfer of ownership of a single property from the husband and wife to the LLC. It can be used when the entire property is being transferred. 2. Partial Parcel Transfer: This type of quitclaim deed is utilized when only a portion of the property owned by the husband and wife needs to be transferred to the LLC. It allows for a specific section, such as a designated plot or area, to be transferred while retaining other portions under personal ownership. 3. Multiple Parcel Transfer: In cases where the husband and wife jointly own multiple properties and wish to transfer all of them to the LLC, a quitclaim deed can be used to facilitate the transfer of all properties at once. This helps consolidate ownership and management under the LLC. 4. Conditional Transfer: Sometimes, a quitclaim deed may be subject to certain conditions or limitations. For instance, it may stipulate that the transfer of ownership to the LLC is only valid if specific criteria are met, such as obtaining permission from a governing authority or paying off outstanding debts. This type of deed can add clauses to ensure the transfer occurs only under certain circumstances. 5. Contingent Transfer: A contingent quitclaim deed is used when the transfer of ownership to the LLC depends on a future event. This allows for flexibility in situations where ownership rights may need to be transferred at a later date. For example, the deed may state that ownership will transfer to the LLC upon the death of one of the spouse granters. In conclusion, a Clarksville Tennessee Quitclaim Deed from Husband and Wife to LLC is a legal instrument that enables the transfer of property rights from a married couple to an LLC. Understanding the various types of quitclaim deeds available can help individuals choose the most suitable option based on their specific circumstances and objectives. It is important to consult with a qualified legal professional to ensure the proper preparation and execution of the deed.