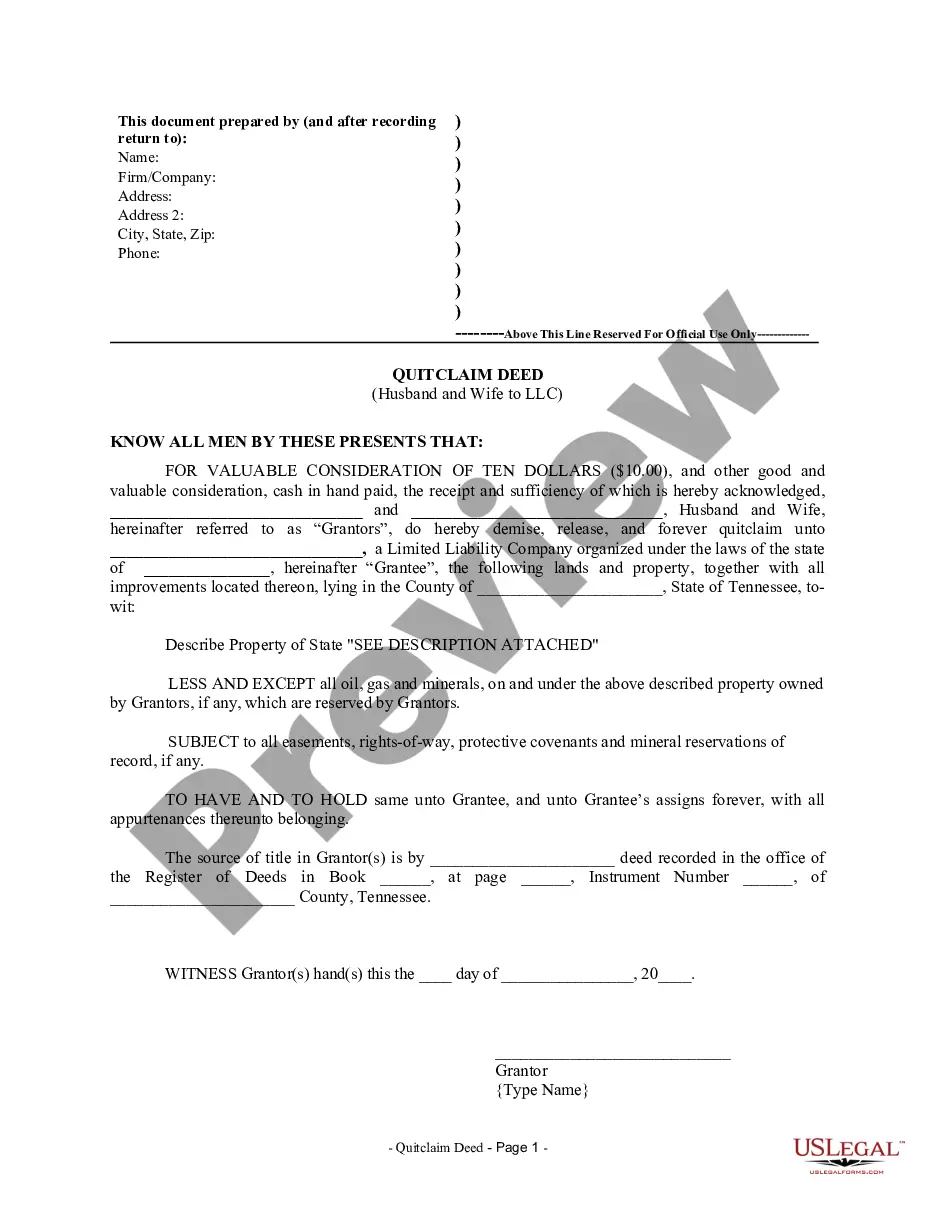

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Knoxville Tennessee Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership rights of a property from a married couple to a limited liability company (LLC) located in Knoxville, Tennessee. This type of deed is commonly used when a married couple wants to transfer ownership of their property to their LLC for various reasons such as asset protection, estate planning, or business purposes. The deed ensures a clear transfer of ownership and protects the LLC from any potential claims against the property. There are several types of Knoxville Tennessee Quitclaim Deed from Husband and Wife to LLC, each with its own specific purpose. Some of the most common ones include: 1. General Quitclaim Deed: This is the most straightforward type of quitclaim deed used to transfer the ownership of a property from a husband and wife to an LLC. It relinquishes any rights or claims the couple may have on the property and transfers them fully to the LLC. 2. Quitclaim Deed with Special Warranty: This type of deed guarantees that the transferring parties have not performed any actions that would impair the title, but it provides a limited warranty in comparison to a warranty deed. It protects the LLC from any undisclosed encumbrances or defects in the property's title that may have originated during the couple's ownership. 3. Quitclaim Deed in Lieu of Foreclosure: In situations where the marriage is facing financial difficulties and the property is at risk of foreclosure, a couple may choose to transfer the property to their LLC using this deed. It serves as an alternative to a foreclosure process and helps protect their LLC's assets. 4. Quitclaim Deed for Estate Planning: This type of deed is primarily used when a husband and wife want to transfer their property to an LLC for estate planning purposes. By transferring the property to an LLC, they can better manage and distribute their assets to their beneficiaries. It is important to consult with an attorney or a real estate professional specializing in Knoxville, Tennessee real estate laws to ensure that the quitclaim deed is properly executed and in compliance with all legal requirements specific to the state and county.A Knoxville Tennessee Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership rights of a property from a married couple to a limited liability company (LLC) located in Knoxville, Tennessee. This type of deed is commonly used when a married couple wants to transfer ownership of their property to their LLC for various reasons such as asset protection, estate planning, or business purposes. The deed ensures a clear transfer of ownership and protects the LLC from any potential claims against the property. There are several types of Knoxville Tennessee Quitclaim Deed from Husband and Wife to LLC, each with its own specific purpose. Some of the most common ones include: 1. General Quitclaim Deed: This is the most straightforward type of quitclaim deed used to transfer the ownership of a property from a husband and wife to an LLC. It relinquishes any rights or claims the couple may have on the property and transfers them fully to the LLC. 2. Quitclaim Deed with Special Warranty: This type of deed guarantees that the transferring parties have not performed any actions that would impair the title, but it provides a limited warranty in comparison to a warranty deed. It protects the LLC from any undisclosed encumbrances or defects in the property's title that may have originated during the couple's ownership. 3. Quitclaim Deed in Lieu of Foreclosure: In situations where the marriage is facing financial difficulties and the property is at risk of foreclosure, a couple may choose to transfer the property to their LLC using this deed. It serves as an alternative to a foreclosure process and helps protect their LLC's assets. 4. Quitclaim Deed for Estate Planning: This type of deed is primarily used when a husband and wife want to transfer their property to an LLC for estate planning purposes. By transferring the property to an LLC, they can better manage and distribute their assets to their beneficiaries. It is important to consult with an attorney or a real estate professional specializing in Knoxville, Tennessee real estate laws to ensure that the quitclaim deed is properly executed and in compliance with all legal requirements specific to the state and county.