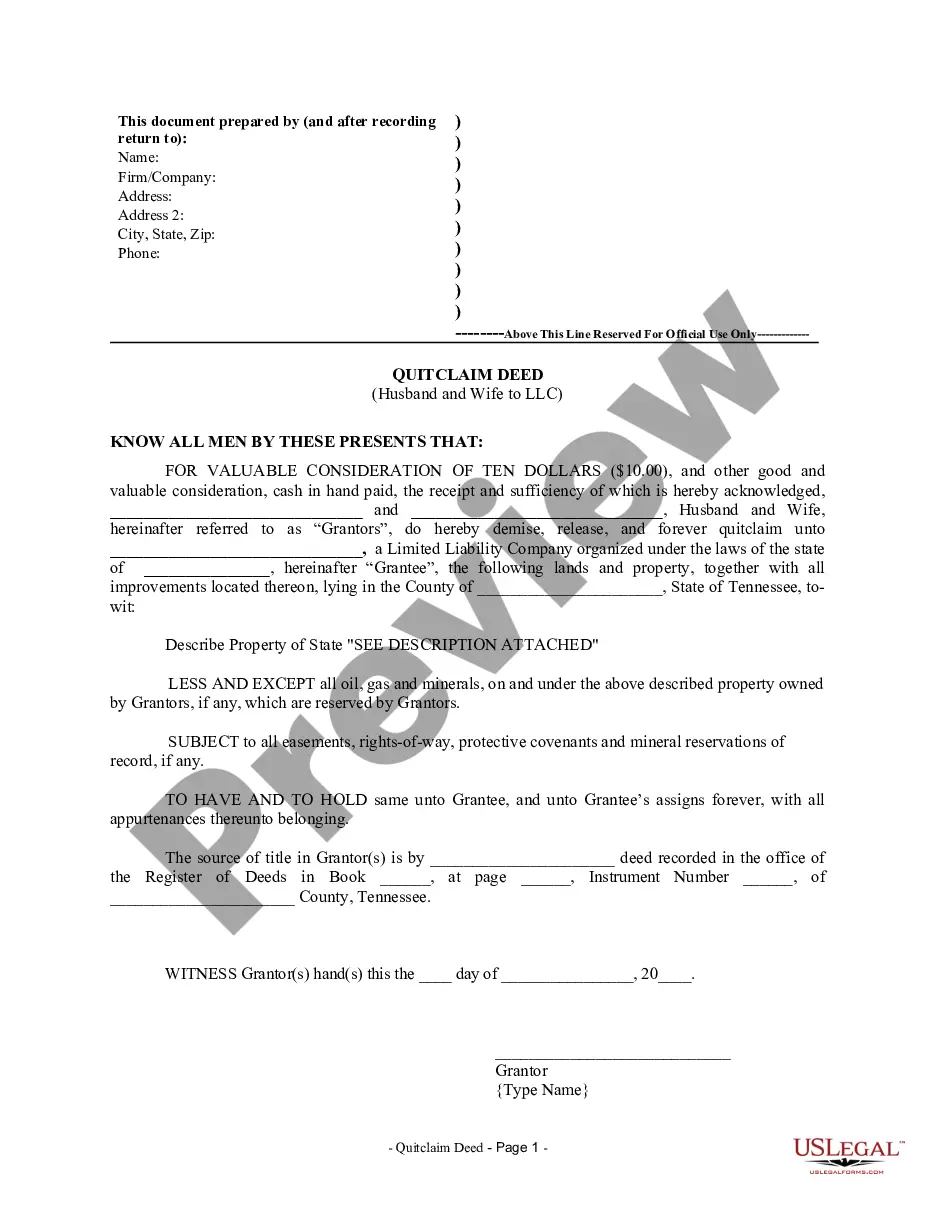

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A quitclaim deed is a legal document that transfers ownership of real estate from one party to another. In the context of Murfreesboro, Tennessee, a quitclaim deed from husband and wife to a Limited Liability Company (LLC) involves the transfer of property ownership from a married couple to their LLC. This type of deed is particularly relevant for individuals looking to protect their personal assets and establish a legal separation between their personal and business interests. In Murfreesboro, there are different types of quitclaim deeds that can be used to transfer ownership from a husband and wife to an LLC. Some variations include: 1. Murfreesboro Tennessee Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: This quitclaim deed is used when the property is owned jointly by the husband and wife, and they intend to transfer ownership to their LLC. Joint tenancy signifies equal rights and interest in the property, and the quitclaim deed allows them to transfer their joint ownership to their LLC. 2. Murfreesboro Tennessee Tenants in Common Quitclaim Deed from Husband and Wife to LLC: In cases where the husband and wife own the property as tenants in common, this type of quitclaim deed can be used to transfer their respective ownership interests to their LLC. With tenants in common, each spouse may hold a different percentage of ownership in the property, which can be transferred to the LLC accordingly. 3. Murfreesboro Tennessee Community Property Quitclaim Deed from Husband and Wife to LLC: If the property is classified as community property, which is a legal framework that recognizes joint ownership of assets acquired during marriage, a community property quitclaim deed can be used to transfer ownership to the LLC. This type of deed ensures both spouses have equal rights in the LLC ownership. Using a quitclaim deed to transfer property ownership from husband and wife to an LLC in Murfreesboro, Tennessee provides several advantages. It allows for the protection of personal assets, limits personal liability, and enables better separation between personal and business interests. These deeds also ensure compliance with state laws governing property transfers and establish a clear record of ownership for the LLC.A quitclaim deed is a legal document that transfers ownership of real estate from one party to another. In the context of Murfreesboro, Tennessee, a quitclaim deed from husband and wife to a Limited Liability Company (LLC) involves the transfer of property ownership from a married couple to their LLC. This type of deed is particularly relevant for individuals looking to protect their personal assets and establish a legal separation between their personal and business interests. In Murfreesboro, there are different types of quitclaim deeds that can be used to transfer ownership from a husband and wife to an LLC. Some variations include: 1. Murfreesboro Tennessee Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: This quitclaim deed is used when the property is owned jointly by the husband and wife, and they intend to transfer ownership to their LLC. Joint tenancy signifies equal rights and interest in the property, and the quitclaim deed allows them to transfer their joint ownership to their LLC. 2. Murfreesboro Tennessee Tenants in Common Quitclaim Deed from Husband and Wife to LLC: In cases where the husband and wife own the property as tenants in common, this type of quitclaim deed can be used to transfer their respective ownership interests to their LLC. With tenants in common, each spouse may hold a different percentage of ownership in the property, which can be transferred to the LLC accordingly. 3. Murfreesboro Tennessee Community Property Quitclaim Deed from Husband and Wife to LLC: If the property is classified as community property, which is a legal framework that recognizes joint ownership of assets acquired during marriage, a community property quitclaim deed can be used to transfer ownership to the LLC. This type of deed ensures both spouses have equal rights in the LLC ownership. Using a quitclaim deed to transfer property ownership from husband and wife to an LLC in Murfreesboro, Tennessee provides several advantages. It allows for the protection of personal assets, limits personal liability, and enables better separation between personal and business interests. These deeds also ensure compliance with state laws governing property transfers and establish a clear record of ownership for the LLC.