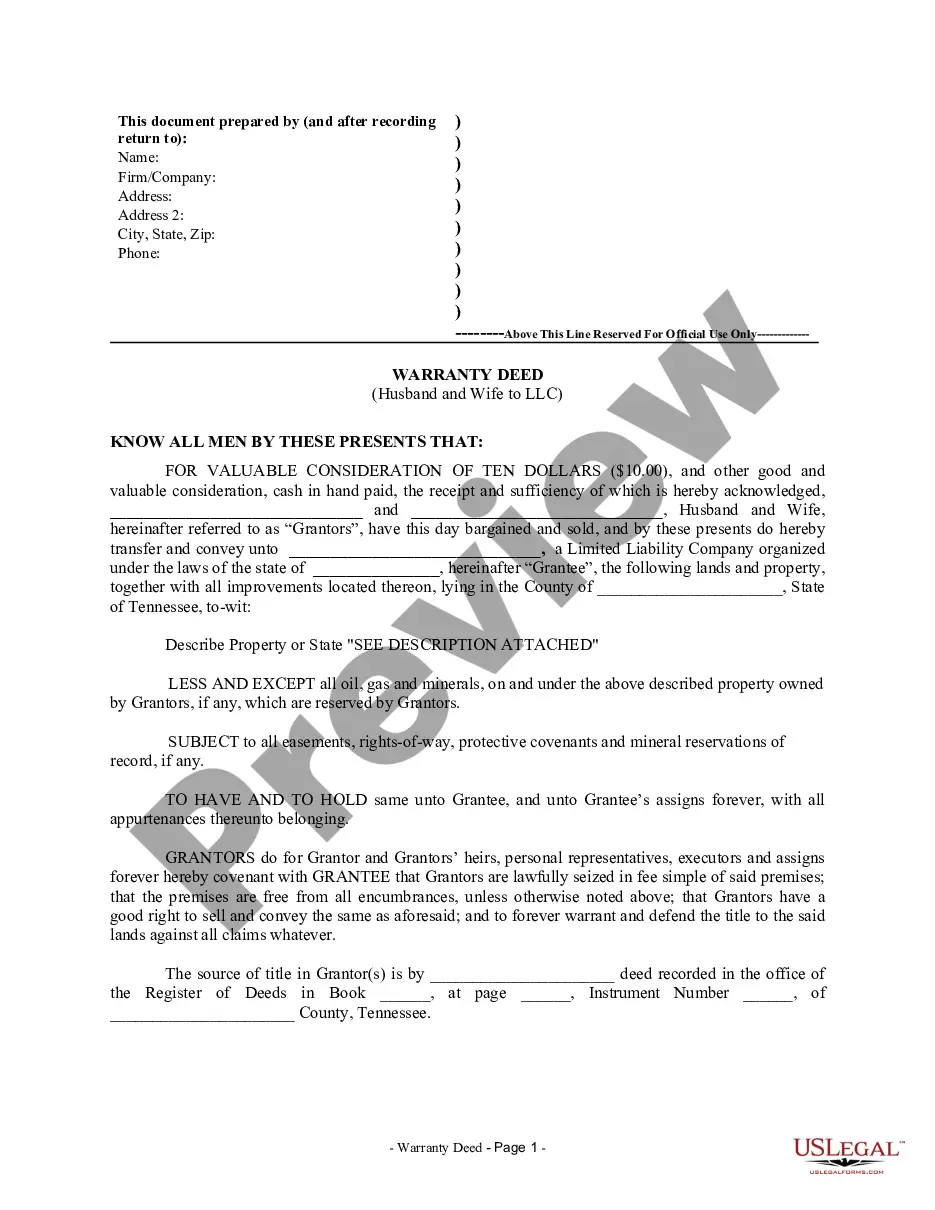

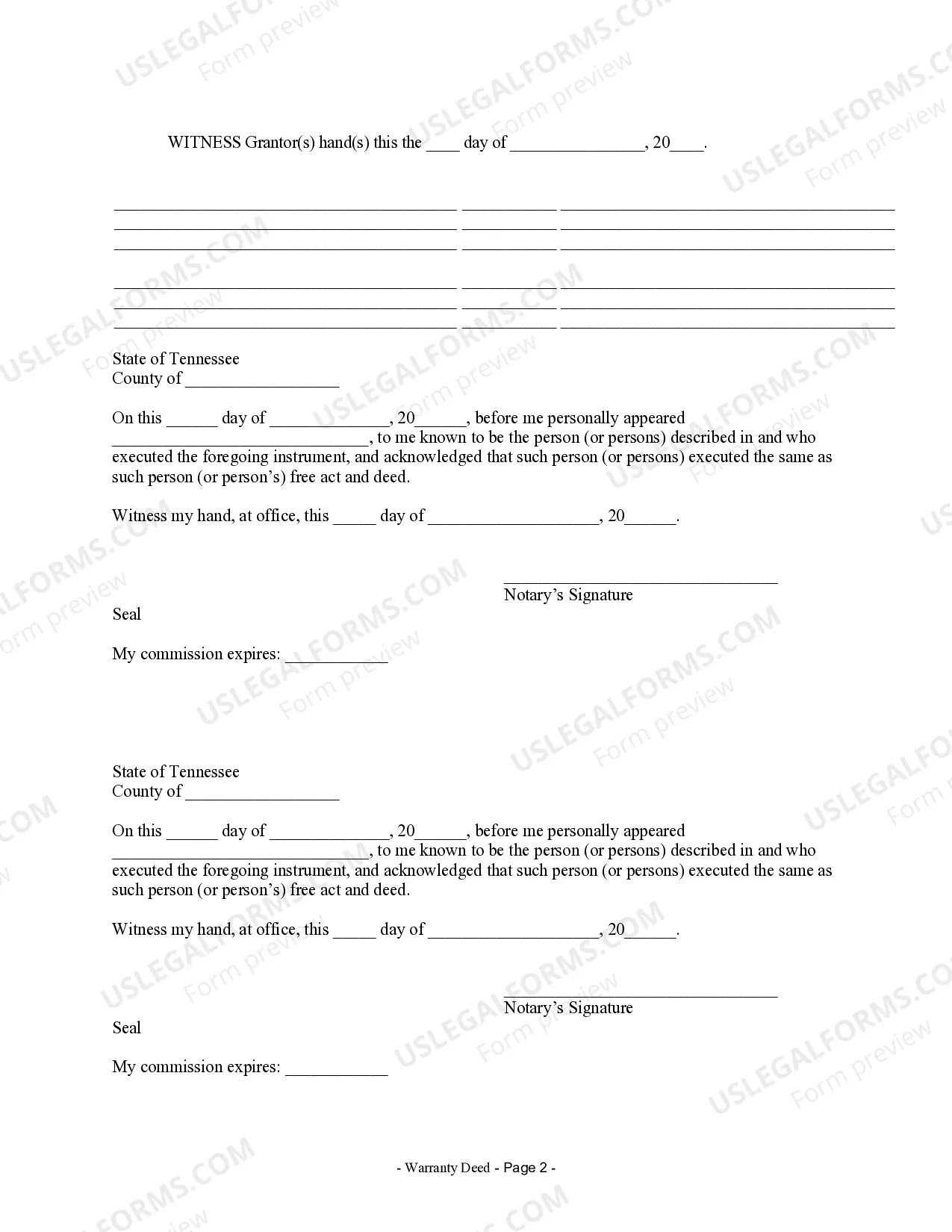

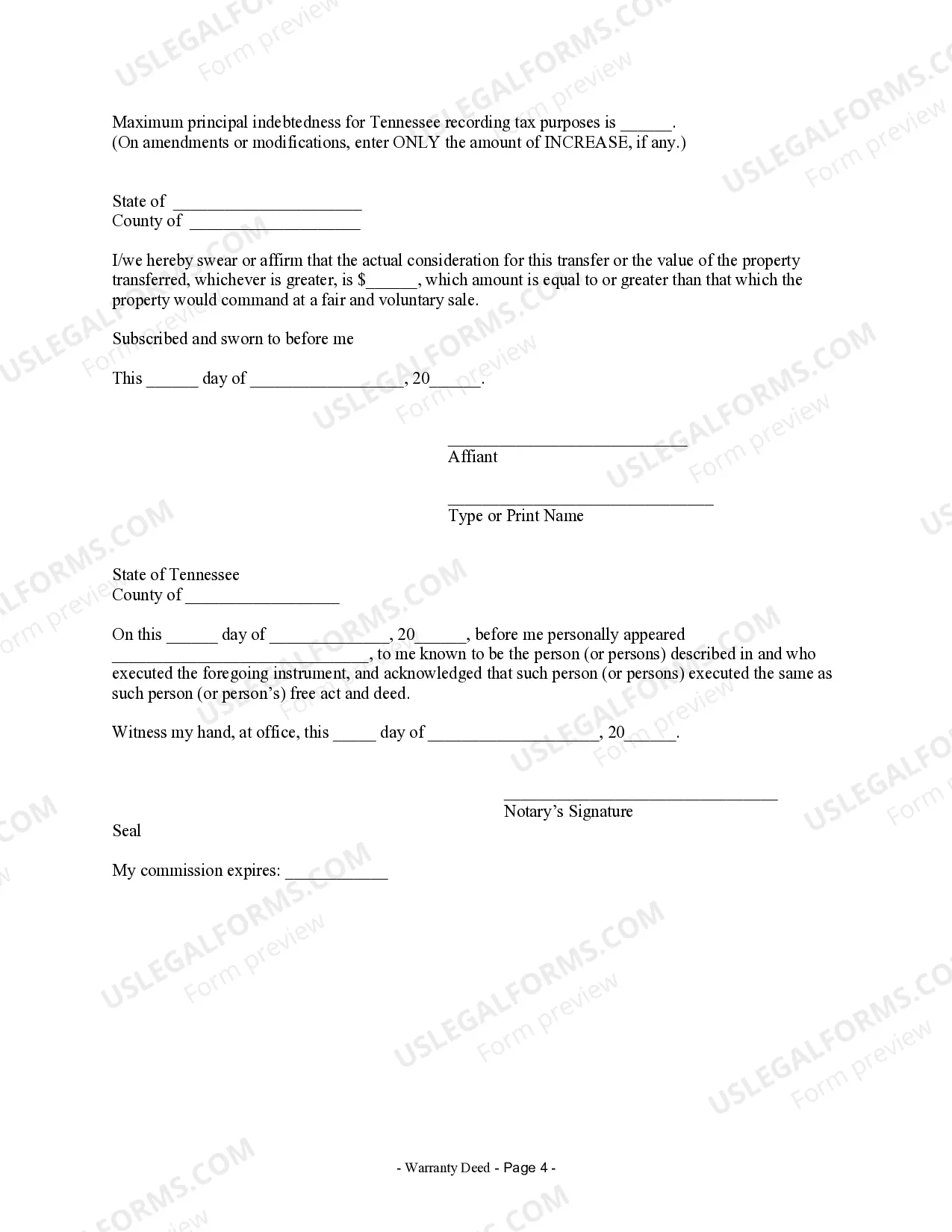

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A Murfreesboro Tennessee Warranty Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to a limited liability company (LLC) in Murfreesboro, a city located in Rutherford County, Tennessee. The purpose of this warranty deed is to protect the LLC from any potential claims or liabilities associated with the property, while also providing assurance to the LLC that the property is free from any undisclosed encumbrances or title defects. In Murfreesboro, there are several types of Warranty Deeds that can be executed from Husband and Wife to LLC, including: 1. General Warranty Deed: This type of warranty deed provides the broadest form of protection, as it guarantees that the granters (husband and wife) hold clear title to the property and will defend it against any future claims. The granters also warrant that the property is free from liens, encumbrances, or defects, except those specifically disclosed in the deed. 2. Special Warranty Deed: Unlike the general warranty deed, a special warranty deed provides a more limited form of protection to the grantee (the LLC). It guarantees that the granters have not caused any title defects during their ownership of the property but does not warrant against any defects that originated before their ownership. 3. Quitclaim Deed: This is a deed that transfers any interest the granters may have in the property to the LLC. However, it does not contain any warranties or guarantees regarding the title status or ownership history of the property. It only transfers the granters' rights without making any claims as to the property's condition. When it comes to executing a Murfreesboro Tennessee Warranty Deed from Husband and Wife to LLC, it is important to consult with a qualified attorney or real estate professional who can provide guidance on the specific requirements and legal implications of the chosen deed type. This will ensure a smooth and legally compliant transfer of ownership from the married couple to the LLC.A Murfreesboro Tennessee Warranty Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to a limited liability company (LLC) in Murfreesboro, a city located in Rutherford County, Tennessee. The purpose of this warranty deed is to protect the LLC from any potential claims or liabilities associated with the property, while also providing assurance to the LLC that the property is free from any undisclosed encumbrances or title defects. In Murfreesboro, there are several types of Warranty Deeds that can be executed from Husband and Wife to LLC, including: 1. General Warranty Deed: This type of warranty deed provides the broadest form of protection, as it guarantees that the granters (husband and wife) hold clear title to the property and will defend it against any future claims. The granters also warrant that the property is free from liens, encumbrances, or defects, except those specifically disclosed in the deed. 2. Special Warranty Deed: Unlike the general warranty deed, a special warranty deed provides a more limited form of protection to the grantee (the LLC). It guarantees that the granters have not caused any title defects during their ownership of the property but does not warrant against any defects that originated before their ownership. 3. Quitclaim Deed: This is a deed that transfers any interest the granters may have in the property to the LLC. However, it does not contain any warranties or guarantees regarding the title status or ownership history of the property. It only transfers the granters' rights without making any claims as to the property's condition. When it comes to executing a Murfreesboro Tennessee Warranty Deed from Husband and Wife to LLC, it is important to consult with a qualified attorney or real estate professional who can provide guidance on the specific requirements and legal implications of the chosen deed type. This will ensure a smooth and legally compliant transfer of ownership from the married couple to the LLC.