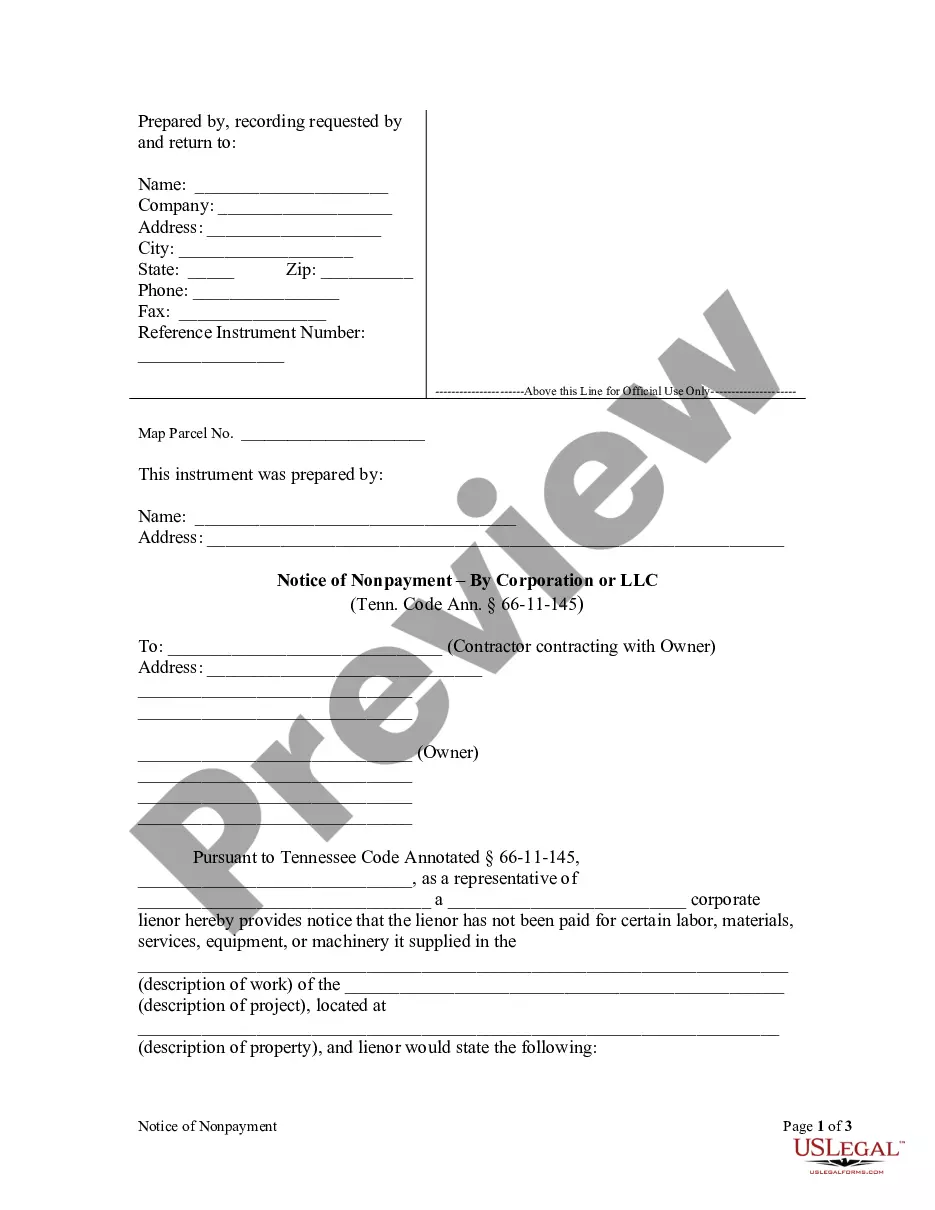

Every subcontractor, laborer or materialman contracted with or employed to work on buildings, fixtures, machinery, or improvements, or to furnish materials for the same, except one-family, two-family, three-family and four-family residential units, whether such subcontractor, laborer or materialman was employed by or contracted with the person who originally contracted with the owner of the premises or by an immediate or remote subcontractor acting under contract with the original contractor, or any subcontractor, shall mail, within ninety (90) days of the last day of the month within which work, services or materials were provided, a notice of nonpayment for such work, services or materials to the owner and contractor contracting with the owner if its account is, in fact, unpaid. The notice, which shall be served by registered or certified mail, return receipt requested.

The Memphis Tennessee Notice of Nonpayment by Corporation or LLC is a legal document that serves as formal communication from a creditor to a corporation or limited liability company (LLC) regarding outstanding payments that have not been settled. This notice is typically utilized when the creditor has not received the agreed-upon payment within the specified timeframe. The purpose of the notice is to formally inform the corporation or LLC about the nonpayment, and it also serves as a prerequisite for pursuing legal remedies to collect the owed amount. It is crucial for creditors to issue this notice as it acts as evidence of their attempt to resolve the matter amicably prior to escalating the situation legally. To ensure its validity, the notice should include essential information such as the name and address of the creditor (including contact details), the name and address of the corporation or LLC (including contact details), the outstanding amount, the date on which the payment was expected, and the date of the notice itself. Additionally, the notice should mention the consequences of the corporation or LLC failing to respond or settle the nonpayment, which may include legal action or other remedies. Different types or variations of the Memphis Tennessee Notice of Nonpayment by Corporation or LLC may exist based on specific circumstances or requirements. Some possible variations could include: 1. Initial Notice of Nonpayment: This is the initial communication sent to the corporation or LLC, informing them that their payment is overdue and prompting them to settle the outstanding amount within a specified timeframe. 2. Final Notice of Nonpayment: If the initial notice does not succeed in securing payment, a final notice may be issued, typically with stricter language and a shorter deadline for payment before legal action is pursued. 3. Notice of Nonpayment with Intent to Sue: In situations where the corporation or LLC continues to neglect payment after receiving previous notices, this type of notice can be sent to inform them of the creditor's intent to file a lawsuit to recover the amount owed. It may also outline the potential consequences of legal action, such as additional legal fees and potential damage to the corporation's reputation. In conclusion, the Memphis Tennessee Notice of Nonpayment by Corporation or LLC is a critical legal document used to notify a corporate entity about an unpaid debt. By sending this notice, creditors can establish a paper trail of their attempts to resolve nonpayment issues and may proceed with legal action if necessary. Variations of this notice can occur depending on the stages of communication and the creditor's intentions.The Memphis Tennessee Notice of Nonpayment by Corporation or LLC is a legal document that serves as formal communication from a creditor to a corporation or limited liability company (LLC) regarding outstanding payments that have not been settled. This notice is typically utilized when the creditor has not received the agreed-upon payment within the specified timeframe. The purpose of the notice is to formally inform the corporation or LLC about the nonpayment, and it also serves as a prerequisite for pursuing legal remedies to collect the owed amount. It is crucial for creditors to issue this notice as it acts as evidence of their attempt to resolve the matter amicably prior to escalating the situation legally. To ensure its validity, the notice should include essential information such as the name and address of the creditor (including contact details), the name and address of the corporation or LLC (including contact details), the outstanding amount, the date on which the payment was expected, and the date of the notice itself. Additionally, the notice should mention the consequences of the corporation or LLC failing to respond or settle the nonpayment, which may include legal action or other remedies. Different types or variations of the Memphis Tennessee Notice of Nonpayment by Corporation or LLC may exist based on specific circumstances or requirements. Some possible variations could include: 1. Initial Notice of Nonpayment: This is the initial communication sent to the corporation or LLC, informing them that their payment is overdue and prompting them to settle the outstanding amount within a specified timeframe. 2. Final Notice of Nonpayment: If the initial notice does not succeed in securing payment, a final notice may be issued, typically with stricter language and a shorter deadline for payment before legal action is pursued. 3. Notice of Nonpayment with Intent to Sue: In situations where the corporation or LLC continues to neglect payment after receiving previous notices, this type of notice can be sent to inform them of the creditor's intent to file a lawsuit to recover the amount owed. It may also outline the potential consequences of legal action, such as additional legal fees and potential damage to the corporation's reputation. In conclusion, the Memphis Tennessee Notice of Nonpayment by Corporation or LLC is a critical legal document used to notify a corporate entity about an unpaid debt. By sending this notice, creditors can establish a paper trail of their attempts to resolve nonpayment issues and may proceed with legal action if necessary. Variations of this notice can occur depending on the stages of communication and the creditor's intentions.