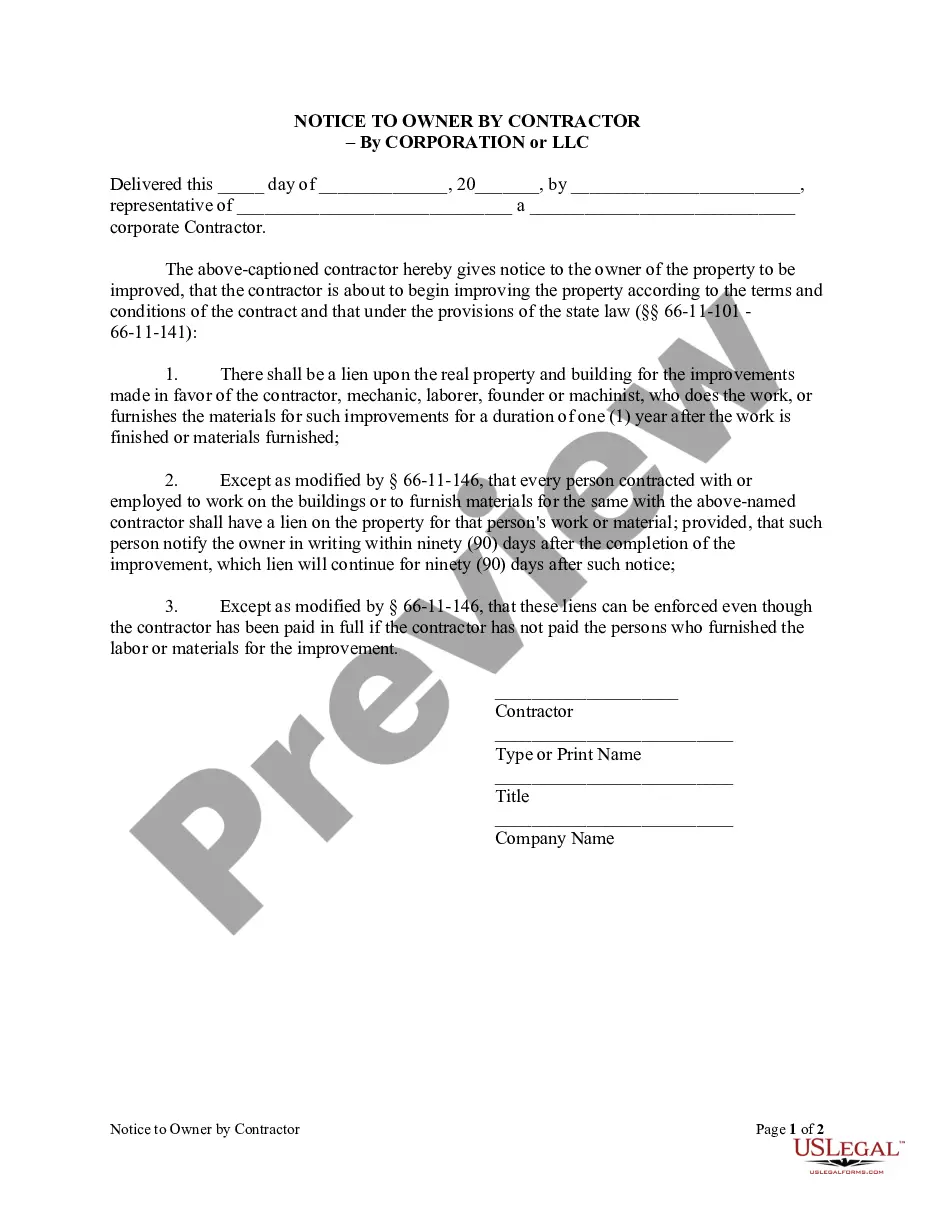

This form is used by a corporate contractor to attest to the fact that all parties who might have a lien against an improved property have been paid.

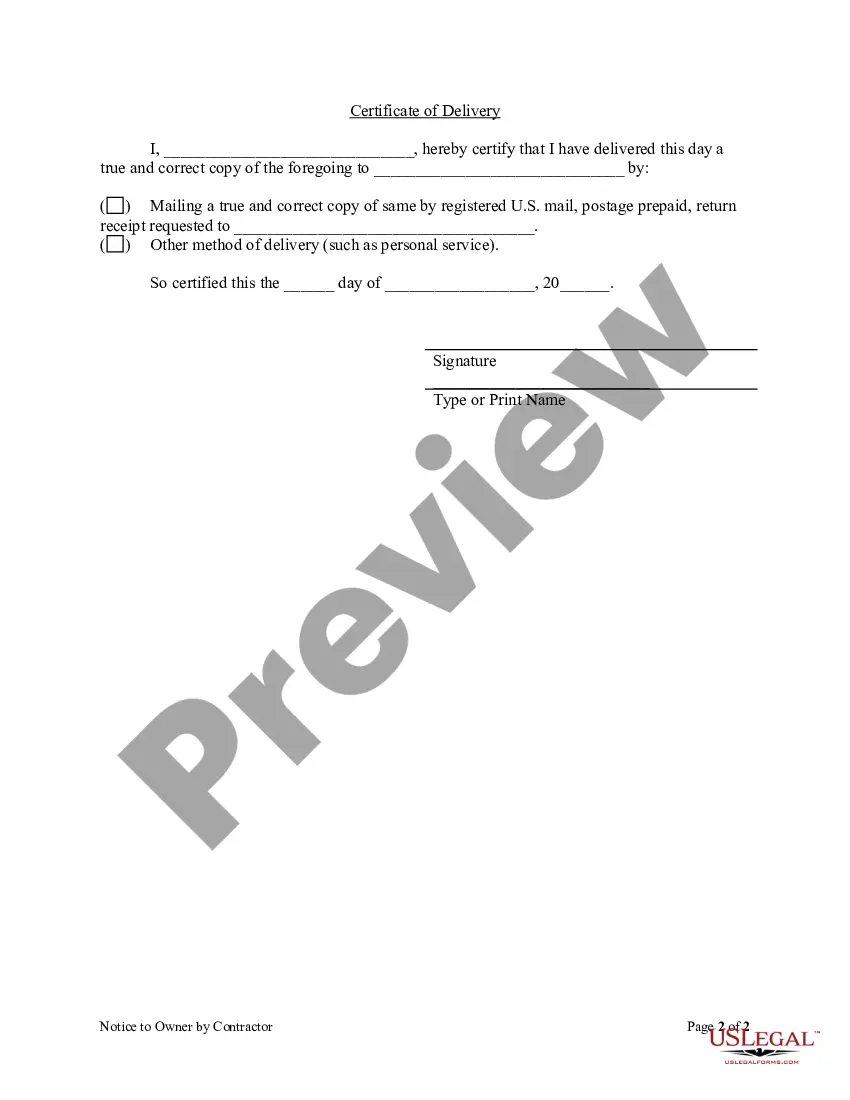

A Memphis Tennessee Notice to Owner of Construction Lien — Corporation or LLC is a legally binding document used by contractors, subcontractors, material suppliers, or laborers to inform the owner of a property of their intention to file a construction lien against it. This notice is specifically designed for corporations or limited liability companies (LCS) involved in construction projects within Memphis, Tennessee. Keywords: Memphis Tennessee, Notice to Owner, Construction Lien, Corporation, LLC, contractors, subcontractors, material suppliers, laborers. When a contractor or other parties involved in a construction project are not paid for their work or materials, they have the right to file a construction lien against the property. This lien provides them with a legal right to claim compensation by forcing the sale of the property to settle any outstanding debts. In Memphis, Tennessee, the Notice to Owner requirement ensures that owners are aware of potential construction liens and can take necessary steps to resolve disputes and payment issues before a lien is filed. The Notice to Owner of Construction Lien — Corporation or LLC is one variation of this notice specifically tailored for corporations or LCS as the claimant. There may be variations of this notice depending on the specific circumstances, such as the type of claimant. For example, there might be different notices for individual contractors, material suppliers, or laborers. The Notice to Owner of Construction Lien — Corporation or LLC typically includes the following key information: 1. Claimant Information: The full legal name of the corporation or LLC filing the notice, along with their registered address and contact details. 2. Description of Work or Materials: A detailed description of the work or materials provided by the claimant, including dates, locations, and any relevant project references. 3. Property Information: The address and legal description of the property where the work or materials were provided. 4. Owner Information: The name and contact information of the property owner or their authorized representative. 5. Notice to Owner: A clear and explicit statement that the claimant intends to file a construction lien against the property if payment is not received within a specified timeframe. 6. Proof of Notice: The claimant may be required to provide documentation or a statement affirming that a copy of the Notice to Owner has been sent to the property owner by certified mail or served personally. It's important for claimants to familiarize themselves with the specific legal requirements and deadlines for filing a Notice to Owner of Construction Lien — Corporation or LLC in Memphis, Tennessee, as these may vary from other jurisdictions. Claimants should consider consulting with a legal professional familiar with Tennessee construction lien laws to ensure compliance. By filing a Notice to Owner, corporations or LCS assert their rights and preserve their right to file a construction lien, urging prompt resolution of any outstanding payments.A Memphis Tennessee Notice to Owner of Construction Lien — Corporation or LLC is a legally binding document used by contractors, subcontractors, material suppliers, or laborers to inform the owner of a property of their intention to file a construction lien against it. This notice is specifically designed for corporations or limited liability companies (LCS) involved in construction projects within Memphis, Tennessee. Keywords: Memphis Tennessee, Notice to Owner, Construction Lien, Corporation, LLC, contractors, subcontractors, material suppliers, laborers. When a contractor or other parties involved in a construction project are not paid for their work or materials, they have the right to file a construction lien against the property. This lien provides them with a legal right to claim compensation by forcing the sale of the property to settle any outstanding debts. In Memphis, Tennessee, the Notice to Owner requirement ensures that owners are aware of potential construction liens and can take necessary steps to resolve disputes and payment issues before a lien is filed. The Notice to Owner of Construction Lien — Corporation or LLC is one variation of this notice specifically tailored for corporations or LCS as the claimant. There may be variations of this notice depending on the specific circumstances, such as the type of claimant. For example, there might be different notices for individual contractors, material suppliers, or laborers. The Notice to Owner of Construction Lien — Corporation or LLC typically includes the following key information: 1. Claimant Information: The full legal name of the corporation or LLC filing the notice, along with their registered address and contact details. 2. Description of Work or Materials: A detailed description of the work or materials provided by the claimant, including dates, locations, and any relevant project references. 3. Property Information: The address and legal description of the property where the work or materials were provided. 4. Owner Information: The name and contact information of the property owner or their authorized representative. 5. Notice to Owner: A clear and explicit statement that the claimant intends to file a construction lien against the property if payment is not received within a specified timeframe. 6. Proof of Notice: The claimant may be required to provide documentation or a statement affirming that a copy of the Notice to Owner has been sent to the property owner by certified mail or served personally. It's important for claimants to familiarize themselves with the specific legal requirements and deadlines for filing a Notice to Owner of Construction Lien — Corporation or LLC in Memphis, Tennessee, as these may vary from other jurisdictions. Claimants should consider consulting with a legal professional familiar with Tennessee construction lien laws to ensure compliance. By filing a Notice to Owner, corporations or LCS assert their rights and preserve their right to file a construction lien, urging prompt resolution of any outstanding payments.