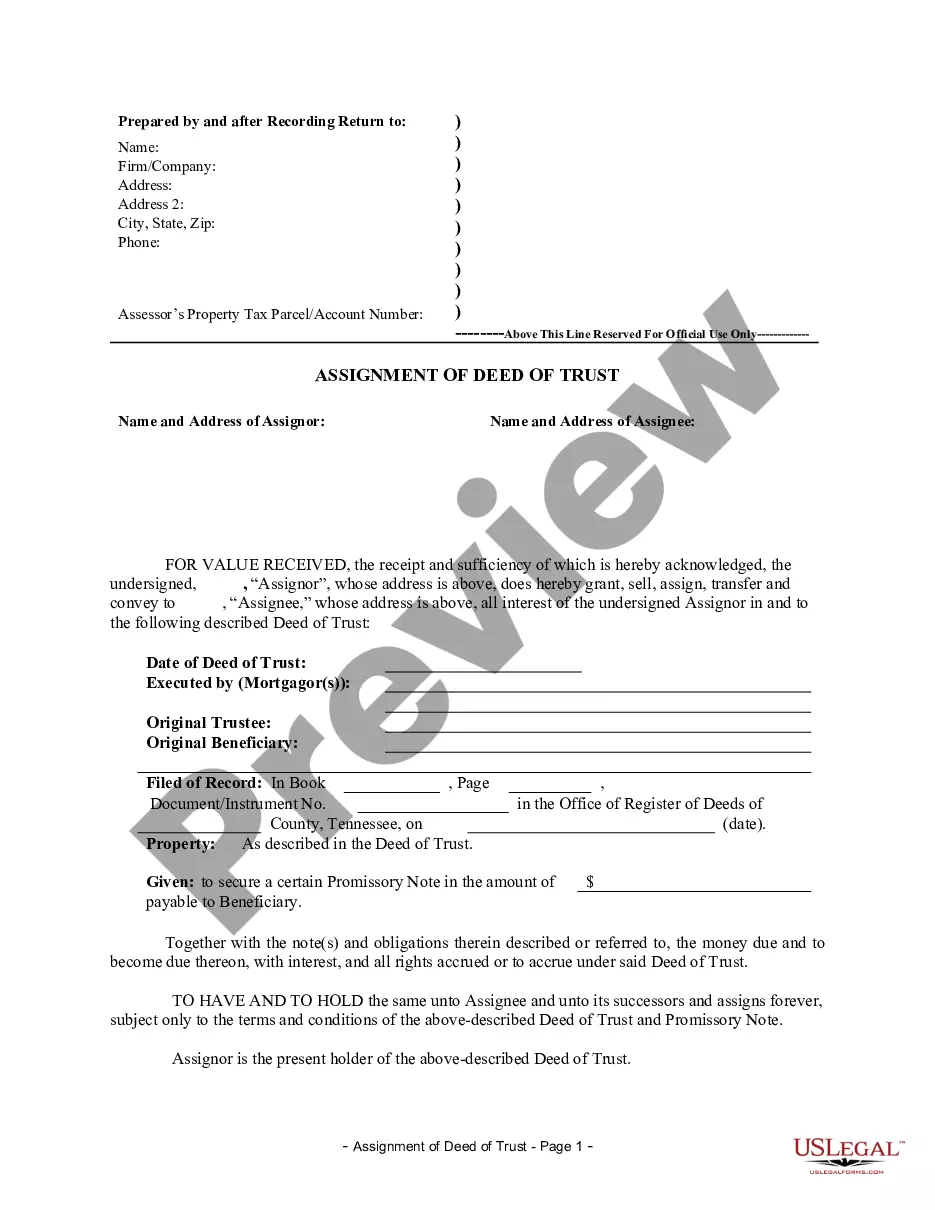

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

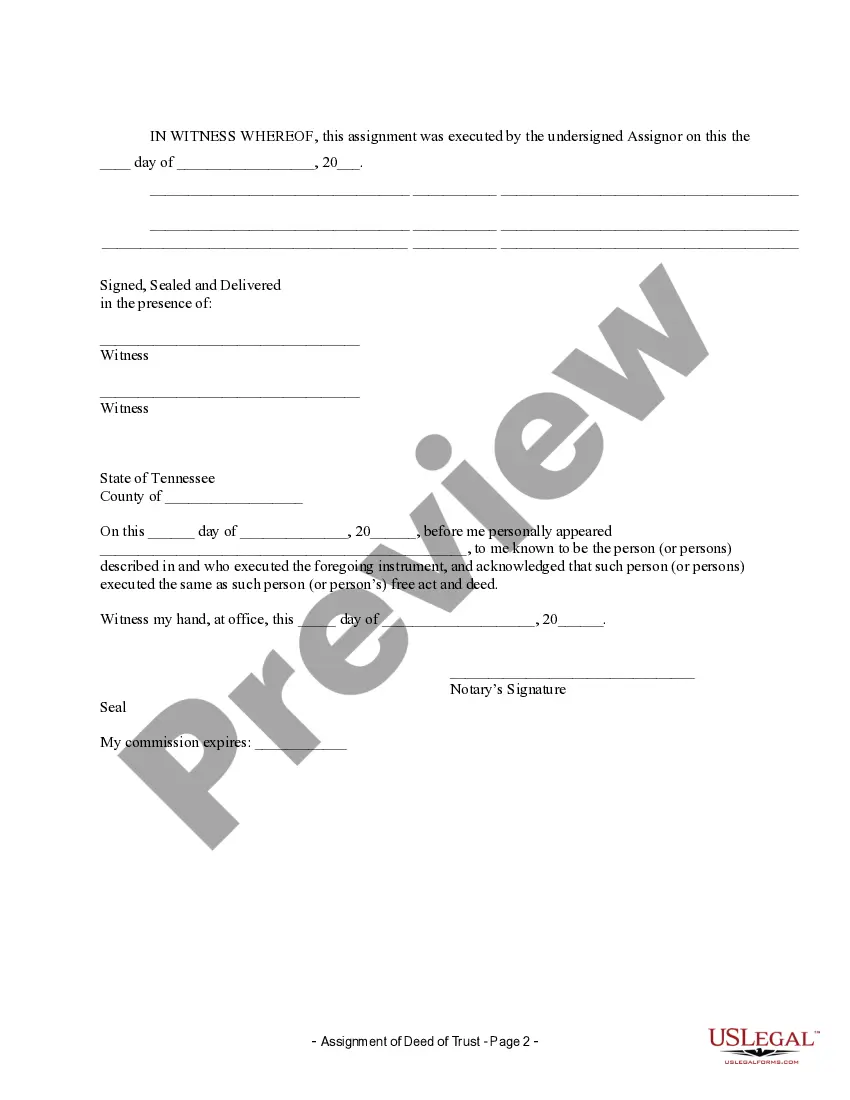

Title: Knoxville Tennessee Assignment of Deed of Trust by Individual Mortgage Holder: Detailed Description and Types Explained Introduction: In Knoxville, Tennessee, the Assignment of Deed of Trust by Individual Mortgage Holder refers to a legal process where an individual mortgage holder transfers their interest in a property to another party. This document holds significant importance in real estate transactions and serves as a crucial instrument for transferring ownership rights. Here, we will provide you with a detailed description of what this assignment entails, along with an overview of its various types within Knoxville, Tennessee. 1. Clear Understanding of Assignment of Deed of Trust: The Assignment of Deed of Trust is a legal contract where the individual mortgage holder, known as the "assignor," transfers their rights, interests, and associated obligations in a property to another party, known as the "assignee." This assignment takes place by the assignor endorsing, signing, and subsequently recording the assignment in the county where the property is located. 2. Importance and Purpose: The purpose of the Assignment of Deed of Trust is to ensure a smooth transfer of property rights and provide a legal framework for all parties involved. It allows the mortgage holder to transfer their interest to a new party, typically a lender or investor, who then becomes responsible for collecting payments and enforcing the terms of the mortgage. 3. Knoxville Tennessee Assignment of Deed of Trust by Individual Mortgage Holder Types: a) Private Lender Assignment: This type of assignment occurs when an individual mortgage holder, who lent money directly to a borrower, transfers their rights and interests to another private lender. The assignee assumes the responsibility of collecting repayments and enforcing the mortgage terms. b) Creditor Assignment: In some cases, a mortgage holder may assign their deed of trust to a creditor who holds a judgment lien against the property. This assignment allows the creditor to potentially collect the debt owed by the borrower through the property's foreclosure if the debt remains unpaid. c) Due to Sale of Debt: Another common scenario is when an individual mortgage holder assigns their deed of trust due to selling the associated debt to an investor or a financial institution. The assignee then holds the right to collect payments and manage the mortgage. Conclusion: In Knoxville, Tennessee, the Assignment of Deed of Trust by Individual Mortgage Holder is a legally significant process for transferring ownership rights and duties related to a property. It incorporates various types, each catering to different scenarios involving private lenders, creditors, or debt buyers. Understanding the different types is essential when engaging in real estate transactions to ensure compliance with applicable laws and protect the interests of all parties involved.Title: Knoxville Tennessee Assignment of Deed of Trust by Individual Mortgage Holder: Detailed Description and Types Explained Introduction: In Knoxville, Tennessee, the Assignment of Deed of Trust by Individual Mortgage Holder refers to a legal process where an individual mortgage holder transfers their interest in a property to another party. This document holds significant importance in real estate transactions and serves as a crucial instrument for transferring ownership rights. Here, we will provide you with a detailed description of what this assignment entails, along with an overview of its various types within Knoxville, Tennessee. 1. Clear Understanding of Assignment of Deed of Trust: The Assignment of Deed of Trust is a legal contract where the individual mortgage holder, known as the "assignor," transfers their rights, interests, and associated obligations in a property to another party, known as the "assignee." This assignment takes place by the assignor endorsing, signing, and subsequently recording the assignment in the county where the property is located. 2. Importance and Purpose: The purpose of the Assignment of Deed of Trust is to ensure a smooth transfer of property rights and provide a legal framework for all parties involved. It allows the mortgage holder to transfer their interest to a new party, typically a lender or investor, who then becomes responsible for collecting payments and enforcing the terms of the mortgage. 3. Knoxville Tennessee Assignment of Deed of Trust by Individual Mortgage Holder Types: a) Private Lender Assignment: This type of assignment occurs when an individual mortgage holder, who lent money directly to a borrower, transfers their rights and interests to another private lender. The assignee assumes the responsibility of collecting repayments and enforcing the mortgage terms. b) Creditor Assignment: In some cases, a mortgage holder may assign their deed of trust to a creditor who holds a judgment lien against the property. This assignment allows the creditor to potentially collect the debt owed by the borrower through the property's foreclosure if the debt remains unpaid. c) Due to Sale of Debt: Another common scenario is when an individual mortgage holder assigns their deed of trust due to selling the associated debt to an investor or a financial institution. The assignee then holds the right to collect payments and manage the mortgage. Conclusion: In Knoxville, Tennessee, the Assignment of Deed of Trust by Individual Mortgage Holder is a legally significant process for transferring ownership rights and duties related to a property. It incorporates various types, each catering to different scenarios involving private lenders, creditors, or debt buyers. Understanding the different types is essential when engaging in real estate transactions to ensure compliance with applicable laws and protect the interests of all parties involved.