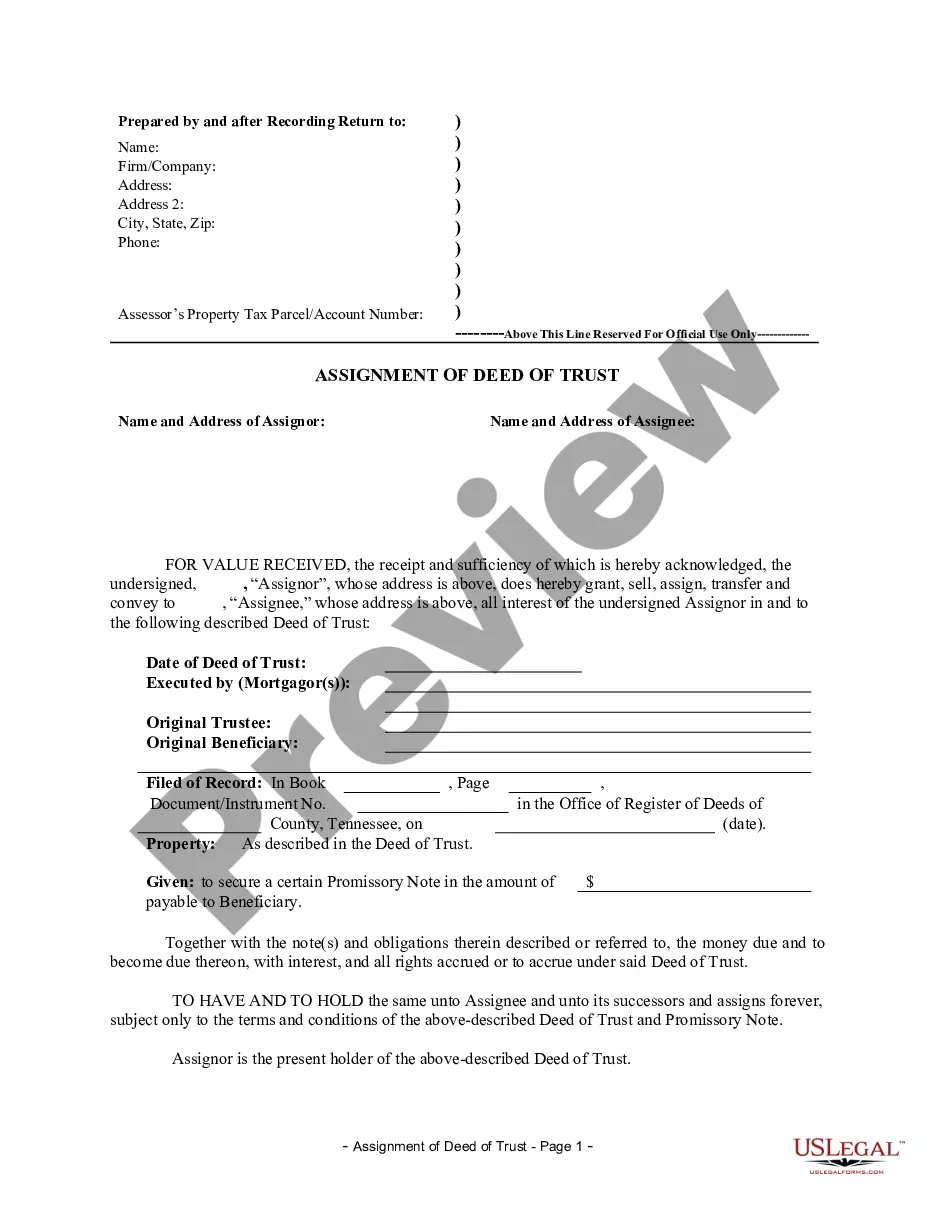

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

A Knoxville Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder is a legal document that transfers the rights and interests of a corporate mortgage holder (typically a lending institution or bank) to a new party, known as the assignee. This transfer of the deed of trust allows the assignee to assume the rights and obligations of the original mortgage holder as they pertain to the property in question. The assignment of a deed of trust in Knoxville, Tennessee is a commonly used mechanism to facilitate the transfer of mortgage loans from one entity to another. This process typically occurs when the original mortgage holder decides to sell or assign the loan to another financial institution or investor. There are various types of Knoxville Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder, each serving a specific purpose depending upon the circumstances of the transfer. Some common types include: 1. Partial Assignment of Deed of Trust: This type of assignment involves only a portion of the mortgage loan being transferred to the assignee. It could be a partial sale of the loan or a temporary assignment for specific purposes. 2. Full Assignment of Deed of Trust: In this type of assignment, the entire mortgage loan is transferred to the assignee, including all rights, interests, and obligations held by the original mortgage holder. 3. Assignment to a Subsidiary: When a corporate mortgage holder assigns the deed of trust to its subsidiary company, it is known as an assignment to a subsidiary. This type of assignment is commonly used for internal restructuring or administrative purposes. 4. Assignment to a Third Party: An assignment to a third party occurs when the mortgage loan is transferred to another financial institution or investor outside the corporate structure of the original mortgage holder. This type of assignment often takes place during the sale or securitization of mortgage loans. 5. Assignment for Consideration: This type of assignment involves a monetary consideration, such as a purchase price or fee, paid by the assignee to the corporate mortgage holder in exchange for the transfer of the deed of trust. It is important to note that the specific terms and conditions of the Knoxville Tennessee Assignment of Deed of Trust by Corporate Mortgage Holder may vary depending on the agreement between the parties involved and the applicable state laws. It is advisable to consult with a qualified attorney or real estate professional to ensure compliance with all legal requirements and to properly draft and execute the assignment document.