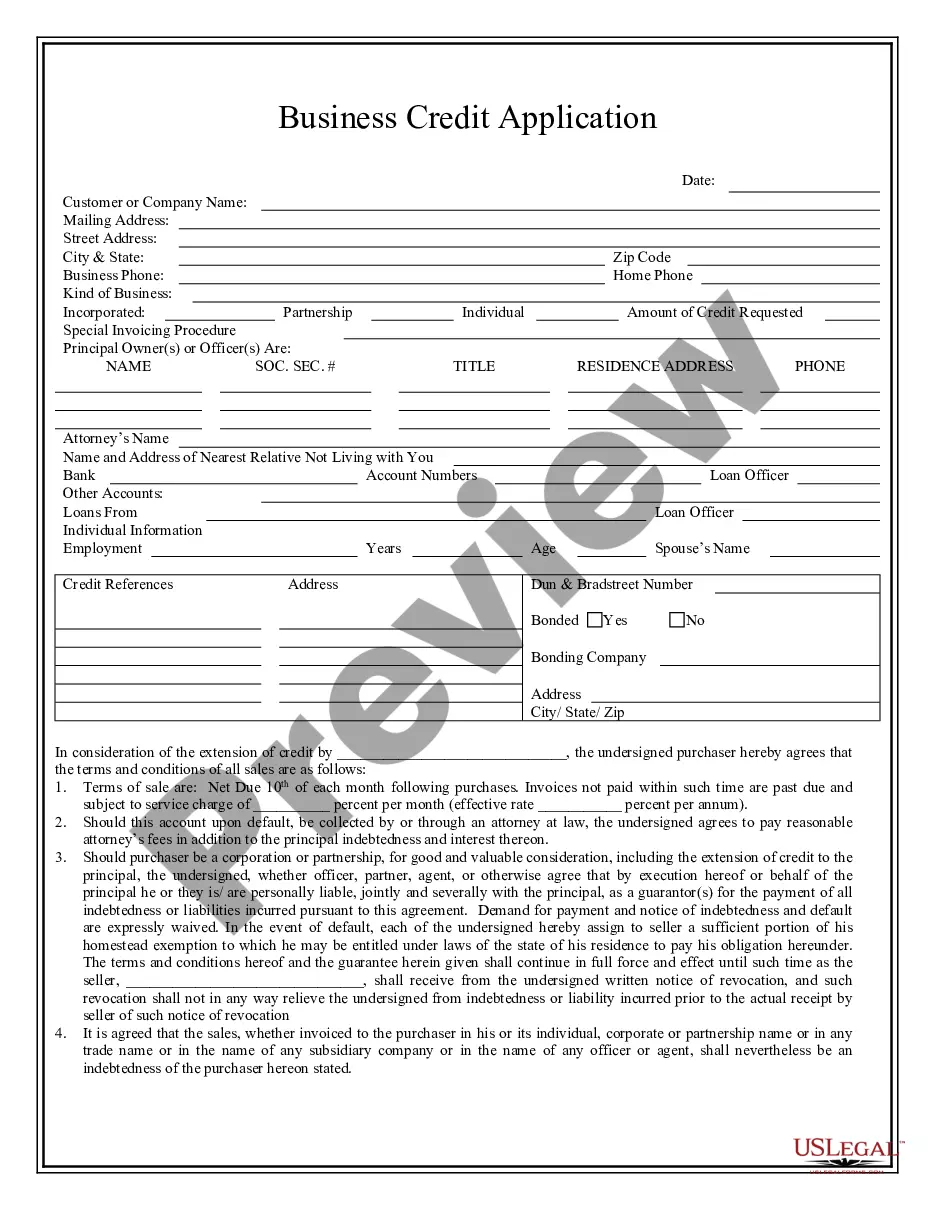

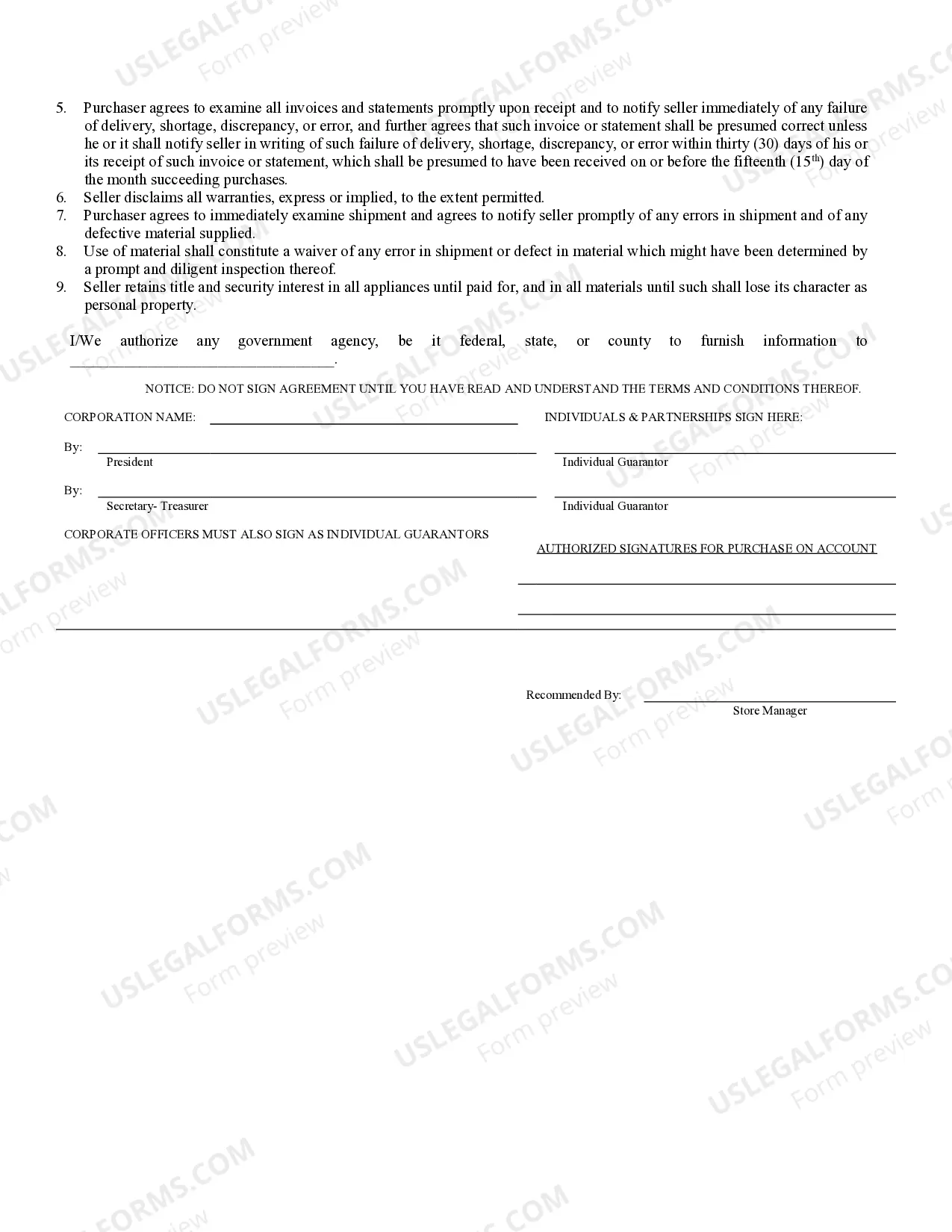

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Chattanooga Tennessee Business Credit Application is a formal document required by financial institutions or creditors in Chattanooga, Tennessee, for businesses seeking credit for various purposes. This comprehensive application provides detailed information about a company's financial standing, creditworthiness, and business operations to guide lenders in assessing the risks associated with extending credit. The Chattanooga Tennessee Business Credit Application typically consists of several sections that capture essential information about the applying business. These sections may include: 1. Business Information: This section requires the business's legal name, address, contact details, and type of entity (e.g., sole proprietorship, partnership, corporation). It may also inquire about the duration of operation and the number of employees. 2. Ownership Details: Here, the application seeks information about the business owners or principal shareholders. It may require the names, addresses, and contact details of these individuals, as well as their percentage of ownership in the company. 3. Financial Statements: Financial aspects play a crucial role in assessing a business's creditworthiness. The application typically requests financial statements such as balance sheets, income statements, and cash flow statements. These statements provide a snapshot of the company's financial health and demonstrate its ability to manage debt. 4. Business Plan: Some credit applications may require the inclusion of a business plan, detailing the company's objectives, strategies, market analysis, and projected financial performance. This helps lenders evaluate the viability and growth potential of the business. 5. Credit References: The application often asks for credit references, including names and contact details of other companies with whom the business has established credit relationships. This information helps credit providers verify the applicant's payment history and credibility. 6. Collateral Details: In cases where the credit application involves secured loans, applicants may need to provide information about the collateral they are willing to pledge, such as real estate or equipment. Collateral acts as security for the loan in case of default. Types of Chattanooga Tennessee Business Credit Applications may vary based on the specific purpose or loan type. Some common variations include: 1. Small Business Credit Application: Designed for small businesses, startups, or companies with limited operations seeking credit for growth, working capital, or equipment financing. 2. Revolving Credit Application: This type of application applies to businesses looking for a revolving line of credit, allowing them to borrow funds as needed up to a predetermined limit and repay the borrowed amounts over time. 3. Commercial Real Estate Loan Application: For businesses interested in acquiring or refinancing commercial properties, this application requires detailed property information, such as location, valuation, occupancy rates, and leases. 4. Equipment Financing Application: Specifically tailored for businesses seeking credit to purchase or lease equipment required for their operations. This application focuses on equipment details, costs, and expected revenue generation. 5. Trade Credit Application: Trade credit refers to credit extended by suppliers or vendors to businesses for purchasing goods or services. This application typically involves accounts payable information and trade references. It is important to note that each financial institution or creditor may have its own customized credit application, but they generally cover the essential aspects mentioned above.