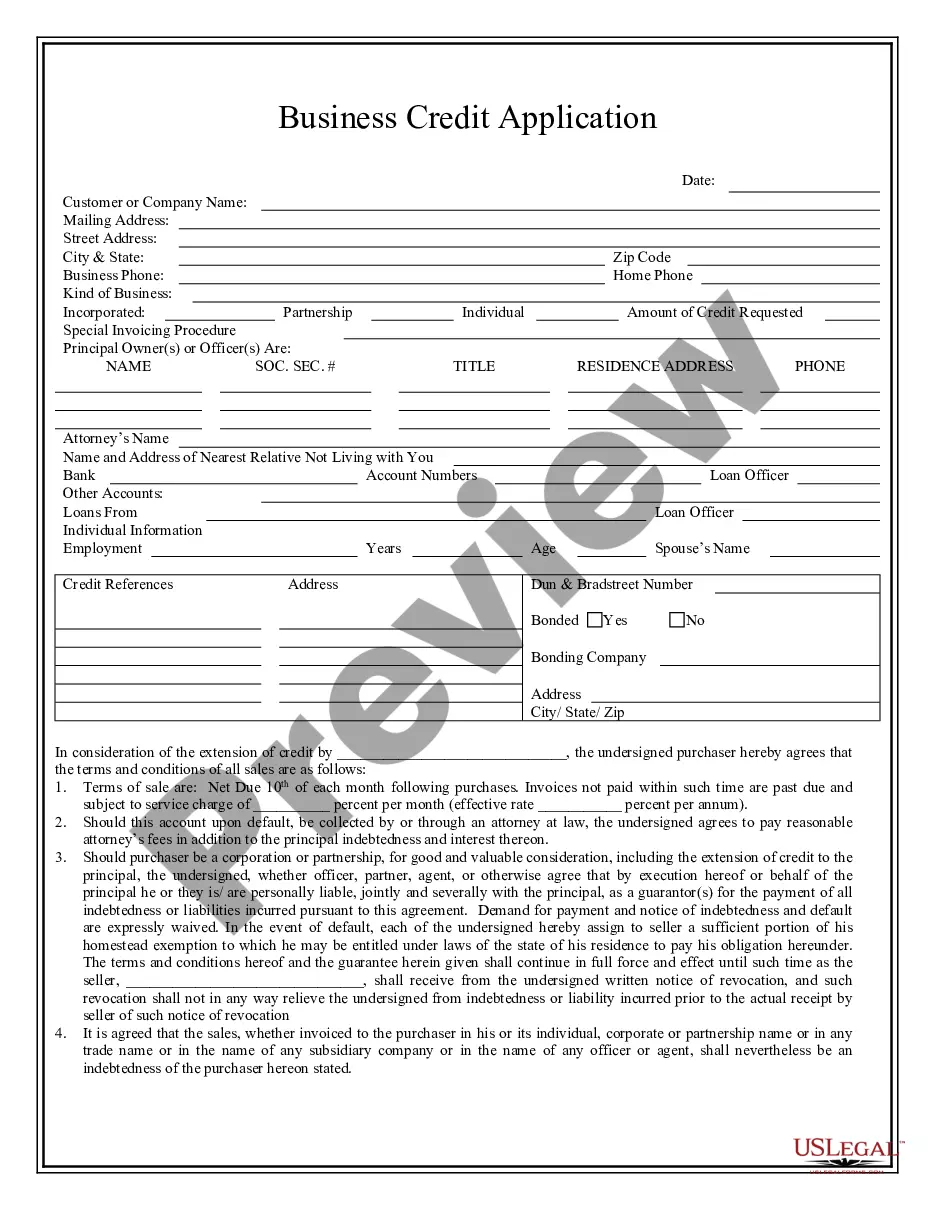

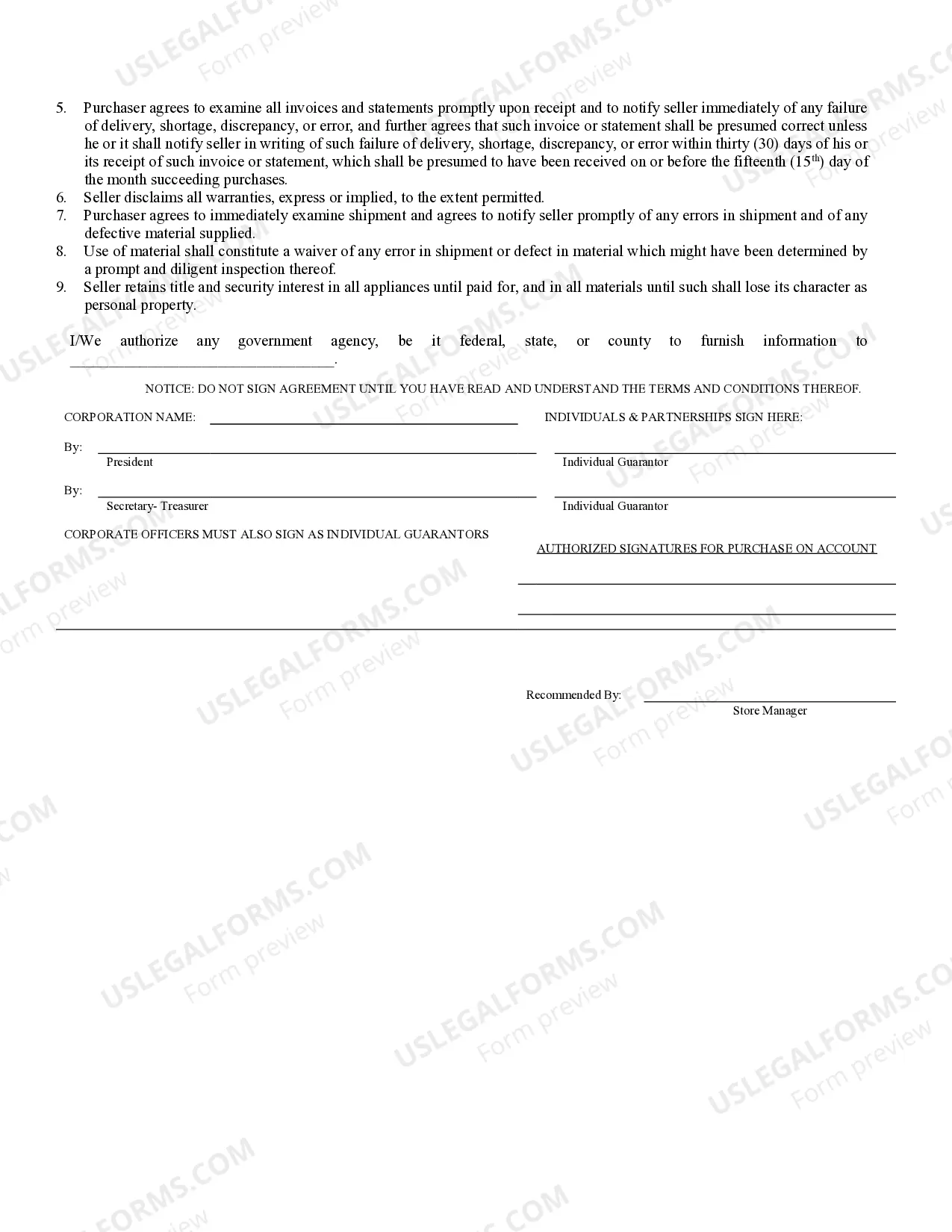

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

The Clarksville Tennessee Business Credit Application is a comprehensive and detailed form that enables businesses in Clarksville, Tennessee to apply for credit from various financial institutions, lenders, and creditors. This application is specifically designed to gather essential information about the business and its owners, allowing lenders to assess their creditworthiness and make informed decisions regarding granting credit facilities. This application form consists of multiple sections, including: 1. Business Information: This section requires the business's legal name, owner's name, address, and contact details. It also collects the years in operation, industry type, and the number of employees. Providing accurate and up-to-date information is crucial to establish credibility. 2. Financial Information: In this segment, the applicant is required to provide detailed financial data about their business. This includes annual revenue, profit, operating expenses, assets, liabilities, and debt-to-income ratio. Additionally, the application may request bank statements, tax returns, and income statements to support the financial information provided. 3. Owner/Personal Information: The lenders also assess the personal creditworthiness of the business owner. This section gathers personal information, including social security number, date of birth, current address, and contact details. The owner's personal credit history and financial stability play a significant role in determining the credit application's success. 4. Trade References: The credit application usually includes space for providing trade references, which are other businesses or suppliers that the applicant has or had credit relationships with. This section enables lenders to verify the applicant's payment history and credibility within the business community. 5. Terms and Conditions: The applicant must carefully review and agree to the terms and conditions set forth by the lender or creditor. These may include interest rates, payment terms, collateral requirements, and any additional fees associated with the credit facility. 6. Multiple Types: The Clarksville Tennessee Business Credit Application can have various types based on the specific purpose or entity. These may include Small Business Loan Applications, Business Line of Credit Applications, Equipment Financing Applications, Commercial Real Estate Loan Applications, and Business Credit Card Applications. It is important for businesses in Clarksville, Tennessee to complete the credit application accurately, providing all necessary information. The application may differ slightly depending on the lender or creditor, but its overall goal remains the same — to assess the creditworthiness and financial stability of the business to determine whether granting credit is a viable option.The Clarksville Tennessee Business Credit Application is a comprehensive and detailed form that enables businesses in Clarksville, Tennessee to apply for credit from various financial institutions, lenders, and creditors. This application is specifically designed to gather essential information about the business and its owners, allowing lenders to assess their creditworthiness and make informed decisions regarding granting credit facilities. This application form consists of multiple sections, including: 1. Business Information: This section requires the business's legal name, owner's name, address, and contact details. It also collects the years in operation, industry type, and the number of employees. Providing accurate and up-to-date information is crucial to establish credibility. 2. Financial Information: In this segment, the applicant is required to provide detailed financial data about their business. This includes annual revenue, profit, operating expenses, assets, liabilities, and debt-to-income ratio. Additionally, the application may request bank statements, tax returns, and income statements to support the financial information provided. 3. Owner/Personal Information: The lenders also assess the personal creditworthiness of the business owner. This section gathers personal information, including social security number, date of birth, current address, and contact details. The owner's personal credit history and financial stability play a significant role in determining the credit application's success. 4. Trade References: The credit application usually includes space for providing trade references, which are other businesses or suppliers that the applicant has or had credit relationships with. This section enables lenders to verify the applicant's payment history and credibility within the business community. 5. Terms and Conditions: The applicant must carefully review and agree to the terms and conditions set forth by the lender or creditor. These may include interest rates, payment terms, collateral requirements, and any additional fees associated with the credit facility. 6. Multiple Types: The Clarksville Tennessee Business Credit Application can have various types based on the specific purpose or entity. These may include Small Business Loan Applications, Business Line of Credit Applications, Equipment Financing Applications, Commercial Real Estate Loan Applications, and Business Credit Card Applications. It is important for businesses in Clarksville, Tennessee to complete the credit application accurately, providing all necessary information. The application may differ slightly depending on the lender or creditor, but its overall goal remains the same — to assess the creditworthiness and financial stability of the business to determine whether granting credit is a viable option.