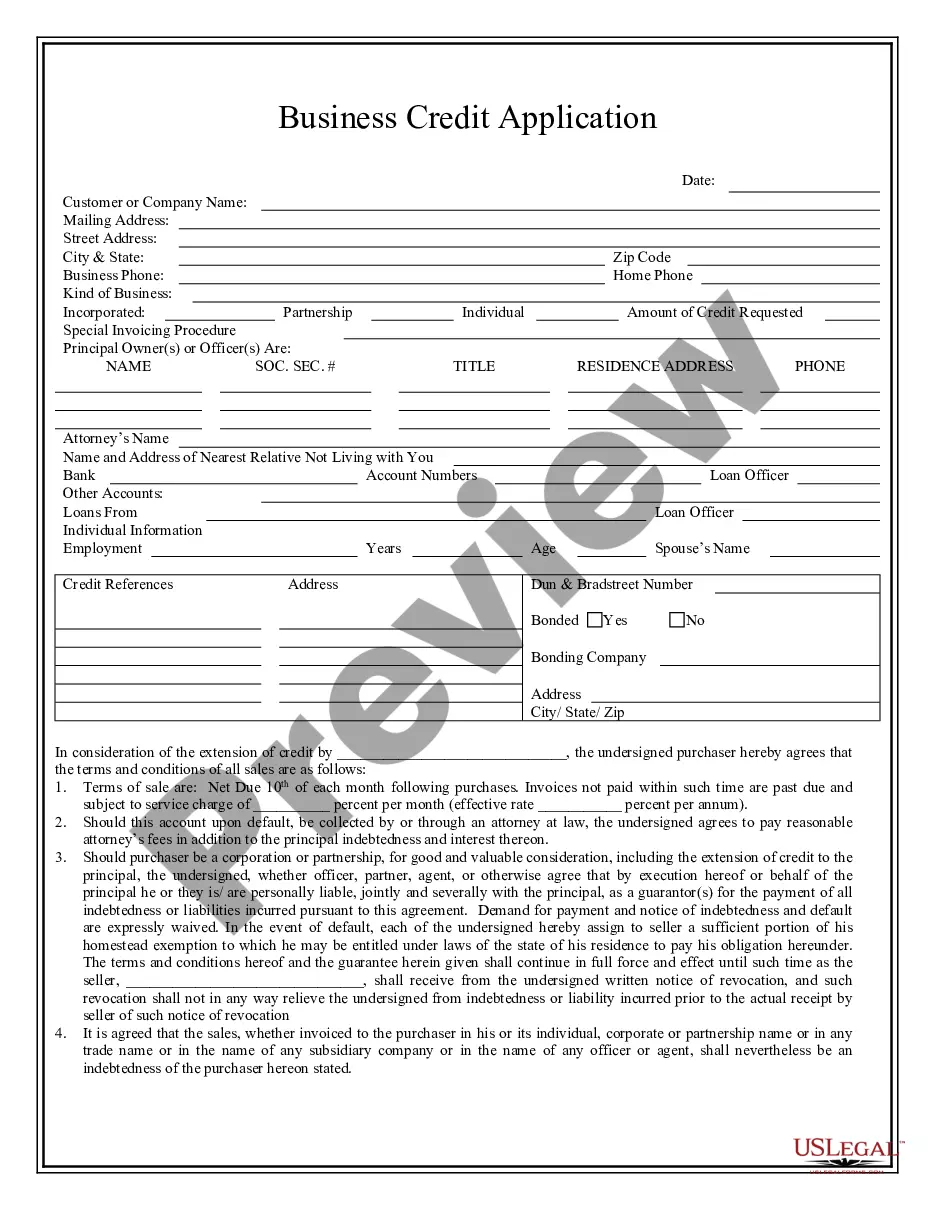

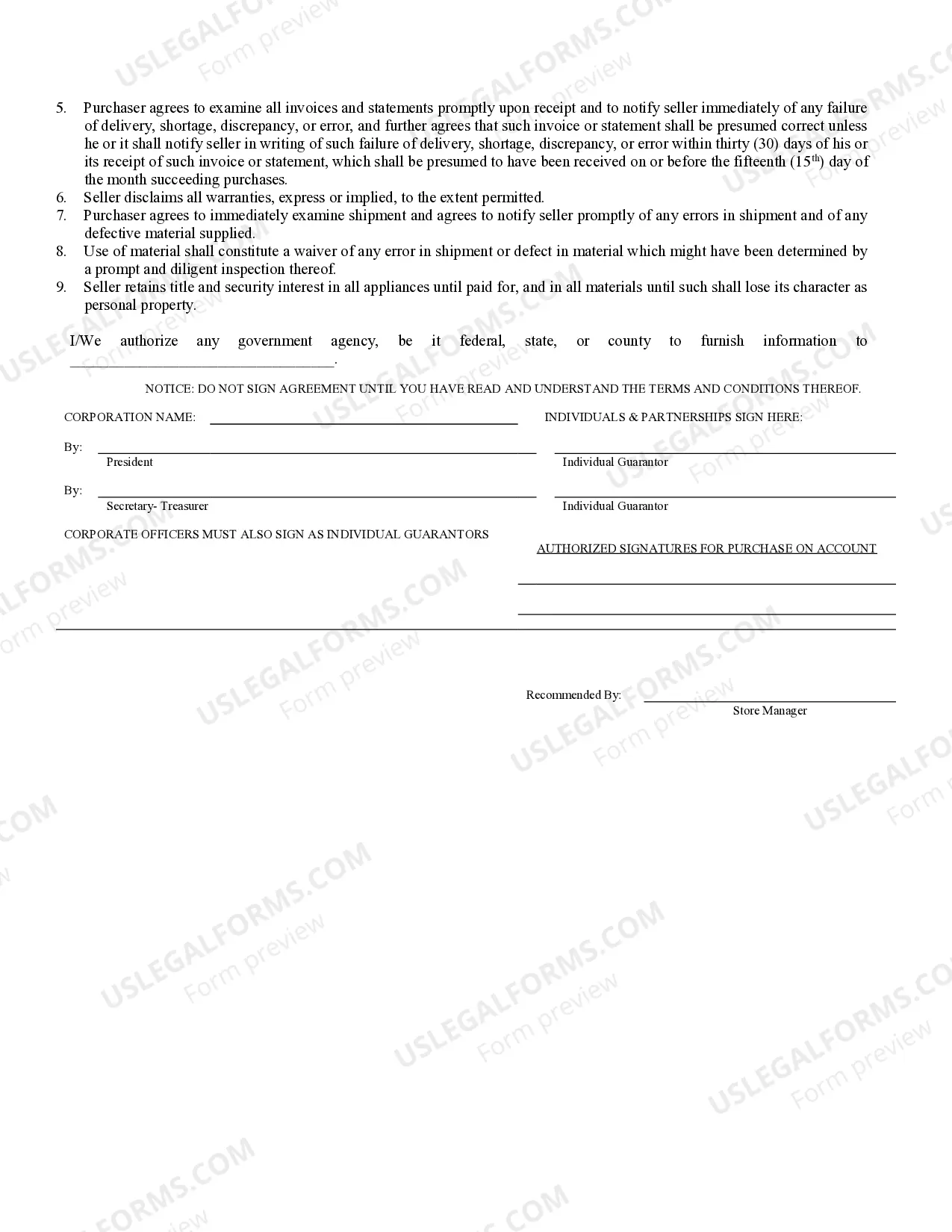

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Knoxville Tennessee Business Credit Application is a comprehensive form used by businesses located in Knoxville, Tennessee, to apply for credit from various financial institutions or vendors. This application serves as a means for businesses to access credit lines, loans, or establish trade credit for purchasing goods or services necessary for their operations. The Knoxville Tennessee Business Credit Application typically collects vital information about the applying business, including its legal name, physical address, contact details, industry category, years in operation, and its entity type (sole proprietorship, partnership, corporation, etc.). Additional information such as federal tax identification number (EIN), employer identification number (if applicable), and a brief overview of the business's products or services may also be required. Furthermore, the application typically asks for financial details, including annual revenue, net income, current cash reserves, outstanding debts, and other business assets. These details help the credit provider assess the business's financial stability and its ability to manage credit obligations. Depending on the lender or vendor, the application may require the submission of supporting documents such as bank statements, income statements, balance sheets, and tax returns. In Knoxville, Tennessee, various financial institutions and vendors may offer different types of Business Credit Applications tailored to specific needs. These include: 1. Knoxville Small Business Credit Application: Designed for small businesses with relatively lower revenue and financing requirements. 2. Knoxville Start-Up Business Credit Application: Geared towards newly established businesses that may have limited financial history or credit references. 3. Knoxville Commercial Real Estate Credit Application: For businesses seeking credit specifically for real estate acquisition, construction, or expansion. 4. Knoxville Vendor Credit Application: Used when applying for credit with specific vendors or suppliers to facilitate trade credit terms for product purchases. 5. Knoxville Business Line of Credit Application: Aimed at businesses that require ongoing access to credit, providing flexibility for borrowing and repayment. 6. Knoxville Equipment Financing Credit Application: Crafted for businesses looking to finance equipment purchases to support their operations. It is important to carefully review and complete the appropriate Knoxville Tennessee Business Credit Application based on the specific credit needs and requirements of the business.Knoxville Tennessee Business Credit Application is a comprehensive form used by businesses located in Knoxville, Tennessee, to apply for credit from various financial institutions or vendors. This application serves as a means for businesses to access credit lines, loans, or establish trade credit for purchasing goods or services necessary for their operations. The Knoxville Tennessee Business Credit Application typically collects vital information about the applying business, including its legal name, physical address, contact details, industry category, years in operation, and its entity type (sole proprietorship, partnership, corporation, etc.). Additional information such as federal tax identification number (EIN), employer identification number (if applicable), and a brief overview of the business's products or services may also be required. Furthermore, the application typically asks for financial details, including annual revenue, net income, current cash reserves, outstanding debts, and other business assets. These details help the credit provider assess the business's financial stability and its ability to manage credit obligations. Depending on the lender or vendor, the application may require the submission of supporting documents such as bank statements, income statements, balance sheets, and tax returns. In Knoxville, Tennessee, various financial institutions and vendors may offer different types of Business Credit Applications tailored to specific needs. These include: 1. Knoxville Small Business Credit Application: Designed for small businesses with relatively lower revenue and financing requirements. 2. Knoxville Start-Up Business Credit Application: Geared towards newly established businesses that may have limited financial history or credit references. 3. Knoxville Commercial Real Estate Credit Application: For businesses seeking credit specifically for real estate acquisition, construction, or expansion. 4. Knoxville Vendor Credit Application: Used when applying for credit with specific vendors or suppliers to facilitate trade credit terms for product purchases. 5. Knoxville Business Line of Credit Application: Aimed at businesses that require ongoing access to credit, providing flexibility for borrowing and repayment. 6. Knoxville Equipment Financing Credit Application: Crafted for businesses looking to finance equipment purchases to support their operations. It is important to carefully review and complete the appropriate Knoxville Tennessee Business Credit Application based on the specific credit needs and requirements of the business.