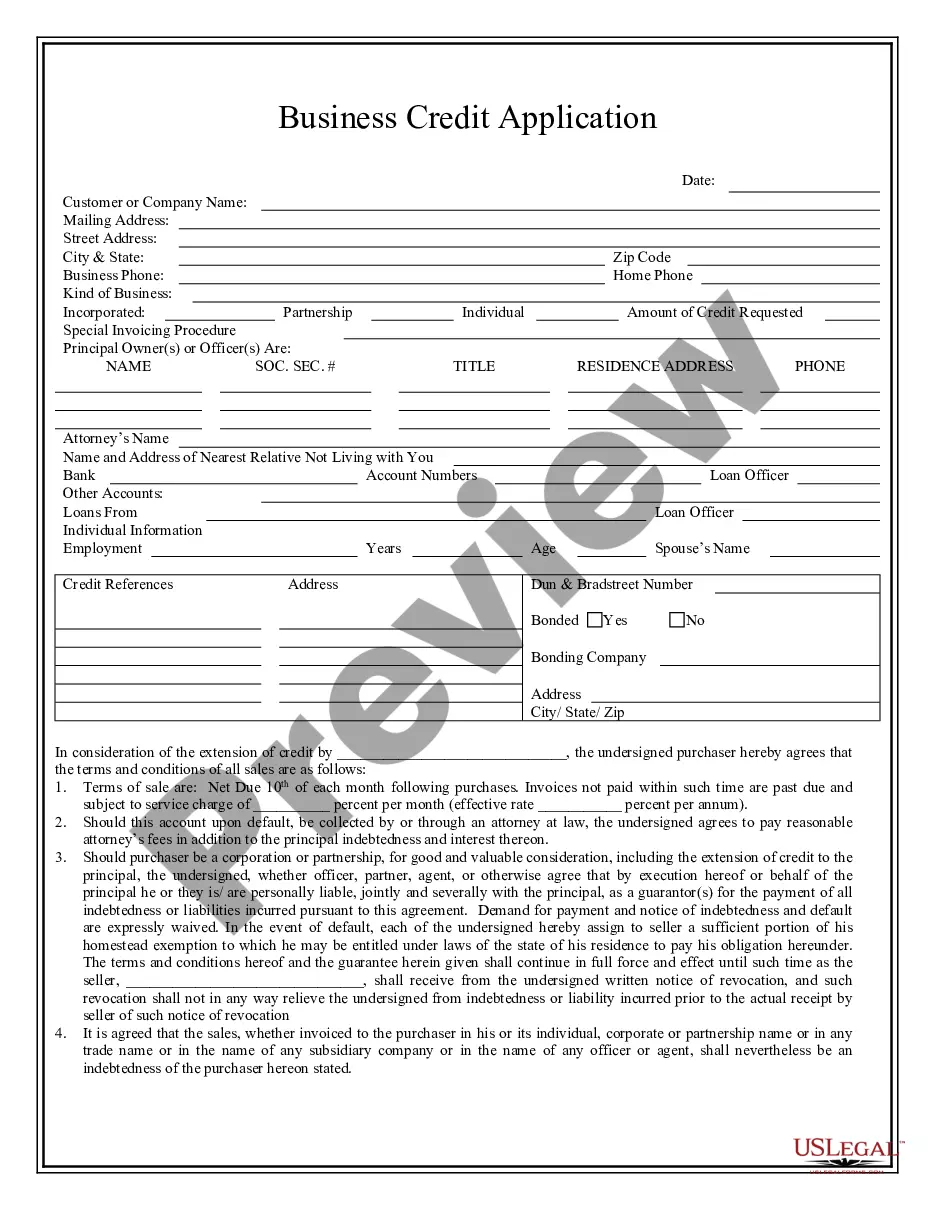

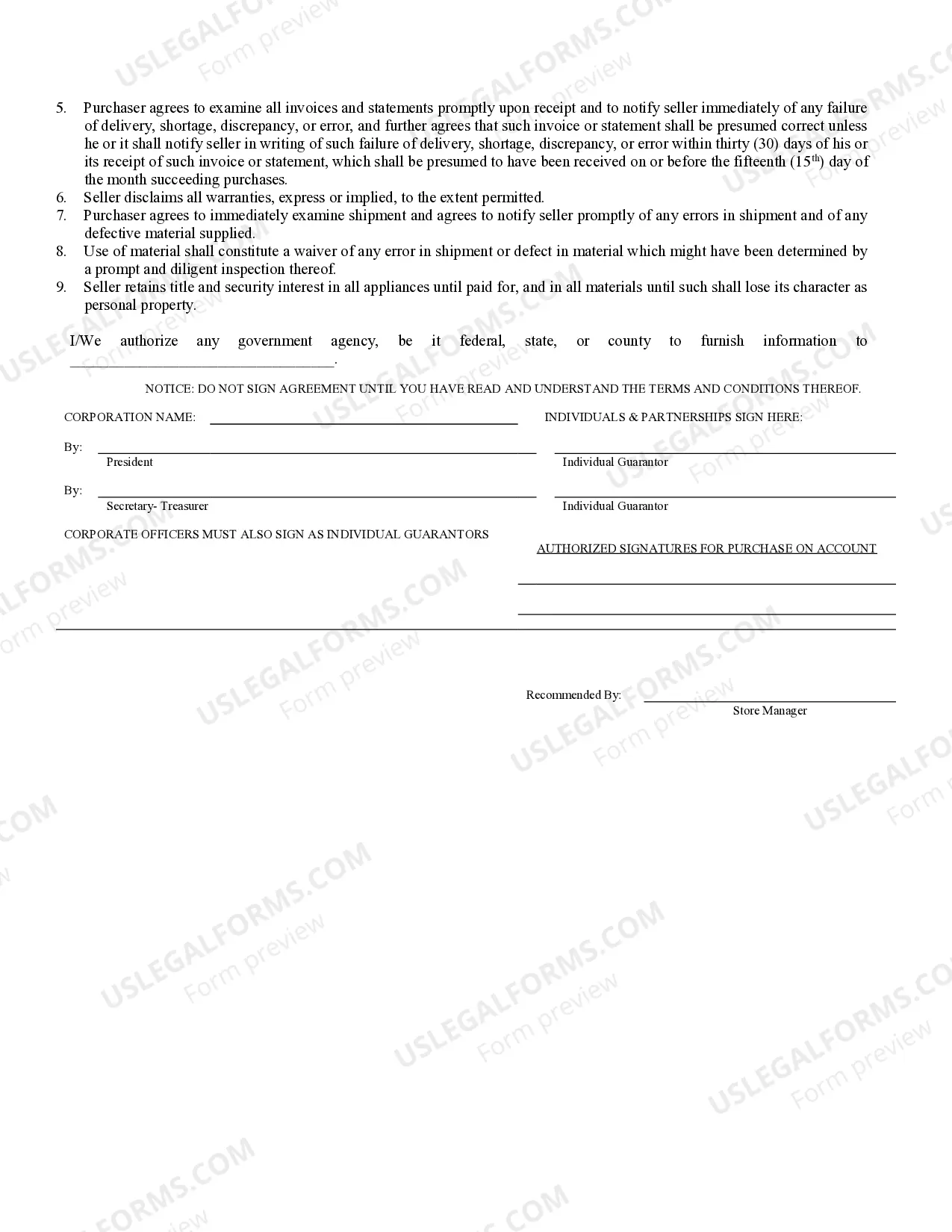

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

The Memphis Tennessee Business Credit Application is a formal document used by businesses located in Memphis, Tennessee to apply for credit services from financial institutions or commercial lenders. This application is designed to gather essential information about the applying business to assess its creditworthiness and determine its eligibility for various credit facilities. The Memphis Tennessee Business Credit Application typically includes several crucial sections. These sections may cover important details about the business, such as the legal name, business structure (e.g., sole proprietorship, partnership, corporation), industry type, and the number of years the company has been in operation. Moreover, the application may require the business owner to provide their personal details, including their name, contact information, social security number, and ownership percentage in the company. Financial information is another vital aspect of the Memphis Tennessee Business Credit Application. The application usually seeks details about the company's annual revenue, profit margins, assets, liabilities, existing loans, and other financial obligations. Additionally, some applications may require the business owner to disclose information related to their personal financial situation, such as personal income, credit history, and outstanding debts. Furthermore, the Memphis Tennessee Business Credit Application might ask for information regarding the desired credit or loan amount, along with its intended purpose. This section allows the applicant to specify the type of credit facility they are seeking, whether it's a business line of credit, term loan, equipment financing, or any other financing option. Clearly defining the purpose of the credit helps in assessing the business's potential to generate returns and manage the borrowed funds responsibly. It is important to note that there might be different types of Memphis Tennessee Business Credit Applications tailored to specific credit services or financial institutions. For instance, there could be separate applications for commercial bank loans, Small Business Administration (SBA) loans, or credit lines offered by local credit unions. These variations might arise due to the specific requirements of different lenders or the unique programs they offer to businesses in Memphis, Tennessee. To ensure a comprehensive application process, it is advisable to provide accurate and up-to-date information and to include any necessary supporting documents. Most applications also require the business owner's signature or consent, indicating their agreement to the terms and conditions associated with the credit facility or loan. Ultimately, the Memphis Tennessee Business Credit Application serves as a vital tool for businesses seeking credit services in the Memphis area, allowing lenders to better evaluate their creditworthiness and make informed decisions on granting credit.