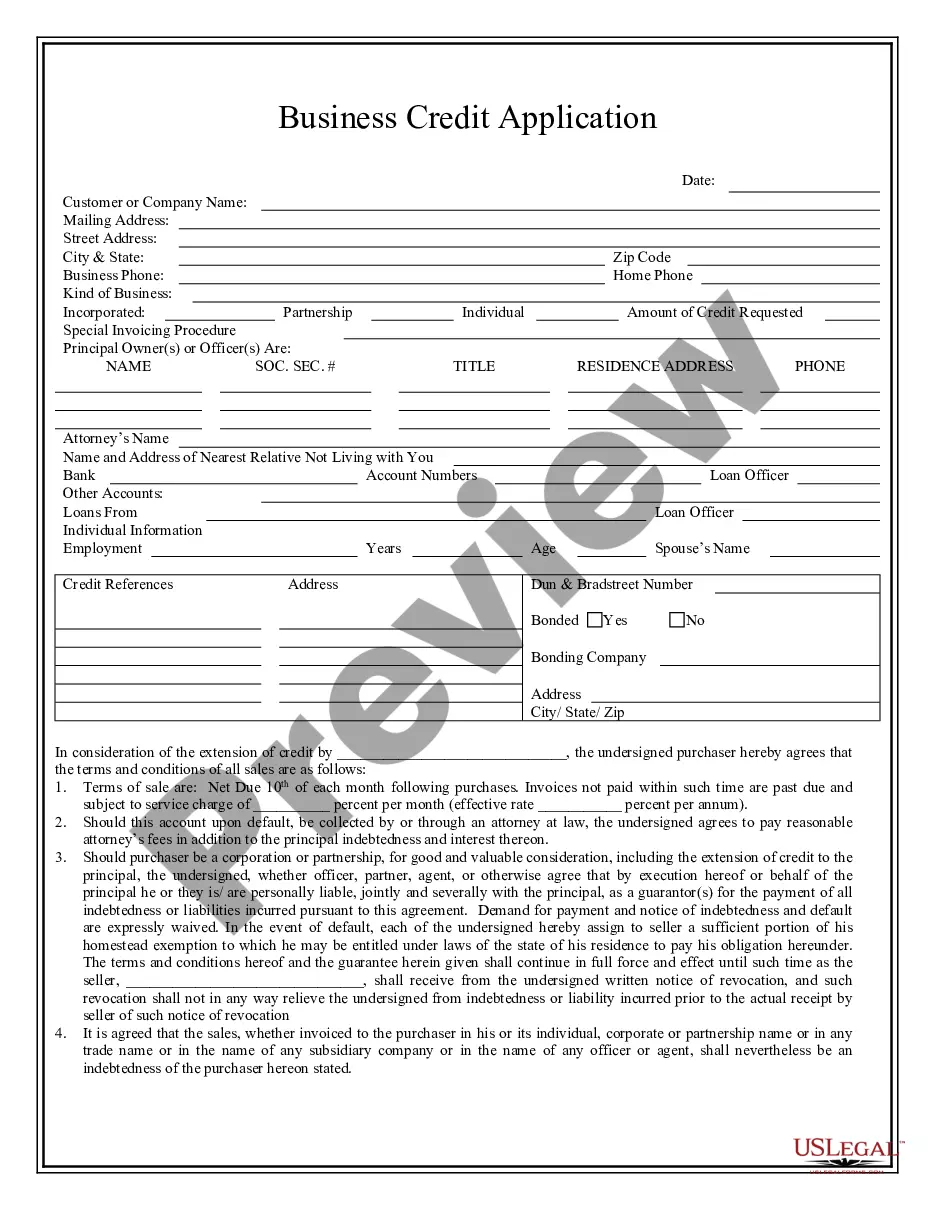

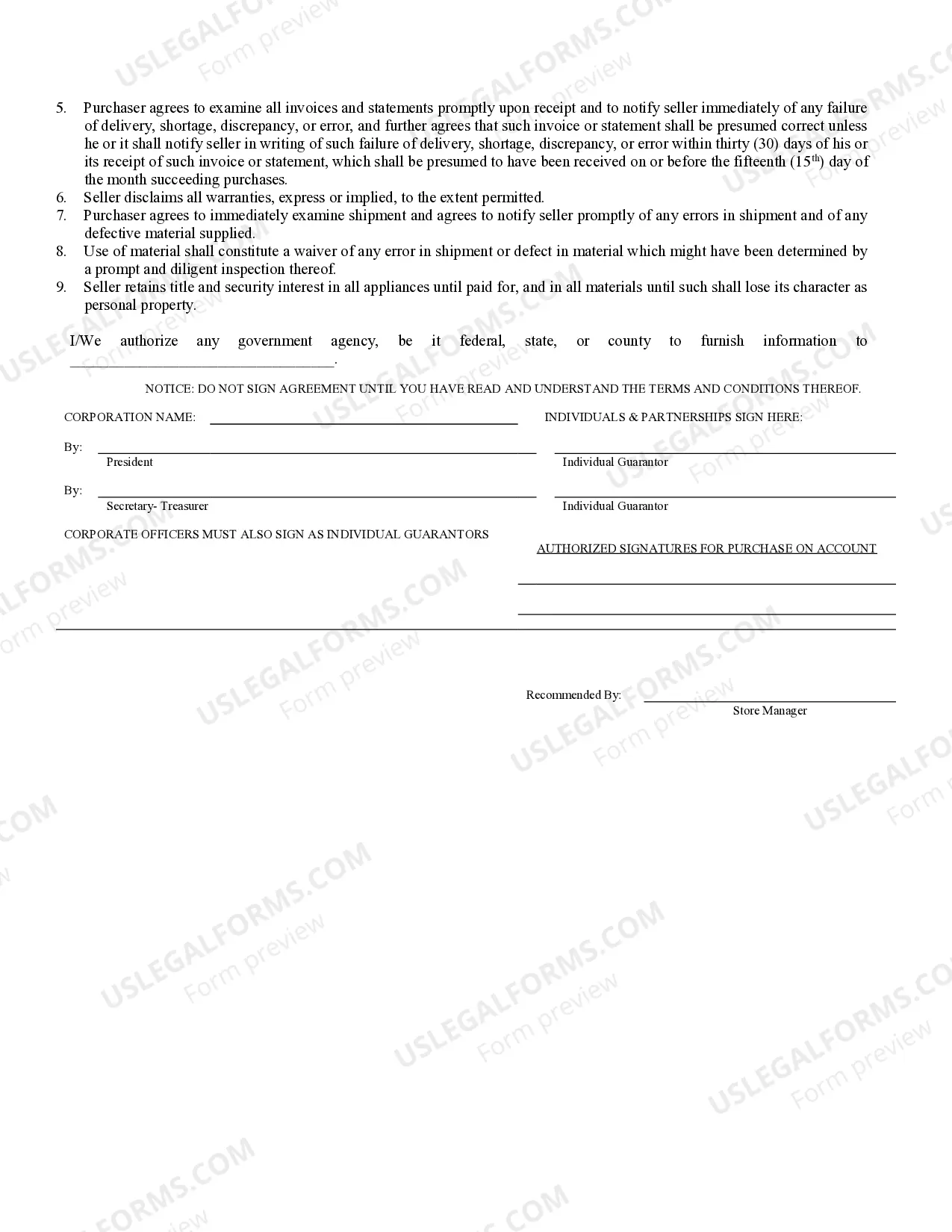

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

The Murfreesboro Tennessee Business Credit Application is a comprehensive form used by businesses in Murfreesboro, Tennessee to apply for credit services. It is designed to collect relevant and necessary information about a company and its financial standing to determine creditworthiness. The Murfreesboro Tennessee Business Credit Application is an essential tool for businesses seeking financial support or partnerships to expand their operations, purchase new equipment, or invest in growth opportunities. The application typically includes fields and sections covering important aspects such as company name, address, phone number, and email address. It also requests detailed information about the company's legal structure, ownership, and years in operation. Additionally, the application typically requires financial data, including revenue figures, profit and loss statements, balance sheets, and cash flow statements. These financial statements provide a comprehensive understanding of the company's financial health, stability, and ability to repay loans or credit obligations. Furthermore, the Murfreesboro Tennessee Business Credit Application may include sections related to the company's trade references, such as suppliers or other businesses it has a credit relationship with. These references help lenders or credit providers assess the applicant's payment history and overall creditworthiness. Additionally, the application might ask for information on the company's industry, competitors, and market conditions as they can play a crucial role in evaluating credit risk. As for the different types of Murfreesboro Tennessee Business Credit Applications, they could vary depending on the specific financial institution or lender providing the credit. Some variations may include: 1. Small Business Credit Application: Designed specifically for small businesses looking to access credit to fund their operations or growth initiatives. This application might focus on the unique financial needs and challenges faced by small businesses. 2. Commercial Credit Application: Tailored for larger companies that require substantial credit lines to support their day-to-day operations, capital expenditure, or mergers and acquisitions. This application is more comprehensive in terms of financial documentation and often comes with stricter approval criteria. 3. Vendor or Supplier Credit Application: This type of application is utilized when a company wishes to establish credit terms with certain vendors or suppliers. It helps create a credit relationship to facilitate ongoing purchases on credit rather than upfront payments. In conclusion, the Murfreesboro Tennessee Business Credit Application is a crucial document that allows businesses in Murfreesboro, Tennessee, to apply for credit services. It presents essential information about the company's financial health, trade references, industry background, and more, enabling lenders to assess creditworthiness and make informed decisions. Different variations of the application cater to the specific needs of small businesses, large commercial enterprises, or credit relationships with vendors or suppliers.The Murfreesboro Tennessee Business Credit Application is a comprehensive form used by businesses in Murfreesboro, Tennessee to apply for credit services. It is designed to collect relevant and necessary information about a company and its financial standing to determine creditworthiness. The Murfreesboro Tennessee Business Credit Application is an essential tool for businesses seeking financial support or partnerships to expand their operations, purchase new equipment, or invest in growth opportunities. The application typically includes fields and sections covering important aspects such as company name, address, phone number, and email address. It also requests detailed information about the company's legal structure, ownership, and years in operation. Additionally, the application typically requires financial data, including revenue figures, profit and loss statements, balance sheets, and cash flow statements. These financial statements provide a comprehensive understanding of the company's financial health, stability, and ability to repay loans or credit obligations. Furthermore, the Murfreesboro Tennessee Business Credit Application may include sections related to the company's trade references, such as suppliers or other businesses it has a credit relationship with. These references help lenders or credit providers assess the applicant's payment history and overall creditworthiness. Additionally, the application might ask for information on the company's industry, competitors, and market conditions as they can play a crucial role in evaluating credit risk. As for the different types of Murfreesboro Tennessee Business Credit Applications, they could vary depending on the specific financial institution or lender providing the credit. Some variations may include: 1. Small Business Credit Application: Designed specifically for small businesses looking to access credit to fund their operations or growth initiatives. This application might focus on the unique financial needs and challenges faced by small businesses. 2. Commercial Credit Application: Tailored for larger companies that require substantial credit lines to support their day-to-day operations, capital expenditure, or mergers and acquisitions. This application is more comprehensive in terms of financial documentation and often comes with stricter approval criteria. 3. Vendor or Supplier Credit Application: This type of application is utilized when a company wishes to establish credit terms with certain vendors or suppliers. It helps create a credit relationship to facilitate ongoing purchases on credit rather than upfront payments. In conclusion, the Murfreesboro Tennessee Business Credit Application is a crucial document that allows businesses in Murfreesboro, Tennessee, to apply for credit services. It presents essential information about the company's financial health, trade references, industry background, and more, enabling lenders to assess creditworthiness and make informed decisions. Different variations of the application cater to the specific needs of small businesses, large commercial enterprises, or credit relationships with vendors or suppliers.