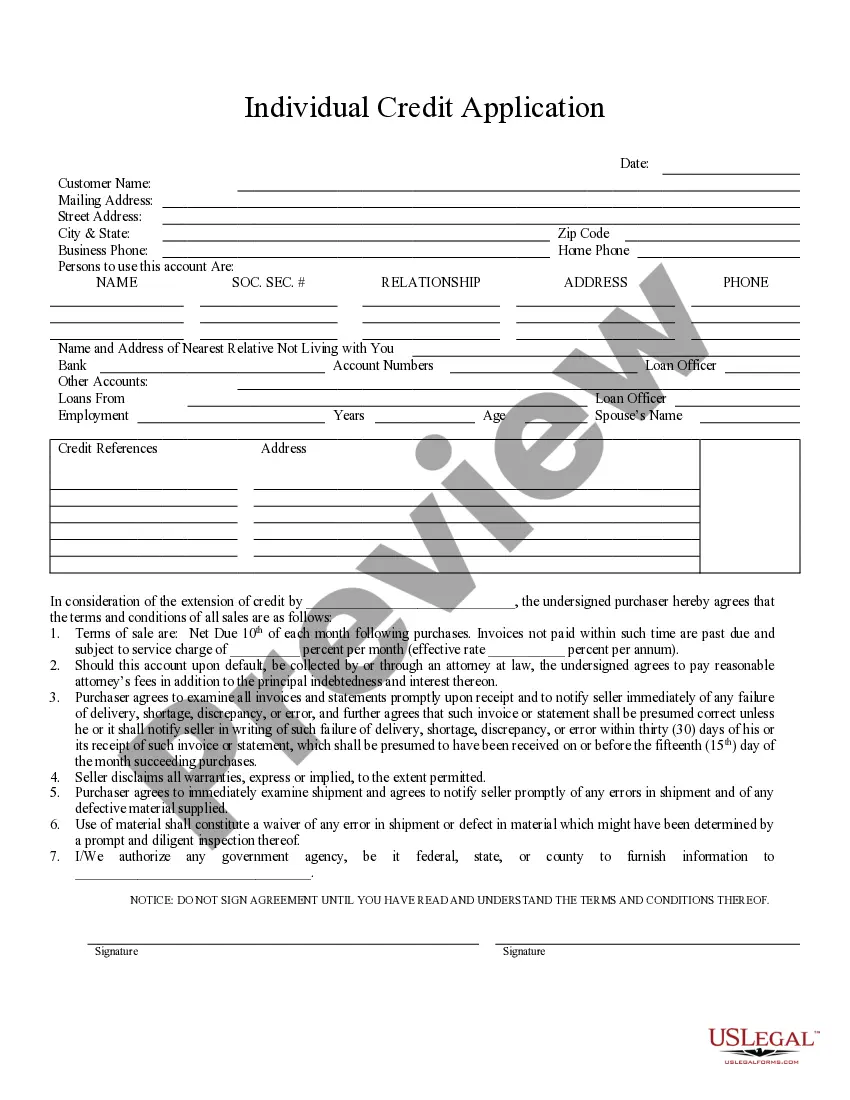

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Title: Chattanooga Tennessee Individual Credit Application: A Comprehensive Guide to Credit Applications in the Area Description: As you embark on your financial journey, understanding the Chattanooga Tennessee Individual Credit Application is crucial. This detailed description will walk you through the essentials of credit applications, key points to consider, and any variations specific to the Chattanooga area. Keywords: Chattanooga, Tennessee, individual credit application, credit application process, credit application requirements, credit score, creditworthiness, financial information, personal financial statement, credit history, lenders, different types of credit applications, mortgage application, auto loan application, personal loan application, credit card application. Introduction: The Chattanooga Tennessee Individual Credit Application is a standardized document used by individuals residing in Chattanooga, Tennessee, to apply for credit from various lenders. It serves as a means for lenders to evaluate a potential borrower's creditworthiness and determine whether they are eligible for credit. Understanding the Credit Application Process: When filling out a Chattanooga Tennessee Individual Credit Application, individuals must provide accurate and complete information to ensure a thorough evaluation. Along with personal details, such as name, address, and contact information, the application typically requires details about employment, income, and other financial obligations. Credit Application Requirements: To assess an applicant's creditworthiness, lenders may require specific documentation alongside the credit application. These documents commonly include recent pay stubs, bank statements, tax returns, and identification proof. Gathering such documentation beforehand can streamline the application process. Evaluating Creditworthiness: Lenders extensively review an applicant's credit application and additional financial information to assess their creditworthiness. Factors such as credit score, credit history, debt-to-income ratio, and employment stability play pivotal roles in determining an applicant's eligibility for credit. Different Types of Chattanooga Tennessee Individual Credit Applications: 1. Mortgage Application: Chattanooga residents looking to purchase or refinance a home will typically complete a mortgage credit application. This type of application includes additional sections for property details, loan amount, and terms. 2. Auto Loan Application: If financing a vehicle purchase, individuals often fill out an auto loan credit application. In addition to personal and financial information, this application may require details about the desired vehicle, such as make, model, and identification number. 3. Personal Loan Application: Individuals seeking personal loans for various purposes, like debt consolidation or unexpected expenses, will submit a personal loan credit application. 4. Credit Card Application: Chattanooga residents interested in obtaining a credit card can do so by completing a credit card application. This application alone focuses on an individual's credit history, income, and existing financial commitments. Conclusion: Understanding the Chattanooga Tennessee Individual Credit Application is vital for those seeking credit in Chattanooga. By completing the application accurately and providing requisite documentation, individuals can increase their chances of approval while obtaining credit to fulfill their financial goals. Whether applying for a mortgage, auto loan, personal loan, or credit card, knowledge of the unique details and requirements associated with each application type can simplify the process.Title: Chattanooga Tennessee Individual Credit Application: A Comprehensive Guide to Credit Applications in the Area Description: As you embark on your financial journey, understanding the Chattanooga Tennessee Individual Credit Application is crucial. This detailed description will walk you through the essentials of credit applications, key points to consider, and any variations specific to the Chattanooga area. Keywords: Chattanooga, Tennessee, individual credit application, credit application process, credit application requirements, credit score, creditworthiness, financial information, personal financial statement, credit history, lenders, different types of credit applications, mortgage application, auto loan application, personal loan application, credit card application. Introduction: The Chattanooga Tennessee Individual Credit Application is a standardized document used by individuals residing in Chattanooga, Tennessee, to apply for credit from various lenders. It serves as a means for lenders to evaluate a potential borrower's creditworthiness and determine whether they are eligible for credit. Understanding the Credit Application Process: When filling out a Chattanooga Tennessee Individual Credit Application, individuals must provide accurate and complete information to ensure a thorough evaluation. Along with personal details, such as name, address, and contact information, the application typically requires details about employment, income, and other financial obligations. Credit Application Requirements: To assess an applicant's creditworthiness, lenders may require specific documentation alongside the credit application. These documents commonly include recent pay stubs, bank statements, tax returns, and identification proof. Gathering such documentation beforehand can streamline the application process. Evaluating Creditworthiness: Lenders extensively review an applicant's credit application and additional financial information to assess their creditworthiness. Factors such as credit score, credit history, debt-to-income ratio, and employment stability play pivotal roles in determining an applicant's eligibility for credit. Different Types of Chattanooga Tennessee Individual Credit Applications: 1. Mortgage Application: Chattanooga residents looking to purchase or refinance a home will typically complete a mortgage credit application. This type of application includes additional sections for property details, loan amount, and terms. 2. Auto Loan Application: If financing a vehicle purchase, individuals often fill out an auto loan credit application. In addition to personal and financial information, this application may require details about the desired vehicle, such as make, model, and identification number. 3. Personal Loan Application: Individuals seeking personal loans for various purposes, like debt consolidation or unexpected expenses, will submit a personal loan credit application. 4. Credit Card Application: Chattanooga residents interested in obtaining a credit card can do so by completing a credit card application. This application alone focuses on an individual's credit history, income, and existing financial commitments. Conclusion: Understanding the Chattanooga Tennessee Individual Credit Application is vital for those seeking credit in Chattanooga. By completing the application accurately and providing requisite documentation, individuals can increase their chances of approval while obtaining credit to fulfill their financial goals. Whether applying for a mortgage, auto loan, personal loan, or credit card, knowledge of the unique details and requirements associated with each application type can simplify the process.