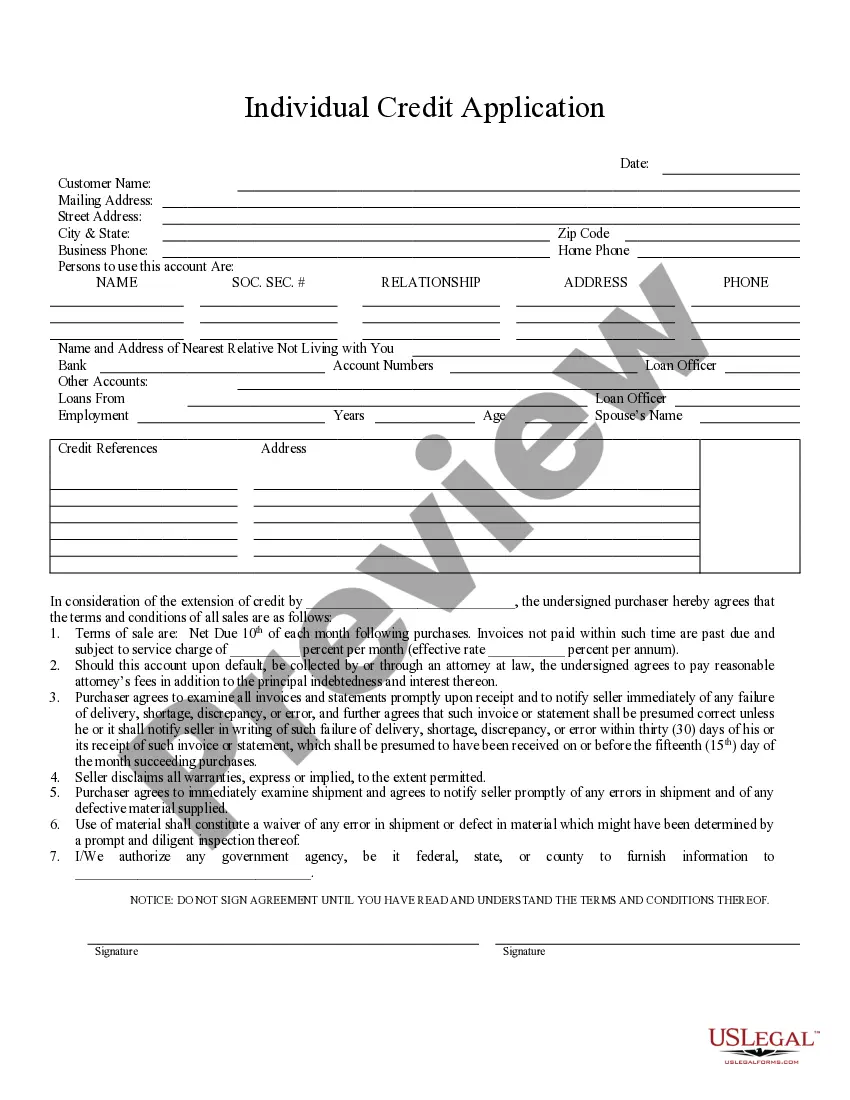

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Clarksville Tennessee Individual Credit Application

Description

How to fill out Tennessee Individual Credit Application?

Take advantage of the US Legal Forms and gain immediate access to any document you desire.

Our user-friendly website, featuring a vast array of documents, enables you to locate and acquire nearly any document sample you require.

You can save, complete, and sign the Clarksville Tennessee Individual Credit Application within a few minutes rather than spending hours online looking for the correct template.

Utilizing our catalog is an excellent approach to enhance the security of your form submissions.

If you haven't created an account yet, follow the steps outlined below.

Access the page with the form you require. Verify that it is the template you were aiming to find: check its title and description, and use the Preview feature if it is available.

- Our experienced attorneys regularly review all the documents to ensure that the templates are appropriate for a specific area and adhere to current laws and regulations.

- How can you access the Clarksville Tennessee Individual Credit Application.

- If you already have a membership, simply Log In to your account.

- The Download option will be available on all the templates you view.

- Additionally, you can find all your previously saved files in the My documents section.

Form popularity

FAQ

On a credit application, lenders usually request detailed personal information, financial history, and relevant documentation. This includes your identification, income sources, and any existing financial obligations. Completing the Clarksville Tennessee Individual Credit Application requires careful attention to detail, as accurate information helps expedite the approval process. With tools from uslegalforms, you can manage your application efficiently and confidently.

A credit application generally requests personal identification details, financial information, and your current employment status. You will need to provide data such as your income, debts, and sometimes information about your housing situation. During the Clarksville Tennessee Individual Credit Application, this data is essential for lenders to make informed decisions. Utilizing resources like uslegalforms can help streamline the collection of this information.

A credit card application typically requests personal information such as your name, address, and Social Security number, as well as your income and employment details. Some applications may also ask about existing debts and monthly expenses. By accurately completing the Clarksville Tennessee Individual Credit Application, you help ensure a smooth review process. Many users find platforms like uslegalforms helpful for preparing their applications.

The credit application process involves submitting your completed application form along with any requested documentation. Once you've submitted your Clarksville Tennessee Individual Credit Application, lenders will review your information and assess your creditworthiness. This review may take a few days, during which the lender may reach out for additional information. Once completed, you will receive a decision regarding your application.

To apply for credit, you typically need to provide your identity information, income details, and monthly expenses. This includes your full name, address, Social Security number, and employment status. During the Clarksville Tennessee Individual Credit Application, creditors will evaluate this information to determine your creditworthiness. Having all necessary documents ready will streamline your application experience.

A customer credit application form is a document used to gather essential information from individuals seeking credit. It captures details such as personal information, income, and financial history. Completing this form is the first step in the Clarksville Tennessee Individual Credit Application process, allowing creditors to assess your eligibility for credit. Using platforms like uslegalforms can simplify this process and ensure you have the right documents.

To write a credit application, start by gathering the necessary information such as your contact details, income, and credit history. Structure your application clearly and include all requested information. Ensure that you present a compelling case to the lender, as this will enhance your chances of approval for your Clarksville Tennessee Individual Credit Application.

The individual seeking credit fills out the credit application form. This person provides their personal and financial information to support their request. If you are applying for a joint account, both parties will need to complete their respective sections in the Clarksville Tennessee Individual Credit Application.

Filling out a credit card application involves providing essential details such as your name, address, and employment information. Verify that your financial history is accurately presented, as lenders will review this to judge your application. Staying organized will help you successfully complete your Clarksville Tennessee Individual Credit Application.

When applying for credit, you'll typically need to provide personal details, including your social security number, income, employment status, and housing costs. This information helps lenders assess your creditworthiness and determine your eligibility. Make sure your information is accurate to improve your chances when you submit your Clarksville Tennessee Individual Credit Application.