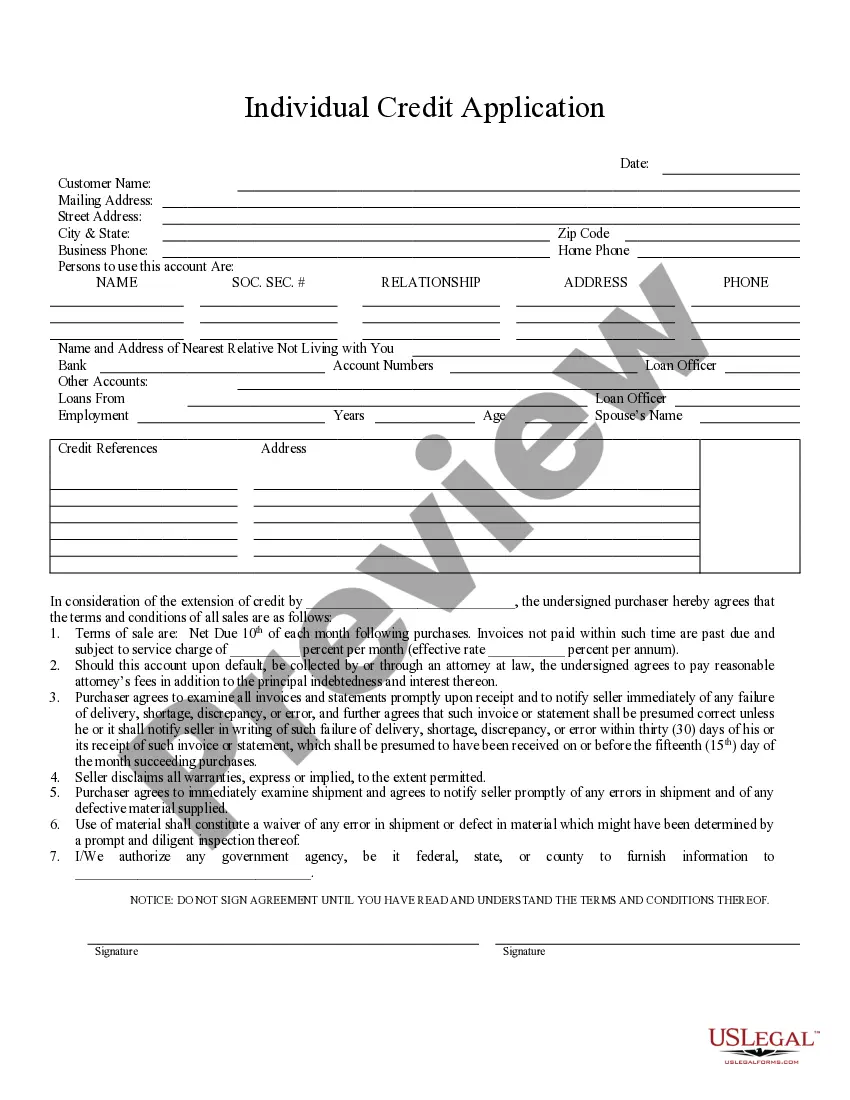

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

The Memphis Tennessee Individual Credit Application is a formal document designed to assess an individual's creditworthiness when applying for credit or loans in the city of Memphis, Tennessee. This application serves as a crucial tool for lenders, banks, and financial institutions to evaluate an applicant's financial health, credibility, and ability to repay borrowed funds. Keywords: Memphis Tennessee, Individual Credit Application, creditworthiness, credit, loans, lenders, banks, financial institutions, evaluate, financial health, credibility, ability to repay. This credit application captures essential information about the applicant, including personal details such as name, current address, social security number, contact information, and employment history. It also requires the disclosure of financial information, such as income, savings, investments, and other assets owned by the applicant. Additionally, the application may request information about existing debts, credit card balances, and past loan histories. Keywords: applicant, personal details, name, current address, social security number, contact information, employment history, financial information, income, savings, investments, assets, existing debts, credit card balances, loan histories. Furthermore, the Memphis Tennessee Individual Credit Application may include sections for references and co-applicants. References are often required to validate the applicant's character and reliability, usually from individuals who are not immediate family members. Co-applicants are individuals who share the responsibility of repaying the credit or loan and can provide additional financial support and stability. Keywords: references, co-applicants, character, reliability, immediate family members, financial support, stability. Different types of Memphis Tennessee Individual Credit Applications may exist, depending on the specific needs and requirements of different lenders or financial institutions. Some particular types may include auto loan applications, mortgage loan applications, personal loan applications, or credit card applications. These variations address the unique criteria and documentation needed for each type of credit or loan. Keywords: types, needs, requirements, lenders, financial institutions, auto loan applications, mortgage loan applications, personal loan applications, credit card applications, criteria, documentation. In summary, the Memphis Tennessee Individual Credit Application is a comprehensive tool that allows lenders to assess an applicant's creditworthiness and financial capacity for borrowing in the city of Memphis. By collecting detailed information about the applicant's personal and financial background, this application helps determine the level of risk involved in lending funds and aids financial institutions in making informed decisions. Keywords: comprehensive tool, creditworthiness, financial capacity, borrowing, risk, funds, informed decisions.The Memphis Tennessee Individual Credit Application is a formal document designed to assess an individual's creditworthiness when applying for credit or loans in the city of Memphis, Tennessee. This application serves as a crucial tool for lenders, banks, and financial institutions to evaluate an applicant's financial health, credibility, and ability to repay borrowed funds. Keywords: Memphis Tennessee, Individual Credit Application, creditworthiness, credit, loans, lenders, banks, financial institutions, evaluate, financial health, credibility, ability to repay. This credit application captures essential information about the applicant, including personal details such as name, current address, social security number, contact information, and employment history. It also requires the disclosure of financial information, such as income, savings, investments, and other assets owned by the applicant. Additionally, the application may request information about existing debts, credit card balances, and past loan histories. Keywords: applicant, personal details, name, current address, social security number, contact information, employment history, financial information, income, savings, investments, assets, existing debts, credit card balances, loan histories. Furthermore, the Memphis Tennessee Individual Credit Application may include sections for references and co-applicants. References are often required to validate the applicant's character and reliability, usually from individuals who are not immediate family members. Co-applicants are individuals who share the responsibility of repaying the credit or loan and can provide additional financial support and stability. Keywords: references, co-applicants, character, reliability, immediate family members, financial support, stability. Different types of Memphis Tennessee Individual Credit Applications may exist, depending on the specific needs and requirements of different lenders or financial institutions. Some particular types may include auto loan applications, mortgage loan applications, personal loan applications, or credit card applications. These variations address the unique criteria and documentation needed for each type of credit or loan. Keywords: types, needs, requirements, lenders, financial institutions, auto loan applications, mortgage loan applications, personal loan applications, credit card applications, criteria, documentation. In summary, the Memphis Tennessee Individual Credit Application is a comprehensive tool that allows lenders to assess an applicant's creditworthiness and financial capacity for borrowing in the city of Memphis. By collecting detailed information about the applicant's personal and financial background, this application helps determine the level of risk involved in lending funds and aids financial institutions in making informed decisions. Keywords: comprehensive tool, creditworthiness, financial capacity, borrowing, risk, funds, informed decisions.