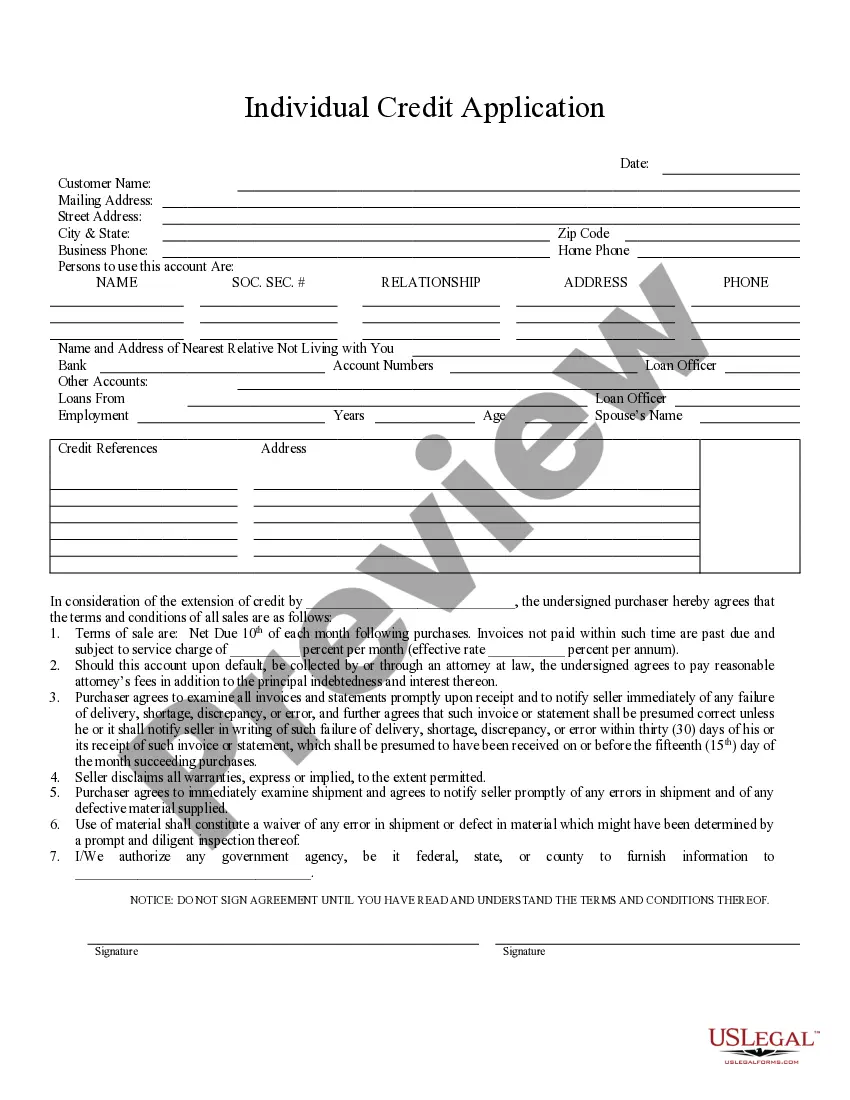

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

The Murfreesboro Tennessee Individual Credit Application is a comprehensive form that individuals residing in Murfreesboro, Tennessee can fill out to apply for credit with various financial institutions. This application serves as a vital tool for both lenders and borrowers, enabling lenders to assess the creditworthiness of individuals and borrowers to secure loans or lines of credit. This credit application typically requires personal information such as full name, social security number, date of birth, current address, and contact details. It may also ask for employment history, income details, and information about assets and liabilities. Lenders use this information to evaluate an individual's financial standing, their ability to repay borrowed funds, and their overall creditworthiness. By meticulously filling out the Murfreesboro Tennessee Individual Credit Application, prospective borrowers provide lenders with essential details that allow for a thorough assessment. This assessment involves analyzing various factors, including credit history, income stability, existing debts, and any outstanding obligations. Lenders also consider the applicant's credit score, which provides a numerical representation of their creditworthiness based on their past borrowing and repayment behavior. Murfreesboro Tennessee Individual Credit Application helps individuals to apply for different types of credit, tailored to their specific needs and circumstances. Some common types of credit applications include: 1. Auto Loan Application: This credit application caters specifically to individuals who wish to finance the purchase of a vehicle. It may require additional information such as the make and model of the desired vehicle, purchase price, and down payment details. 2. Personal Loan Application: These applications are for individuals seeking a general-purpose loan, such as funding for a vacation, home renovation, or medical expenses. Lenders may ask for a detailed explanation of the loan purpose to assess the borrower's financial responsibility. 3. Credit Card Application: This type of credit application focuses on obtaining a credit card, enabling individuals to make purchases on credit. It typically requires income information, current employment details, and existing credit card balances. 4. Mortgage Application: Mortgage applications are geared towards individuals seeking to finance the purchase of a home or property. These applications usually require extensive financial information, including income documentation, tax returns, and details about the property being purchased. In conclusion, the Murfreesboro Tennessee Individual Credit Application serves as a crucial document for residents of Murfreesboro seeking credit opportunities. By providing comprehensive and accurate information, individuals can increase their chances of securing credit and achieving their financial goals. It is important to note that the specific information requested and the application process may vary depending on the financial institution and the type of credit being applied for.The Murfreesboro Tennessee Individual Credit Application is a comprehensive form that individuals residing in Murfreesboro, Tennessee can fill out to apply for credit with various financial institutions. This application serves as a vital tool for both lenders and borrowers, enabling lenders to assess the creditworthiness of individuals and borrowers to secure loans or lines of credit. This credit application typically requires personal information such as full name, social security number, date of birth, current address, and contact details. It may also ask for employment history, income details, and information about assets and liabilities. Lenders use this information to evaluate an individual's financial standing, their ability to repay borrowed funds, and their overall creditworthiness. By meticulously filling out the Murfreesboro Tennessee Individual Credit Application, prospective borrowers provide lenders with essential details that allow for a thorough assessment. This assessment involves analyzing various factors, including credit history, income stability, existing debts, and any outstanding obligations. Lenders also consider the applicant's credit score, which provides a numerical representation of their creditworthiness based on their past borrowing and repayment behavior. Murfreesboro Tennessee Individual Credit Application helps individuals to apply for different types of credit, tailored to their specific needs and circumstances. Some common types of credit applications include: 1. Auto Loan Application: This credit application caters specifically to individuals who wish to finance the purchase of a vehicle. It may require additional information such as the make and model of the desired vehicle, purchase price, and down payment details. 2. Personal Loan Application: These applications are for individuals seeking a general-purpose loan, such as funding for a vacation, home renovation, or medical expenses. Lenders may ask for a detailed explanation of the loan purpose to assess the borrower's financial responsibility. 3. Credit Card Application: This type of credit application focuses on obtaining a credit card, enabling individuals to make purchases on credit. It typically requires income information, current employment details, and existing credit card balances. 4. Mortgage Application: Mortgage applications are geared towards individuals seeking to finance the purchase of a home or property. These applications usually require extensive financial information, including income documentation, tax returns, and details about the property being purchased. In conclusion, the Murfreesboro Tennessee Individual Credit Application serves as a crucial document for residents of Murfreesboro seeking credit opportunities. By providing comprehensive and accurate information, individuals can increase their chances of securing credit and achieving their financial goals. It is important to note that the specific information requested and the application process may vary depending on the financial institution and the type of credit being applied for.