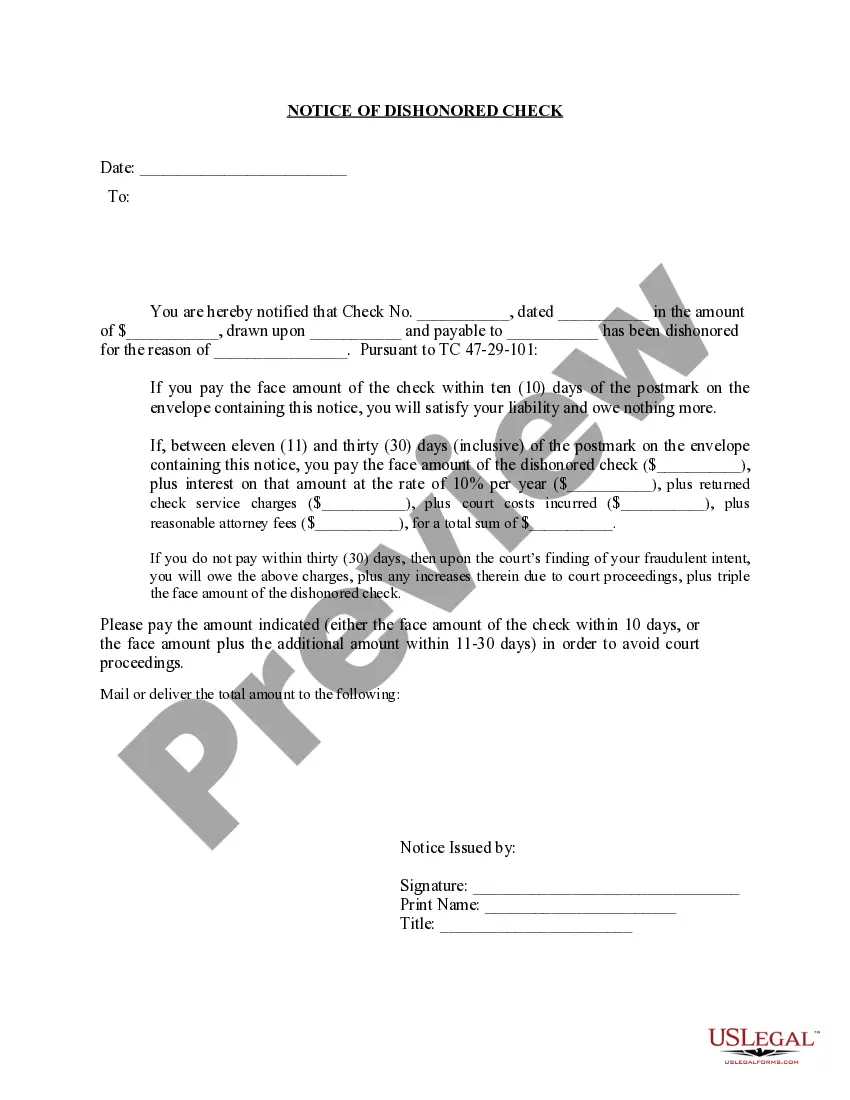

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Chattanooga Tennessee Notice of Dishonored Check — Civil In Chattanooga, Tennessee, a Notice of Dishonored Check — Civil is sent to individuals or businesses who have written a bad check or a bounced check. This legal document serves as a formal notification and outlines the consequences of issuing such a check and the necessary actions to resolve the matter. A bad check, also known as a bounced check, is a check that is returned by the bank due to insufficient funds in the account or other reasons, causing it to be dishonored. When this happens, the recipient of the check may experience financial losses or inconvenience, and they have the right to take legal action to recover the funds. The Notice of Dishonored Check — Civil contains several important details. It typically includes the date of the dishonored check, the name and address of the person or business who issued the check, as well as the name and contact information of the recipient. Additionally, the notice specifies the amount of the bounced check, any associated fees or penalties, and the deadline by which the check must be made good. There are various types of bad checks that can result in a Notice of Dishonored Check — Civil. These can include: 1. Insufficient Funds Check: This occurs when the person writing the check does not have enough money in their account to cover the check amount. 2. Closed Account Check: If the issuer of the check has closed their bank account before the recipient attempts to deposit or cash the check, it will be returned as dishonored. 3. Forgery or Fraudulent Check: In cases where someone intentionally writes a check knowing that they do not have sufficient funds or if the check is forged or stolen, it will be considered a bad check. Receiving a Notice of Dishonored Check — Civil can have serious consequences. Failure to resolve the matter promptly can lead to legal action, additional fees, and damage to one's credit rating. It is crucial for individuals who receive such a notice to contact the sender immediately to discuss repayment options or other arrangements to rectify the situation. In conclusion, a Chattanooga Tennessee Notice of Dishonored Check — Civil is a legal document sent to inform individuals or businesses about a bad check or a bounced check. This formal notice provides details regarding the dishonored check and outlines the necessary steps to resolve the issue. It is important for recipients to take swift action to avoid further complications and potential legal consequences.Chattanooga Tennessee Notice of Dishonored Check — Civil In Chattanooga, Tennessee, a Notice of Dishonored Check — Civil is sent to individuals or businesses who have written a bad check or a bounced check. This legal document serves as a formal notification and outlines the consequences of issuing such a check and the necessary actions to resolve the matter. A bad check, also known as a bounced check, is a check that is returned by the bank due to insufficient funds in the account or other reasons, causing it to be dishonored. When this happens, the recipient of the check may experience financial losses or inconvenience, and they have the right to take legal action to recover the funds. The Notice of Dishonored Check — Civil contains several important details. It typically includes the date of the dishonored check, the name and address of the person or business who issued the check, as well as the name and contact information of the recipient. Additionally, the notice specifies the amount of the bounced check, any associated fees or penalties, and the deadline by which the check must be made good. There are various types of bad checks that can result in a Notice of Dishonored Check — Civil. These can include: 1. Insufficient Funds Check: This occurs when the person writing the check does not have enough money in their account to cover the check amount. 2. Closed Account Check: If the issuer of the check has closed their bank account before the recipient attempts to deposit or cash the check, it will be returned as dishonored. 3. Forgery or Fraudulent Check: In cases where someone intentionally writes a check knowing that they do not have sufficient funds or if the check is forged or stolen, it will be considered a bad check. Receiving a Notice of Dishonored Check — Civil can have serious consequences. Failure to resolve the matter promptly can lead to legal action, additional fees, and damage to one's credit rating. It is crucial for individuals who receive such a notice to contact the sender immediately to discuss repayment options or other arrangements to rectify the situation. In conclusion, a Chattanooga Tennessee Notice of Dishonored Check — Civil is a legal document sent to inform individuals or businesses about a bad check or a bounced check. This formal notice provides details regarding the dishonored check and outlines the necessary steps to resolve the issue. It is important for recipients to take swift action to avoid further complications and potential legal consequences.