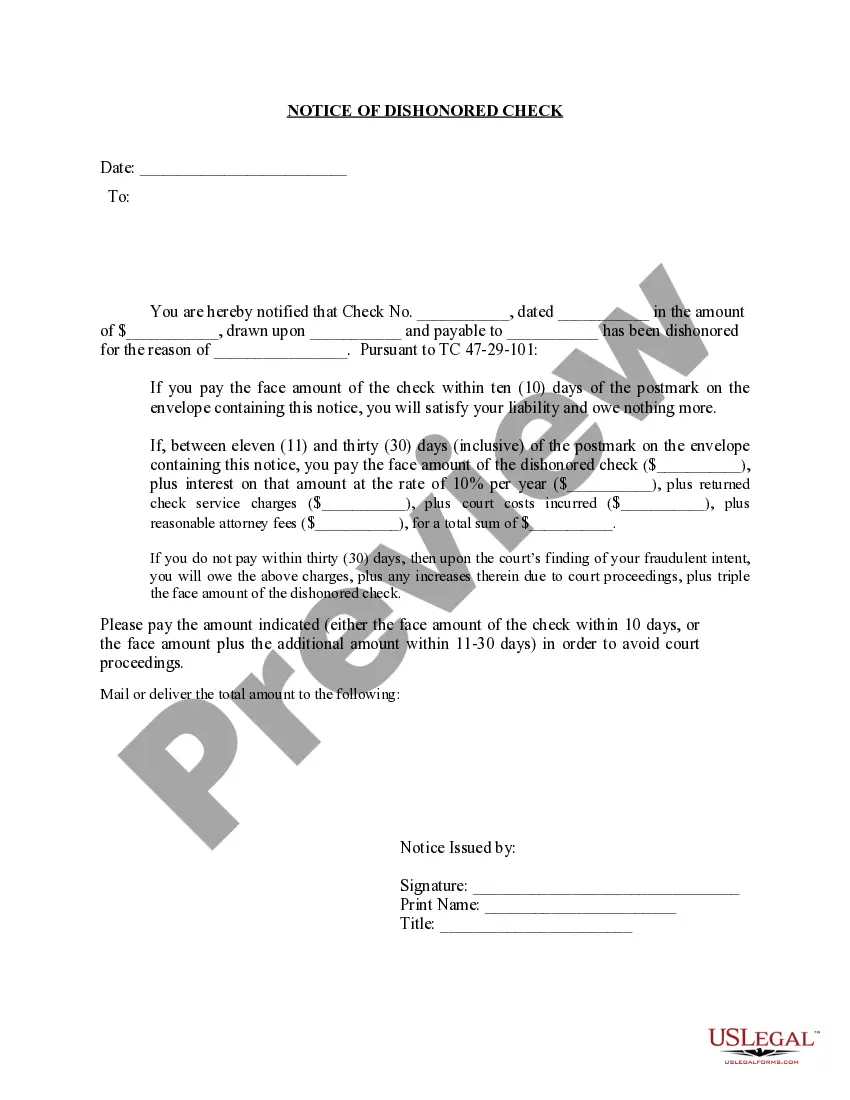

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Understanding the Knoxville Tennessee Notice of Dishonored Check — Civil Introduction: In Knoxville, Tennessee, individuals or businesses who receive a bad check or a bounced check have recourse to initiate legal proceedings through the Knoxville Tennessee Notice of Dishonored Check — Civil. This notice serves as a formal warning to the check writer, notifying them of their non-payment and the potential legal consequences. In this article, we will delve into the details and various types of bad check scenarios covered by this notice. Types of Bad Checks: 1. Insufficient Funds Check: An insufficient funds check or NSF check occurs when the check writer does not have enough money in their bank account to cover the check amount. The recipient of such a check can initiate legal action by filing a Knoxville Tennessee Notice of Dishonored Check — Civil. 2. Closed Account Check: A closed account check is issued from a bank account that has been closed by the writer. This type of bad check is often unintentional, but the check recipient can still file a Knoxville Tennessee Notice of Dishonored Check — Civil to seek restitution. 3. Alteration or Forgery Check: If a check has been altered or forged, it is considered a bad check. This may involve unauthorized changes to the check's date, payee, or amount. Recipients of such checks can file the Knoxville Tennessee Notice of Dishonored Check — Civil to address these fraudulent activities. 4. Post-Dated Check: A post-dated check is one that displays a future date, meaning it cannot be immediately cashed. However, if the check is deposited before the specified date and is returned unpaid, the recipient can file a Knoxville Tennessee Notice of Dishonored Check — Civil. Consequences and Process: Seeking legal action through the Knoxville Tennessee Notice of Dishonored Check — Civil can lead to various consequences for the check writer. Some of them include: 1. Financial Obligation: Once the notice is filed, the check writer becomes liable to repay the check amount, any bounced check fees, and potential damages, as deemed fit by the court. 2. Legal Penalties: Depending on the severity of the offense and local regulations, the check writer may face legal penalties for passing a bad check, including fines, probation, or even imprisonment. 3. Credit and Reputation: Passing bad checks can negatively impact the check writer's credit rating. Additionally, their reputation within the local business community may be tarnished, making it difficult to establish trust in future financial transactions. To file a Knoxville Tennessee Notice of Dishonored Check — Civil, follow these general steps: 1. Contact the Local Court: Reach out to the local court in Knox County, Tennessee, to gather necessary documents and guidance regarding filing procedures. 2. Document Collection: Collect all relevant evidence, including the original bounced check, any correspondence or notifications sent to the check writer, and any records of damages or incurred expenses. 3. Filing the Notice: Complete the Knoxville Tennessee Notice of Dishonored Check — Civil form, providing accurate details about the check writer, the bounced check, and any supporting evidence. 4. Serving the Notice: Have the notice served to the check writer through a legal process server or sheriff's office, ensuring proper documentation of the delivery. Conclusion: The Knoxville Tennessee Notice of Dishonored Check — Civil provides a legal avenue for individuals and businesses to seek restitution for bad checks, protecting their financial interests. Whether you have received an NSF check, a closed account check, an altered/forged check, or a post-dated check, understanding the filing process and consequences is crucial for resolving such matters effectively.Title: Understanding the Knoxville Tennessee Notice of Dishonored Check — Civil Introduction: In Knoxville, Tennessee, individuals or businesses who receive a bad check or a bounced check have recourse to initiate legal proceedings through the Knoxville Tennessee Notice of Dishonored Check — Civil. This notice serves as a formal warning to the check writer, notifying them of their non-payment and the potential legal consequences. In this article, we will delve into the details and various types of bad check scenarios covered by this notice. Types of Bad Checks: 1. Insufficient Funds Check: An insufficient funds check or NSF check occurs when the check writer does not have enough money in their bank account to cover the check amount. The recipient of such a check can initiate legal action by filing a Knoxville Tennessee Notice of Dishonored Check — Civil. 2. Closed Account Check: A closed account check is issued from a bank account that has been closed by the writer. This type of bad check is often unintentional, but the check recipient can still file a Knoxville Tennessee Notice of Dishonored Check — Civil to seek restitution. 3. Alteration or Forgery Check: If a check has been altered or forged, it is considered a bad check. This may involve unauthorized changes to the check's date, payee, or amount. Recipients of such checks can file the Knoxville Tennessee Notice of Dishonored Check — Civil to address these fraudulent activities. 4. Post-Dated Check: A post-dated check is one that displays a future date, meaning it cannot be immediately cashed. However, if the check is deposited before the specified date and is returned unpaid, the recipient can file a Knoxville Tennessee Notice of Dishonored Check — Civil. Consequences and Process: Seeking legal action through the Knoxville Tennessee Notice of Dishonored Check — Civil can lead to various consequences for the check writer. Some of them include: 1. Financial Obligation: Once the notice is filed, the check writer becomes liable to repay the check amount, any bounced check fees, and potential damages, as deemed fit by the court. 2. Legal Penalties: Depending on the severity of the offense and local regulations, the check writer may face legal penalties for passing a bad check, including fines, probation, or even imprisonment. 3. Credit and Reputation: Passing bad checks can negatively impact the check writer's credit rating. Additionally, their reputation within the local business community may be tarnished, making it difficult to establish trust in future financial transactions. To file a Knoxville Tennessee Notice of Dishonored Check — Civil, follow these general steps: 1. Contact the Local Court: Reach out to the local court in Knox County, Tennessee, to gather necessary documents and guidance regarding filing procedures. 2. Document Collection: Collect all relevant evidence, including the original bounced check, any correspondence or notifications sent to the check writer, and any records of damages or incurred expenses. 3. Filing the Notice: Complete the Knoxville Tennessee Notice of Dishonored Check — Civil form, providing accurate details about the check writer, the bounced check, and any supporting evidence. 4. Serving the Notice: Have the notice served to the check writer through a legal process server or sheriff's office, ensuring proper documentation of the delivery. Conclusion: The Knoxville Tennessee Notice of Dishonored Check — Civil provides a legal avenue for individuals and businesses to seek restitution for bad checks, protecting their financial interests. Whether you have received an NSF check, a closed account check, an altered/forged check, or a post-dated check, understanding the filing process and consequences is crucial for resolving such matters effectively.