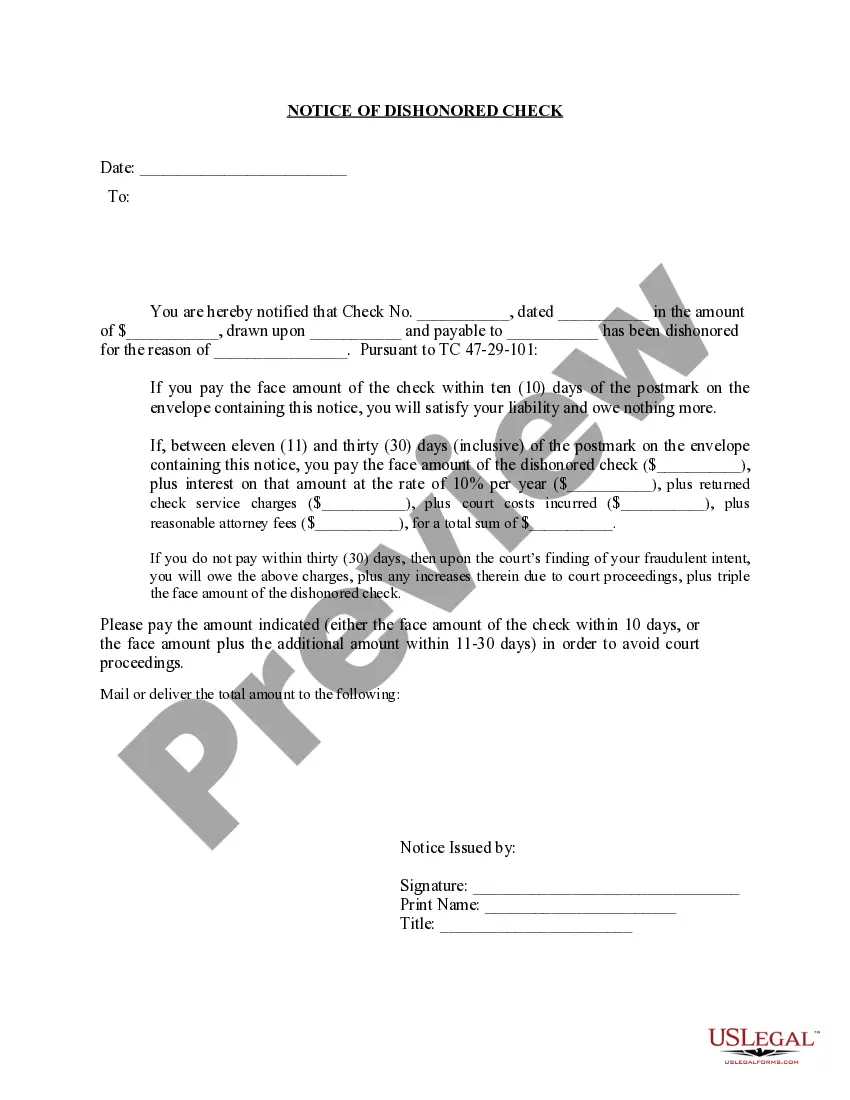

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Murfreesboro Tennessee Notice of Dishonored Check: Understanding Bad Checks and Bounced Checks Introduction: In Murfreesboro, Tennessee, receiving a Notice of Dishonored Check — Civil can be a challenging situation to navigate. This document serves as an official notification that a check you have submitted has been returned unpaid by the bank. This article aims to provide a comprehensive overview of bad checks, bounced checks, and their significance in Murfreesboro, Tennessee. Let's explore the ins and outs of this legal matter and shed light on potential types of bad checks. 1. Defining Bad Checks and Bounced Checks: A bad check, also known as an insufficient fund check or a dishonored check, refers to a form of payment that cannot be honored due to insufficient funds in the drawer's account. A bounced check, on the other hand, indicates that the bank has returned the check unpaid for various reasons such as non-sufficient funds (NSF), closed accounts, or discrepancies in the signature or amount. 2. Understanding the Murfreesboro Tennessee Notice of Dishonored Check: The Murfreesboro Tennessee Notice of Dishonored Check — Civil is an official written notice sent to the individual or entity who has submitted the affected check. It serves as a legal document, reminding the recipient of their responsibility to rectify the situation and settle the outstanding payment promptly. Failure to address the situation can result in legal consequences. 3. Consequences of Writing a Bad or Bounced Check: The consequences of writing a bad or bounced check in Murfreesboro, Tennessee, can vary depending on the circumstances and the intent. However, potential repercussions may include financial penalties, payment of treble damages (three times the check amount), civil lawsuits, damage to credit ratings, and even the possibility of criminal charges. 4. Different Types of Bad Checks: a. Insufficient Funds Checks: The most common type of bad check, where the account lacks sufficient funds to cover the check amount when presented for payment. b. Post-Dated Checks: When a recipient attempts to cash a check before the date specified on the document, resulting in a bounced check. c. Closed Account Checks: Occurs when the account associated with the check has been closed before the recipient attempts to cash it, rendering the check void. Conclusion: A Murfreesboro Tennessee Notice of Dishonored Check — Civil indicates the occurrence of a bad check or bounced check, highlighting the legal consequences and potential repayment obligations for the individual or entity involved. Understanding the implications of dishonored checks is crucial to avoid financial and legal troubles. It is recommended to seek legal advice to address the situation properly and prevent further complications.Title: Murfreesboro Tennessee Notice of Dishonored Check: Understanding Bad Checks and Bounced Checks Introduction: In Murfreesboro, Tennessee, receiving a Notice of Dishonored Check — Civil can be a challenging situation to navigate. This document serves as an official notification that a check you have submitted has been returned unpaid by the bank. This article aims to provide a comprehensive overview of bad checks, bounced checks, and their significance in Murfreesboro, Tennessee. Let's explore the ins and outs of this legal matter and shed light on potential types of bad checks. 1. Defining Bad Checks and Bounced Checks: A bad check, also known as an insufficient fund check or a dishonored check, refers to a form of payment that cannot be honored due to insufficient funds in the drawer's account. A bounced check, on the other hand, indicates that the bank has returned the check unpaid for various reasons such as non-sufficient funds (NSF), closed accounts, or discrepancies in the signature or amount. 2. Understanding the Murfreesboro Tennessee Notice of Dishonored Check: The Murfreesboro Tennessee Notice of Dishonored Check — Civil is an official written notice sent to the individual or entity who has submitted the affected check. It serves as a legal document, reminding the recipient of their responsibility to rectify the situation and settle the outstanding payment promptly. Failure to address the situation can result in legal consequences. 3. Consequences of Writing a Bad or Bounced Check: The consequences of writing a bad or bounced check in Murfreesboro, Tennessee, can vary depending on the circumstances and the intent. However, potential repercussions may include financial penalties, payment of treble damages (three times the check amount), civil lawsuits, damage to credit ratings, and even the possibility of criminal charges. 4. Different Types of Bad Checks: a. Insufficient Funds Checks: The most common type of bad check, where the account lacks sufficient funds to cover the check amount when presented for payment. b. Post-Dated Checks: When a recipient attempts to cash a check before the date specified on the document, resulting in a bounced check. c. Closed Account Checks: Occurs when the account associated with the check has been closed before the recipient attempts to cash it, rendering the check void. Conclusion: A Murfreesboro Tennessee Notice of Dishonored Check — Civil indicates the occurrence of a bad check or bounced check, highlighting the legal consequences and potential repayment obligations for the individual or entity involved. Understanding the implications of dishonored checks is crucial to avoid financial and legal troubles. It is recommended to seek legal advice to address the situation properly and prevent further complications.