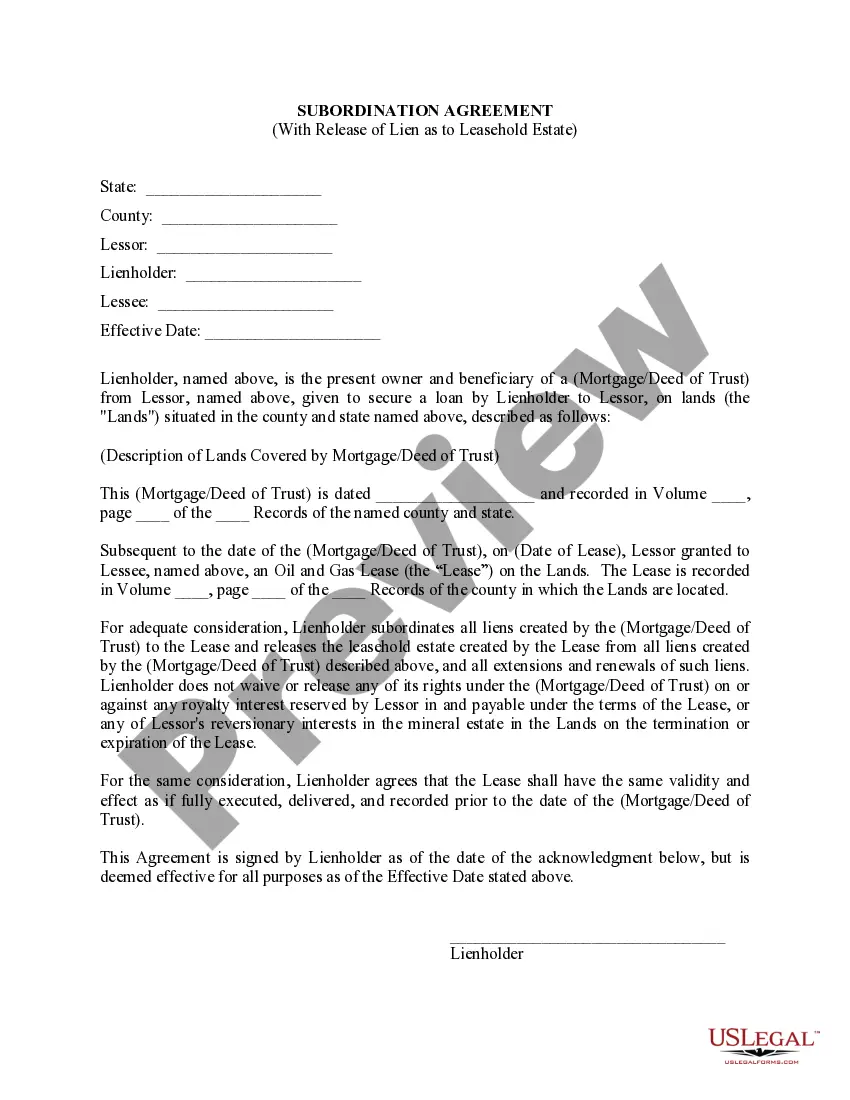

This Lease Subordination Agreement is a lienholder's lien that was created by a (Mortgage/Deed of Trust) and is subordinated to a mineral/oil/gas lease and lienholder releases, said Leasehold from all liens created by said (Mortgage/Deed of Trust), and all extensions and renewals of such liens. Lienholder retains all rights under the (Mortgage/Deed of Trust) against any royalty interest reserved by the lessor in and payable under the terms of the lease, or any of lessor's reversionary interests on the termination or expiration of the lease.

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.

A Nashville Tennessee Lease Subordination Agreement refers to a legally binding document that outlines the terms and conditions between a tenant, landlord, and a third party, typically a lender, regarding the subordination of the lease. In simpler terms, it establishes the hierarchy of claims on a property in the event of default or foreclosure. One type of Nashville Tennessee Lease Subordination Agreement is the Commercial Lease Subordination Agreement. This type of agreement is commonly used in commercial real estate transactions, where a business leases a property for their operations. The agreement ensures that the tenant's lease is subordinate to any mortgage or lien on the property, meaning that the lender has priority over the lease in case of default. Another type is the Residential Lease Subordination Agreement, applicable when a residential property is involved. This agreement typically arises when a landlord wants to mortgage their property but already has a tenant in place. It allows the lender to have priority over the tenant's lease if the property goes into foreclosure. Nashville Tennessee Lease Subordination Agreements are important for both tenants and landlords. For tenants, it ensures that they understand the potential risks if the landlord defaults on their mortgage payments. It also helps protect their leasehold interests and occupancy rights. Landlords benefit from Lease Subordination Agreements as well. By obtaining consent from tenants to subordinate their lease, landlords can secure better financing options and interest rates when seeking mortgages for their property. This agreement allows lenders to have priority over the lease, reducing the risks associated with default or foreclosure. Keywords: Nashville Tennessee, Lease Subordination Agreement, tenant, landlord, third party, lender, subordination, hierarchy of claims, default, foreclosure, Commercial Lease Subordination Agreement, commercial real estate, business, operations, mortgage, lien, priority, Residential Lease Subordination Agreement, residential property, tenant in place, foreclosure, risks, leasehold interests, occupancy rights, financing options, interest rates, consent.A Nashville Tennessee Lease Subordination Agreement refers to a legally binding document that outlines the terms and conditions between a tenant, landlord, and a third party, typically a lender, regarding the subordination of the lease. In simpler terms, it establishes the hierarchy of claims on a property in the event of default or foreclosure. One type of Nashville Tennessee Lease Subordination Agreement is the Commercial Lease Subordination Agreement. This type of agreement is commonly used in commercial real estate transactions, where a business leases a property for their operations. The agreement ensures that the tenant's lease is subordinate to any mortgage or lien on the property, meaning that the lender has priority over the lease in case of default. Another type is the Residential Lease Subordination Agreement, applicable when a residential property is involved. This agreement typically arises when a landlord wants to mortgage their property but already has a tenant in place. It allows the lender to have priority over the tenant's lease if the property goes into foreclosure. Nashville Tennessee Lease Subordination Agreements are important for both tenants and landlords. For tenants, it ensures that they understand the potential risks if the landlord defaults on their mortgage payments. It also helps protect their leasehold interests and occupancy rights. Landlords benefit from Lease Subordination Agreements as well. By obtaining consent from tenants to subordinate their lease, landlords can secure better financing options and interest rates when seeking mortgages for their property. This agreement allows lenders to have priority over the lease, reducing the risks associated with default or foreclosure. Keywords: Nashville Tennessee, Lease Subordination Agreement, tenant, landlord, third party, lender, subordination, hierarchy of claims, default, foreclosure, Commercial Lease Subordination Agreement, commercial real estate, business, operations, mortgage, lien, priority, Residential Lease Subordination Agreement, residential property, tenant in place, foreclosure, risks, leasehold interests, occupancy rights, financing options, interest rates, consent.