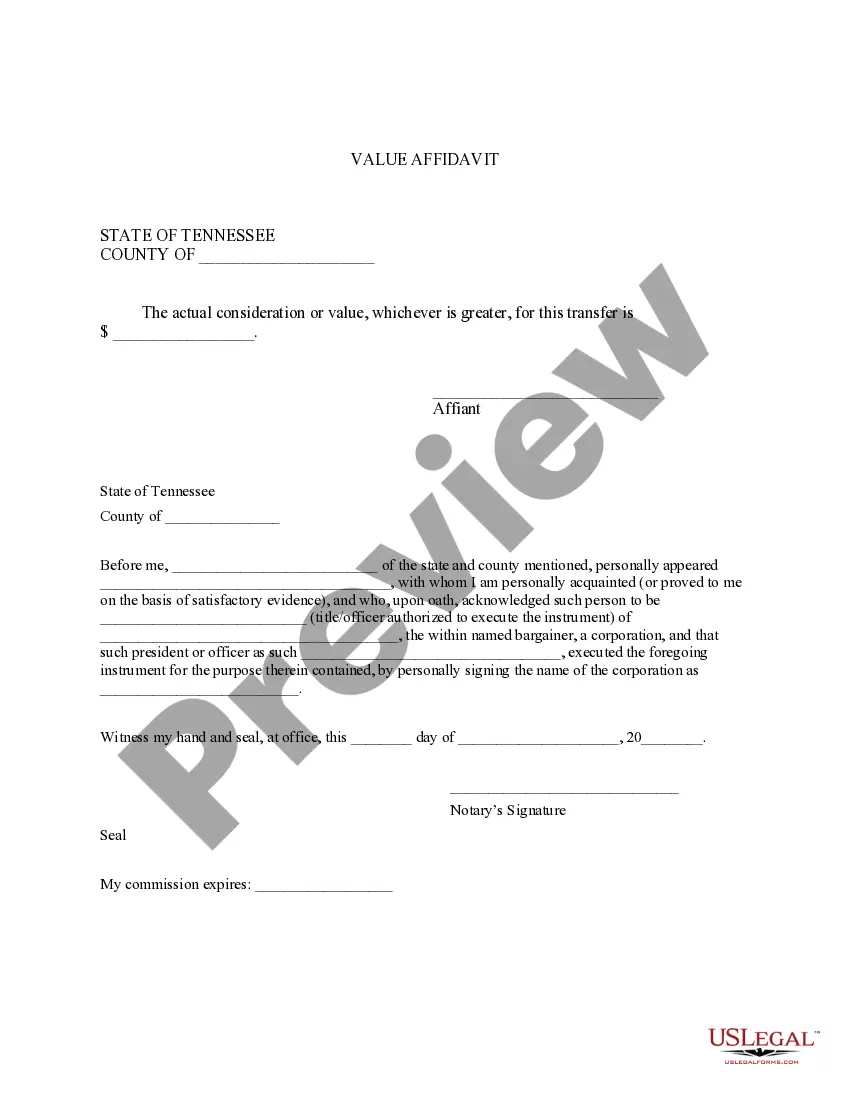

This is a sample form for use in Tennessee, a Tennessee Statement of Property Value. Adapt to fit your circumstances. Available in standard formats.

Chattanooga Tennessee Statement of Property Value, often referred to as the Chattanooga Tennessee Property Assessment Statement, is an official document that provides an estimation of the value of a property located in the city of Chattanooga, Tennessee. This document plays a crucial role in determining property taxes, as it serves as the basis for calculating the assessed value of the property. The Chattanooga Tennessee Statement of Property Value provides a detailed description of various aspects related to the property, such as its physical characteristics, location, and condition. It includes pertinent information about the property owner, such as name, address, and contact details. Moreover, it reflects the property's assessed value, which is established through a comprehensive evaluation process carried out by the Hamilton County Assessor of Property. In Chattanooga, there are several types of property value statements that may be issued, depending on the purpose and nature of the property. These include residential property value statements, commercial property value statements, industrial property value statements, and vacant land property value statements. A residential property value statement focuses on determining the value of houses, apartments, townhouses, or any other dwelling unit within Chattanooga's jurisdiction. It takes into account factors such as the property's size, location, number of rooms, amenities, and recent sale prices of comparable properties in the area. This assessment is crucial for determining fair property taxes for homeowners. On the other hand, a commercial property value statement determines the value of non-residential properties, such as office buildings, retail spaces, hotels, and factories. It considers aspects like the property's size, location, accessibility, available utilities, and the potential income it can generate. This assessment helps ensure that businesses are taxed fairly based on the value of their property. Similarly, an industrial property value statement assesses the worth of industrial properties, including warehouses, manufacturing facilities, distribution centers, and research labs. It evaluates factors like the property's size, zoning, environmental considerations, proximity to transportation, and utility infrastructure. Accurate assessment of industrial properties assists in maintaining equity in property tax payments. Lastly, a vacant land property value statement determines the value of undeveloped or vacant land within Chattanooga. It focuses on factors such as location, size, topography, availability of utilities, and potential use for development. Accurate assessment of vacant land is essential for equitable taxation and planning purposes. In summary, the Chattanooga Tennessee Statement of Property Value serves as a critical document in determining property taxes. It provides a detailed overview of various property types, including residential, commercial, industrial, and vacant land. These assessments aim to ensure fair and accurate valuation, allowing for equitable taxation based on the property's value.