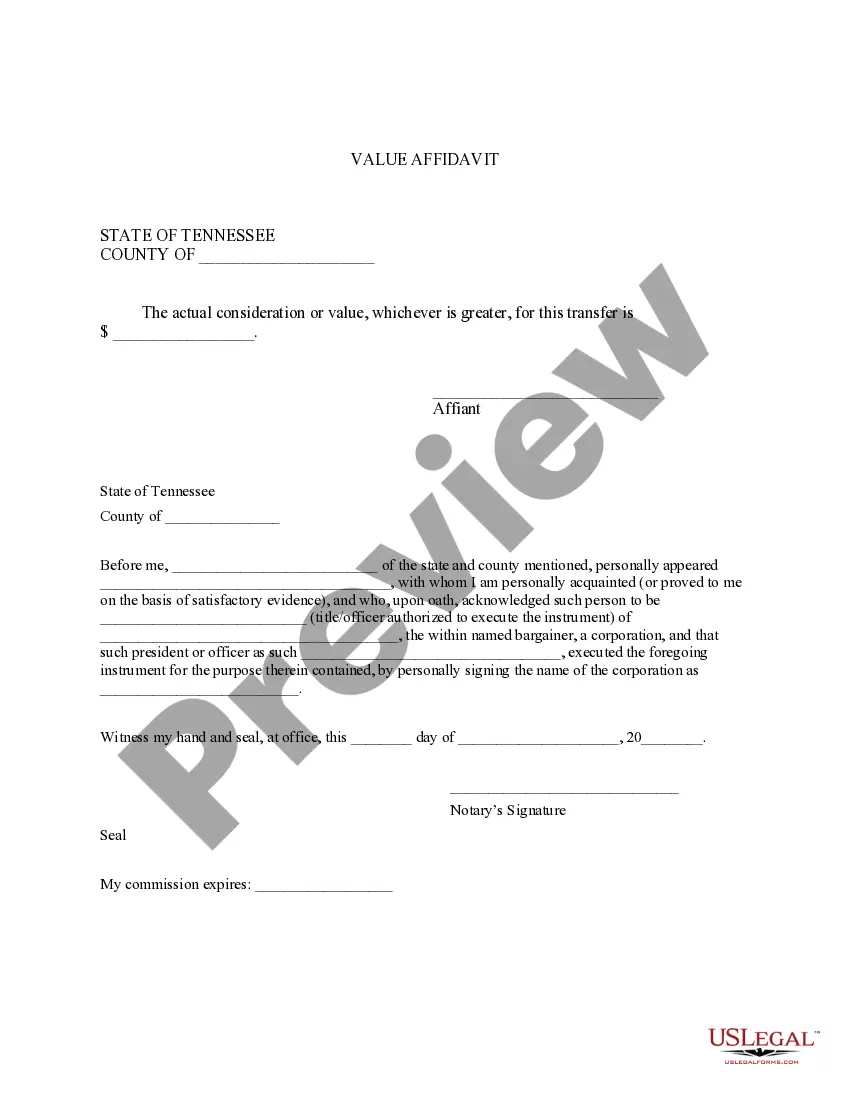

This is a sample form for use in Tennessee, a Tennessee Statement of Property Value. Adapt to fit your circumstances. Available in standard formats.

Memphis Tennessee Statement of Property Value is an official document that provides detailed information about the assessed value of a property located in the city of Memphis, Tennessee. This statement serves as an important record for property owners, potential buyers, real estate professionals, and local authorities. The Statement of Property Value is generated by the Shelby County Assessor's Office, which is responsible for assessing the value of all properties in Memphis. This assessment is performed annually or at regular intervals as mandated by state laws. The purpose of this assessment is to determine the fair market value of the property, which is used to calculate property taxes. The statement includes various key details about the property, such as the owner's name, address, and contact information. It also contains the legal description of the property, including parcel numbers, lot numbers, and subdivision information. This helps to uniquely identify the property within the assessment records. One of the crucial components mentioned in the Statement of Property Value is the assessed value of the property. Assessors determine this value by considering multiple factors, including property size, location, improvements, market conditions, and recently sold comparable properties in the area. The assessed value is usually a percentage of the property's fair market value established by the assessor's office. In addition to the assessed value, the statement may include other relevant information like the classification of the property, exemptions or credits applied, any changes in ownership, and recent maintenance or renovations recorded. These details can be important for property owners, as they can impact property taxes, insurance rates, and potential market value. Different types of Memphis Tennessee Statement of Property Value can be categorized based on the property type. For example, there are separate statements for residential properties, commercial properties, vacant land, and agricultural properties. Each type of statement may have specific sections tailored to the unique characteristics and considerations associated with that property type. Overall, the Memphis Tennessee Statement of Property Value is a comprehensive document that provides vital information about a property's assessed value and other related details. It serves as a valuable resource for property owners, buyers, and professionals in the real estate industry, enabling them to make informed decisions regarding property transactions, taxation, and investment opportunities.