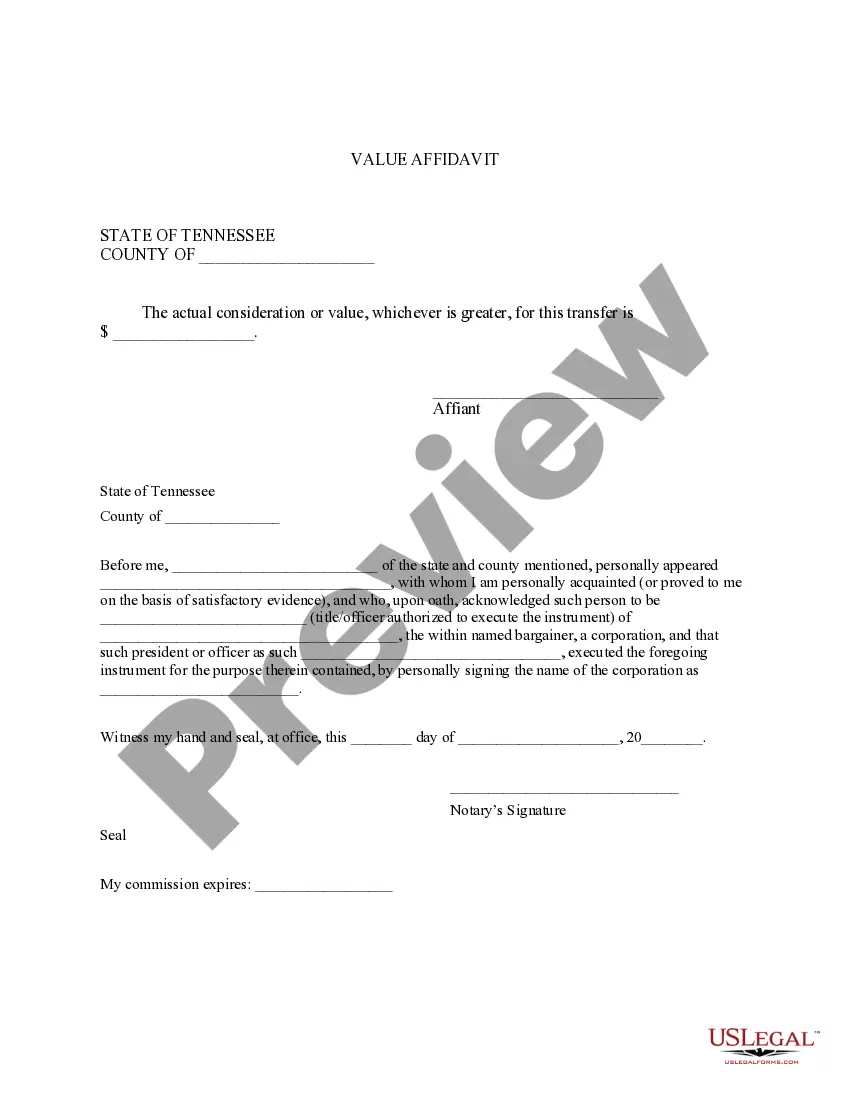

This is a sample form for use in Tennessee, a Tennessee Statement of Property Value. Adapt to fit your circumstances. Available in standard formats.

The Murfreesboro Tennessee Statement of Property Value is a vital document that provides a comprehensive overview of a property's assessed value and associated details in the city of Murfreesboro, Tennessee. This statement is essential for property owners, buyers, and other concerned parties as it establishes the value at which the property is assessed for tax purposes and assists in property valuation, tax planning, and financial decision-making. The Murfreesboro Tennessee Statement of Property Value encompasses various relevant keywords such as property assessment, market valuation, tax assessment, property details, and similar terms. It contains a wealth of information, including the legal description of the property, owner information, land attributes, improvements, and property characteristics. The statement also includes the assessed value of the land and any structures on the property, providing a detailed breakdown of their respective worth. Moreover, the Murfreesboro Tennessee Statement of Property Value may also offer information regarding previous value assessments, changes in property value over time, and relevant sales data in the vicinity. This data assists property owners in understanding the fluctuation in property value and its correlation to the local real estate market. There are different types of Murfreesboro Tennessee Statement of Property Value tailored for specific purposes. These may include: 1. Annual Property Tax Assessment Statement: This form of the statement is issued annually to property owners by the Rutherford County Assessor of Property. It outlines the assessed value of the property and serves as the basis for determining property taxes. 2. Property Valuation Appeal Statement: In case a property owner disagrees with the assessed value mentioned in the statement, they can file an appeal to request a reassessment. The appeal statement specifies the reasons for disagreement and provides supporting evidence or comparable sales data to justify the property's reassessment. 3. Historical Property Value Statement: This type of statement presents a historical overview of the property's assessed values over a specific period, allowing property owners to track and analyze changes in the property's worth. It helps in understanding the property's appreciation or depreciation trend and aids in long-term financial planning. In conclusion, the Murfreesboro Tennessee Statement of Property Value is a crucial document that provides property owners with a detailed overview of their property's assessed value for tax purposes. Utilizing the relevant keywords, it assists property owners, buyers, and interested parties in making informed decisions regarding taxation, property valuation, and real estate investment in Murfreesboro, Tennessee.The Murfreesboro Tennessee Statement of Property Value is a vital document that provides a comprehensive overview of a property's assessed value and associated details in the city of Murfreesboro, Tennessee. This statement is essential for property owners, buyers, and other concerned parties as it establishes the value at which the property is assessed for tax purposes and assists in property valuation, tax planning, and financial decision-making. The Murfreesboro Tennessee Statement of Property Value encompasses various relevant keywords such as property assessment, market valuation, tax assessment, property details, and similar terms. It contains a wealth of information, including the legal description of the property, owner information, land attributes, improvements, and property characteristics. The statement also includes the assessed value of the land and any structures on the property, providing a detailed breakdown of their respective worth. Moreover, the Murfreesboro Tennessee Statement of Property Value may also offer information regarding previous value assessments, changes in property value over time, and relevant sales data in the vicinity. This data assists property owners in understanding the fluctuation in property value and its correlation to the local real estate market. There are different types of Murfreesboro Tennessee Statement of Property Value tailored for specific purposes. These may include: 1. Annual Property Tax Assessment Statement: This form of the statement is issued annually to property owners by the Rutherford County Assessor of Property. It outlines the assessed value of the property and serves as the basis for determining property taxes. 2. Property Valuation Appeal Statement: In case a property owner disagrees with the assessed value mentioned in the statement, they can file an appeal to request a reassessment. The appeal statement specifies the reasons for disagreement and provides supporting evidence or comparable sales data to justify the property's reassessment. 3. Historical Property Value Statement: This type of statement presents a historical overview of the property's assessed values over a specific period, allowing property owners to track and analyze changes in the property's worth. It helps in understanding the property's appreciation or depreciation trend and aids in long-term financial planning. In conclusion, the Murfreesboro Tennessee Statement of Property Value is a crucial document that provides property owners with a detailed overview of their property's assessed value for tax purposes. Utilizing the relevant keywords, it assists property owners, buyers, and interested parties in making informed decisions regarding taxation, property valuation, and real estate investment in Murfreesboro, Tennessee.