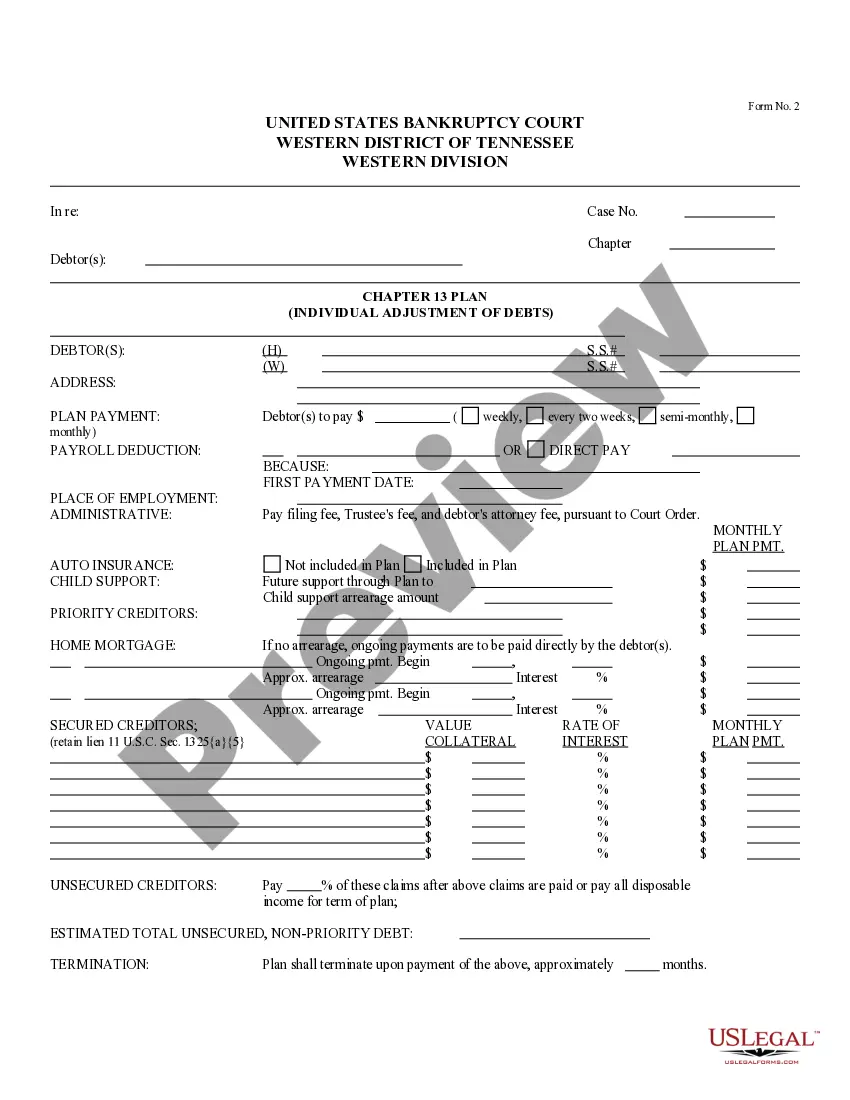

The chapter 13 plan provides that the debtor will pay the trustee a certain sum of money to be distributed among the creditors listed in the plan. The document provides information concerning: secured creditors, unsecured creditors, and the date of plan termination.

Clarksville Tennessee Chapter 13 Plan

Description

How to fill out Tennessee Chapter 13 Plan?

Are you seeking a dependable and affordable legal forms provider to obtain the Clarksville Tennessee Chapter 13 Plan? US Legal Forms is your ideal option.

Whether you require a fundamental agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce process through the court, we have you covered. Our website offers more than 85,000 current legal document templates for personal and business purposes. All templates that we provide are not generic but tailored based on the specifications of particular states and regions.

To acquire the form, you need to Log In to your account, find the necessary template, and click the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My documents section.

Are you unfamiliar with our platform? No problem. You can set up an account in minutes, but before that, ensure to do the following.

You can now register your account. Then choose a subscription plan and continue to payment. Once the payment is complete, download the Clarksville Tennessee Chapter 13 Plan in any available file format. You can return to the website anytime and redownload the form at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms now, and stop wasting hours learning about legal paperwork online once and for all.

- Check if the Clarksville Tennessee Chapter 13 Plan complies with the laws of your state and locality.

- Review the form’s description (if available) to understand who and what the form is designed for.

- Restart the search if the template doesn’t meet your particular situation.

Form popularity

FAQ

To qualify for a Clarksville Tennessee Chapter 13 Plan, you must meet specific debt limits. As of now, unsecured debts must be less than $419,275, and secured debts must be under $1,257,850. These amounts can change, so it's crucial to verify the current thresholds before filing. Understanding these limits will help you determine if a Chapter 13 Plan is the right option for you.

The monthly payment for a Clarksville Tennessee Chapter 13 Plan varies based on your income, expenses, and debt amount. Generally, your payment will reflect your disposable income after accounting for living expenses. Many factors influence this calculation, so working with a knowledgeable advisor can help tailor a plan that fits your financial situation. You want to ensure your payments are manageable while effectively addressing your debts.

Certain factors can disqualify you from a Clarksville Tennessee Chapter 13 Plan. For instance, if you have filed for Chapter 13 in the last two years or if your debts exceed the legal limits set by the bankruptcy court, you may not qualify. Additionally, failing to complete a credit counseling course can also lead to disqualification. It's essential to consult a professional to get tailored advice based on your situation.

You can indeed file for a Chapter 13 bankruptcy online in Tennessee. Utilizing a reliable platform, such as USLegalForms, makes this process straightforward and accessible. The Clarksville Tennessee Chapter 13 Plan allows you to manage your debts effectively while keeping your valuable assets. By completing your filing online, you save time and ensure that everything is submitted correctly.

To estimate your Chapter 13 payment in Clarksville, Tennessee, start by assessing your total disposable income after necessary expenses. Next, consider the debts you need to repay, which may include secured debts like mortgages or car loans, and unsecured debts like credit cards. This calculation will give you a ballpark figure for your monthly payments. For more precise calculations and guidance, you can visit uslegalforms to access tools that will help you estimate your payments effectively.

A typical payment in a Clarksville Tennessee Chapter 13 Plan can vary significantly based on your income, types of debts, and the total amount owed. Generally, you’ll propose a monthly payment that you can manage over three to five years, focusing on paying off secured debts first. Courts review and verify your proposed payment plan to ensure it aligns with your financial capabilities. For personalized projections and assistance, uslegalforms offers resources that can help you estimate your payments accurately.

Completing a Chapter 13 plan involves detailing your financial situation, including debts and income, and proposing a repayment strategy for creditors. You'll need to gather accuracy in your documents and ensure you meet the guidelines set by the bankruptcy court in Clarksville, Tennessee. Following the right procedures will help ensure your plan is approved. Utilizing uslegalforms can streamline this process by providing you with necessary forms and expert advice.

In a Clarksville Tennessee Chapter 13 Plan, income includes your monthly earnings from all sources, along with additional income like Social Security benefits, pensions, and rental income. It's essential to consider both gross and net income to arrive at an accurate calculation. This total income figure will help determine your payment plan and eligibility for Chapter 13. You may also want to consult uslegalforms for tailored guidance on documenting and calculating your income.

Chapter 13 bankruptcies can be worth it for many individuals facing overwhelming debt. They offer a way to reorganize your debts while keeping your property, such as your home or car, safe from repossession. In Clarksville, Tennessee, this plan provides a fresh start by eliminating unsecured debts once the payment period ends. Moreover, using USLegalForms can simplify the process, ensuring that you have the necessary documents and guidance to navigate your Clarksville Tennessee Chapter 13 Plan effectively.