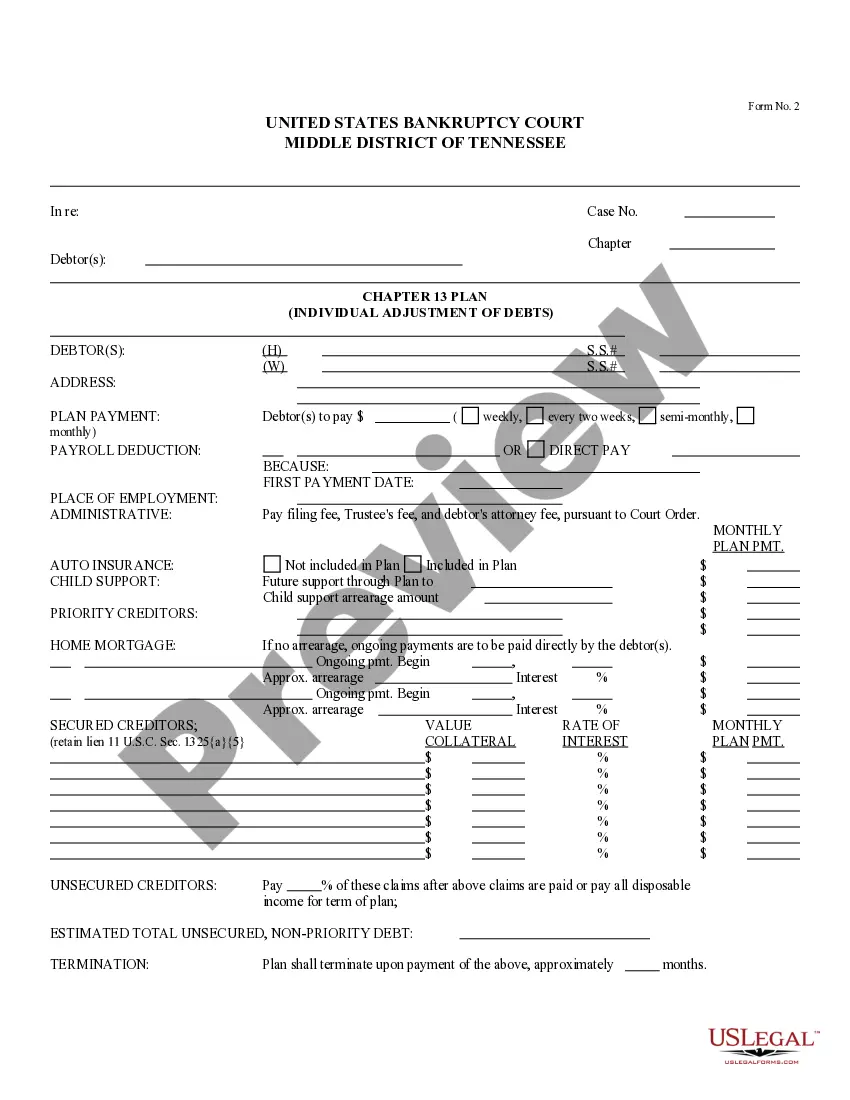

The chapter 13 plan provides that the debtor will pay the trustee a certain sum of money to be distributed among the creditors listed in the plan. The document provides information concerning: secured creditors, unsecured creditors, and the date of plan termination.

Clarksville Tennessee Chapter 13 Plan

Description

How to fill out Tennessee Chapter 13 Plan?

Acquiring verified templates tailored to your regional statutes can be challenging unless you utilize the US Legal Forms library.

It's an online reservoir of over 85,000 legal forms catering to both personal and professional requirements and various real-life situations.

All the documents are organized appropriately by usage area and jurisdiction, making it simple to locate the Clarksville Tennessee Chapter 13 Plan as easy as one, two, three.

Submit your credit card information or use your PayPal account to complete the transaction.

- Review the Preview option and form details.

- Ensure you've selected the right one that aligns with your needs and fully meets your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you discover any discrepancies, utilize the Search feature above to find the correct one. If it fits your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Your Chapter 13 payment may be high due to several factors, including the amount of debt you need to repay and your income level. In a Clarksville Tennessee Chapter 13 Plan, the court evaluates your finances to determine your payment. Additionally, if you are behind on secured debts, like a mortgage, this could also raise your required monthly payment. Analyzing your budget and discussing options with a specialist can help you understand and address your payment concerns.

Yes, you can negotiate your Chapter 13 payment, but it requires careful planning. In the Clarksville Tennessee Chapter 13 Plan, the court needs to approve any changes to your payment schedule. You may need to provide proof of your financial situation to show why a modification is necessary. Working with an experienced attorney can help you effectively navigate this process.

To complete a Clarksville Tennessee Chapter 13 Plan, you should first gather all necessary financial documents, including income statements and a list of debts. Next, consider consulting with a local bankruptcy attorney who can help you draft your repayment plan in compliance with state laws. This plan will detail how and when you will repay your creditors over a specified timeframe. Lastly, you can use platforms like US Legal Forms to find templates and resources that simplify this process, ensuring you meet all required legal standards.

Several factors can disqualify you from a Clarksville Tennessee Chapter 13 Plan. For instance, if you have filed for Chapter 7 bankruptcy and failed to complete the repayment plan, you might be ineligible. Additionally, if your debts exceed certain limits or if you have not received credit counseling, you could face disqualification. To understand your situation better, consider using US Legal Forms, where you can find guidance tailored to your needs.

To file Chapter 13 in Tennessee, you must have a regular income and unsecured debts not exceeding $465,275, as well as secured debts under $1,395,875. These limits help determine your eligibility for a Clarksville Tennessee Chapter 13 plan. If you're unsure about your debt levels, tools like USLegalForms can assist with evaluating your financial situation.

A typical Chapter 13 repayment plan lasts three to five years, during which you make monthly payments to a bankruptcy trustee. The trustee then distributes the funds to your creditors according to the plan's terms. If you need assistance creating a tailored Clarksville Tennessee Chapter 13 plan, USLegalForms can help you through the process.

Yes, you can file a Chapter 13 plan online in Tennessee. The process is straightforward and allows you to submit your documents conveniently from home. Moreover, using services like USLegalForms can simplify your filing experience, making it easier to manage your Clarksville Tennessee Chapter 13 plan.