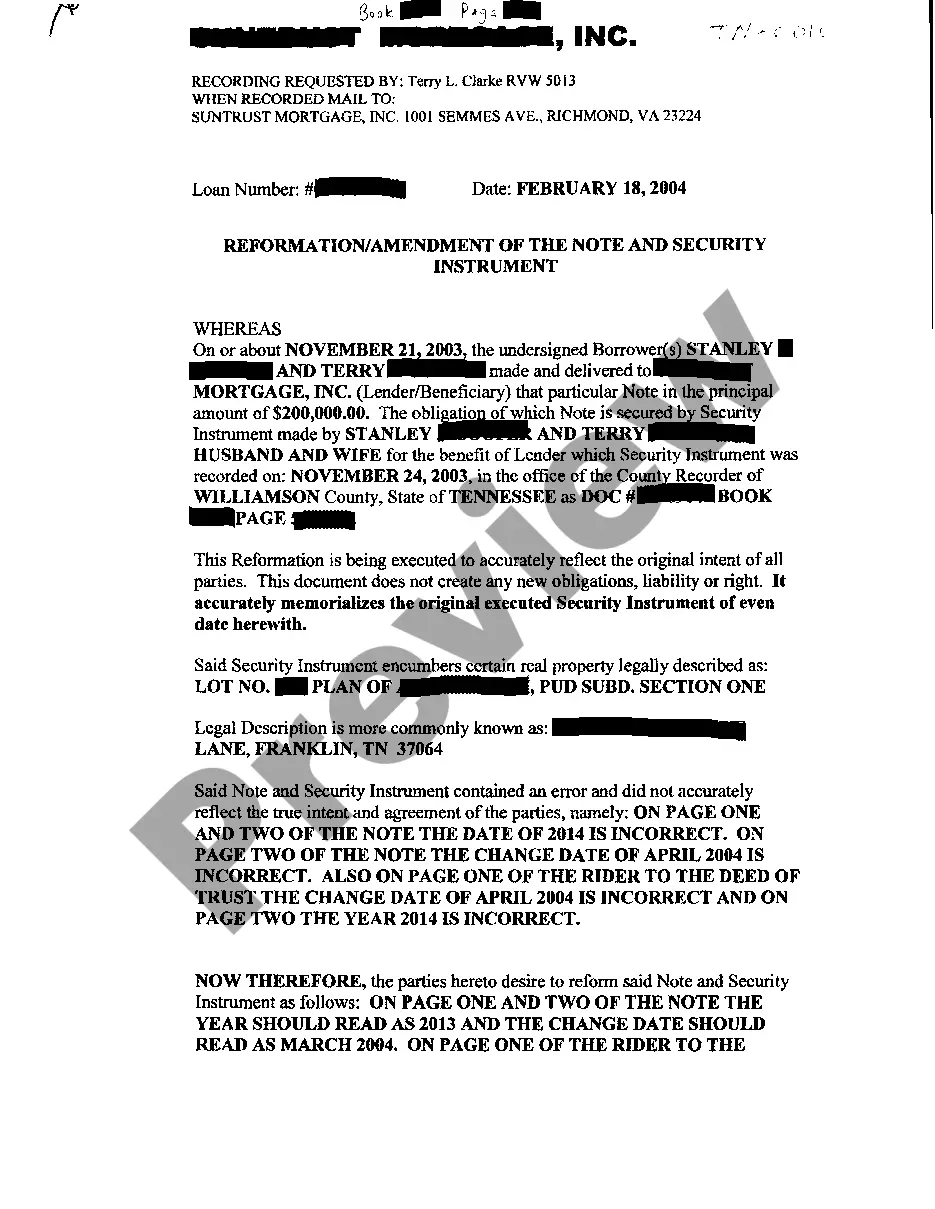

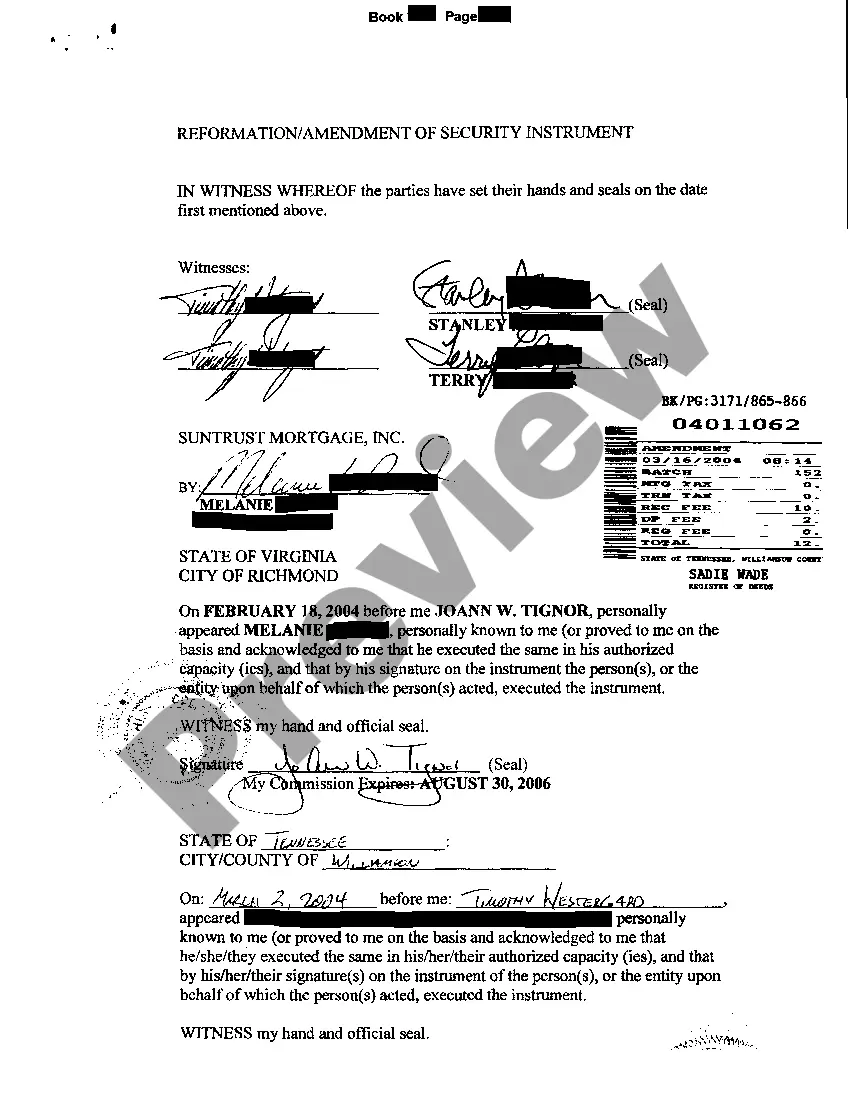

The Nashville Tennessee Reformation Amendment of Note And Security Instrument is a legal document that brings changes or modifications to the original terms and conditions of a promissory note and security instrument. It is designed to protect the rights and interests of all parties involved in a mortgage or loan transaction in Nashville, Tennessee. The amendment serves as a means to rectify any errors, omissions, or inconsistencies found in the original note and security instrument, ensuring that the document accurately reflects the parties' intentions. It may involve changes to the interest rate, payment terms, maturity date, or other provisions outlined in the original agreement. Keywords: Nashville Tennessee, Reformation Amendment, Note, Security Instrument, Promissory Note, Mortgage, Loan, Modifications, Terms and Conditions, Errors, Omissions, Inconsistencies, Intentions, Interest Rate, Payment Terms, Maturity Date, Agreement. Different types of Nashville Tennessee Reformation Amendment of Note And Security Instrument may include: 1. Rate Adjustment Amendment: This type of amendment focuses on modifying the interest rate stated in the promissory note and security instrument. It may be done to reflect changes in the market interest rates or to address errors in the initial documentation. 2. Extension/Modification Amendment: This amendment is executed when the parties involved decide to extend the maturity date of the loan or make modifications to the existing terms of repayment. This could include changes to the payment schedule, loan amount, or any other relevant provisions. 3. Collateral Substitution Amendment: In situations where the collateral securing the loan needs to be substituted or changed, this type of amendment is utilized. It outlines the new collateral being offered to ensure the loan remains properly secured. 4. Reformation Amendment due to Error: When errors are discovered in the original note and security instrument, this amendment is used to rectify them. It corrects any mistakes in the legal description of the property, borrower's name, loan terms, or any other relevant information. 5. Ratification Amendment: This amendment is used to confirm and validate a previously informal or poorly documented agreement. It aims to ensure that the terms agreed upon are legally binding and enforceable. In conclusion, the Nashville Tennessee Reformation Amendment of Note And Security Instrument is a critical legal tool for modifying, clarifying, or correcting the original terms and conditions of a promissory note and security instrument associated with loans or mortgages in Nashville, Tennessee. The different types of amendments serve diverse purposes, allowing parties to address errors, adjust interest rates, extend loan terms, substitute collateral, or ratify previously informal agreements.

Nashville Tennessee Reformation Amendment of Note And Security Instrument

Description

How to fill out Nashville Tennessee Reformation Amendment Of Note And Security Instrument?

If you are searching for a valid form, it’s extremely hard to find a more convenient service than the US Legal Forms website – one of the most comprehensive online libraries. With this library, you can find a huge number of document samples for organization and individual purposes by types and states, or key phrases. Using our high-quality search option, discovering the latest Nashville Tennessee Reformation Amendment of Note And Security Instrument is as easy as 1-2-3. Moreover, the relevance of each document is confirmed by a team of professional lawyers that regularly review the templates on our website and update them in accordance with the most recent state and county regulations.

If you already know about our platform and have a registered account, all you should do to get the Nashville Tennessee Reformation Amendment of Note And Security Instrument is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the sample you require. Check its explanation and make use of the Preview feature to check its content. If it doesn’t meet your needs, use the Search option at the top of the screen to find the needed record.

- Confirm your selection. Click the Buy now option. After that, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Receive the template. Pick the file format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Nashville Tennessee Reformation Amendment of Note And Security Instrument.

Every single template you save in your user profile does not have an expiration date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to receive an extra duplicate for modifying or creating a hard copy, you may return and save it again anytime.

Make use of the US Legal Forms extensive collection to get access to the Nashville Tennessee Reformation Amendment of Note And Security Instrument you were seeking and a huge number of other professional and state-specific samples in one place!