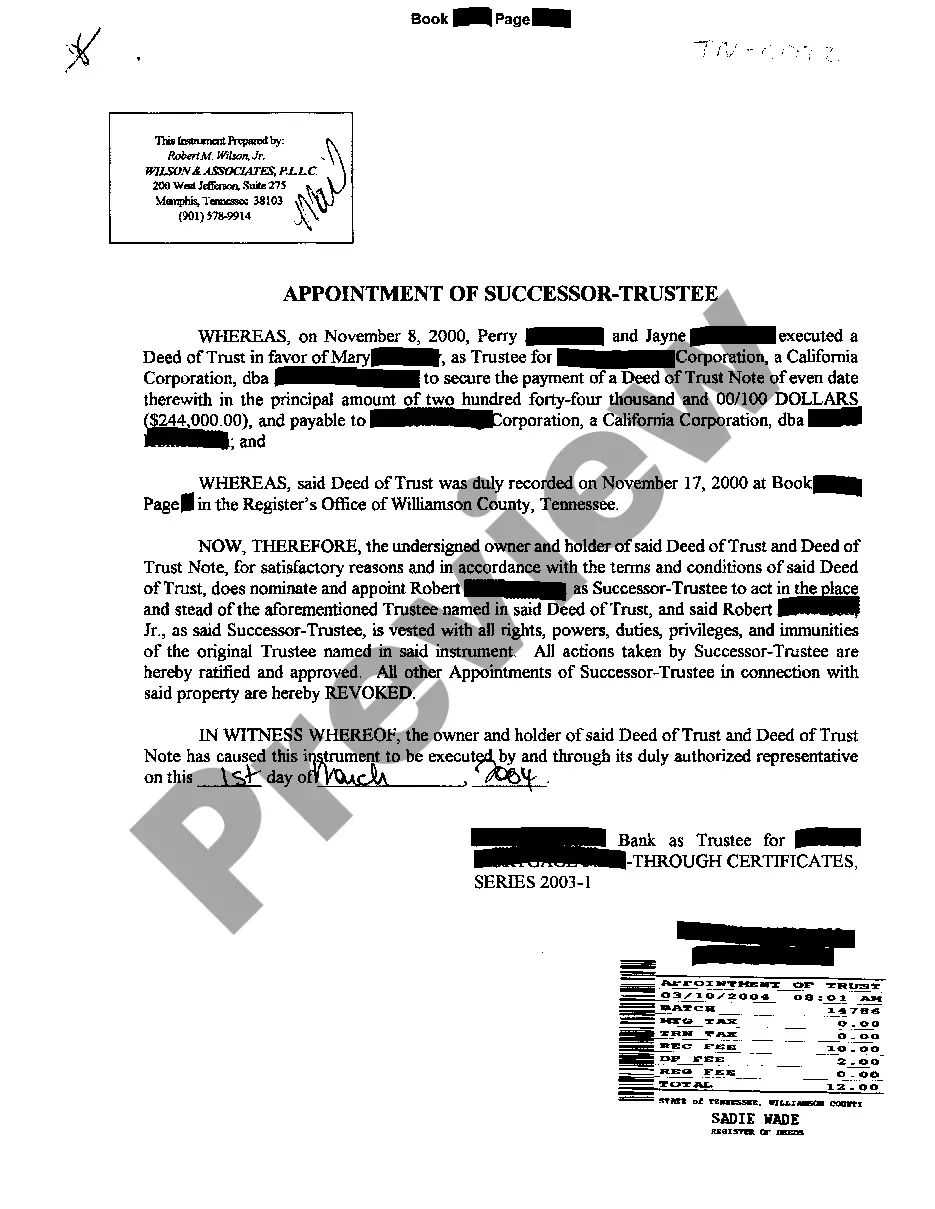

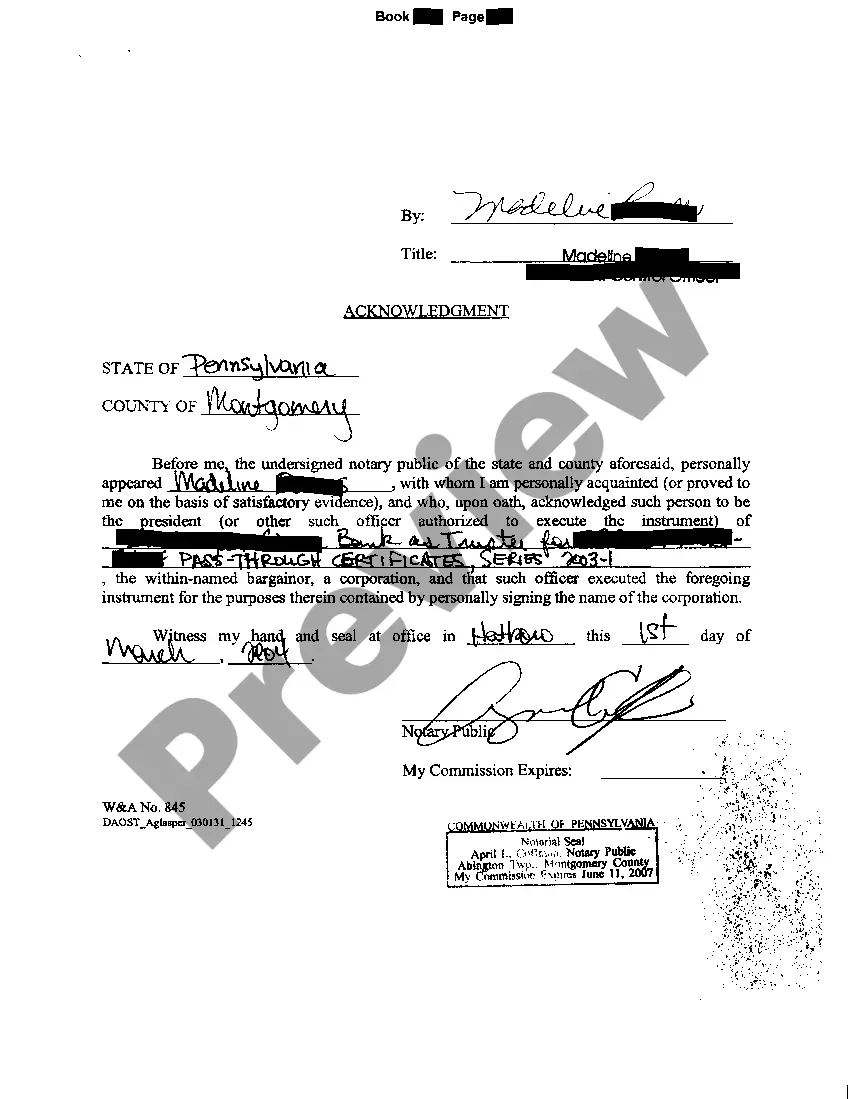

Murfreesboro Tennessee Appointment of Successor Trustee refers to the legal process of designating an individual or entity to take over the responsibilities and management of a trust in the event that the current trustee is unable or unwilling to fulfill their duties. This appointment ensures the smooth continuation of the trust's affairs and protects the interests of the beneficiaries. The Murfreesboro Tennessee Appointment of Successor Trustee can be categorized into two types: 1. Testamentary Appointment: This type of appointment is made in accordance with the terms and conditions outlined in the trust or's will. A testamentary appointment of a successor trustee becomes effective upon the death of the trustee specified in the will. 2. Revocable Living Trust Appointment: A revocable living trust is created during the trust or's lifetime and can be modified or revoked as per their wishes. The appointment of a successor trustee in a revocable living trust comes into effect when the original trustee becomes incapacitated, passes away, or voluntarily steps down. In both types of appointments, it is imperative to follow the legal procedures outlined in Murfreesboro, Tennessee, to ensure the appointment is valid and enforceable. The successor trustee, also known as the alternate trustee or contingent trustee, assumes various responsibilities, including: 1. Trust Administration: The successor trustee takes charge of managing and distributing the trust assets in accordance with the trust document and applicable laws. They must ensure the wishes of the trust or and the best interests of the beneficiaries are upheld. 2. Fiduciary Duties: The appointed successor trustee has a fiduciary duty to act in the best interests of the trust and its beneficiaries. They must manage the trust's assets prudently, avoid conflicts of interest, and make decisions that align with the overall objectives of the trust. 3. Financial and Legal Responsibilities: The successor trustee must maintain accurate records of all trust transactions, file necessary tax returns, and fulfill other legal requirements. They may need to consult with attorneys, accountants, and financial advisors to ensure compliance. 4. Communication with Beneficiaries: The successor trustee is responsible for keeping beneficiaries informed about the trust's progress, providing periodic accounting, and addressing any concerns or inquiries they may have. 5. Decision-Making Authority: The successor trustee gains the authority to make significant decisions concerning the trust, such as selling assets, making investments, or modifying the distribution plan, if permitted by the trust agreement. Properly appointing a successor trustee in Murfreesboro, Tennessee, is crucial to safeguarding the integrity and effectiveness of a trust. It is recommended to consult with an experienced estate planning attorney who specializes in trust administration to ensure compliance with all legal requirements and guidelines specific to the jurisdiction.

Murfreesboro Tennessee Appointment of Successor Trustee

Description

How to fill out Murfreesboro Tennessee Appointment Of Successor Trustee?

Make use of the US Legal Forms and get instant access to any form template you need. Our beneficial platform with thousands of documents allows you to find and obtain almost any document sample you need. You can download, complete, and certify the Murfreesboro Tennessee Appointment of Successor Trustee in just a couple of minutes instead of browsing the web for many hours seeking an appropriate template.

Utilizing our catalog is an excellent strategy to improve the safety of your form submissions. Our experienced attorneys regularly review all the records to ensure that the forms are appropriate for a particular state and compliant with new laws and regulations.

How do you obtain the Murfreesboro Tennessee Appointment of Successor Trustee? If you already have a profile, just log in to the account. The Download button will be enabled on all the documents you view. In addition, you can find all the earlier saved files in the My Forms menu.

If you don’t have an account yet, follow the tips below:

- Find the template you need. Make sure that it is the template you were seeking: examine its headline and description, and utilize the Preview feature if it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the saving process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Select the format to get the Murfreesboro Tennessee Appointment of Successor Trustee and modify and complete, or sign it for your needs.

US Legal Forms is probably the most significant and reliable template libraries on the internet. We are always happy to assist you in virtually any legal case, even if it is just downloading the Murfreesboro Tennessee Appointment of Successor Trustee.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!