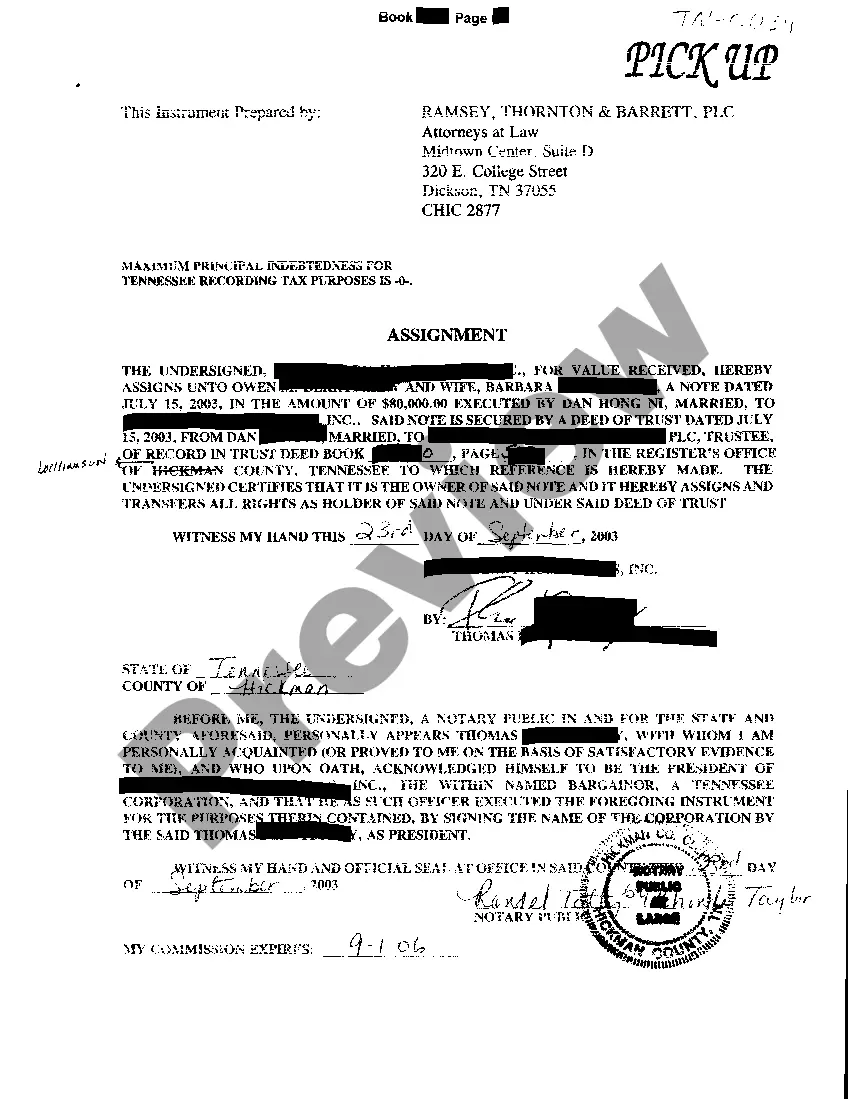

A Chattanooga Tennessee Assignment of Promissory Note refers to a legal document that transfers the rights and obligations of a promissory note from one party (the assignor) to another (the assignee) within the jurisdiction of Chattanooga, Tennessee. This document is commonly used when the original lender or holder of the promissory note wishes to transfer their interest in the debt to another party. The assignment of a promissory note involves the complete transfer of ownership, along with all rights, interests, and benefits associated with the note. By completing this assignment, the assignor eliminates any future responsibilities and assigns all rights to collect payments, enforce terms, and other entitlements to the assignee. In Chattanooga, Tennessee, there are generally two types of Assignment of Promissory Notes: 1. Absolute Assignment: This type of assignment involves a complete transfer of ownership and all rights associated with the promissory note from the assignor to the assignee. The assignee becomes the new owner of the debt and assumes full responsibility for collecting payments and enforcing the terms of the note. This type of assignment is often used when there is a sale of a loan portfolio or when the original lender wants to transfer the note to another financial institution. 2. Collateral Assignment: In this type of assignment, the assignor transfers the rights to a promissory note as collateral for a separate debt or obligation, while still retaining some interest in the note. Here, the assignor uses the promissory note as security for a loan or as collateral against another liability. The assignee, known as the collateral assignee, has limited rights and can only collect payments or enforce terms if the assignor defaults on the original obligation. When executing a Chattanooga Tennessee Assignment of Promissory Note, it is crucial to include several key elements. These include: 1. Parties Involved: Clearly state the names and addresses of both the assignor and the assignee. 2. Recitals: Provide a detailed background explaining the intention and purpose of the assignment. 3. Assignment Clause: Clearly state that the assignor assigns all rights, interests, and benefits of the promissory note to the assignee. 4. Governing Law: Specify that the assignment is governed by the laws of Tennessee and, more specifically, Chattanooga. 5. Consideration: Outline any exchange of value, such as monetary compensation or the release of a previous obligation, if applicable. 6. Signatures: Both the assignor and assignee must sign and date the assignment, along with any witnesses if required. In conclusion, a Chattanooga Tennessee Assignment of Promissory Note is a legally binding document that transfers the ownership and associated rights of a promissory note from one party to another within the jurisdiction of Chattanooga, Tennessee. The absolute and collateral assignment are two common types of assignments utilized in this context. Careful attention must be given to the key elements of the assignment to ensure its validity and effectiveness within the legal framework of Chattanooga, Tennessee.

Chattanooga Tennessee Assignment of Promissory Note

Description

How to fill out Chattanooga Tennessee Assignment Of Promissory Note?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any law education to draft such papers from scratch, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI tpapers.

No matter if you require the Chattanooga Tennessee Assignment of Promissory Note or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Chattanooga Tennessee Assignment of Promissory Note in minutes employing our reliable service. In case you are already a subscriber, you can proceed to log in to your account to get the needed form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps before downloading the Chattanooga Tennessee Assignment of Promissory Note:

- Be sure the template you have found is specific to your area since the rules of one state or area do not work for another state or area.

- Review the document and go through a quick outline (if available) of cases the paper can be used for.

- If the form you picked doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and pick the subscription plan that suits you the best.

- Log in to your account credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Chattanooga Tennessee Assignment of Promissory Note as soon as the payment is done.

You’re good to go! Now you can proceed to print the document or complete it online. If you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.