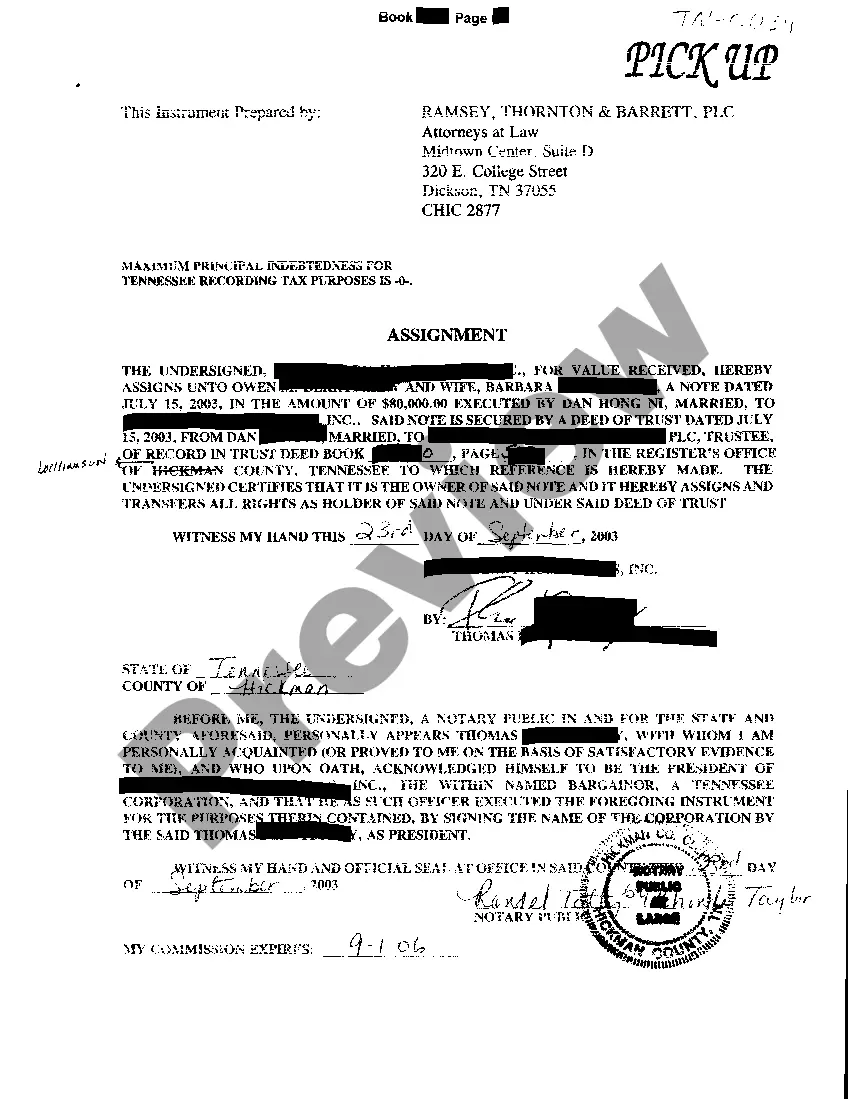

A Murfreesboro Tennessee Assignment of Promissory Note is a legal document that outlines the transfer of rights and obligations of a promissory note from one party to another in Murfreesboro, Tennessee. This agreement effectively establishes that the assignee has the authority to collect the debt and that the assignor no longer has a claim to it. A promissory note is a legally binding instrument that represents a borrower's promise to repay a loan. Assigning a promissory note can occur in various situations, such as when a financial institution wants to sell or transfer its interest in the debt. The Murfreesboro Tennessee Assignment of Promissory Note typically includes the names and contact information of both the assignor and assignee, the date of the assignment, and a detailed description of the promissory note being transferred. It should also include the principal amount of the loan, the interest rate, the repayment terms, and any applicable penalties or fees. The document should explicitly state that the assignment is being made under the laws of the State of Tennessee. There are different types of Murfreesboro Tennessee Assignment of Promissory Note, which may vary based on specific circumstances. Some common types include: 1. Absolute Assignment: This type of assignment is a complete transfer of rights and obligations from the assignor to the assignee. The assignee assumes full responsibility for collecting repayments and enforcing the terms of the promissory note. 2. Collateral Assignment: In this type of assignment, the assignor pledges the promissory note as collateral to secure another debt, such as a loan or line of credit. If the assignor defaults on the other debt, the assignee has the right to claim the promissory note. 3. Partial Assignment: With a partial assignment, only a portion of the promissory note is transferred to the assignee. This type is often used when multiple parties contribute to a loan, and each party assigns a percentage of their interest to another party. 4. Assignment for Security: In this scenario, the promissory note is assigned to secure the performance of an obligation, such as a guarantee or indemnity. If the assignor fails to fulfill the obligation, the assignee can claim the promissory note. It is vital to consult with legal professionals or financial advisors when engaging in a Murfreesboro Tennessee Assignment of Promissory Note to ensure compliance with local regulations and to protect the rights and interests of all parties involved.

Murfreesboro Tennessee Assignment of Promissory Note

Description

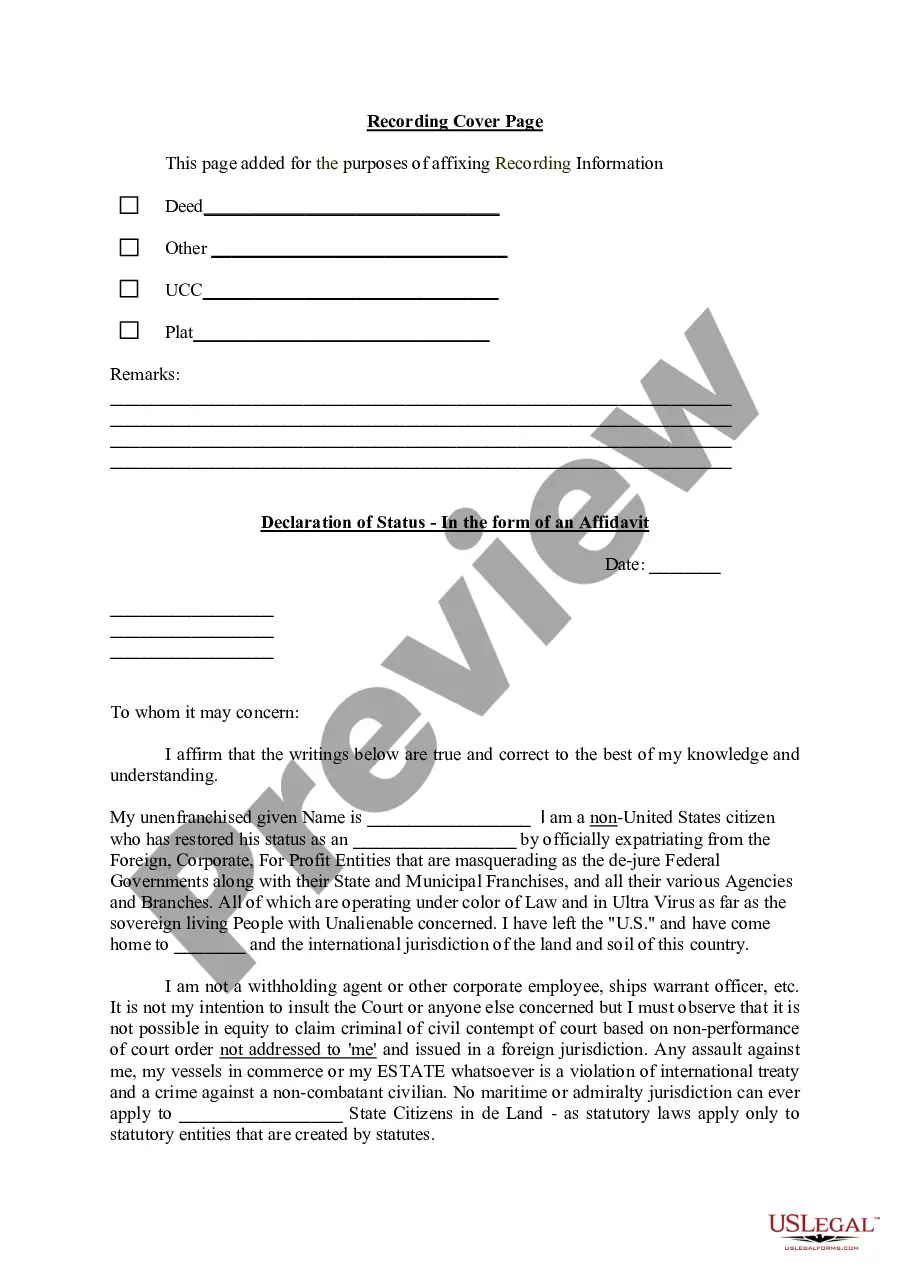

How to fill out Murfreesboro Tennessee Assignment Of Promissory Note?

Regardless of social or professional rank, filling out legal documents is an unfortunate requirement in today's work atmosphere.

Frequently, it’s nearly impossible for an individual without any legal training to create such documentation from scratch, primarily due to the complex terminology and legal subtleties involved.

This is where US Legal Forms can come to the rescue.

- Our service provides an extensive collection of over 85,000 ready-to-use state-specific documents suitable for almost any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to save time by utilizing our DIY papers.

- Whether you need the Murfreesboro Tennessee Assignment of Promissory Note or any other document valid in your region or county, US Legal Forms has everything you need readily available.

- Here's how to obtain the Murfreesboro Tennessee Assignment of Promissory Note quickly with our dependable service.

- If you’re already a subscriber, feel free to Log In to your account and download the necessary form.

Form popularity

FAQ

A Tennessee notary can notarize documents in any county within the state, as long as they are in compliance with state laws. This flexibility allows you to easily find a notary for your Murfreesboro Tennessee Assignment of Promissory Note, regardless of where you reside. Using platforms like US Legal Forms can help you locate a qualified notary in your vicinity.

You can obtain a notary in a different county, but it is essential to ensure that the notary is authorized to notarize documents in your area. Tennessee law allows for this, but the validity of your Murfreesboro Tennessee Assignment of Promissory Note may depend on the notary’s jurisdiction. Always check the notary’s credentials to avoid potential issues.

Yes, the location of a notary can significantly impact the validity of your Murfreesboro Tennessee Assignment of Promissory Note. Notaries typically need to operate within their commission area. This means that finding a notary close to your geographical location can facilitate smoother transactions.

Notaries in Tennessee must adhere to specific rules and regulations. They must be at least 18 years old, a resident of the state, and maintain an accurate record of all notarial acts. Understanding these rules is essential for anyone involved in the Murfreesboro Tennessee Assignment of Promissory Note, as it ensures the legality and reliability of your documents.

Yes, we provide notarization services for a promissory note in Murfreesboro, Tennessee. Notarization adds credibility and legality to your document, ensuring all parties involved can trust its authenticity. Our platform simplifies the process, allowing you to generate the necessary documents and obtain notarization with ease.

Yes, you can assign a promissory note to another party. The assignment transfers the right to receive payments to the new holder, but it does not relieve the original borrower of their obligations. Proper documentation is essential to facilitate this process smoothly. For assistance with this type of transaction, uslegalforms can provide valuable resources to support your Murfreesboro Tennessee Assignment of Promissory Note.

Yes, you can assign a promissory note to a trust. This process allows the trust to receive payments directly from the borrower, providing a mechanism for managing income within the trust. It is vital to ensure that the assignment complies with state laws and the terms outlined in the original promissory note. For detailed guidance, you might consider utilizing platforms like uslegalforms to streamline your Murfreesboro Tennessee Assignment of Promissory Note.

In Rutherford County, Tennessee, a quit claim deed typically contains the grantor's name, the grantee's name, a legal description of the property, and any relevant stipulations regarding the transfer. This type of deed is often used to transfer property ownership without promising to clear any liens. If you are exploring options related to property transfers, understanding the quit claim deed will be important, especially in contexts like a Murfreesboro Tennessee Assignment of Promissory Note.

To retrieve your promissory note, start by contacting the lender or financial institution that issued it. Requesting a copy is your best course, as they typically keep records of all agreements made. If you prefer a fresh start, you can also utilize uslegalforms to create a new promissory note that accurately reflects your current agreements.

In Tennessee, the statute of limitations for enforcing a promissory note is typically six years from the date of default. After this period, the lender may lose the right to sue for repayment. It is wise to maintain accurate records and stay aware of this time frame if you find yourself dealing with an assignment of promissory note situation in Murfreesboro.