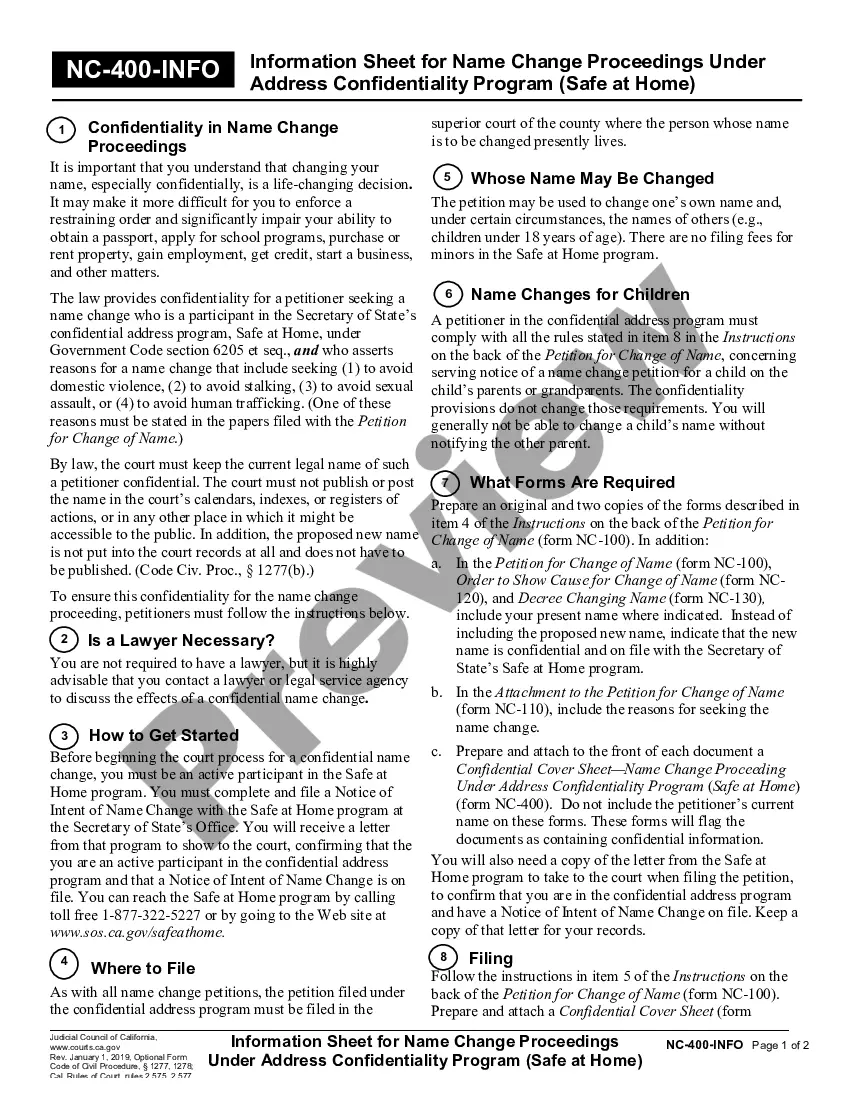

Memphis, Tennessee Complaints regarding Breach of Deed of Trust provisions to keep property in good repair typically involve allegations that the borrower or property owner has failed to uphold their obligations stated in the Deed of Trust. This legal document outlines the terms and conditions of a loan secured by real estate and includes provisions that mandate the borrower's responsibility in maintaining the property in good repair throughout the loan term. Such complaints usually arise when parties, such as lenders or other interested parties, believe that the borrower has neglected their duty to adequately maintain the property, resulting in potential devaluation or damages to the property. These complaints aim to address the breach of contract and seek remedies such as monetary damages, injunctions, or specific performance in order to rectify the situation. Keywords commonly associated with Memphis, Tennessee Complaints regarding Breach of Deed of Trust provisions to keep property in good repair may include: 1. Breach: The failure to perform one's duties or obligations as outlined in the Deed of Trust. 2. Deed of Trust: A legal document outlining the terms of a loan secured by real estate, including provisions for property maintenance. 3. Provisions: Terms and conditions specified in the Deed of Trust that mandate the borrower's responsibilities for property upkeep. 4. Property Maintenance: The regular care and repairs required to preserve the condition and value of the property. 5. Mortgagee/Lender: The party who lent the money in exchange for the borrower's promise to keep the property in good repair. Additional types of Memphis, Tennessee Complaints regarding Breach of Deed of Trust provisions to keep property in good repair may include: 1. Failure to Perform Basic Repairs: Allegations that the borrower has neglected to perform necessary repairs that impact the property's overall condition and value. 2. Failure to Address Structural Issues: Complaints that the borrower has not taken appropriate action to address structural problems, such as foundation issues or roof leaks, which could lead to further damage. 3. Failure to Maintain the Exterior: Allegations that the borrower has neglected maintenance tasks such as painting, landscaping, or general upkeep of the property's external appearance. 4. Failure to Comply with Safety Codes: Complaints asserting that the borrower has not adhered to safety regulations, potentially endangering occupants or visitors to the property. 5. Failure to Maintain Utilities: Allegations that the borrower has failed to keep utilities, such as water, electricity, or heating systems, in proper working condition, potentially affecting habitability and property value. It is important to note that the specific types of complaints and their naming may vary depending on the specific circumstances and individuals involved.

Memphis Tennessee Complaint regarding Breach of Deed of Trust provisions to keep property in good repair

Description

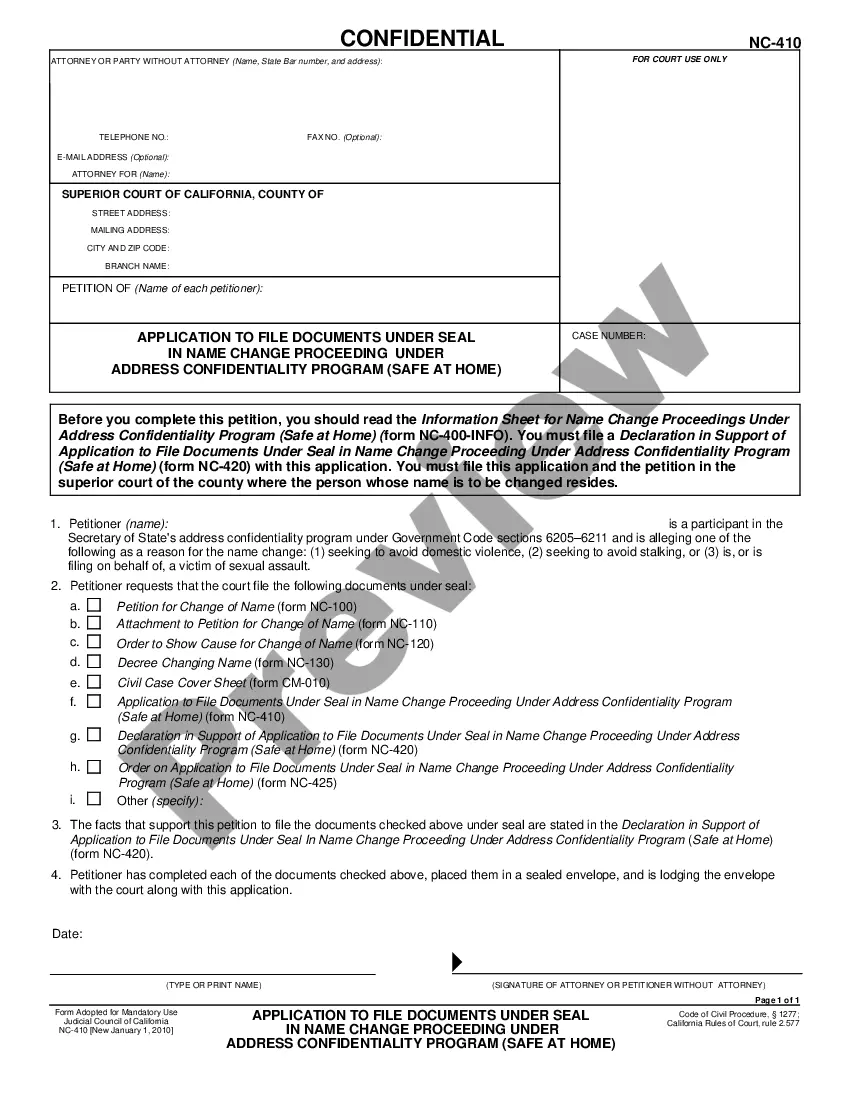

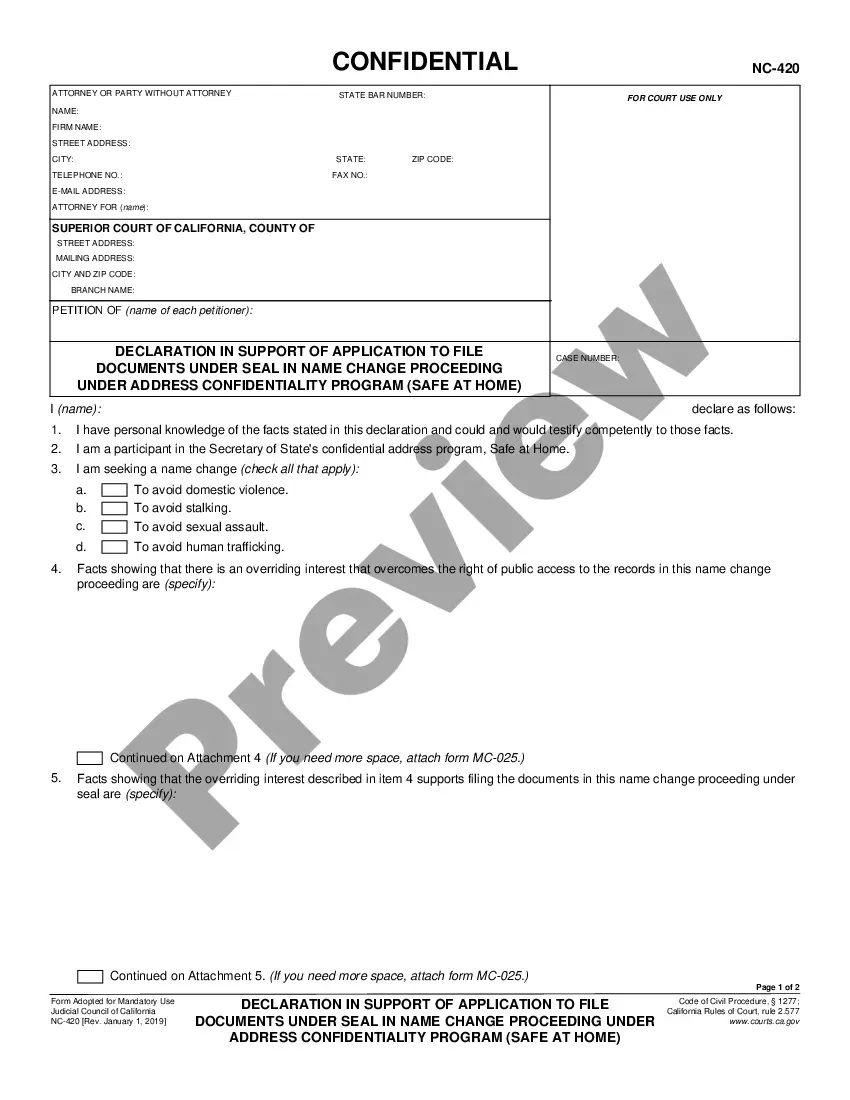

How to fill out Memphis Tennessee Complaint Regarding Breach Of Deed Of Trust Provisions To Keep Property In Good Repair?

Irrespective of social or professional standing, completing law-related documents is an unfortunate requirement in the current professional landscape.

Often, it’s nearly unfeasible for individuals without legal education to generate this type of paperwork from scratch, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms proves to be useful.

However, if you are new to our platform, make sure to follow these steps before acquiring the Memphis Tennessee Complaint regarding Breach of Deed of Trust provisions to ensure property upkeep.

Confirm the template you have selected is tailored to your location, as the regulations of one state or area do not apply to another state or area.

- Our platform offers an extensive collection of over 85,000 ready-to-use state-specific documents that suffice for nearly every legal situation.

- US Legal Forms also acts as a fantastic resource for associates or legal advisors aiming to enhance their efficiency by using our DIY documents.

- Whether you require the Memphis Tennessee Complaint regarding Breach of Deed of Trust provisions to maintain property in good condition or any other paper that will be recognized in your state or region, US Legal Forms has it all available.

- Here’s how you can obtain the Memphis Tennessee Complaint regarding Breach of Deed of Trust provisions to preserve property in good shape quickly through our dependable service.

- If you are currently a subscriber, you can simply Log In to your account to obtain the appropriate form.

Form popularity

FAQ

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

Tennessee is a title theory state with respect to real property security interests, meaning that legal title to real property is conveyed by the borrower via a deed of trust to a trustee on behalf of the lender.

If it meets legal requirements for validity, the deed of trust has no automatic expiration. It will be valid until either the borrower repays the loan the trust deed is security for or if the property is sold in a foreclosure action.

(a) Liens on realty, equitable or retained in favor of vendor on the face of the deed, also liens of mortgages, deeds of trust, and assignments of realty executed to secure debts, shall be barred, and the liens discharged, unless suits to enforce the same be brought within ten (10) years from the maturity of the debt.

Tennessee is a title theory state with respect to real property security interests, meaning that legal title to real property is conveyed by the borrower via a deed of trust to a trustee on behalf of the lender.

Most states, including Tennessee and Virginia, utilize the deed of trust. Lenders prefer the deed of trust because in the event of a foreclosure, the neutral trustee conducts the sale, not the lender. This frees up the lender to bid on the property, which is common.

?When someone finances a home, the lender secures the loan to the home by having the borrower sign either a mortgage or a deed of trust....Mortgage States and Deed of Trust States. StateMortgage StateDeed of Trust StateTennesseeYTexasYUtahYVermontY47 more rows

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.