Title: Chattanooga Tennessee Answer to Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile Introduction: In Chattanooga, Tennessee, individuals facing a complaint for debt collection or a wrongful repossession of their automobile have the legal right to file an answer and countercomplaint. This detailed description will outline the process and provide valuable information about countercomplaint options for debt collection and wrongful repossession cases in Chattanooga, Tennessee. 1. Understanding the Answer to Complaint for Debt Collection in Chattanooga, Tennessee: — Debt collection complaints typically arise when a creditor or debt collection agency initiates legal actions to collect outstanding debts. — Responding to a complaint requires filing an answer, which is a written legal document submitted to the court to address and refute the allegations made in the complaint. — Key elements of an answer may include a concise statement of admission, denial, or lack of knowledge for each allegation presented in the complaint. — It is crucial to adhere to the specific instructions outlined in the summons and carefully review the debt collection laws applicable in Chattanooga, Tennessee. 2. Exploring the Countercomplaint for Wrongful Repossession of Automobile in Chattanooga, Tennessee: — Wrongful repossession cases occur when vehicles are unlawfully repossessed by creditors or repo companies without proper legal justification. — Individuals who believe their vehicle was wrongfully repossessed have the option to file a countercomplaint against the creditor or repo company. — The countercomplaint must be supported by evidence illustrating the absence of default on payment, violation of repossession laws, or any other pertinent grounds for wrongful repossession. — The countercomplaint allows the aggrieved party to seek compensation for damages, return of the vehicle, and potentially punitive damages depending on the circumstances. Types of Chattanooga Tennessee Answer to Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile: 1. Answer to Complaint for Debt Collection: — On-time payment defense: If the creditor or debt collection agency erroneously claims the debtor missed payments, the answer may include evidence proving timely payments were made. — Statute of limitations defense: If the debt being pursued is outside the statute of limitations, the debtor can assert this defense in their answer and potentially have the case dismissed. — Verification request: The debtor can request the creditor to provide documented proof regarding the ownership of the debt, outstanding balance, and any applicable agreements. 2. Countercomplaint for Wrongful Repossession of Automobile: — Breach of peace: If the repossession process involved aggressive or intimidating actions, the individual can file a countercomplaint highlighting the violation of repossession laws designed to protect debtors' rights. — Lack of notice: If the repo company failed to provide proper notice before repossession, the individual can file a countercomplaint based on this violation. — Defective documentation: If the repossession or loan documents are invalid or contain errors, the countercomplaint can challenge the repossession by asserting the absence of a lawful contract. Conclusion: Understanding the process of filing an answer to a debt collection complaint and pursuing a countercomplaint for wrongful repossession is crucial for individuals facing these legal challenges in Chattanooga, Tennessee. With a well-prepared response and countercomplaint, debtors can protect their rights and seek appropriate remedies under the law. It is advisable to consult with an experienced attorney for guidance specific to each individual case.

Chattanooga Tennessee Answer To Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile

Description

How to fill out Chattanooga Tennessee Answer To Complaint For Debt Collection And Countercomplaint For Wrongful Repossession Of Automobile?

If you are looking for a relevant form template, it’s impossible to choose a more convenient place than the US Legal Forms website – probably the most considerable libraries on the internet. Here you can find thousands of form samples for company and individual purposes by categories and regions, or keywords. Using our advanced search function, finding the most recent Chattanooga Tennessee Answer To Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile is as easy as 1-2-3. Additionally, the relevance of each file is proved by a group of professional attorneys that regularly review the templates on our website and revise them in accordance with the newest state and county laws.

If you already know about our platform and have a registered account, all you need to receive the Chattanooga Tennessee Answer To Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile is to log in to your profile and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions listed below:

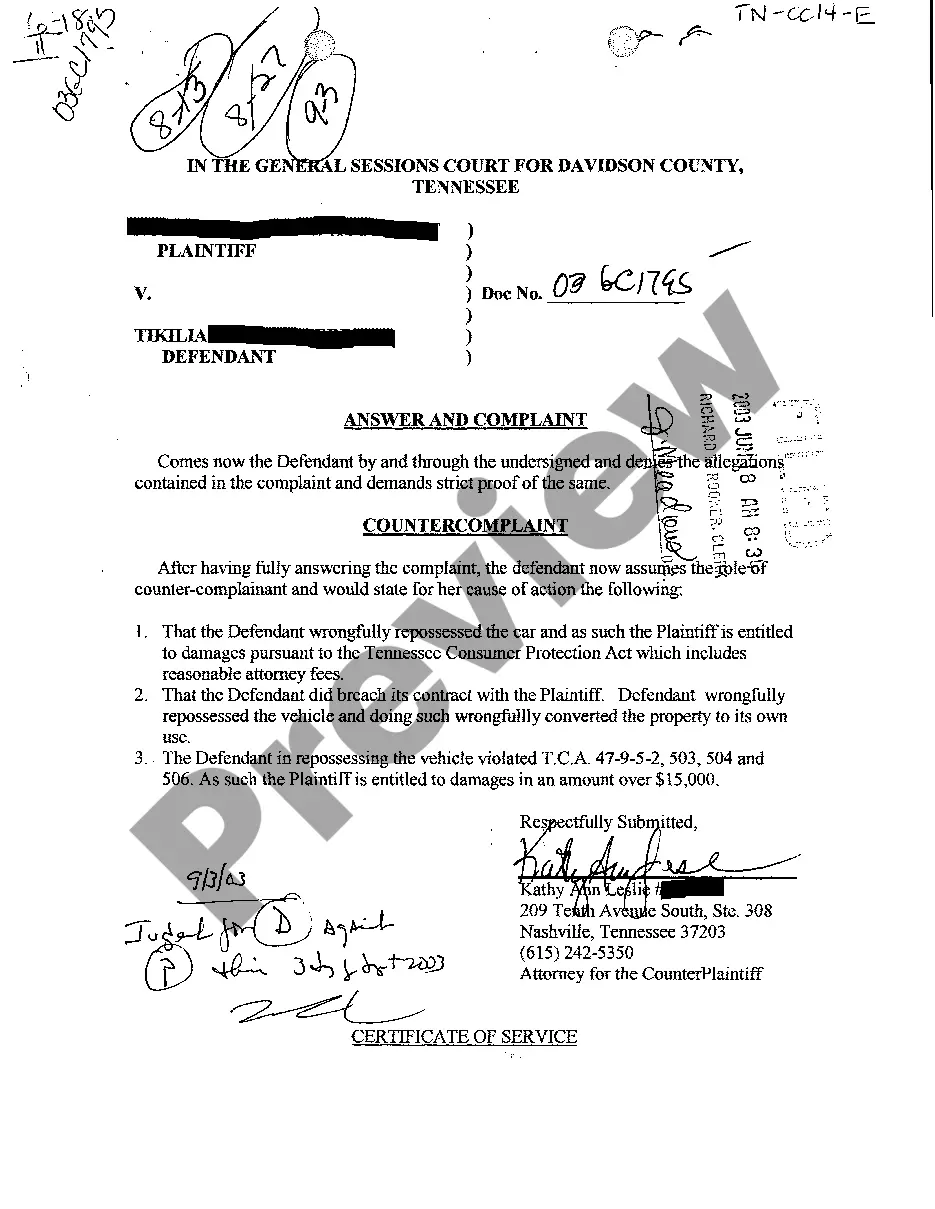

- Make sure you have chosen the sample you want. Read its information and utilize the Preview function to see its content. If it doesn’t suit your needs, use the Search option at the top of the screen to discover the proper record.

- Confirm your choice. Click the Buy now option. After that, select the preferred pricing plan and provide credentials to register an account.

- Process the transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the form. Select the file format and save it to your system.

- Make adjustments. Fill out, modify, print, and sign the acquired Chattanooga Tennessee Answer To Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile.

Each and every form you save in your profile has no expiration date and is yours forever. You can easily gain access to them using the My Forms menu, so if you need to have an extra version for enhancing or printing, you may return and save it once more whenever you want.

Take advantage of the US Legal Forms professional library to gain access to the Chattanooga Tennessee Answer To Complaint for Debt Collection and Countercomplaint for Wrongful Repossession of Automobile you were looking for and thousands of other professional and state-specific samples in a single place!